The DNA Synthesis Market size was estimated USD 3.46 billion in 2023 and is expected to reach USD 14.54 billion by 2031 at a CAGR of 19.62% during the forecast period of 2024-2031.

The natural formation of nucleic acid strands by DNA replication is known as DNA synthesis. They are created artificially in the laboratory utilizing genetic engineering and enzyme chemistry for a variety of purposes including therapeutics, diagnostics, and academic and industrial research. With the recent acceptance of DNA synthesis, several applications have grown in popularity.

Get more information on DNA Synthesis Market - Request Free Sample Report

DRIVERS

Increasing usage in food and the agriculture industry

Increasing demand for DNA sequences and synthetic genes

The need for synthetic genes and DNA sequences has been fast expanding due to advances in synthetic biology and genetic engineering. Synthetic genes and DNA sequences can be utilized to make novel enzymes, proteins, and other compounds with unique features for use in a variety of applications. Furthermore, developments in DNA synthesis technology have made it easier and less expensive to create genes and DNA sequences. As a result, demand for synthetic genes and DNA sequences has increased, while the cost of DNA synthesis has decreased. These synthetic genes and DNA sequences have a wide range of uses, including gene therapy, medication development, and agricultural biotechnology. For example, Evonetix describes DNA synthesizer technology that will accelerate development across many therapeutic modalities.

RESTRAIN

Synthesis Errors and Quality Control

The process of DNA synthesis is not error-free, and errors may occur. Because of these flaws, DNA sequences that differ from the planned design are produced, resulting in inaccuracies in the final output. Maintaining high-quality control requirements and reducing synthesis errors are continuous challenges for DNA synthesis businesses. Accurate synthesis is required, especially for applications such as gene therapy or DNA-based diagnostics. DNA sequencing is used by manufacturers to ensure the accuracy of manufactured DNA sequences. This entails comparing the synthesized sequence to the intended design in order to find any differences. The amount of DNA produced is measured using several techniques such as UV spectroscopy or quantitative PCR (qPCR). This guarantees that the correct amount of DNA is produced.

OPPORTUNITY

Increasing demand for personalized medicine

DNA synthesis aids in the development of potentially life-saving medications. Personalized medicine is a drug that is tailored to a patient's individual therapeutic needs. It is based on data from pharmacogenomics, pharmacogenetics, pharmacometabolomics, and pharmacoproteomics. It aids in the early detection and prevention of many ailments, as well as the monitoring of therapy. Personalized medicine is also characterized as enhanced healthcare through the use of preventative medicine, rational medication development, therapeutic monitoring, and early illness identification. Scientists are developing individualized medication for patients with specific genetic variants and mutations by employing gene synthesis. The development of DNA-based diagnostic assays relies heavily on DNA synthesis. Synthetic DNA probes or primers are used in these assays to detect specific genetic sequences linked to diseases, infections, or genetic variants. The growing desire for personalized treatment and precise diagnostics has fueled the expansion of DNA-based diagnostics.

CHALLENGES

DNA synthesis can be an expensive operation, making it difficult for researchers on tight budgets to obtain the technology.

Possibility of unintentional release of synthetic DNA or the emergence of harmful diseases

In terms of the global pharmaceutical business, the war's influence has been limited to pharma manufacturers' investments and operations, as well as exporters' market interests in Russia, Ukraine, and other CIS nations, a phenomena that may be short-term and ephemeral. This is also because Russia and Ukraine are primarily pharma importing countries, implying that global pharma is not overly reliant on this region for essential raw materials and supplies. Indeed, some major pharmaceutical corporations have reduced their activities in Russia. However, there is merit to the notion that the pharmaceutical sector is dependent on oil and gas not just for transportation and logistics, but also because a huge number of pharmaceutical goods are derived from petrochemicals.

IMPACT OF ONGOING RECESSION

Many biopharmaceutical and biotechnology companies are now scrutinizing their spending and risk. Economic realities such as uncontrollable inflation, restricted capital, and supply chain challenges may hinder expansion goals, but there are reasons for optimism, as biotech experts recently emphasized. The research has shown that recessions can have an impact on medication demand for a variety of reasons, including lower use of patented biologics and branded pharmaceuticals, as well as an increase in utilization of biosimilars and generics.

