DNA Test Kit Market Report Size Analysis:

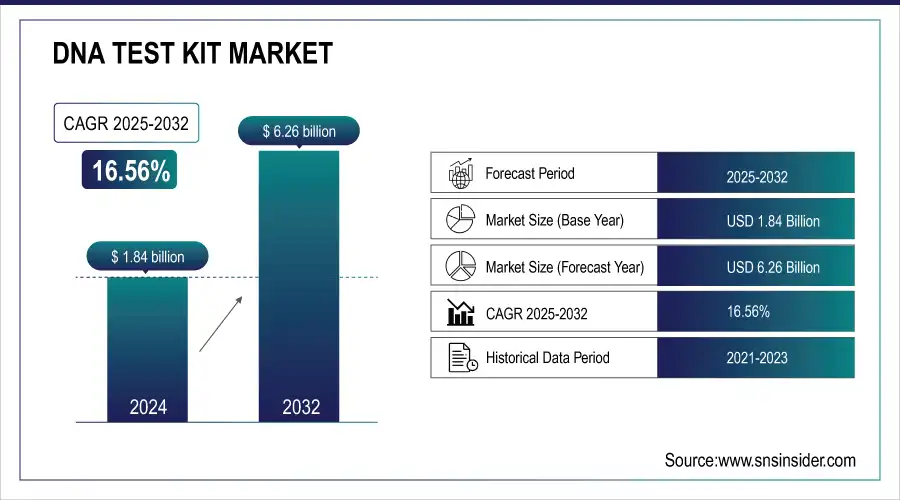

The DNA test kit Market size was valued at USD 1.84 billion in 2024 and is expected to reach USD 6.26 billion by 2032, growing at a CAGR of 16.56% over the forecast period of 2025-2032.

The global DNA test kit market is experiencing a surge in demand in the backdrop of recent developments in genetic science, the broadening scope of personalized medicine, and the growing incidence of hereditary diseases. According to the CDC, 1/6 of people in the U.S. are carriers of a serious inherited health condition, leading to the popularity of DNA test kits for proactive health management. The FDA’s approval of more than 40 direct-to-consumer (DTC) genetic tests is indicative of regulatory endorsement and safety vetting.

Further, the WHO introduced DNA testing as the choice of primary screening test for cervical cancer, indicating strong institutional support. In the U.S. DNA test kit market, the entrance of those platforms has prompted consumer behavior to change. Now, companies offer the possibility to start a genetic test on one's own, enabling self-motivated healthcare. The U.S. household spending will be over USD 5,850 per household per year, and a portion of this amount is currently being spent on preventive testing and health-related products, which now includes direct-to-consumer DNA test kits.

To Get more information on DNA test kit Market - Request Free Sample Report

For instance, Thermo Fisher Scientific reported it had stopped selling them in areas that regarded DNA use as unethical (2024), indicating the growing corporate responsibility in the worldwide DNA test kit market.

R&D investments are adding to the DNA test kit market size, as in 2025, Regeneron has purchased 23andMe for approximately USD 256 million, to protect genetic data assets and enhance long-term innovation ability. Likewise, efforts such as Southern Research have shown a promising program, such as Southern Research’s launch of free genetic testing programs in early 2024, targeting underprivileged demographics to increase inclusiveness and market penetration.

According to the National Human Genome Research Institute, more than USD 2 billion has been invested in the past 10 years alone on genomics R&D, which has driven a new era of innovation in the DNA test kit companies' space. Significant regulatory directives issued by organizations such as ACOG and FDA about carrier screening, as well as test precision, also play a vital role in guiding the DNA test kits market analysis. Supply is also accelerating, as companies are ramping up development to cater to demand, which may be 5-10 times that of pre-pandemic, particularly in the cancer risk, ancestry, and carrier screening segments.

For instance, Maury Povich’s introduction of home-based DNA test kits in 2023 is evidence of increasing cultural acceptance and entertainment backdrops also fueling the development of the market in DNA test kit market share.

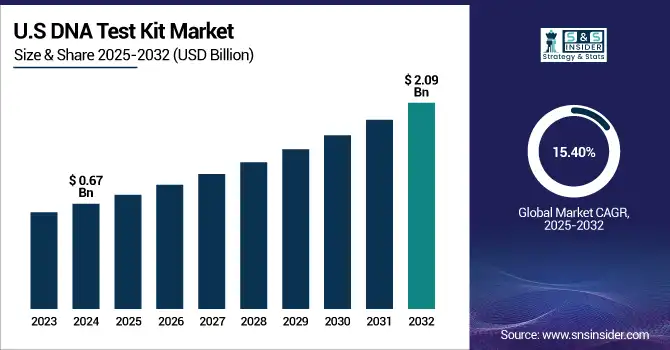

The U.S. DNA test kit market size was valued at USD 0.67 billion in 2024 and is expected to reach USD 2.09 billion by 2032, growing at a CAGR of 15.40% over the forecast period of 2025-2032. The U.S. was ahead given the competitive nature of leading market participants (Ancestry, 23andMe, Helix) and also friendly FDA guidelines for direct-to-consumer (DTC) genetic testing.

