Dental Regeneration Market Report Scope & Overview:

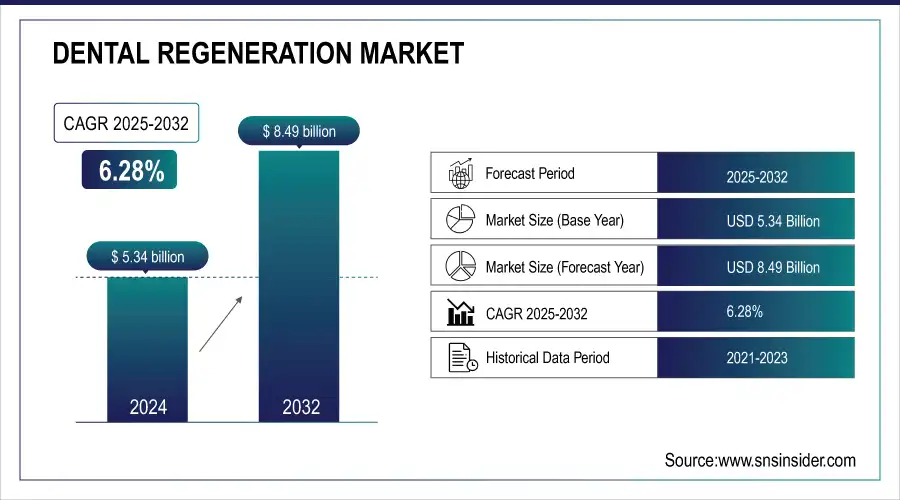

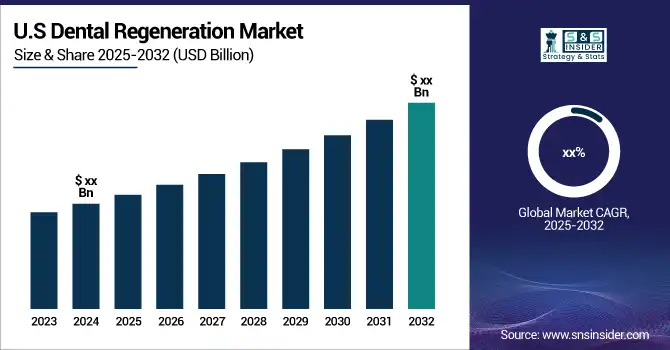

The Global Dental Regeneration Market, valued at USD 5.34 Billion in 2024, is projected to reach USD 8.49 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.28% during the forecast period.

Get More Information on Dental regeneration Market - Request Sample Report

Dental regeneration is a stem cell-based regenerative medicine process used to replace damaged or lost teeth by generating them from autologous stem cells in the field of tissue engineering and stem cell biology. The preservation of enamel's integrity is a challenge. It is subject to wear, injury, and decay because it is constantly demineralized and remineralized within the oral environment. It cannot renew since it is made up of cells that are lost following the dental eruption.

Dental Regeneration Market Trends:

-

Increased research studies and advancements in developmental biology are driving innovations in dental regeneration.

-

Utilization of biology and bioinformatics to map gene expression during tooth formation is enhancing targeted regeneration approaches.

-

Rising prevalence of tooth deformities and irregularities is fueling demand for dental regeneration solutions.

-

Growing investment in R&D for novel and effective dental regeneration techniques is accelerating market growth.

-

Greater public awareness, supported by media and online information, is increasing demand for dental regeneration products and services.

Dental Regeneration Market Growth Drivers:

-

Advances in developmental biology and an increase in research studies are propelling the dental regeneration market forward.

