Cardiovascular Information System Market Size Analysis:

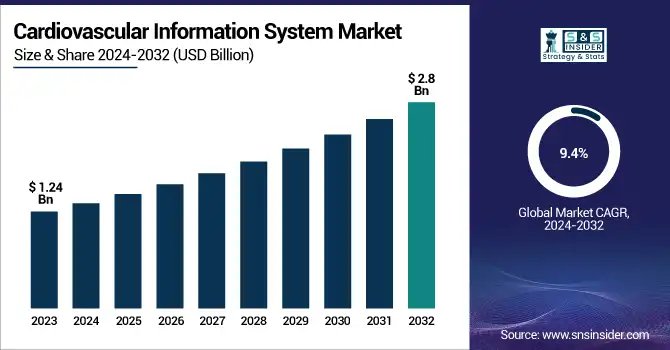

The Cardiovascular Information System Market size was valued at USD 1.24 Billion in 2023 and is expected to reach USD 2.8 Billion by 2032, growing at a CAGR of 9.4% over the forecast period 2024-2032.

Get more information on Cardiovascular Information System Market - Request Sample Report

The Cardiovascular Information System Market Report discusses the adoption, and maximum CVIS implemented in hospitals and cardiology centers. It reviews device integration trends with interoperability with ECG machines, catheterization labs, and echocardiography. The report discusses growth opportunities in the market, fueled by AI-based analytics and cloud solutions. This also covers regional distribution as well as channels of funds in healthcare expenditure. Its implications in regulatory compliance trends (HIPAA, GDPR), and feature adoption trends in AI diagnostics and remote monitoring are explored to provide a comprehensive view of market drivers and technological heights in the CVIS landscape along with information on changing strategies in healthcare.

Cardiovascular Information System Market Dynamics

Drivers

-

Healthcare providers are increasingly recognizing the importance of seamless data exchange and integration across disparate systems to enable comprehensive patient care and improve clinical outcomes.

Data integration and interoperability in Cardiovascular Information Systems (CVIS) set the foundation for improved patient care and clinical efficiency. Nevertheless, problems remain in having a smooth exchange of data between platforms. According to a 2024 report, 93% of cardiology leaders are struggling with integration, and 46% of healthcare facilities do not have standardized protocols at the point of care, resulting in data silos and workflow inefficiencies. Such fragmentation frequently leads to duplicate tests being run unnecessarily thus raising operational costs. On the other hand, a few healthcare organizations that have implemented a fully integrated CVIS reported a 35% reduction in medication errors and a 20% improvement in outcomes for cardiovascular patient cases. These statistics underscore the critical importance of prioritizing data integration and interoperability in CVIS to optimize patient care and operational efficiency.

-

The prevalence and incidence of cardiovascular diseases and the adoption of telemedicine in cardiovascular diseases are increasing.

Restraint

-

The major factor restraining the growth in demand for CVIS is limited interoperability among the various end-user systems in the healthcare market.

According to a 2024 analysis by the Office of the National Coordinator for Health Information Technology (ONC), only 55% of U.S. hospitals can electronically search for, send, receive, and integrate patient information from external providers. But this fragmentation creates data silos, where vital patient information is too dispersed to complete a patient record, increasing the possibility of a medical error. For example, the blood sugar of a patient may be recorded in mmol/L at one center and mg/dL at another, which can easily lead to confusion and further difficulties in medical interpretation. Moreover, these challenges are compounded by the absence of standardized data formats and communication protocols across various EHR systems, resulting in disparate channels for seamless data exchange. Such fragmentation not only impairs clinical workflows but also exacerbates the likelihood of errors, as manual data entry between disparate systems becomes the norm. Addressing these interoperability challenges is crucial for enhancing data integration, improving patient care, and optimizing the functionality of CVIS.

Opportunity:

-

Incorporating AI and machine learning algorithms can enhance predictive analytics and diagnostic capabilities within CVIS, leading to improved patient outcomes.

The merger of Artificial Intelligence (AI) and Machine Learning (ML) with Cardiovascular Information Systems (CVIS) presents significant opportunities to enhance patient care. Recent advancements demonstrate AI's potential with early identification and personalized management of cardiovascular diseases. Other high-profile studies have taken even more direct steps towards telemedicine in January of 2025, UK scientists announced the development of AI software for home-based electrocardiogram (ECG) devices, which can provide specific information about patient heart health. These can serve as early warning signs for fatal conditions, which can save thousands of lives if treated in a timely manner. In December 2024, UK doctors introduced an AI algorithm that scans millions of records at individual general practitioners to find new cardiac patients at risk of hidden atrial fibrillation (AF), a condition that packs an 82 percent higher risk of cardiovascular stroke. Early diagnosis and treatment facilitated by this tool could prevent thousands of strokes annually.