DNA Test Kit Market Dynamics:

Drivers:

-

Rising Awareness, Consumer Empowerment, and the Growing Role of Genomics in Personalized Healthcare Propels Market Growth

The global market is on the rise due to the mainstreaming of genomic testing in clinical care and consumer technology. One primary driver is the push to widen the clinical use of genomics, genomic screening in the general adult population is under consideration, as pilot studies at Geisinger and Intermountain Healthcare demonstrate, where 3% of participants with no family history were found to have a pathogenic variant.

Meanwhile, wearable tech companies are starting to team up with genomics firms to associate genetic insights with lifestyle advice, making DNA test kits even more attractive to health-savvy customers. The U.S. Preventive Services Task Force (USPSTF) has further updated its guidelines to support genetic testing for additional groups at increased risk of hereditary cancers, increasing legitimacy.

R&D dollars from the NIH All of Us Research Program have topped more than USD 1.5 billion, underscoring the nationwide push to gather diverse genomic information for future treatment and population-based screening. In addition, academic hubs, such as the Broad Institute and Stanford Genomics, are still promulgating the open-source, affordable DNA sequencing protocol to make affordability and market access more feasible. This convergence of clinical, consumer, and research use has not only increased DNA test kit market share, but it also drives further innovation.

Restraints:

-

Reimbursement Challenges, Interpretation Complexity, and Supply Chain Inconsistencies are Major Barriers for DNA Test Kit Adoption

Most insurers, including public payers, such as Medicare, do not yet regularly pay for consumer-initiated or non-diagnostic tests, denying broader access. Less than 35% of commercial plans cover multi-gene panel testing despite its growing clinical importance, as of a 2023 GAO report. In addition, test complexity is another limitation. A study published in 2022 revealed that roughly 40% of DTC test-takers misinterpreted their results, which could have added unnecessary stress needlessly or given false reassurance. This underscores the need for accessible genetic counseling, which is poorly funded and available only in large cities. On the supply front, a post-pandemic surge in demand for raw materials, such as reagents and sequencing chips, created shortages, which slowed down and compromised and reliability of tests.

Furthermore, backlogs in labs, caused by a lack of staff, have slowed processing times by as much as 30% in some areas. In stark contrast to pharmaceutical regulation, genetic test regulation has been a hodgepodge of anything goes, of no particular standard, and, for consumers, no recourse at all, much of the time. All of these issues serve as friction points to an otherwise high-growth DNA test kit industry analysis market requiring systemic improvements in infrastructure, reimbursement, and user education.

DNA Test Kit Market Segmentation Analysis:

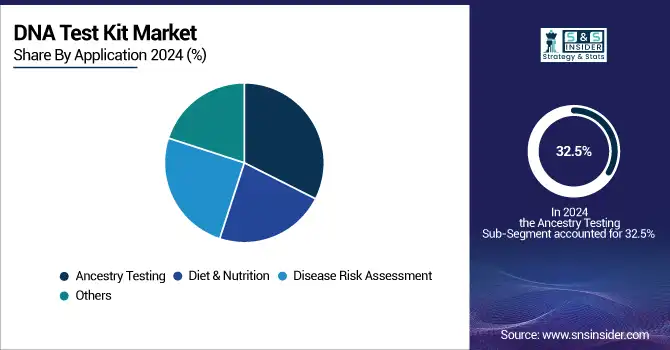

By Application

Ancestry testing was the dominant segment in the global DNA testing kit market, with the market share equivalent to 32.5% in 2024 due to mass consumer interest in genealogy, aggressive advertising, and growing international databases, which helped make it the big kahuna. This was in part due to the availability of these services through online marketplaces and the introduction of ancestry insights on wellness platforms, cementing the category’s leadership.

The disease risk assessment segment had the highest CAGR in 2024, owing to the increasing focus on preventive healthcare and awareness of genetic predisposition. Growth in tests for genetic causes of such conditions as cancer of the breast and ovary (BRCA1/2), diabetes, and cardiovascular disease is also associated with greater uptake. Advances in genomic interpretation tools and greater consumer demand for actionable health data also helped drive this segment.