The global dental regeneration market is growing as a result of increased research studies on dental regeneration, developments in developmental biology, an aging population, and new creative technologically enhanced therapies. It is feasible to focus the development of spatial-temporal specific expression and achieve the expected objective of dental regeneration by utilizing biology and bioinformatics to establish the pattern of gene expression during tooth formation. According to additional study, the increased prevalence of tooth deformity or informity is a major reason driving market expansion. These studies on bioengineered teeth show that with focused differentiation and certain stem cell expression patterns, full dental regeneration is conceivable. Rising study and development of new advantageous ways for dental regeneration is assisting in the growth. Rising research and development of novel advantageous approaches for dental regeneration is fueling market growth.

Dental Regeneration Market Restraints:

-

High cost of regenerative therapies

Regenerative therapies are extremely expensive and can be difficult for many people to obtain. This is owing to the high expense of the therapy's supplies as well as the competence necessary to perform it. As a result, many people are unable to obtain these therapies, which can stifle growth in the dental regeneration market.

Dental Regeneration Market Opportunities:

-

The rising demand for dental implants and reconstructive surgery

The expansion of healthcare infrastructure in emerging nations, and technical advancements in dentistry are the primary factors driving the global dental regeneration market. The increased frequency of periodontal disorders, as well as the rising demand for cosmetic dentistry, are driving market expansion. The market is very competitive, with several global and regional businesses present. In addition, the market is distinguished by a high degree of product innovation and competitive pricing. The industry is projected to gain traction further as regenerative dentistry methods become more widely used and new products are introduced.

Dental Regeneration Market Segment Analysis:

By Type

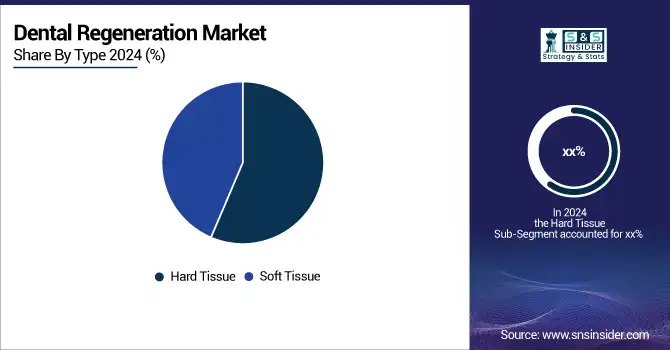

In 2024, the hard tissue segment dominated the dental regeneration market due to its widespread application and established techniques. Looking ahead, the soft tissue segment is expected to grow at the fastest rate, driven by advancements in regenerative technologies, rising demand for aesthetic dental procedures, and increasing research in innovative soft tissue therapies.

By Age Group

In 2024, the adult segment dominated the dental regeneration market due to higher demand for restorative and cosmetic dental treatments among this group. Looking ahead, the geriatric segment is expected to grow at the fastest rate, driven by an aging population, increasing prevalence of oral health issues in older adults, and advancements in regenerative therapies tailored to address age-related dental conditions.

Dental Regeneration Market Regional Analysis:

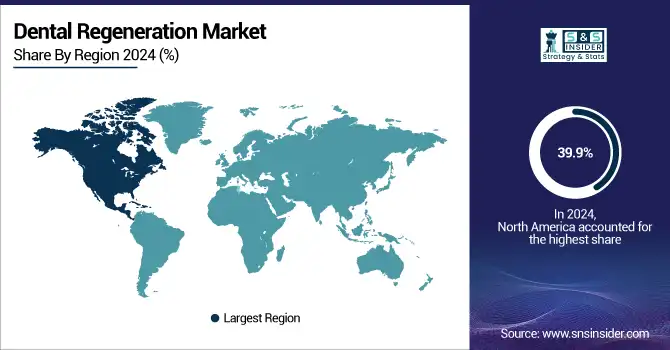

North America Dental Regeneration Market Insights

North America held a significant market share of 39.9% in 2024. This is due to an increase in tooth loss and the prevalence of diseases such as periodontal disease, dental caries, pupal periapical disorders, and enamel hypoplasia. These are the primary drivers fueling the region's market growth. Furthermore, advances in dentistry regeneration therapies and a growing geriatric population are fueling market expansion.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Asia Pacific Dental Regeneration Market Insights

