Agriculture Drone Market Report Scope & Overview:

To get more information on Agriculture Drone Market - Request Free Sample Report

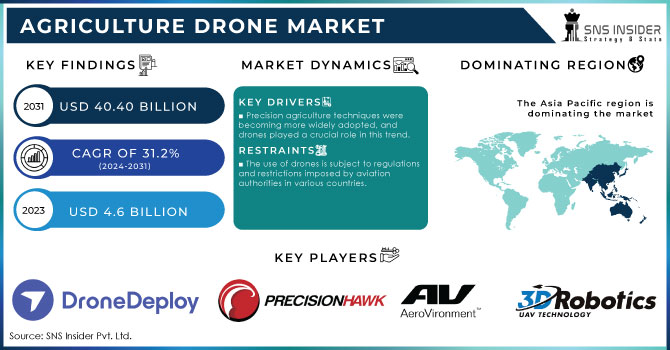

The Agriculture Drone Market size amounted to USD 4.6 Billion in 2023 & is estimated to reach USD 40.40 Billion by 2031 and increase at a compound annual growth rate (CAGR) of 31.2% between 2024 and 2031.

Agri-tech firms have developed innovative models for easing farming practises by focusing more on wireless platforms, such as drone technology, to enable real-time decision-making regarding yield monitoring, crop health monitoring, field mapping, irrigation scheduling, and harvesting management in order to increase agricultural productivity. Agriculture drones are Unmanned Aerial Vehicles (UAVs) used in farming and agricultural applications. These drones are equipped with a wide range of sensors and imaging technologies, e.g. LIDAR, camera or multispectral sensing that enables them to collect data on agriculture's agricultural productivity in addition to other aspects affecting it.

A variety of reasons are driving the global market, including the rising need for precision agriculture, developments in drone technology, government backing, cost-effectiveness, & more awareness and education. Furthermore, UAV data may be utilised for a variety of applications, including crop monitoring, mapping, and analysis, as well as plant counting, irrigation management, and pest control. UAVs can also assist farmers optimise agricultural operations, minimise waste, and enhance yields by delivering precise and timely information on crop health and production. Furthermore, the worldwide market is expected to rise during the projected period due to an increase in the implementation and usage of such technologies.

With growing business activity, research, and investment, North America is one of the most important markets, with the United States being one of the most important marketplaces. The National Institute for Food and Agriculture awarded Kansas City State University more than $100,000 for a drone research programme that has aided in the production of stronger, more wheat and other grains are resistant strains of popular crops. Drones will monitor wheat-breeding facilities in the same way that aerial imaging technology is used in agriculture to identify and cross-breed wheat strains. This discovery will allow certain crops to mature faster and may have an influence on the global seed industry.

Drones equipped with various sensors, such as multispectral, hyperspectral, and thermal cameras, can capture high-resolution images and data that help farmers monitor crop health, detect nutrient deficiencies, and identify areas of stress. This enables the precise application of resources like water, fertilizers, and pesticides. Drones can cover large agricultural areas quickly, reducing the time and labour required for manual inspections. This efficiency results in cost savings and higher production. Drones gather valuable data that can be processed to create maps, models, and analytics for making informed decisions about crop management, irrigation, and overall farm operations.

Agriculture Drone Market Dynamics

DRIVERS

-

Precision agriculture techniques were becoming more widely adopted, and drones played a crucial role in this trend.

-

Data-Driven Insights are the driver of the Agriculture Drone Market.

Drones collected vast amounts of data from fields, enabling farmers to make informed decisions about planting, irrigation, fertilization, and pest control. This data-driven approach aimed to increase yield while minimizing resource wastage.

RESTRAIN

-

The use of drones is subject to regulations and restrictions imposed by aviation authorities in various countries.

-

Skill and Training Requirements are the restraint of the Agriculture Drone Market.

Operating agriculture drones effectively requires a certain level of technical expertise and training. Farmers and operators need to learn how to pilot drones, analyze collected data, and integrate it into their farming practices. The learning curve can be a challenge for some users.

OPPORTUNITY

-

Incorporating AI and machine learning algorithms into agriculture drones can enhance their capabilities.

-

Customization for Specific Crops is an opportunity for Agriculture Drone Market.

Developing specialized drones and sensor payloads tailored to the unique needs of different crops and farming practices can provide significant value. This customization can lead to more accurate and effective data collection and analysis.

CHALLENGES:

-

Most drones have limitations on flight time and range due to battery constraints.

-

Data Overload and Interpretation are the challenges of the Agriculture Drone Market.

Drones collect large amounts of data, and farmers may struggle with processing and interpreting this data effectively. Without proper data analysis tools and expertise, the collected data may not translate into actionable insights.

