CNC Tool & Cutter Grinding Machine Market Report Scope & Overview:

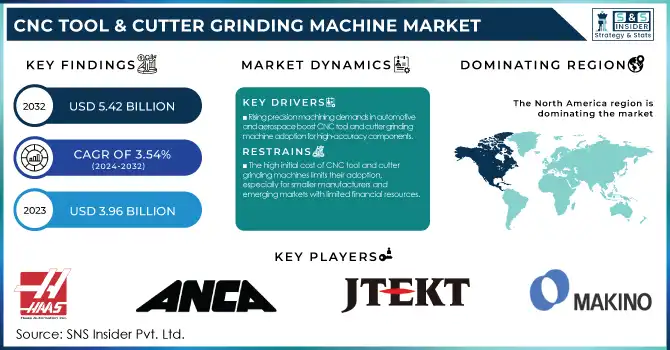

The CNC Tool & Cutter Grinding Machine Market size was valued at USD 3.96 Billion in 2023 and is expected to reach USD 5.42 Billion by 2032 With a growing CAGR of 3.54%. over the forecast period 2024-2032.

To get more information on CNC Tool & Cutter Grinding Machine Market - Request Free Sample Report

The CNC Tool & Cutter Grinding Machine Market report offers a comprehensive analysis of regional manufacturing output trends and utilization rates, along with an in-depth look at maintenance and downtime metrics It illustrates the adoption of advanced technologies across multiple regions and a comparative overview of the regional export/import dynamic. Such data have significant implications for market efficiency, technology dependency, and competition by geography, among others.

CNC Tool & Cutter Grinding Machine Market Dynamics

DRIVERS

-

The rising demand for precision machining, driven by industries like automotive and aerospace, fuels the growth of CNC tool and cutter grinding machines for high-accuracy, tight-tolerance components.

The rising demand for precision machining is a key growth driver for the CNC tool and cutter grinding machine market. Industries such as automotive, aerospace, and defense are becoming more dependent on high-fidelity components that require tight tolerances and flawless finishes. The grinding of the tool and cutter is performed by the CNC tool and cutter grinding machine, which produce drilling milling and grinding tools with better accuracy, repeatability, and efficiency. The increasing demand for these machines is also driven by recent technological developments in the manufacturing process, including the requirement for custom-made and high-grade instruments. This growth is also driven by other trends such as a shift towards lightweight materials in aerospace and automotive industries and increased adoption of electric vehicles. These advancements in CNC grinding technologies, like automation and smart functions, enhance productivity and precision, which in turn only serves to strengthen the critical role that these machines play in a multitude of industries This trend will continue as global manufacturing needs change.

RESTRAINT

-

The high initial cost of CNC tool and cutter grinding machines limits their adoption, especially for smaller manufacturers and emerging markets with limited financial resources.

The high initial cost of CNC tool and cutter grinding machines is a significant barrier, particularly for smaller manufacturers or businesses in emerging markets. The machines involve a large amount of capital investment, such as advanced model purchasing, installation, and operator training. They are expensive to acquire, with many of the advanced models costing millions of dollars, not to mention that a significant amount of money must be put into install and operator training. This results in many SMEs having to forego advanced manufacturing technologies because they cannot afford to pay for the individual capital investments upfront. In addition, the complexity of these devices makes them more expensive, causing companies with shallow wallets to find it hard to justify the spending. For example, in some countries the high cost of the product hinders the adoption of CNC grinders, especially where price sensitivity is greater or if manufacturing companies are reluctant to spend on high-end product lines without any guaranteed returns.

OPPORTUNITY

-

The growth of 3D printing in industries like aerospace creates opportunities for CNC tool and cutter grinding machines to refine 3D printed components through post-processing, ensuring precision and quality.

