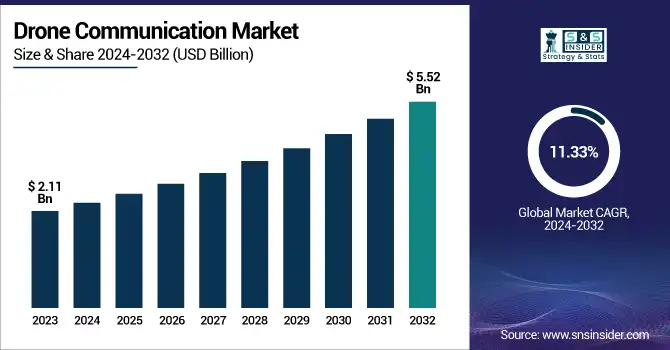

Drone Communication Market Size & Growth:

The Drone Communication Market was valued at USD 2.11 billion in 2023 and is expected to reach USD 5.52 billion by 2032, growing at a CAGR of 11.33% over the forecast period 2024-2032.

To Get more information on Drone Communication Market - Request Free Sample Report

Different frequency bands such as 2.4 GHz (GigaHertz) 5.8 GHz and higher (GigaHertz) play a vital role in drone communication. However, the 5G introduction facilitates drone communication as it offers: low latency, high bandwidth, and reliable communication enabling real-time operations. In swarm ops drones are seamlessly communicating with one another to coordinate and collaborate to get the job done. It adds that also, communication is also affected by frequency and data rate, with high frequencies allowing for high-speed data transfer and the complexity of video streaming and telemetry that is needed for many drone functions. The US drone communication market fueled by the advent of 5G, AI, and meshed networking technologies to expand in 2024 The Pentagon, for its part, is increasingly investing in drone communication technology, spending USD 500 million per year on its "Replicator" program. The clarity of the Federal Aviation Administration regulations under Part 107 has also contributed to the growth of drone operations in other industries such as defense, agriculture, and infrastructure as well.

The U.S. Drone Communication Market is estimated to be USD 0.54 Billion in 2023 and is projected to grow at a CAGR of 9.92%. Driving the growth of the Drone Communication Market in the U.S. are advancements in 5G technology that offers broadband, low latency, and real-time communication capabilities for drones. On top of that, the demand for drones in the defense sector, agriculture, infrastructure, and logistics is also growing which is aiding the regulatory regimes for large-scale adoption and innovation.

Drone Communication Market Dynamics

Key Drivers:

-

Driving Forces Behind Global Drone Communication Market Growth in Defense Agriculture and Industrial Sectors

One of the major factors for the growth of the global drone communication market is the rising demand for drones among military, commercial, and industrial ponds. The increased demand for real-time surveillance, reconnaissance, and secure communication networks in the defense sector has led to a substantial increase in demand. Also, improvements in communication technologies like RF systems, 5G, and mesh networking can allow for much faster and more reliable data transmission that can improve drone efficiency and operational range. Market Dynamics Government initiatives for upgrading defense infrastructure coupled with regulatory support also propel market growth. At the same time, increasing penetration of drones in agriculture, mining, and oil & gas for data collection and remote monitoring, is driving the demand for robust drone communication systems.

Restrain:

-

Key Challenges Hindering Drone Communication Market Growth Including Bandwidth Limitations Security and Regulatory Issues

The most significant restraint impacting the Drone Communication Market is restricted bandwidth and spectrum availability for drone operations. As drones proliferate in the airspace, the increase in signals can lead to congestion and poor communication due to interference, particularly in urban or congested environments. The challenges of regulatory complexities surrounding frequency allocation and inter-state drone flights lead to inconsistency and lack of seamless communication as well. Moreover, drones are susceptible to cybersecurity threats such as hacking, data leakage, and signal jamming, which are always significant issues, because if their functionality is affected, sensitive operations can be disrupted in both the defense and commercial sectors.

Opportunity:

-

Expanding 5G Infrastructure Unlocks Immense Opportunities for Drone Communication AI IoT and Commercial Growth

As 5G infrastructures expand rapidly, the opportunities for using 5G for drone communication systems are immense, especially when considering AI and IoT, both of which will work seamlessly to determine drone-cloud connectivity and processing of drone data. These myriad technologies enable immediate analysis of data, autonomous flight movements, and interlinked operations over long ranges. In emerging economies, drone proliferation is leading to newer opportunities for players in agriculture and emergency services. In addition, the commercial sector is increasing the adoption of drones for delivery services, infrastructure inspection, and cinematography which drives requirements for advanced low-latency communication solutions. At the same time, firms that provide communication modules that are lightweight, low-power, and high-security will attract strong interest in the changing marketplace.