IMPACT OF RUSSIA-UKRAINE WAR

Ukraine, famed for agriculture and other heavy industries, is an unlikely location for drone innovation. However, the constraints of war, more than 200 Ukrainian drone manufacturers are now collaborating with front-line military units to adjust and upgrade drones to better their capacity to kill and spy on the enemy. Over the previous year, the initiative has assisted commercial firms in training over 10,000 drone operators, with the goal of training an additional 10,000 in the next six months. Russia's air force is considered to be 10 times larger than Ukraine's, and it has grounded most of it after shooting down multiple fighter jets early in the conflict. With the help of drones, Ukraine has been able to watch and hit critical targets more than a kilometre beyond enemy lines, while also improving its conventional artillery's accuracy. Agriculture Drone Market has gained profits up to 3.2-4.1% due to the Russia-Ukraine war.

IMPACT OF ONGOING RECESSION

Drones, or unmanned aerial vehicles, are increasingly being used in a wide range of businesses, from personal use to military purposes, but they may also help a country's economic production. According to a World Economic Forum study, drones have the potential to be at the core of a technology-led revolution in Indian agriculture, raising the country's GDP by 1-1.5% while creating at least five lakh jobs in the next years. The agriculture business in Asia is crucial to the economy since it employs 8-10% of the population and feeds 1.5 billion people in the world's second most populous country. In actuality, Asian agriculture is vital not just for the domestic market, but also for the global food supply chain. In the ongoing recession, Agriculture Drone Market has increased its product & service prices up to 2-3.1%.

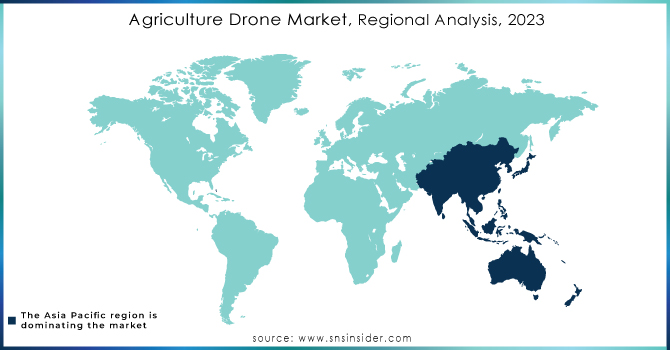

Agriculture Drone Market Regional Analysis

Asia Pacific: During the projection period, Asia Pacific will be the dominating region. The Asia Pacific market is predicted to develop rapidly due to increased agricultural output and worldwide agricultural exports. The demand for agriculture unmanned aerial vehicles is likely to be increased by major farming countries, like China, India, Indonesia and several others in Asia. Furthermore, regional market players are extensively spending in product development, which will drive up demand for agricultural UAV services throughout the projection period.

North America: The second-largest market share was held by North America. The region's growth is due to different government programmes and investments to improve the sector. The Department of Transportation (DOT) and the Federal Aviation Administration (FAA), for example, have created favourable legislation to encourage commercial and small unmanned aerial systems by eliminating the need for a pilot licence. Furthermore, commercial agricultural enterprises operating enormous acres across the country have a significant and loyal client base in the United States. This, together with the availability of appropriate manufacturing businesses in the United States and Canada, explains North America's dominance in the worldwide agriculture drone market share.

Need any customization research on Agriculture Drone Market - Enquiry Now

KEY PLAYERS

The major Players are Drone Deploy, Precision Hawk Inc, DIL, AeroVironment Inc., 3D Robotics, Trimble Navigation Ltd., Parrot Drone, Sintera LLC, Ag Eagle, Delair Tech SAS and other players.

RECENT DEVELOPMENT

In 2022: Trimble announced a next-generation 3D paving control system for asphalt compactors, which is intended to increase the compactors' speed and accuracy.

In 2022: The Pininfarina Shanghai EA-30X is a professional agriculture spraying drone that can cover all terrains, all hours, and all plant protection application scenarios. The next-generation night autonomous operation of the EA-30X dual-eye environment sensing technology provides dynamic continuous obstacle avoidance as well as complete coverage of terrain below 90 degrees.

In 2021: DJI unveiled its latest crop protection drone, the AGRAS T20, in its crop protection series for agriculture. It has a maximum payload of 20 kg and a 20% improvement in spray uniformity of about seven metres.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.6 Billion |

| Market Size by 2031 | US$ 40.40 Billion |

| CAGR | CAGR of 31.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hybrid Wing, Rotary Wing, Fixed Wing) • By Component (Navigation Systems, Batteries, Cameras, others), and By Application (Livestock Monitoring, Precision Agriculture, Precision Fish Farming, Irrigation, Smart Greenhouse) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Drone Deploy, Precision Hawk Inc, DIL, AeroVironment Inc., 3D Robotics, Trimble Navigation Ltd., Parrot Drone, Sintera LLC, Ag Eagle, Delair Tech SAS |

| Key Drivers | • Precision agriculture techniques were becoming more widely adopted, and drones played a crucial role in this trend. • Data-Driven Insights are the driver of the Agriculture Drone Market. |

| Market Restraints | • The use of drones is subject to regulations and restrictions imposed by aviation authorities in various countries. • Skill and Training Requirements are the restraint of the Agriculture Drone Market. |