The expansion of 3D printing and additive manufacturing, particularly in industries like aerospace, is creating new opportunities for CNC tool and cutter grinding machines. While additive manufacturing enables production of complex and customized parts that are built layer by layer, many additive manufacturing components need post-processing to meet the target surface finish, accuracy, and functionality. Machine tools are critical to this process, including CNC tool and cutter grinding machines which can shape and sharpen tools used in 3D printing or perhaps polish the final components to meet stringent industry standards. In the case of aerospace, where performance and safety are paramount, CNC grinding of 3D printed parts removes defects and achieves surface finish specifications. The integration of these technologies leads to improved production processes and expanding design choices, ultimately resulting in superior-quality final products.

CHALLENGES

-

Stricter environmental regulations on waste disposal, energy use, and emissions impose additional costs and challenges for CNC tool and cutter grinding machine manufacturers.

Environmental regulations have become more stringent across various industries, and the CNC tool and cutter grinding machine market is no exception. Manufacturers now have to adhere to regulations on waste disposal, energy consumption, and carbon emissions. For example, these rules can require using environmentally friendly materials, practices that save energy, and the disposal of industrial waste such as metal shavings, oils, and other environmental pollutants. CNC machine manufacturers have to spend on advanced production technologies that'll minimize waste generation, along with waste management systems and machines that consume less energy, ultimately leading to a rise in operational costs. Moreover, this process may also entail periodic audits and certifications by environmental compliance organizations, as well as the potential to up to upgrade equipment, which will only serve to raise costs even further. As much as these regulations encourage sustainable practices, they create hurdles for manufacturers, specifically small-scale firms with fewer resources. Indeed, the shifting dynamics here could prove daunting for many, yet those that adjust to these demands may find themselves ahead of the game by catering to environmentally aware consumers and businesses alike.

CNC Tool & Cutter Grinding Machine Market Segmentation Analysis

By Type

The Universal Grinding Machines segment dominated with a market share of over 48% in 2023, due to their flexibility and versatility. These machines can handle a wide range of applications, making them highly sought after across industries such as automotive, aerospace, and manufacturing. They can also serve varied production requirements because of their aptitude for grinding several kinds of tools, even complex geometries. Universal grinders vary from other specific machines due to their flexibility since they can be used for different types of materials and cutting tools. This flexibility also eliminates the need of multiple machines, thus making them economical to manufacturers. Universal grinding machines have not lost any visibility in the market, with various industries looking for solutions that offer improved productivity and precision consequently leading to their dominance in the sector.

By Application

The Automotive segment dominated with a market share of over 44% in 2023, due to the growing demand for precision manufacturing and tooling in automotive production. The invention of new components in vehicles brings ever-increasing quality, accuracy, efficiency and durability requirements for tools. The best example of the required precision apart from engine components is gears and transmission system, where CNC grinding machine plays a vital role in producing them. The stringent requirements set by the automotive industry in terms of better performance, improved safety, and greater fuel efficiency have led to a high demand for finely engineered, quality components which tends to increase the demand for tool grinding machines with CNC features. Furthermore, the emergence of electric vehicles and autonomous technologies is upping the complexity of automotive parts, maintaining demand in this segment.

CNC Tool & Cutter Grinding Machine Market Regional Outlook

North America region dominated with a market share over 38% in 2023, due to several key factors. The region hosts some of the global leading manufacturers of CNC machinery which leads to innovation and quality across the sector. Moreover, the growing acceptance of advanced technologies in North America strengthens the need for high-precision tools needed by manufacturing sectors like automotive, aerospace, and precision engineering. CNC machines are widely used in these industries, allowing market growth in demand for such machines. North America also dominates the global CNC Tool and Cutter grinding machine market due to the presence of well-established manufacturing hubs in the U.S. and Canada, and significant research and development investments.

Asia-Pacific is the fastest-growing region in the CNC Tool & Cutter Grinding Machine market, primarily due to rapid industrialization and a burgeoning manufacturing sector across countries like China, Japan, and India. These countries are progressively concentrating on improving their manufacturing competence, resulting in a rising requirement for high-precision tooling to cater to sectors such as automotive, aerospace, and electronics. This is furtherly boosted by the advent of automation and smart manufacturing, which upgrades production efficiency and minimize the cost of operations. The increasing adoption of Industry 4.0, robotics, and IoT in manufacturing plants are other factors aiding in the growth of sophisticated CNC tool and cutter grinding machines, and consequently, the fast market growth in the region.

