Dredging Market Report Scope & Overview:

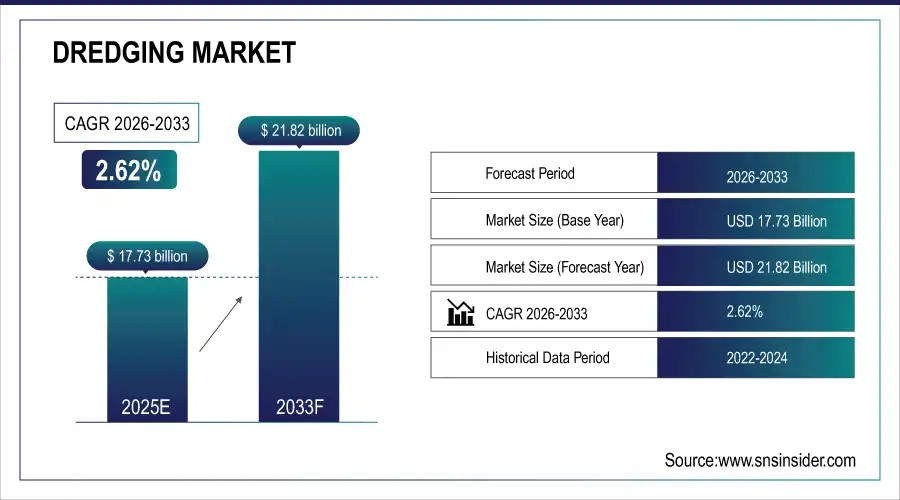

The Dredging Market Size was valued at USD 17.73 billion in 2025E and is expected to reach USD 21.82 billion by 2033, growing at a CAGR of 2.62% over the forecast period of 2026-2033.

To Get more information On Dredging Market - Request Free Sample Report

The Dredging Market is experiencing significant growth due to rising global maritime trade, expanding port infrastructure, and increasing coastal urbanization. With a surge in seaborne cargo and container traffic, ports require frequent dredging to maintain and deepen navigation channels, ensuring safe and efficient vessel movement. Additionally, large-scale land reclamation projects, especially in Asia-Pacific and the Middle East, are driving demand for dredging services. Environmental and coastal protection initiatives, including beach nourishment and flood control, further contribute to market expansion.

For instance, the Water Infrastructure Finance and Innovation Act (WIFIA) program has provided over USD 19 billion in low-interest loans for water infrastructure projects, including dredging initiatives.

Market Size and Forecast:

-

Dredging Market Size in 2025E: USD 17.73 Billion

-

Dredging Market Size by 2033: USD 21.82 Billion

-

CAGR: 2.62% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Key Dredging Market Trends

-

Rising focus on port modernization and expansion projects globally, driven by increasing maritime trade, larger vessel sizes, and the need for efficient logistics and supply chains.

-

Growth in inland waterways and river dredging projects to improve navigability, flood control, and irrigation infrastructure, particularly in emerging economies with growing industrial activity.

-

Expansion of advanced dredging technologies, including cutter suction, trailing suction hopper, and environmentally optimized dredgers, with improved efficiency, precision, and reduced ecological impact.

-

Rising collaborations between dredging contractors, port authorities, and private stakeholders to develop integrated port ecosystems, sustainable land reclamation, and coastal protection solutions.

-

Integration of digital monitoring, GPS-based navigation, and IoT-enabled solutions in dredgers to optimize operations, ensure safety, and minimize environmental disturbances.

