Dry Type Transformer Market Report & Overview:

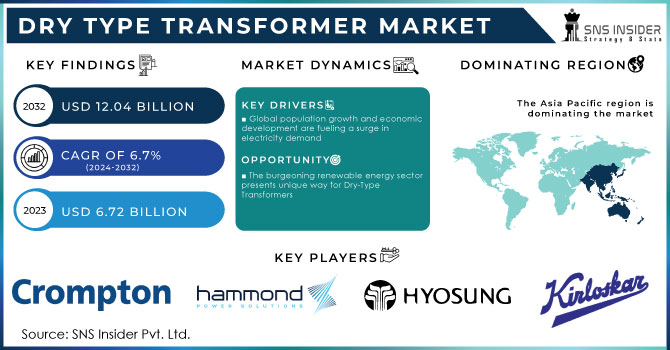

The Dry Type Transformer Market was valued at USD 6.52 billion in 2023 and is projected to reach USD 11.45 billion by 2032, growing at a robust CAGR of 6.45% over the forecast period from 2024 to 2032. This growth is attributed to the growing adoption of transformers across industries due to their safer, more energy-efficient, and environmentally friendly nature compared to oil-filled transformers. The demand in the market is primarily driven by increasing urbanization, modernization of the grid, and integration of renewable energy, especially in the commercial, industrial, and utility sector. The growing obsolescence of aging transformers and the demand for low-maintenance, low fire-risk solutions have been spikes in the global uptake. High-efficiency insulation, Internet of Things (IoT)-enabled monitoring, and smart grid compatibility are increasing the performance metrics of these technologies, providing better energy loss reduction, overload tolerance, and lifespan extension. On the other hand, supply chain constraints such as the rise in raw material prices (copper, aluminum, and insulation resins) along with longer lead times resulting from complexities in manufacturing are impacting market dynamics.However, increased investments in R&D for digitalization, enhanced thermal management, and harmonics reduction are expected to drive innovation, further solidifying the market’s expansion.

Get More Information on Dry Type Transformer Market - Request Sample Report

Dry Type Transformer Market Dynamics:

Drivers:

- Rising Data Center Expansion Fueling Dry-Type Transformer Demand

The rapid growth of cloud computing, AI, and big data analytics is driving an unprecedented expansion of data centers worldwide, raising the need for stable, efficient and low-maintenance power solutions. With regard to server room element, as dry type transformers have fire-resistant oil-free, fireproof design, these transformers are rapidly becoming a favorable option when analyzing safety and reliability in high-density server rooms. For critical infrastructure such as hyperscale and edge data centers, needing continuous, uninterrupted power, these transformers provide low energy losses, improved heat dissipation, and reduced maintenance. Moreover, strict energy efficiency regulations and the growing demand for sustainable power management in data centers are also propelling adoption. With growing AI workloads and high-performance computing, demand for transformers that are compact and high-efficiency will continue, determining the shape of the market in the future.

Restraints:

- Power Limitations Restricting Large-Scale Adoption of Dry-Type Transformers

Dry-type transformers face limitations in handling high-voltage and heavy industrial applications, restricting their use in large-scale power transmission networks. Unlike oil-filled transformers, which can efficiently manage higher voltage levels and large power loads, dry-type transformers rely on air as a cooling medium, making them less effective for high-capacity operations. This limitation restricts their use in long-distance electricity transmission, substations, as well as in heavy-load sectors such as steel, chemical, and heavy manufacturing. Moreover their efficacy diminishes at very high voltages, resulting in greater energy losses, rendering them less applicable for the national grid. It also creates a challenge for these applied in large electrical infrastructures projects, as the technological gap must be addressed in the current context of higher insulation and design performance.

Opportunities

- Energy Efficiency Goals Driving Dry-Type Transformer Demand

Energy-efficient technologies on a global scale is promoting strong growth opportunities of the dry-type transformer market. The demand for these low-loss high-performance transformers is increasing with nearly 200 countries committing to double the rate of improvement in energy efficiency by 2030. Consequently, to tackle climate change and carbon emissions, governments and sectors are actively pursuing sustainable power solutions, propelling the evolution of dry-type transformers that are environmentally benign, flame proof and require zero maintenance. With the COP28 mandate on stricter carbon reduction policies, industries are being pushed toward energy efficient technology. But as net zero hits the pause button for 2024, the demand for next-gen transformers to make the most of power for all entities is more important than ever new transformers to better distribute energy. The transition to greener grids, intelligent infrastructure, and electrified industry will further drive demand, making dry-type transformers a pivotal technology for meeting global energy-efficiency goals.

Challenges:

- Dry-type transformers face performance issues from dust, insulation aging, and thermal wear, requiring regular inspections.