By Service Type

Oligonucleotide Synthesis

Gene Synthesis

In 2023, Oligonucleotide Synthesis segment is expected to held the highest market share of 55.2% during the forecast period owing to oligonucleotide synthesis is a rapid and low-cost method of synthesizing desired oligonucleotide sequences. Furthermore, companies are embarking on strategic endeavors to introduce unique products, which will grow the segment. For example, in October 2022, Bachem announced a collaboration with Eli-Lilly and Company for the research and manufacturing of oligonucleotide-based APIs. The collaboration calls for Bachem to provide technical infrastructure and experience to help Lilly implement its new oligonucleotide manufacturing technique.

By Application

Research and Development

Diagnostics

Therapeutics

In 2023, the Research and Development segment is expected to dominate the market growth of 24.3% during the forecast period due to the technology, there are numerous benefits, such as speedy amplification, the requirement for a small amount of material, and utility in the detection of various diseases. When compared to other traditional methods, PCR allows for higher levels of amplification of specific sequences and more sensitive detection in less time, the technique is therefore particularly valuable for forensics, genetic identification testing, in vitro diagnostics, and industrial quality control. In clinical laboratories, real-time PCR has several advantages, including the simultaneous detection of several genes, lower reagent costs, the capacity to provide internal controls, and sample preservation for tumor profiling.

By End User

Biopharmaceutical Companies

Academic and Research Institutes

Contract Research Organizations

In 2023, the Biopharmaceutical Companies segment is expected to dominate the market growth of 40.1% during the forecast period to due to increasing demand for biotechnology-based trade opportunities globally. Furthermore, synthetic nucleotides hasten the creation of enhanced bio-molecular therapeutics such as enzymes, peptides, RNA catalysts, and aptamers. Furthermore, because to advancements in nucleotide manufacturing processes and an emphasis on automation and autonomous technologies, businesses can now synthesis DNA fragments more quickly, inexpensively, and effectively. DNA synthesis is a fundamental molecular biology procedure that is important in a variety of domains, including genetic engineering and clinical diagnosis and treatment. Such elements are projected to dominate the segment.

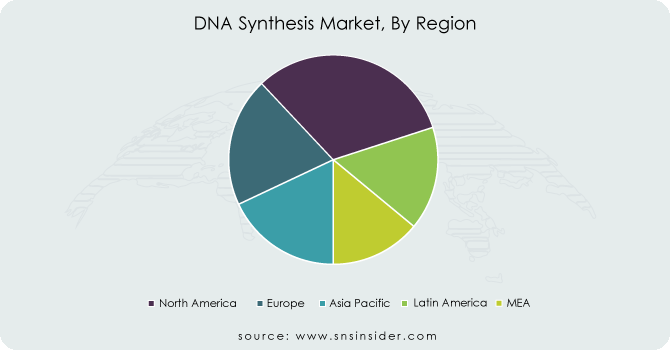

North America held a significant market share of over 40.1% in 2023 due to the demand for synthetic nucleotides in this region is growing due to the various research projects in the region for emerging developments in biotechnology, including the rapid creation of medicines and vaccines, demand for synthetic nucleotides in this region is increasing.

Asia-Pacific is witness to expand fastest CAGR rate during the forecast period due to increased financing for biological research and drug development is increasing demand for a steady supply of synthetic nucleotides for use in research. Numerous ongoing research investigations at research institutions around the region, as well as emerging market participants, are positively impacting market growth.

REGIONAL COVERAGE

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are GenScript Biotech Corporation, Thermo Fisher Scientific, Inc., Bioneer Corporation,Twist Bioscience, Eton Bioscience, IBA GmbH, LGC Biosearch Technologies, Eurofins Scientific, Quintara Biosciences Inc.,Integrated DNA Technologies and Others.

GenScript Biotech Corporation, in May 2023, GenScript Biotech Corporation created the GenTitan Gene Fragments Synthesis service to accelerate gene synthesis and reduce costs. This will allow the organization to broaden its service offerings and cater to a bigger consumer base.