U.S. Dredging Market Insights

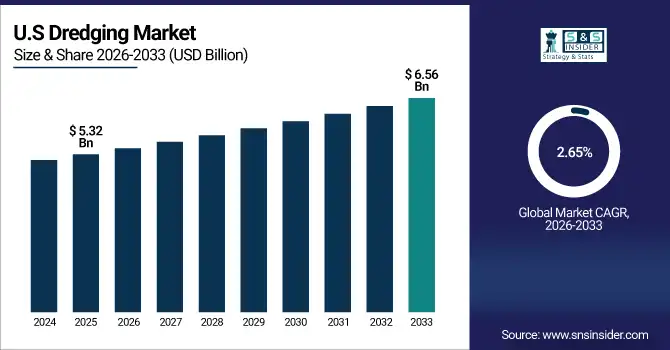

The U.S. dredging market is valued at USD 5.32 Billion in 2025E and is expected to reach USD 6.56 billion by 2033, growing at a CAGR of 2.65% over the forecast period of 2026-2033. Large-scale federal and state projects, including port deepening, river channel maintenance, and coastal protection initiatives, drive demand. Private contractors and industrial end-users are increasingly investing in modern dredging vessels and automation solutions. Expansion of infrastructure programs in key states like Louisiana, Texas, and California strengthens the market, while technological upgrades in dredging equipment enhance operational efficiency and safety

Dredging Market Growth Driver

-

Expansion of Global Maritime Trade and Port Modernization Boosts Market Growth

Rising global trade volumes and increasing vessel sizes are driving the modernization and expansion of ports worldwide. Governments and private stakeholders are investing heavily in deepening harbors, constructing new terminals, and upgrading port infrastructure. In the U.S., the Port of Los Angeles invested over USD 1.3 billion in 2024–2025 for harbor deepening and terminal upgrades. Similarly, in Europe, the Port of Rotterdam Authority allocated €500 million in 2025 for dredging and expansion projects to accommodate ultra-large container ships. These investments stimulate demand for advanced dredging equipment, including cutter suction and trailing suction hopper dredgers, and encourage adoption of eco-friendly dredging practices.

Dredging Market Restraint

-

-

Environmental Regulations and High Operational Costs Limit Market Expansion

-

Stringent environmental regulations related to water quality, sediment disposal, and marine ecosystem preservation pose challenges for dredging operations. Compliance increases project complexity and operational costs. In Europe, dredging projects must meet the EU Water Framework Directive and Marine Strategy Framework Directive, adding regulatory approvals and monitoring costs. In the U.S., the Clean Water Act and the National Environmental Policy Act require detailed environmental impact assessments before dredging permits are granted. High fuel consumption, maintenance expenses, and specialized equipment requirements further restrict small contractors from entering or scaling operations in this market.

Dredging Market Opportunity

-

-

Emerging Economies and Coastal Infrastructure Development Offer Growth Potential

-

Rapid urbanization, industrialization, and coastal development in emerging economies provide significant growth opportunities. In India, the Sagarmala Project plans USD 12 billion investments by 2030 for port development and dredging activities. In Southeast Asia, Indonesia and Vietnam are undertaking large-scale river and coastal dredging projects to improve navigability and support trade expansion. Adoption of technologically advanced dredgers with digital navigation, precision sediment removal, and eco-friendly operations is encouraged by government grants and private investments. These initiatives allow dredging companies to expand operations and cater to both industrial and environmental applications globally.

Dredging Market Segment Highlights:

-

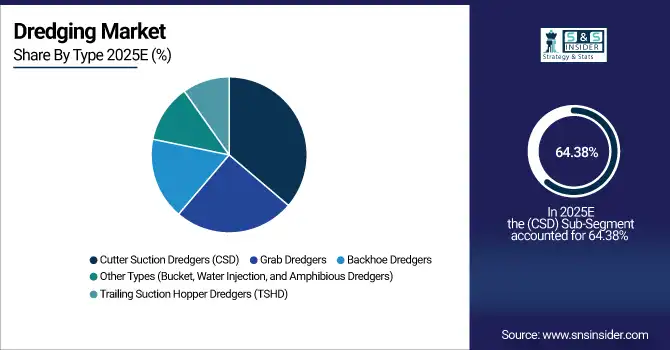

By Type: Cutter Suction Dredgers (CSD) – 35% share (largest); Trailing Suction Hopper Dredgers (TSHD) fastest-growing at 7.8% CAGR, driven by high-capacity and multi-purpose deployments.

-

By Application: Port Construction & Expansion – 40% share (largest); Land Reclamation fastest-growing at 8.2% CAGR, supported by rising coastal development and industrial projects.

