Drone Photography Services Market Size & Trends:

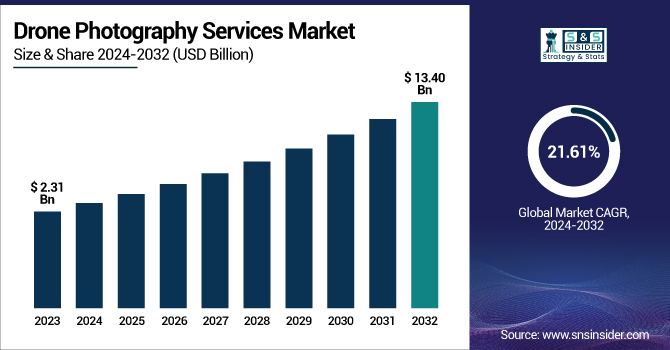

The Drone Photography Services Market was valued at USD 2.31 billion in 2023 and is expected to reach USD 13.40 billion by 2032, growing at a CAGR of 21.61% over the forecast period 2024-2032.

To Get more information on Drone Photography Services Market - Request Free Sample Report

Improving the imaging quality and service scope of drone photography services, an increasing number of operators are procuring advanced drone equipment and payloads to deliver high-resolution aerial photography services. Market growth is being propelled by advancements in technology, including AI-integrated drones and advanced camera technology. Scalable Services: As the fleet size grows, it can offer many scalable services across industries such as real estate and agriculture. Higher battery lifespan and range are enhancing operational time and coverage, allowing drones to be more efficient for long-term and extensive photography plans. Sectors such as agriculture, construction, e-commerce, healthcare, retail, and real estate are demanding more U.S. drone photography services in 2024. The boom is driven by the Federal Aviation Administration, allowing beyond visual line of sight (BVLoS) operations, which means all kinds of stuff like those Amazon drones and stuff by Zipline could finally start working. Improvements in these image evaluation and processing tools are also expanding applications of the technology for things like disaster response, construction monitoring, and precision agriculture.

The U.S. Drone Photography Services Market is estimated to be USD 0.66 billion in 2023 and is projected to grow at a CAGR of 20.82%. The U.S. Drone Photography Services Market is driven by growing adoption for emergency response applications such as search and rescue, environmental monitoring, inspections of industrial infrastructures, and support for both government and corporations to maintain business continuity. The fast-paced development and service innovation are driven by government initiatives that support drone integration, increasing demand for real-time aerial data, and growing applications that include media, tourism, and sports events.

Drone Photography Services Market Dynamics

Key Drivers:

-

Rising Demand for High-Quality Drone Photography Boosts Adoption Across Key Industry Applications

Growth of the drone photography services market is driven by the increasing demand for better-quality images captured by drones over high-resolution aerial images for various applications in different industries like real estate, agriculture, construction, media, and surveillance. The relative cheapness and ease of availability of UAVs, coupled with advancements in camera technology, have allowed service providers to produce highly effective and economical visual media. Drone photography facilitates engaging presentations and comprehensive analysis of the site in sectors such as real estate and infrastructure development, supporting project planning and marketing functions. Moreover, various countries have extended regulatory support for commercial drone deployment, stimulating the growth of the commercial drone market by propelling various enterprises to utilize aerial services for streamlined operations and more accurate data.

Restrain:

-

Strict Drone Regulations and Privacy Concerns Pose Major Challenge for Drone Photography Service Providers

The regulatory environment surrounding drone operations in various nations serves as a significant challenge in the Drone Photography Services Market. Operational flexibility is restricted due to airspace restrictions, licensing, and no-fly zones, especially in urban or sensitive areas. Nabil Z Service providers have to comply with cumbersome approvals, which will increase lead time to execute a project and restrict ad-hoc or location-oriented shoots. Drones do capture imagery that typically is not available to the general public, but they also present data privacy problems, especially when flying for commercial purposes over private properties or public spaces. Such issues can lead to legal challenges and diminish user trust, especially in countries with stringent data protection regulations.