Asia-Pacific is witness to expand fastest CAGR rate of 6.8% during the forecast period The region's primary drivers include an aging population, an increase in the prevalence of dental disorders such as dentin hypersensitivity, dental caries, and periodontal diseases, and an increase in disposable income. For example, according to an NIH report, the frequency of dental caries in India will be 56.3% in 2022. According to reports, 62% of patients are above the age of 18 and 52% are between the ages of 3 and 18. Furthermore, 29% of early childhood caries cases were detected utilizing missing, decayed, or filled teeth as diagnostic criteria.

Europe Dental Regeneration Market Insights

The Europe dental regeneration market is advancing due to growing investments in research and development, increasing adoption of innovative regenerative therapies, and rising awareness of dental health. Strong presence of key market players, supportive regulatory frameworks, and advancements in biotechnology are driving innovation. Increasing demand for minimally invasive procedures and aesthetic dental solutions is further fueling growth.

Latin America (LATAM) and Middle East & Africa (MEA) Dental Regeneration Market Insights

The dental regeneration market in LATAM and MEA is expanding with rising awareness of oral health and growing adoption of advanced dental treatments. Increased focus on improving dental care infrastructure, coupled with emerging technological innovations, is driving market growth. Rising demand for cost-effective and minimally invasive procedures is creating new opportunities in these regions.

Dental Regeneration Market Key Players:

Apollo White Dental

Integrated Dental Holdings

My Dentist

Floss Dental Clinic

Aspen Dental Clinic

Heartland Dental

Dentsply Sirona

Delta Dental

Clove Dental

Competitive Landscape for Dental Regeneration Market:

VideaHealth is a Boston-based dental technology company that leverages artificial intelligence to assist dental professionals in diagnosing and treating oral conditions. Their AI platform analyzes dental radiographs to detect issues like cavities and gum disease, enhancing diagnostic accuracy and patient care. By integrating AI into dental workflows, VideaHealth aims to improve clinical outcomes and streamline practice operations

In June 2022, VideaHealth, a leading provider of dental artificial intelligence solutions, announced that Health Canada has given it a Medical Device Establishment License for their AI-powered dental caries detection system, Video Caries Assist. VideaHealth's AI and software solutions were designed with efficiency and ethics in mind. They enable dentists to examine patient X-rays more successfully, get paid faster, and make more precise treatment suggestions.

According to an announcement by Zimmer Biomet Holdings, a global pioneer in medical technology, ZimVie, formerly known as Zimmer Biomet's Dental and Spine business, successfully spun out in March 2022. This transaction is expected to accelerate growth and offer superior value for all stakeholders by sharpening Zimmer Biomet and ZimVie's emphasis on patient and customer needs.

In July 2022, my doctor joined with a dental clinic to strengthen their leadership in the medical business and deliver a high-quality experience to their clientele.

Dentsply Sirona completed the acquisition of Datum Dental, Ltd. and its OSSIX biomaterial portfolio in January 2021. A well-known manufacturer of innovative dental regeneration solutions based on GLYMATRIX technology. This acquisition has expanded the company's product line. Datum Dental's robust R&D pipeline has also increased the firm's capabilities for future development.

|

Report Attributes |

Details |

| Market Size in 2024 | USD 5.34 Billion |

| Market Size by 2032 | USD 8.49 Billion |

| CAGR | CAGR of 6.28% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

By Type (Hard Tissue, Soft Tissue), By Age Group (Pediatric, Adult, Geriatric), By End User (Hospitals, Dental Clinics, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

Smile Dental Care, Apollo White Dental, Integrated Dental Holdings, My Dentist, Zimmer Biomet, Floss Dental Clinic, Axiss Dental, VideaHealth, Aspen Dental Clinic, Heartland Dental, Dentsply Sirona, Delta Dental, Clove Dental |