Twist Bioscience, in January 2023, Twist Bioscience and Astellas have formed a research agreement to develop multitarget antibodies. The goal of this strategic alliance was to find antibodies against several targets of interest as well as curative medicines for individuals suffering from diseases with no therapeutic choices. This strategy is likely to assist the organization in improving its service offerings.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.46 Billion |

| Market Size by 2031 | US$ 14.54 Billion |

| CAGR | CAGR of 19.62% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Oligonucleotide Synthesis, Gene Synthesis) • By Application (Research and Development, Diagnostics, Therapeutics) • By End User (Biopharmaceutical Companies, Academic and Research Institutes, Contract Research Organizations) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | GenScript Biotech Corporation, Thermo Fisher Scientific, Inc., Bioneer Corporation,Twist Bioscience, Eton Bioscience, IBA GmbH, LGC Biosearch Technologies, Eurofins Scientific, Quintara Biosciences Inc.,Integrated DNA Technologies |

| Key Drivers | • Increasing usage in food and the agriculture industry • Increasing demand for DNA sequences and synthetic genes |

| Market Challenges | • DNA synthesis can be an expensive operation, making it difficult for researchers on tight budgets to obtain the technology. • Possibility of unintentional release of synthetic DNA or the emergence of harmful diseases |

Ans: Analytical Instrumentation Market size was valued at USD 3.46 billion in 2023.

Ans: DNA Synthesis Market is anticipated to expand by 19.62% from 2024 to 2031.

Ans: North America held a significant market share of around 45.8% in 2023.

Ans: USD 14.54 billion is expected to grow by 2031.

Ans: Risk of accidental release of synthetic DNA or the creation of dangerous pathogens.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. DNA Synthesis Market Segmentation, By Service Type

9.1 Introduction

9.3 Oligonucleotide Synthesis

9.4 Gene Synthesis

10. DNA Synthesis Market Segmentation, By Application

10.2 Trend Analysis

10.3 Research and Development

10.4 Diagnostics

10.5 Therapeutics

11. DNA Synthesis Market Segmentation, By End user

11.1 Introduction

11.3 Biopharmaceutical Companies

11.4 Academic and Research Institutes

11.5 Contract Research Organizations

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America DNA Synthesis Market by Country

12.2.3 North America DNA Synthesis Market By Service Type

12.2.4 North America DNA Synthesis Market By Application

12.2.5 North America DNA Synthesis Market By End user

12.2.6 USA

12.2.6.1 USA DNA Synthesis Market By Service Type

12.2.6.2 USA DNA Synthesis Market By Application

12.2.6.3 USA DNA Synthesis Market By End user

12.2.7 Canada

12.2.7.1 Canada DNA Synthesis Market By Service Type

12.2.7.2 Canada DNA Synthesis Market By Application

12.2.7.3 Canada DNA Synthesis Market By End user

12.2.8 Mexico

12.2.8.1 Mexico DNA Synthesis Market By Service Type

12.2.8.2 Mexico DNA Synthesis Market By Application

12.2.8.3 Mexico DNA Synthesis Market By End user

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe DNA Synthesis Market by Country

12.3.2.2 Eastern Europe DNA Synthesis Market By Service Type

12.3.2.3 Eastern Europe DNA Synthesis Market By Application

12.3.2.4 Eastern Europe DNA Synthesis Market By End user

12.3.2.5 Poland

12.3.2.5.1 Poland DNA Synthesis Market By Service Type

12.3.2.5.2 Poland DNA Synthesis Market By Application

12.3.2.5.3 Poland DNA Synthesis Market By End user

12.3.2.6 Romania

12.3.2.6.1 Romania DNA Synthesis Market By Service Type

12.3.2.6.2 Romania DNA Synthesis Market By Application

12.3.2.6.4 Romania DNA Synthesis Market By End user

12.3.2.7 Hungary

12.3.2.7.1 Hungary DNA Synthesis Market By Service Type

12.3.2.7.2 Hungary DNA Synthesis Market By Application

12.3.2.7.3 Hungary DNA Synthesis Market By End user

12.3.2.8 Turkey

12.3.2.8.1 Turkey DNA Synthesis Market By Service Type

12.3.2.8.2 Turkey DNA Synthesis Market By Application

12.3.2.8.3 Turkey DNA Synthesis Market By End user

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe DNA Synthesis Market By Service Type