Opportunity:

-

Technological Advancements and Smart City Projects Unlock New Opportunities for Drone Photography Services Globally

With the advent of various technologies, the market shows attractive opportunities in applications for mapping and surveying, environmental monitoring, and industrial inspections. Soaring urbanization and smart city projects, especially across the Asia Pacific region, are propelling the demand for services offered by drones. AI and machine learning embedded in the drone system also allow for processing data in real time and automated flight paths and safety features, making it essential in a big project. In addition, many emerging markets, particularly in Latin America and the Middle East, are investing in drone infrastructure, creating additional opportunities for service providers looking to expand their footprint in new geographies.

Challenges:

-

Limited Flight Time, Weather Dependency, and Skill Shortage Challenge the Growth of Drone Photography Services

The short battery life and flight time are another big problem the drones are facing that limits the scope and efficiency because, for large area projects or far-field projects, it becomes difficult to monitor. Another significant concern relates to weather dependency, as most drones are extremely sensitive to wind, rain, and poor visibility, which results in most of the services being often delayed or rescheduled. In addition, skilled drone operators and licensed pilots are in short supply, hindering quality and scalability. With the expansion of the market, standardization of safety protocols, pilot training, and maintenance will become more important than ever to mitigate operational risk and maintain mission reliability. Together, these factors make widespread adoption and service expansion difficult.

Drone Photography Services Market Segmentation Analysis

By Type

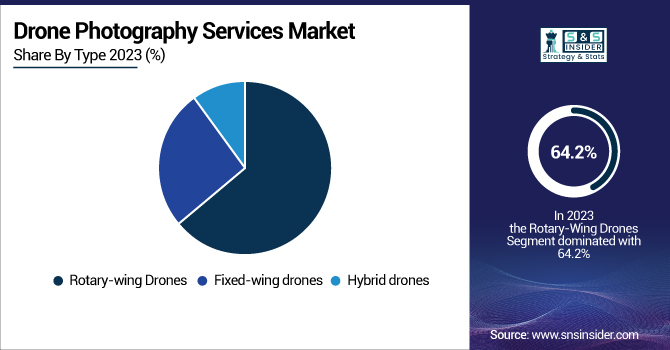

Rotary-wing drones accounted for the highest market share of 64.2% of the drone photography services market in 2023. The main reason for their popularity is their hovering, vertical take-off, and ability to operate in narrow or restricted areas, providing a great option for aerial photography in cities, real estate, or event coverage. They are easy to design and use and cheap to purchase, which has resulted in more demand for both commercial and amateur drone pilots.

Fixed-wing drones are projected to gain the fastest CAGR over the forecast period (2024-2032) owing to their longer flight duration, faster speed, and single-flight range over large areas. They have found use in long-range applications like mapping, surveying, agriculture, and infrastructure inspection, where distance and data acquisition play a major role. With industries in need of scalable, data-centric solutions, expect to see growth within commercial and especially industrial sounders for fixed-wing drones.

By Service Type

In 2023, photography dominated the global drone photography services market by capturing 34.3% share of overall revenue. Much of this strength is attributable to the rising popularity of high-end aerial imagery in areas like real estate photography, vacation rentals, weddings, and social media production. From both personal and commercial aspects, aerial photography has become a popular option, as not only do drones offer more unique and dynamic perspectives, but they also know how to capture them. The low cost and simplicity of rotary-wing drones have also helped to popularize drone-based photographic services.

The mapping and surveying segment is expected to grow at the highest rate from 2024 to 2032. The need for large-scale mapping solutions with high accuracy for infrastructure development, urban planning, precision agriculture, and environmental monitoring has proliferated. With the ability to deliver geospatial data at lower costs as well as high resolution, drones reduce both time and labor compared to traditional and surveying methods and have become crucial tools for industries looking to obtain efficient spatial analysis outputs.

By Application

In 2023, commercial applications held a large revenue share of 71.7% in the market and are anticipated to register the fastest CAGR from 2024 to 2032. This leading market position is further bolstered by the prevalence of drone photography services in real estate, agriculture, construction, media, and infrastructure inspection. Drone use is on the rise in business for high-resolution imagery, measurables, and marketing content, leading to faster, smarter decisions. Besides, increasing implementation of drones for industrial activities, along with governmental support for drone adoption, boosts the growth of the market. With technology facilitating drone improvement, the commercial segment will soon enter rapid growth with innovative, dynamic, scalable solutions to serve the growing requirements of enterprises.