-

By End-User: Government & Public Authorities – 45% share (largest); Private Contractors fastest-growing at 7.5% CAGR due to increasing outsourcing of dredging projects and infrastructure investments.

Dredging Market Segment Analysis

By Type

Cutter Suction Dredgers (CSD) dominate the market with a 35% share in 2025, due to their efficiency in handling large-scale excavation projects, adaptability to various soil types, and widespread use in port construction and land reclamation. Trailing Suction Hopper Dredgers (TSHD) are the fastest-growing segment, projected at a CAGR of 7.8%, driven by their versatility for offshore dredging, high-capacity transport of sediments, and increasing deployment in major coastal infrastructure projects. Backhoe and Grab Dredgers are gaining traction for niche applications such as river dredging and inland waterways maintenance, while other types, including Bucket, Water Injection, and Amphibious Dredgers, are emerging segments supporting specialized operations.

By Application

Port Construction & Expansion leads the market with a 40% share in 2025, fueled by global trade growth, port modernization projects, and government infrastructure investments. Land Reclamation is the fastest-growing application segment with an 8.2% CAGR, supported by increasing urbanization, industrial development, and coastal real estate projects. Inland Waterways & River Dredging and Coastal Protection & Beach Nourishment are witnessing steady adoption due to rising flood management initiatives and climate resilience programs. Mining and other specialized dredging applications are steadily contributing to market growth by enabling resource extraction and environmental maintenance.

By End-User

Government & Public Authorities hold the largest share at 45% in 2025, reflecting their direct involvement in public infrastructure, flood control, and navigational maintenance projects. Private Contractors are the fastest-growing end-user segment, with a CAGR of 7.5%, driven by outsourcing trends, large-scale commercial port and reclamation projects, and the expansion of private industrial dredging contracts. Mining & Industrial Companies are gradually increasing their adoption of dredging services for raw material extraction and industrial site development, enhancing market penetration across commercial sectors.

Dredging Market Regional Analysis

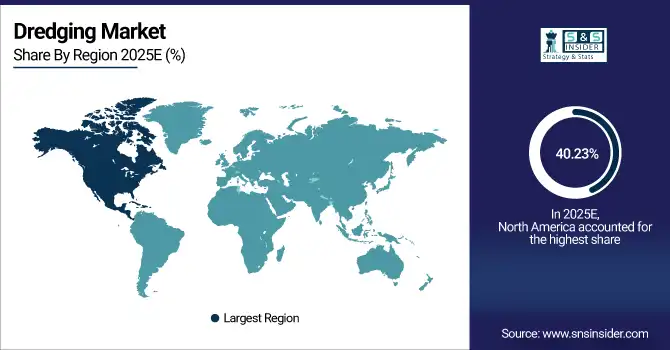

North America Dredging Market Insights

North America accounts for 40.23% of the market in 2025, with the U.S. leading due to extensive inland waterway maintenance, port expansion, and coastal protection programs. Federal funding, state-level infrastructure projects, and private contracts support adoption of modern dredging equipment, including CSD and TSHD vessels. Major investments in river navigation, flood control, and mining dredging operations stimulate regional growth. The region also benefits from technological advancements, workforce expertise, and robust maritime infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Dredging Market Insights

Europe held the significant global dredging market with a 19.11% share in 2025, supported by extensive port modernization, coastal protection, and land reclamation projects. Germany, the Netherlands, and Belgium are leading the region, investing heavily in cutter suction and trailing suction hopper dredgers for large-scale industrial and navigational projects. Strong government policies, environmental regulations, and public-private partnerships enhance project execution efficiency. Investments in advanced dredging technologies and automation further reinforce Europe’s leadership in the global dredging market.

Asia-Pacific Dredging Market Insights

Asia-Pacific holds 26.32% of the global market in 2025 and is the fastest-growing region due to rapid urbanization, infrastructure development, and rising maritime trade. Countries such as China, India, Japan, and South Korea are expanding port facilities, undertaking land reclamation projects, and deploying large-scale dredgers. Government initiatives, funding support, and private-sector investments drive growth in industrial and coastal projects. Increasing industrial demand and strategic infrastructure projects, including airport and harbor expansions, further bolster regional market growth.