12.3.2.9.2 Rest of Eastern Europe DNA Synthesis Market By Application

12.3.2.9.3 Rest of Eastern Europe DNA Synthesis Market By End user

12.3.3 Western Europe

12.3.3.1 Western Europe DNA Synthesis Market by Country

12.3.3.2 Western Europe DNA Synthesis Market By Service Type

12.3.3.3 Western Europe DNA Synthesis Market By Application

12.3.3.4 Western Europe DNA Synthesis Market By End user

12.3.3.5 Germany

12.3.3.5.1 Germany DNA Synthesis Market By Service Type

12.3.3.5.2 Germany DNA Synthesis Market By Application

12.3.3.5.3 Germany DNA Synthesis Market By End user

12.3.3.6 France

12.3.3.6.1 France DNA Synthesis Market By Service Type

12.3.3.6.2 France DNA Synthesis Market By Application

12.3.3.6.3 France DNA Synthesis Market By End user

12.3.3.7 UK

12.3.3.7.1 UK DNA Synthesis Market By Service Type

12.3.3.7.2 UK DNA Synthesis Market By Application

12.3.3.7.3 UK DNA Synthesis Market By End user

12.3.3.8 Italy

12.3.3.8.1 Italy DNA Synthesis Market By Service Type

12.3.3.8.2 Italy DNA Synthesis Market By Application

12.3.3.8.3 Italy DNA Synthesis Market By End user

12.3.3.9 Spain

12.3.3.9.1 Spain DNA Synthesis Market By Service Type

12.3.3.9.2 Spain DNA Synthesis Market By Application

12.3.3.9.3 Spain DNA Synthesis Market By End user

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands DNA Synthesis Market By Service Type

12.3.3.10.2 Netherlands DNA Synthesis Market By Application

12.3.3.10.3 Netherlands DNA Synthesis Market By End user

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland DNA Synthesis Market By Service Type

12.3.3.11.2 Switzerland DNA Synthesis Market By Application

12.3.3.11.3 Switzerland DNA Synthesis Market By End user

12.3.3.1.12 Austria

12.3.3.12.1 Austria DNA Synthesis Market By Service Type

12.3.3.12.2 Austria DNA Synthesis Market By Application

12.3.3.12.3 Austria DNA Synthesis Market By End user

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe DNA Synthesis Market By Service Type

12.3.3.13.2 Rest of Western Europe DNA Synthesis Market By Application

12.3.3.13.3 Rest of Western Europe DNA Synthesis Market By End user

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific DNA Synthesis Market by Country

12.4.3 Asia-Pacific DNA Synthesis Market By Service Type

12.4.4 Asia-Pacific DNA Synthesis Market By Application

12.4.5 Asia-Pacific DNA Synthesis Market By End user

12.4.6 China

12.4.6.1 China DNA Synthesis Market By Service Type

12.4.6.2 China DNA Synthesis Market By Application

12.4.6.3 China DNA Synthesis Market By End user

12.4.7 India

12.4.7.1 India DNA Synthesis Market By Service Type

12.4.7.2 India DNA Synthesis Market By Application

12.4.7.3 India DNA Synthesis Market By End user

12.4.8 Japan

12.4.8.1 Japan DNA Synthesis Market By Service Type

12.4.8.2 Japan DNA Synthesis Market By Application

12.4.8.3 Japan DNA Synthesis Market By End user

12.4.9 South Korea

12.4.9.1 South Korea DNA Synthesis Market By Service Type

12.4.9.2 South Korea DNA Synthesis Market By Application

12.4.9.3 South Korea DNA Synthesis Market By End user

12.4.10 Vietnam

12.4.10.1 Vietnam DNA Synthesis Market By Service Type

12.4.10.2 Vietnam DNA Synthesis Market By Application

12.4.10.3 Vietnam DNA Synthesis Market By End user

12.4.11 Singapore

12.4.11.1 Singapore DNA Synthesis Market By Service Type

12.4.11.2 Singapore DNA Synthesis Market By Application

12.4.11.3 Singapore DNA Synthesis Market By End user

12.4.12 Australia

12.4.12.1 Australia DNA Synthesis Market By Service Type

12.4.12.2 Australia DNA Synthesis Market By Application

12.4.12.3 Australia DNA Synthesis Market By End user

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific DNA Synthesis Market By Service Type

12.4.13.2 Rest of Asia-Pacific DNA Synthesis Market By Application

12.4.13.3 Rest of Asia-Pacific DNA Synthesis Market By End user

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East DNA Synthesis Market by Country

12.5.2.2 Middle East DNA Synthesis Market By Service Type

12.5.2.3 Middle East DNA Synthesis Market By Application

12.5.2.4 Middle East DNA Synthesis Market By End user

12.5.2.5 UAE

12.5.2.5.1 UAE DNA Synthesis Market By Service Type

12.5.2.5.2 UAE DNA Synthesis Market By Application

12.5.2.5.3 UAE DNA Synthesis Market By End user

12.5.2.6 Egypt

12.5.2.6.1 Egypt DNA Synthesis Market By Service Type

12.5.2.6.2 Egypt DNA Synthesis Market By Application

12.5.2.6.3 Egypt DNA Synthesis Market By End user

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia DNA Synthesis Market By Service Type