By Sample Type

Saliva test sample type was the leading segment in the global DNA test kit market in 2024, contributing 25.0% market share. Key to its supremacy was its non-invasive and easy-to-collect nature, the perfect fit for at-home testing kits. Noting companies, including 23andMe and AncestryDNA, had long favored saliva samples for their simplicity and reliability when analyzing a subject's genetic material to produce a personalized ancestry and health risk report.

Hair was the fastest-growing sample type in 2024, as hair is being used more for forensic and paternity investigations. Hair, especially hair with follicles, was an excellent source of DNA and worked well in degraded samples. Their historical identification and criminal justice interests helped raise interest in them for DNA test kit market analysis.

By End-User

Diagnostics and forensics laboratories were the largest shareholding segment in the worldwide market for DNA test kits in 2024, and they own a share of 35.2%. Their success was credited to an increase in demand for higher-fidelity genetic testing in clinical diagnoses and criminal cases. The requirement of certified lab environments and proprietary test technology validates their continued essential function as the place to process and verify DNA kits.

Growth was fastest among academic and research institutions in 2024. This expansion was fueled by growing R&D expenditure in genome science and bioinformatics, especially in collaboration between the public and private sectors. The global institutions have leaned on DNA test kits for population genetics, disease etiology, and personalized medicine research, supported by projects such as the NIH’s All of Us Research Program and Genomics England.

Regional Analysis:

North America held a significant market share of the 2024 global DNA test kit market due to a well-established healthcare system, better consumer awareness, and wider acceptance of personalized medicines.

Get Customized Report as per Your Business Requirement - Enquiry Now

As of 2024, more than 30 million Americans had tested their DNA using a consumer product, revealing significant interest in the market. Canada also demonstrated increasing interest, particularly in ancestry and health risk DNA tests. Mexico saw moderate uptake, with private labs expanding offerings available in urban areas. With the fastest growth observed in North America, this was driven by an increase in home-based test kit use and the incorporation of genomic data into everyday healthcare.

The second fastest growing region in 2024 was Europe, which was driven by government-led genomics projects and a rise in public health genomics investment. Highlighted was the U.K. as the most powerful country, with Genomics England and the integration of genetic screening in routine clinical practice by the U.K. NHS.

In the U.K. specifically, the rollout of the Genomic Medicine Service increased access to DNA testing for rare disease and cancer, which helped lead to adoption. Germany was second, with solid demand from clinical and consumer customers. France and Italy also made contributions by investing in medical genetics and diagnostics. The European progress was also helped by stringent but transparent regulation under the EU’s In Vitro Diagnostic Regulation (IVDR), which provided for the safety and accuracy of the tests.

The DNA test kit market in Asia Pacific expanded rapidly, as China and India played a significant role owing to growing healthcare expenditure and higher inclination towards preventive health. China took the lead in the region with major population genomics projects, including the “China Precision Medicine Initiative,” and the emergence of domestic genetic testing companies.

The rising middle class in India and increasing personalized healthcare options spurred widespread adoption of inexpensive DTC genetic tests (such as those offered by Mapmygenome). Japan and South Korea also saw progress based on the inclusion of genomics in health care and academic R&D. India was growing faster than most countries in the region in 2024, driven by a heightened awareness of diagnostics and domestic innovation in genetic testing products.

DNA Test Kit Market Key Players:

Prominent DNA test kit companies operating in the global market comprise Illumina Inc., Devyser, Ancestry, MyHeritage Ltd., Gene by Gene Ltd., Living DNA Ltd., EasyDNA, Fitness Genes, Helix OpCo LLC, Veritas, Genesis Healthcare Co., Mapmygenome, and Pathway Genomics.

Recent Developments in the DNA Test Kit Market:

In May 2025, the Los Angeles County Sheriff’s Department began investigating the use of defective DNA test kits, which allegedly led to inaccuracies in forensic case outcomes.

In April 2025, the Kenya Medical Research Institute (KEMRI) raised its DNA testing service fees by 35% due to increased demand and operational costs, impacting both legal and medical testing services.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.84 billion |

| Market Size by 2032 | USD 6.26 billion |

| CAGR | CAGR of 16.56% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sample Type (Saliva, Blood, Tissue, Teeth and Bone, Hair, and Others) • By Application (Ancestry Testing, Diet & Nutrition, Disease Risk Assessment, and Others) • By End User (Hospitals, Diagnostics & Forensics Laboratories, Academic & Research Institutes, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Illumina Inc., Devyser, Ancestry, MyHeritage Ltd., Gene by Gene Ltd., Living DNA Ltd., EasyDNA, Fitness Genes, Helix OpCo LLC, Veritas, Genesis Healthcare Co., Mapmygenome, and Pathway Genomics. |