Drone Photography Services Market Regional Outlook

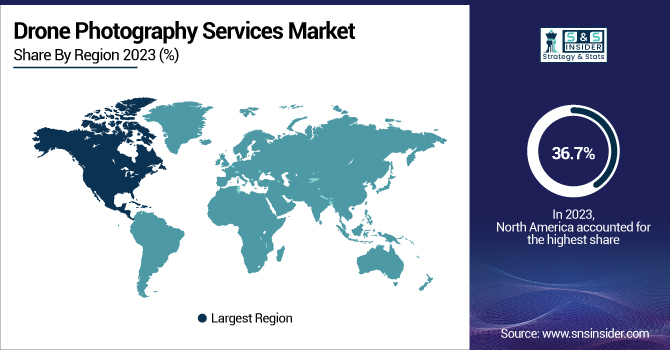

In 2023, North America held the highest share of the drone photography services market, accounting for 36.7%, owing to high demand for drone services from the real estate, construction, media, and agriculture sectors. This culmination of a high-tech environment and regulations that support commercial drone flying has driven widespread adoption across the region. Companies such as DJI are dominating the drone photography and aerial mapping industry within the United States, while other companies like Skydio are beating the reviews and setting new standards for drone technology. For instance, real estate firms like Zillow deploy drones for listing homes, providing distinctive aerial shots to appeal to buyers, and making property more attractive to the market.

The region of Asia Pacific is anticipated to grow with the highest CAGR from 2024 to 2032, due to rapid urbanization and infrastructure development, followed by the demand for aerial data in different application areas like agriculture, construction, and environmental monitoring. This is spearheaded by countries such as China, India, and Japan. At the top of that list is DJI, an international drone manufacturing powerhouse from China, whose drones are commonly used for mapping and surveying in Asian construction works. Similarly, in India, laser-induced technology companies such as Aerial Works are providing drone solutions for agriculture, with services including monitoring and aerial spraying to improve agricultural efficiency. The development of smart city projects in the region also boosts the demand for drone services for urban planning and infrastructure monitoring.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Drone Photography Services Market are:

-

DJI (Phantom 4 RTK)

-

Parrot (Anafi USA)

-

SenseFly (eBee X)

-

Delair (Delair UX11)

-

Skycatch (Skycatch One)

-

Aeryon Labs (SkyRanger R70)

-

Propeller Aero (AeroPoints)

-

Quantum Systems (Tron)

-

Insitu (ScanEagle 3)

-

UAV Propulsion Tech (UAV-Propulsion)

-

Airbus (SkyLab)

-

DroneDeploy (DroneDeploy Software)

-

Autel Robotics (EVO II Pro)

-

Flyability (Elios 2)

-

Kespry (Kespry 2S)

Recent Development

-

In April 2025, Quantum Systems GmbH and RENK Gears Private Ltd. (RENK India) formed a strategic partnership to enhance R&D, production, and digitalization efforts in India, focusing on the defense and technology sectors. The collaboration aims to expand local production capabilities and support India's growing defense investments.

-

In March 2024, Flyability launched a revolutionary Ultrasonic Thickness Measurement (UTM) payload for the Elios 3 drone in the Asia Pacific, enhancing industrial inspections in confined spaces.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.31 Billion |

| Market Size by 2032 | USD 13.40 Billion |

| CAGR | CAGR of 21.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fixed-wing drones, Rotary-wing drones, Hybrid drones) • By Service Type (Photography, Videography, Mapping and surveying, Inspection, Monitoring), • By Application (Individual, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DJI, Parrot, SenseFly, Delair, Skycatch, Aeryon Labs, Propeller Aero, Quantum Systems, Insitu, UAV Propulsion Tech, Airbus, DroneDeploy, Autel Robotics, Flyability, Kespry. |