Need any customization research on CNC Tool & Cutter Grinding Machine Market - Enquiry Now

Some of the major key players of the CNC Tool & Cutter Grinding Machine Market

-

Vollmer (CNC Tool Grinding Machines, CNC Tool Grinders)

-

Makino Milling Machine Co. (CNC Milling Machines, CNC Tool Grinders)

-

Haas Automation, Inc.(CNC Vertical and Horizontal Machining Centers)

-

ANCA Pty Ltd. (CNC Tool and Cutter Grinders)

-

ISOG Technology GmbH (CNC Grinding Machines, Tool Grinding Systems)

-

JTEKT Corp (CNC Tool Grinding Machines, Grinding Machine Components)

-

Korber AG (CNC Tool Grinding Machines, Grinding Systems)

-

Amada Machine Tools Co.(CNC Grinding Machines, Surface Grinders)

-

DANOBAT Group (CNC Grinding Machines, Tool Grinding Solutions)

-

WIDMA Machine Tools (CNC Tool Grinders, CNC Grinding Machines)

-

Rollomatic SA (CNC Tool Grinding Machines, Grinding Centers)

-

J Schneeberger Maschinen AG (CNC Grinding Machines, Tool Grinders)

-

Gleason Corporation (CNC Gear Grinding Machines, Tool Grinders)

-

Gebr. SAACKE GmbH & Co. KG (CNC Tool Grinding Machines, Grinding Tools)

-

Alfred H. Schütte GmbH & Co. KG (CNC Tool Grinding Machines, Precision Grinders)

-

JUNKER Group (CNC Grinding Machines, Tool Grinding Systems)

-

United Grinding Group (CNC Tool Grinding Machines, Surface Grinders)

-

Mitsubishi Heavy Industries Machine Tool Co., Ltd. (CNC Tool Grinders, Surface Grinding Machines)

-

KUKA Robotics (CNC Grinding Systems, Industrial Robots for Grinding)

-

Fives Group (CNC Grinding Machines, Tool Grinding Solutions)

Suppliers for (highly accurate, precise grinding machines used for sharpening and manufacturing cutting tools, which are critical in industries like aerospace, automotive, and metalworking) on CNC Tool & Cutter Grinding Machine Market

-

Vollmer

-

Makino Milling Machine Co., Ltd.

-

Haas Automation, Inc.

-

ANCA Pty Ltd.

-

ISOG Technology GmbH

-

JTEKT Corporation

-

Körber AG

-

Amada Machine Tools Co., Ltd.

-

DANOBAT Group

-

WIDMA Machine Tools

RECENT DEVELOPMENT

In June 24, 2024: Kuka Robotics showcased its latest automation solutions at IMTS 2024, including automated milling and metal additive manufacturing systems, designed to streamline part processing and boost production efficiency. Notably, the CyberDrawers machine feeding unit from Waybo offers quick setup, with installation completed in just one day.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.96 Billion |

| Market Size by 2032 | USD 5.42 Billion |

| CAGR | CAGR of 3.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Tool & Cutter Grinding Machine, Universal Grinding Machine, Blank and Cylindrical Grinding Machines) • By Application (Electrical and Electronics Manufacturing, Aerospace & Defense, Automotive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Vollmer, Makino Milling Machine Co., Ltd., Haas Automation, Inc., ANCA Pty Ltd., ISOG Technology GmbH, JTEKT Corp., Korber AG, Amada Machine Tools Co., Ltd., DANOBAT Group, WIDMA Machine Tools, Rollomatic SA, J Schneeberger Maschinen AG, Gleason Corporation, Gebr. SAACKE GmbH & Co. KG, Alfred H. Schütte GmbH & Co. KG, JUNKER Group, United Grinding Group, Mitsubishi Heavy Industries Machine Tool Co., Ltd., KUKA Robotics, Fives Group. |