Likewise, in October 2024, the NHS in England commenced a trial of an AI tool called AI-ECG risk estimation (Aire), which predicts heart disease-related and all-cause mortality via AI assessment of ECGs. It aims to detect the patients that might need more diagnostic and or therapeutic action, and hence improve output with early intervention. These examples demonstrate this when the integration of AI and ML led to earlier detection, and improved accuracy of diagnoses combined with treatment plans for the patient leading to better outcomes in cardiovascular care.

Challenge:

-

The substantial costs associated with deploying and maintaining CVIS can be a barrier for small and medium-sized healthcare facilities.

The financial burden imposed by implementing and maintaining Cardiovascular Information Systems (CVIS) is enormous and troubling for healthcare institutions. These types of systems require a significant capital undertaking when they are rolled out. Cambridge University Hospitals NHS Foundation Trust, for example, spent £200 million over ten years with Epic Systems on a system that has, among other things, cardiovascular modules built into it to help track and analyze key measures across departments. The costs do not end at development; the continuous maintenance with the required human supervision will keep adding to the costs. A recent example is the University of Pennsylvania Health System, where an AI algorithm designed to assist oncologists required significant human intervention to function correctly, leading to increased operational costs.

Additionally, unforeseen complications during system rollouts can lead to further financial strain. In 2023 problems with Northern Territory's USD 259 million Acacia patient records system faced a significant post-implementation failure resulting in delays in transferring patients in and out of emergency departments. These challenges necessitated additional resources to address system defects and maintain patient care standards.

Cardiovascular Information System Market Segmentation Analysis

By System

In 2023, the highest revenue share was held by the CVIS segment. CVIS solutions provide all-round functionalities along with integration capabilities which make them a dominating component in the global market. CVIS platforms come with a suite of features like patient data management, imaging integration, reporting, analytics, etc., that are critical for today's cardiovascular care. The American Heart Association notes the need for data to drive many decisions in cardiovascular care, and CVIS solutions play an important role by providing one central location for patient information. Additionally, the rise in interest for value-based care and improvements in clinical workflows in healthcare organizations have aided the market growth in healthcare organizations. Various government initiatives to encourage the adoption of health information technology are expected to drive growth in the CVIS segment as well. For example, the Office of the National Coordinator for Health Information Technology (ONC) has implemented the interoperability standards for which CVIS solutions ought to be homologated, driving the vendors to produce even more advanced and interconnected systems.

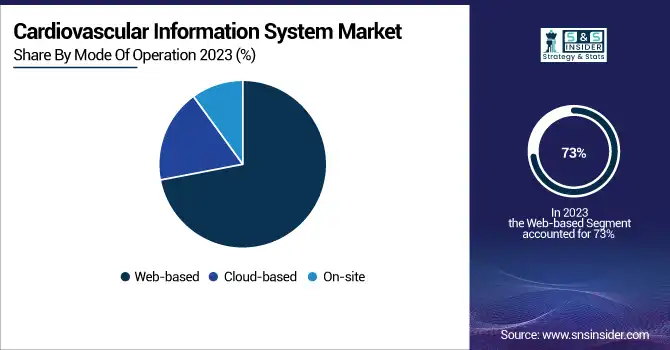

By Mode of Operation

In 2023, the web-based segment held the largest revenue share of 73% in the cardiovascular information system market. Multiple advantages provided by web-based CVIS solutions give rise to this huge market share. Web-based systems allow clinicians to access patient data and imaging studies remotely, facilitating collaboration and decision-making in a timely manner. Such capability has become more relevant since the introduction of telemedicine and wider healthcare delivery across regions. According to the U.S. Department of Health and Human Services, 43.5% of Medicare primary care visits were delivered via telehealth in April 2020. While this percentage has decreased since then, telehealth utilization remains significantly higher than pre-pandemic levels, underscoring the need for web-based healthcare solutions.

In addition, web-based CVIS solutions are a lot easier to scale as well as entail fewer overhead costs for healthcare providers in terms of IT infrastructure. Cloud computing can be beneficial in the healthcare field and all its aspects such as data access and maintenance cost reduction according to a study by the National Institute of Standards and Technology (NIST). This has led to a proliferation of web-based CVIS platforms across most healthcare institutions.

By End User

In 2023, Hospitals held the maximum revenue share and led the market. The dominance of cardiovascular procedures in hospitals, combined with a growing need for integrated patient data management systems, has contributed to this leadership position. According to the American Heart Association, there were approximately 6.2 million hospital stays for cardiovascular diseases in the United States in 2022. Hospitals, particularly large academic medical centers, and integrated health systems, have the financial resources and infrastructure necessary to implement and maintain sophisticated CVIS solutions. According to the U.S. Centers for Medicare & Medicaid Services (CMS), hospital expenditures made up 31% of total U.S. healthcare spending in 2022, a testament to the extensive investments made by these organizations in healthcare technology.