12.5.2.7.2 Saudi Arabia DNA Synthesis Market By Application

12.5.2.7.3 Saudi Arabia DNA Synthesis Market By End user

12.5.2.8 Qatar

12.5.2.8.1 Qatar DNA Synthesis Market By Service Type

12.5.2.8.2 Qatar DNA Synthesis Market By Application

12.5.2.8.3 Qatar DNA Synthesis Market By End user

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East DNA Synthesis Market By Service Type

12.5.2.9.2 Rest of Middle East DNA Synthesis Market By Application

12.5.2.9.3 Rest of Middle East DNA Synthesis Market By End user

12.5.3 Africa

12.5.3.1 Africa DNA Synthesis Market by Country

12.5.3.2 Africa DNA Synthesis Market By Service Type

12.5.3.3 Africa DNA Synthesis Market By Application

12.5.3.4 Africa DNA Synthesis Market By End user

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria DNA Synthesis Market By Service Type

12.5.3.5.2 Nigeria DNA Synthesis Market By Application

12.5.3.5.3 Nigeria DNA Synthesis Market By End user

12.5.3.6 South Africa

12.5.3.6.1 South Africa DNA Synthesis Market By Service Type

12.5.3.6.2 South Africa DNA Synthesis Market By Application

12.5.3.6.3 South Africa DNA Synthesis Market By End user

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa DNA Synthesis Market By Service Type

12.5.3.7.2 Rest of Africa DNA Synthesis Market By Application

12.5.3.7.3 Rest of Africa DNA Synthesis Market By End user

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America DNA Synthesis Market by country

12.6.3 Latin America DNA Synthesis Market By Service Type

12.6.4 Latin America DNA Synthesis Market By Application

12.6.5 Latin America DNA Synthesis Market By End user

12.6.6 Brazil

12.6.6.1 Brazil DNA Synthesis Market By Service Type

12.6.6.2 Brazil DNA Synthesis Market By Application

12.6.6.3 Brazil DNA Synthesis Market By End user

12.6.7 Argentina

12.6.7.1 Argentina DNA Synthesis Market By Service Type

12.6.7.2 Argentina DNA Synthesis Market By Application

12.6.7.3 Argentina DNA Synthesis Market By End user

12.6.8 Colombia

12.6.8.1 Colombia DNA Synthesis Market By Service Type

12.6.8.2 Colombia DNA Synthesis Market By Application

12.6.8.3 Colombia DNA Synthesis Market By End user

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America DNA Synthesis Market By Service Type

12.6.9.2 Rest of Latin America DNA Synthesis Market By Application

12.6.9.3 Rest of Latin America DNA Synthesis Market By End user

13. Company Profiles

13.1 GenScript Biotech Corporation

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Service Type/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Thermo Fisher Scientific, Inc.

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Service Type / Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Bioneer Corporation

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Service Type / Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Twist Bioscience

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Service Type / Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Eton Bioscience

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Service Type/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 IBA GmbH

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Service Type/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 LGC Biosearch Technologies

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Service Type/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Service Type/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Quintara Biosciences Inc.

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Service Type/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Integrated DNA Technologies

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Service Type/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Artificial Intelligence in Ultrasound Imaging Market size was valued at $934.99 Mn in 2023 and is expected to reach $1825 Mn by 2031 and grow at a CAGR of 8.65% over the global forecast period of 2024-2031.

In 2023, The Diabetic Ulcer Treatment Market size amounted to USD 10.31 Billion & is estimated to reach USD 15.59 Billion by 2031 and increase at a compound annual growth rate of 5.3% between 2024 and 2031.

The Analgesics Market was esteemed at USD 29.44 billion out of 2022, and expected to arrive at USD 48 billion by 2030, and develop at a CAGR of 6.3% over the conjecture period 2023-2030.

The Dental Regeneration Market size was estimated USD 6.0 billion in 2022 and is expected to reach USD 8.9 billion by 2030 at a CAGR of 5.1% during the forecast period of 2023-2030.

The Cardiovascular Information System Market Size was valued at USD 1.31 billion in 2023 and is expected to reach USD 2.68 billion by 2031, and grow at a CAGR of 9.4% over the forecast period 2024-2031.

The 3D printed wearables market is valued at USD 3.96 billion in 2022, and it is estimated to increase at a CAGR of 9.7% from 2022 to 2028, reaching USD 8.30 billion by 2030.

Hi! Click one of our member below to chat on Phone