Latin America (LATAM) and Middle East & Africa (MEA) Dredging Market Insights

LATAM (5.34% share) and MEA (9.00% share) are emerging regions with growing market potential. Brazil leads LATAM with investments in port construction, mining, and coastal protection projects. Chile and Argentina are developing river dredging and land reclamation facilities. In MEA, countries like UAE, Saudi Arabia, and Egypt are investing in mega-port projects, coastal protection initiatives, and industrial dredging services. Government support, foreign investments, and strategic infrastructure developments drive growth, creating new opportunities for dredging companies in these regions.

Competitive Landscape for Dredging Market:

Royal Boskalis Westminster

Royal Boskalis Westminster is a leading dredging and maritime services company, specializing in harbor maintenance, land reclamation, and offshore construction projects.

-

In March 2025, Boskalis completed a USD 450 million contract for dredging and land reclamation in the Port of Rotterdam, deploying advanced trailing suction hopper dredgers (TSHDs) to enhance port capacity and efficiency.

Van Oord N.V.

Van Oord N.V. is a Dutch dredging, marine engineering, and offshore projects company.

-

In June 2025, Van Oord commissioned a 2.5 km² coastal protection project in Indonesia, including beach nourishment and construction of breakwaters, employing cutter suction dredgers for sediment relocation.

DEME Group

DEME Group provides dredging, environmental, and marine engineering solutions globally.

-

In April 2025, DEME Group secured a €300 million contract for offshore wind farm seabed preparation in Belgium, using TSHD and specialized backhoe dredgers for foundation installation.

Jan De Nul Group

Jan De Nul Group offers dredging, marine engineering, and offshore services.

-

In August 2025, Jan De Nul completed the expansion of a port in Nigeria worth USD 220 million, utilizing cutter suction dredgers and hybrid dredging techniques to deepen shipping channels.

Dredging Market Key Players

Some of the Dredging Companies

-

Boskalis Westminster N.V.,

-

Van Oord N.V.,

-

DEME Group,

-

Jan De Nul Group,

-

Great Lakes Dredge & Dock Corporation,

-

Royal IHC,

-

Manson Construction Co., Inc.,

-

China Communications Construction Company (CCCC),

-

Akkerman Inc.,

-

Tidewater Inc.,

-

Saam S.A.,

-

Deme Offshore Contractors,

-

Royal Boskalis Westminster,

-

VolkerWessels,

-

Bauer Maschinen GmbH,

-

Van der Meer Dredging,

-

Fugro N.V.,

-

Shanghai Dredging Co., Ltd.,

-

Akkerman Dredging,

-

Jan De Nul Offshore

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 17.73 Billion |

| Market Size by 2033 | USD 21.82 Billion |

| CAGR | CAGR of2.62% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cutter Suction Dredgers (CSD), Trailing Suction Hopper Dredgers (TSHD), Backhoe Dredgers, Grab Dredgers, Other Types – Bucket, Water Injection, and Amphibious Dredgers) • By Application (Port Construction & Expansion, Land Reclamation, Inland Waterways & River Dredging, Coastal Protection & Beach Nourishment, Mining, Other Applications) • By End-User (Government & Public Authorities, Private Contractors, Mining & Industrial Companies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Boskalis Westminster N.V., Van Oord N.V., DEME Group, Jan De Nul Group, Great Lakes Dredge & Dock Corporation, Royal IHC, Manson Construction Co., Inc., China Communications Construction Company (CCCC), Akkerman Inc., Tidewater Inc., Saam S.A., Deme Offshore Contractors, Royal Boskalis Westminster, VolkerWessels, Bauer Maschinen GmbH, Van der Meer Dredging, Fugro N.V., Shanghai Dredging Co., Ltd., Akkerman Dredging, Jan De Nul Offshore |