Challenges:

-

Overcoming Environmental Challenges and Technical Barriers for Seamless Drone Communication System Integration and Deployment

Drone communication can be disrupted by environmental factors such as different terrains, extreme weather conditions, and electromagnetic interference, especially in remote or hostile places. Such hardships hinder the steadiness of the signals an aircraft sends and ultimately huggers the functionality of drones. The other major issue is incorporating a variety of communication systems into already established drone platforms with minimum impact on size weight and power (SWaP). High cost, complex engineering, and standardization are barriers there because need to assure seamless interoperability among RF, SATCOM, and emerging 5G technologies. Furthermore, the unavailability of personnel trained to ensure technical expertise in operating enhanced communication systems in drones can hamper large-scale deployment, especially in regions where development is still a process.

Drone Communication Market Segments Analysis

By Communication

Radio Frequency (RF) communication is anticipated to continue to dominate the communication market with a strong 38.5% share in 2023. In both military, commercial, and even industrial fields, RF communication is still the most popular and commonly used technology for drone control and data transmission, respectively, in real-time. Due to this, it adapts to multiple frequencies and works fine even in far away or extreme fields, making it an ideal selection for different end-users.

The 5G & LTE-based communication segment is anticipated to be the fastest growing segment with the highest CAGR from 2024 to 2032 attributed to the requirement of high-speed low latency data transmission. 5G networks are expanding rapidly across the world and these networks will allow drones to play a larger role in more complex operations with features like autonomous navigation, live-stream HD video feed, and AI-backed analytics. Such technologies provide greater connectivity with the help of which drones will get their specific task done even in dense urban areas or a high-traffic environment, paving the future of drone communication to be transformational 5G/LTE.

By Application

In 2023, the Drone Communication Market for the Military & Defense segment will account for the maximum market share of 27.5% The obverse of this dominance comes from an ever-increasing reliance on drones for spying, reconnaissance, border patrol, and combat. Stable and secure communication systems are essential for military applications, allowing for the real-time transfer of data, pin-point targeting, and the simultaneous execution of multiple air, ground, or naval movements. As governments and defense agencies look to protect as well as strengthen national security and strategic capabilities, investment in advanced drone technologies is becoming a common trend.

The Agriculture segment is likely to record the fastest CAGR between 2024 and 2032 attributed to the increasing adoption of drones in precision farming. Farmers use drones for crop monitoring, soil analysis, irrigation planning, and pest control, which all require real-time data transmission capabilities (Fig. Thus, the fusion of drones and the Internet, GPS, and AI technologies is metamorphosing agriculture, augmenting productivity, and fostering strong growth potential in this segment.

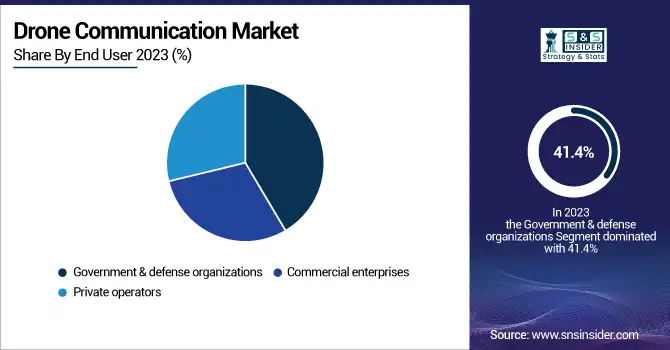

By End User

In 2023, Government & Defense Organizations held the largest share of the Drone Communication Market, at 41.4%. This is due to the broad applications of drones used for reconnaissance, border security, disaster management, and tactical operations that require reliable and near real-time communications systems. The global investment of governments in the modernization of defense infrastructure as well as in enhancing drone-based capabilities has been providing a steady boost to the demand for advanced drone communication technologies.

From 2024 to 2032, the fastest CAGR will be found in the Commercial Enterprises sector. This growth is powered by the increasing number of use cases for drone technology in logistics, infrastructure inspection, agriculture, cinematography, and energy. Demand for high-speed, low-latency communication systems is increasing as businesses worldwide adopt drones to optimize business operations and create and operationalize new types of real-time data. On the other hand, the incorporation of 5G, Artificial Intelligence, and cloud technologies into the commercial sector is expected to play a pivotal role, as one of the most important components in fostering the future growth of the market.