Dry-type transformers have less maintenance requirements than oil-filled ones, but dust accumulation and insulation aging can be attacks on their long-term performance. Dry-type transformers have less maintenance requirements than oil-filled ones, but dust accumulation and insulation aging can be attacks on their long-term performance. And because they depend on air cooling, the lack of oil renders them more vulnerable to atmospheric contaminants, dust, and moisture layer depositing on windings. Over time, this can lead to insulation degradation, which can reduce efficiency, as well as increase the risk of overheating or even electrical failures. Thermal cycling and constant exposure to elevated temperatures also contribute to the degradation of insulation materials, compromising the transformer’s operational life. If they are not inspected and cleaned regularly as part of a sound routine, their performance can degrade, leading to premature replacements in the harsh industrial world. As insulation materials and enclosure designs continue to improve, these risks are becoming less prevalent, but maintenance is still a key challenge to ensuring longevity.

Dry Type Transformer Segment Analysis:

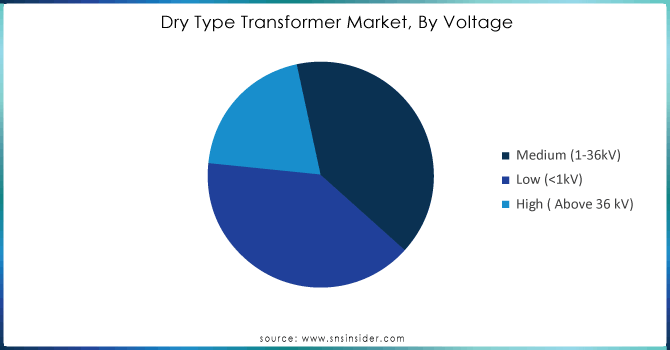

By Voltage

In 2023, the medium voltage segment held the largest market share of approximately 57%, to its broad application in commercial, industrial, and utility applications. Once in the medium voltage range, generally between 1 kV and 36 kV, dry-type transformers is the best option since they have more safety, efficiency and reliability, thus suitable for applications like renewable energy integration, urban substations and industrial power distribution. Their resistance to flame and environmentally-friendly design has also led to higher adoption in sectors where sustainable energy solutions are high on the agenda. Moreover, demand add in for smart grids, electric vehicle infrastructure, aggregate centres has been affirmed of demand for medium voltage transformers, proscribing their market share.

The low voltage segment is the fastest-growing in the Dry Type Transformer Market from 2024 to 2032, due to the increasing demand for dry-type transformers in commercial buildings, residential complexes, and industrial automation. Design and Construction These low and medium voltage transformers, usually less than 1 kV, are smaller, safer, and more energy-efficient. Demand is being further propelled by the proliferation of smart homes, electric vehicle charging stations and renewable energy systems. The low voltage segment of the circuit breaker market is poised for accelerated growth driven by an increase in energy efficiency regulations and energy use, along with the growing adoption of distributed power systems.

By End Use

In 2023, the Utilities segment accounted for 45% of the Dry Type Transformer Market revenue, driven by the modernization of power grids and increasing demand for renewable energy integration. Utilities rely on dry-type transformers for substations, distribution networks, and renewable power projects due to their enhanced safety, low maintenance, and eco-friendly design. The push for smart grids, electrification, and reduced carbon emissions is further fueling adoption. As governments and utilities invest in grid resilience and energy efficiency, the demand for dry-type transformers in this segment is expected to remain strong throughout the forecast period.

The industrial segment is projected to be the fastest-growing in The Dry Type Transformer Market from 2024 to 2032, to the increasing industrial automation, electrification, and heightened demand for energy efficiency. Increasing demand from the industries like manufacturing, mining, oil & gas, chemical processing, etc., that require safety, durability, and operations in harsh environments are expected to drive the demand for dry-type transformers across the globe. The transition to renewable energy, smart factories and high-efficiency power distribution is also supporting demand. Moreover, stringent environmental regulations and increasing need for fire resistant and low maintenance solutions are driving adoption, making industrial the key segment in driving market growth.

Get Customized Report as per Your Business Requirement - Request For Customized Report

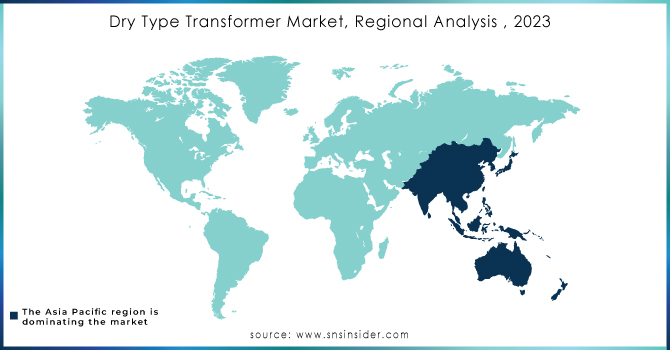

Dry Type Transformer Regional Analysis:

The Asia-Pacific region dominated the dry-type transformer market in 2023, accounting for 45% of total revenue, with the increasing demand for energy due to rapid industrialization and urbanization driving the market growth. Nations like China, India, and Japan are leading the way by investing heavily in power infrastructure, smart grids, and renewable energy initiatives. China, the biggest market, is increasing its transmission and distribution networks whereas India is experiencing rapid growth due to government initiatives such as "Make in India" and rising electrification in rural areas. And Japan’s emphasis on energy efficiency and disaster-resilient grid systems is driving demand. Robust manufacturing capabilities, rising FDI, as well as stringent environmental regulations are also promoting the region’s dominance, by pushing for sustainable power solutions.