In addition, many hospitals are facing significant pressure to improve heart-related patient outcomes and curb cardiovascular readmission rates. The CMS Hospital Readmissions Reduction Program has made it imperative for hospitals to have strong information systems that can follow patients across settings and that have a care management component. CVIS solutions in the context of these objectives, contributing to their widespread adoption in hospital settings.

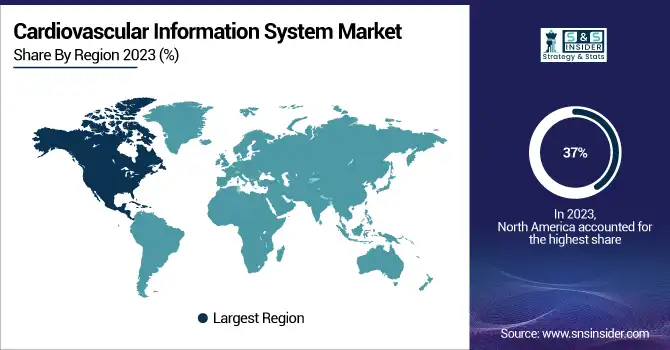

Regional Insights

In 2023, the North American region dominated the market with a share of nearly 37% of the total global CVIS. The factors responsible for this leadership position are extensive healthcare infrastructure, high adoption of healthcare IT solutions, and a large population having cardiovascular disorders in the region. Heart disease continues to top the list of leading causes of death in the United States, with one person dying from a cardiovascular-related condition every 33 seconds, according to the Centers for Disease Control and Prevention.

During the forecast period, the highest CAGR growth is expected to occur in the Asia Pacific region. Some of the factors that have contributed to this rapid growth include the increasing prevalence of cardiovascular diseases, the rising healthcare infrastructure, and growing healthcare IT investments. Asia Pacific CVIS market propellered by China and India As per the Indian Council of Medical Research, cardiovascular diseases accounted for 28.1% of all deaths in India in the year 2022, reiterating the critical need to improve cardiovascular care and management systems. In 2022, the Chinese National Center for Cardiovascular Diseases estimated that there were about 330 million cardiovascular disease patients in China, which provides huge opportunities for adopting the CVIS in China.

Need any customization research on Cardiovascular Information System Market - Enquiry Now

Recent Developments in the Cardiovascular Information System Market

-

Philips Healthcare introduced its next-generation CVIS platform in June 2024, integrating artificial intelligence and machine learning technology to provide clinical decision support and predictive analytics.

-

Siemens Healthineers launched a CVIS solution delivered on the cloud and aimed at small and medium-sized hospitals in September 2024, which is intended to help make advanced cardiovascular information management systems more accessible and affordable.

Cardiovascular Information System Market Key Players

Key Service Providers/Manufacturers

-

Philips Healthcare (IntelliSpace Cardiovascular, Xcelera)

-

Siemens Healthineers (syngo Dynamics, syngo.via)

-

GE Healthcare (Centricity Cardio Enterprise, MUSE Cardiology Information System)

-

McKesson Corporation (McKesson Cardiology, Horizon Cardiology)

-

Agfa Healthcare (IMPAX CV, Enterprise Imaging for Cardiology)

-

Fujifilm Medical Systems (Synapse Cardiovascular, Synapse VNA)

-

LUMEDX Corporation (CardioStar, HealthView CVIS)

-

Cerner Corporation (PowerChart Cardiovascular, CVNet)

-

Merge Healthcare (an IBM Company) (Merge Cardio, Merge Hemo)

-

Digisonics Inc. (DigiView, DigiNet Pro)

Key Users:

-

Cleveland Clinic

-

Mayo Clinic

-

Johns Hopkins Hospital

-

Massachusetts General Hospital

-

The Mount Sinai Hospital

-

NewYork-Presbyterian Hospital

-

Brigham and Women's Hospital

-

Duke University Hospital

-

Cedars-Sinai Medical Center

-

Stanford Health Care

Cardiovascular Information System Market Report Scope

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.24 Billion |

| Market Size by 2032 | USD 2.8 Billion |

| CAGR | CAGR of 9.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Mode Of Operation (Web-based, Cloud-based, On-site) • By System (CVIS, CPACS) • By End User (Hospitals {Large Hospitals, Medium-sized Hospitals, Small Hospitals}, Diagnostic Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Philips Healthcare, Siemens Healthineers, GE Healthcare, McKesson Corporation, Agfa Healthcare, Fujifilm Medical Systems, LUMEDX Corporation, Cerner Corporation, Merge Healthcare (an IBM Company), Digisonics Inc. |