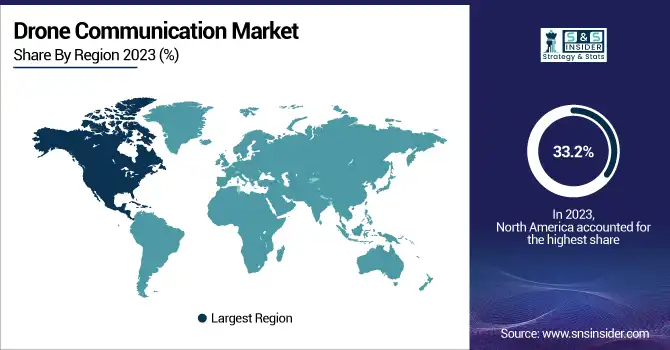

Drone Communication Market Regional Insights

The North American region led the Drone Communication Market as it held 33.2% of market share in 2023 followed by Europe and Asia-Pacific regions owing to higher defense investments, development hubs, and early integration of various drone technologies. The U.S. DOD remains one of the biggest players, utilizing drones for surveillance, gathering intelligence, and strategic missions. In the commercial space, drone-based last-mile delivery solutions such as Zipline and even Amazon Prime Air are heavily dependent on high-quality RF and 5G communication systems. The FAA regulatory framework and paired policies have also fostered innovations and pilot projects in the agricultural, energy, and emergency services sectors.

During the forecast period from 2024 to 2032, the Asia Pacific region is projected to witness the highest compound annual growth rate (CAGR), driven by rapid industrialization, favorable government initiatives, and expanding application of commercial drones. China and India are also investing heavily in drone technology to inform smart farming, and infrastructure monitoring public safety measures, while Japan has already begun deploying drones to undertake disinfection and surveillance to combat the virus. Like India’s “Drone Shakti” program and China’s JD. The use of drones to deliver e-commerce products at sites such as, com is paving the market growth. In agriculture, Japan is using drones for pest control of rice field monitoring. Increasing penetration of 5G and beneficial government initiatives to communicate drone technology with national development policy are fuelling this regional progress.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in the Drone Communication Market are:

-

DJI (OcuSync)

-

Parrot SA (Skycontroller)

-

Lockheed Martin (Stalker XE)

-

Northrop Grumman (Firebird)

-

Raytheon Technologies (Coyote UAV)

-

Thales Group (SkyView)

-

L3Harris Technologies (WESCAM MX™-Series)

-

Boeing (Insitu) (ScanEagle)

-

Textron Systems (Shadow Tactical UAS)

-

AeroVironment (Puma 3 AE)

-

Elbit Systems (Skylark I-LEX)

-

FLIR Systems (now Teledyne FLIR) (Black Hornet Nano)

-

General Atomics (MQ-9 Reaper)

-

Kratos Defense & Security Solutions (XQ-58A Valkyrie)

-

BlueHalo (Intelligent RF™ - DAP)

Drone Communication Market Trends

-

In February 2025, Lockheed Martin launched a new AI-driven counter-drone system to enhance real-time threat detection and response. The modular technology integrates advanced sensors and effectors to counter single and swarm drone threats.

-

In January 2025, L3Harris showcased its T7 robotic system's new drone detection and defeat capabilities during the U.S. Army's Vanguard 24 exercise. The system integrates counter-drone technology to enhance battlefield defense against small unmanned aircraft.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.11 Billion |

| Market Size by 2032 | USD 5.52 Billion |

| CAGR | CAGR of 11.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Communication (Radio frequency (RF) communication, Satellite communication (SATCOM), 5G and LTE-based communication, Mesh networking, Optical and infrared communication) • By Application (Agriculture, Construction & mining, Oil & gas, Military & defense, Commercial, Emergency services, Others) • By End User (Government & defense organizations, Commercial enterprises, Private operators) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DJI, Parrot SA, Lockheed Martin, Northrop Grumman, Raytheon Technologies, Thales Group, L3Harris Technologies, Boeing (Insitu), Textron Systems, AeroVironment, Elbit Systems, FLIR Systems (now Teledyne FLIR), General Atomics, Kratos Defense & Security Solutions, BlueHalo. |