Europe is projected to be the fastest-growing region in the dry-type transformer market from 2024 to 2032, due to strict energy efficiency regulations, renewable energy expansion, and modernization of power grids. Germany, France, and the UK were among those who have been investing by the billions into smart grid, industrial and renewable power technology, all aimed at meeting intra EU carbon neutrality goals. Dry-type transformers are also gaining traction due to their higher efficiency and less expensive maintenance costs, partly because of the transition to wind and solar energy. Moreover, Europe's ambitious energy transition, driven in part by the emergence of the electric vehicle (EV) infrastructure and the expansion of data centers located in Nordic countries and Western Europe, is propelling the growth of the market.

Dry Type Transformer Key Players:

Some of the Major Key Players in Dry Type Transformer Market along with product:

-

Schneider Electric (France) [Energy Management & Automation Solutions]

-

Siemens Energy (Germany) [Power Transmission & Distribution Equipment]

-

Eaton (Ireland) [Electrical Power Management Solutions]

-

Hitachi Ltd. (Japan) [Power Systems & Industrial Equipment]

-

TOSHIBA CORPORATION (Japan) [Transformers & Power Grids]

-

General Electric (US) [Power Generation & Grid Solutions]

-

Fuji Electric Co., Ltd. (Japan) [Industrial & Power Electronics]

-

CG Power & Industrial Solutions Ltd. (India) [Electrical Equipment & Transformers]

-

Kirloskar Electric Company (India) [Industrial Electrical Equipment]

-

HYOSUNG HEAVY INDUSTRIES (South Korea) [Power Transformers & Energy Solutions]

-

Hammond Power Solutions (US) [Dry-Type Transformers & Power Conditioning]

-

VOLTAMP (India) [Power & Distribution Transformers]

-

WEG (Brazil) [Industrial Electrical Solutions]

-

TMC TRANSFORMERS S.P.A. (Italy) [Medium & Low Voltage Transformers]

-

Hanley Energy (Republic of Ireland) [Power & Energy Management Systems]

-

alfanar Group (Germany) [Electrical Engineering & Power Solutions]

-

Efacec (Portugal) [Energy & Mobility Solutions]

-

TBEA Co., Ltd. (China) [Power Transformers & Electrical Equipment]

-

JST Power Equipment, INC. (US) [Power Distribution & Transformer Solutions]

-

Raychem RPG Private Limited (India) [Power & Insulation Solutions]

-

RPT Ruhstrat Power Technology GmbH (Germany) [Industrial Power Systems]

-

Delta Star Power Manufacturing Corp. (Philippines) [Power Transformers & Grid Solutions]

-

ABB Ltd. (Switzerland) [Electrification & Industrial Automation]

-

Hyundai Electric & Energy Systems Co. Ltd. (South Korea) [Electrical & Energy Solutions]

List of Suppliers who provide Raw material and component in Dry Type Transformer Market:

-

Aurubis

-

Hindalco Industries

-

Southwire Company

-

3M

-

DuPont

-

Von Roll

-

Nippon Steel Corporation

-

POSCO

-

Thyssenkrupp Electrical Steel

-

Voestalpine

-

ArcelorMittal

-

Baosteel

-

REA Magnet Wire

-

Fujikura Ltd.

-

LS Cable & System

-

Huntsman Corporation

-

Elantas

-

Axalta Coating Systems

Recent Development

-

July 18, 2024 – Toshiba Transmission and Distribution Systems-India (TTDI), is investing ₹500 crore to increase its transformer production capacity by one and half times by March 2027. The expansion consists of a new center for the custom processing of CRGO steel as well as a manufacturing plant for surge arresters, both designed to enhance India's position as a global T&D equipment hub.

| Report Attributes | Details |

| Market Size in 2023 | USD 6.52 Billion |

| Market Size by 2032 | USD 11.45 Billion |

| CAGR | CAGR of 6.45 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By voltage (Low Voltage, Medium Voltage, High Voltage) • By End Use (Industrial, Commercial, Utilities, Other End Use) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schneider Electric (France), Siemens Energy (Germany), Eaton (Ireland), Hitachi Ltd. (Japan), TOSHIBA CORPORATION (Japan), General Electric (US), Fuji Electric Co., Ltd. (Japan), CG Power & Industrial Solutions Ltd. (India), Kirloskar Electric Company (India), HYOSUNG HEAVY INDUSTRIES (South Korea), Hammond Power Solutions (US), VOLTAMP (India), WEG (Brazil), TMC TRANSFORMERS S.P.A. (Italy), Hanley Energy (Republic of Ireland), alfanar Group (Germany), Efacec (Portugal), TBEA Co., Ltd. (China), JST Power Equipment, INC. (US), Raychem RPG Private Limited (India), RPT Ruhstrat Power Technology GmbH (Germany), Delta Star Power Manufacturing Corp. (Philippines), ABB Ltd. (Switzerland), Hyundai Electric & Energy Systems Co. Ltd. (South Korea). |