Dump Trucks Market Report Scope & Overview:

Get More Information on Dump Trucks Market - Request Sample Report

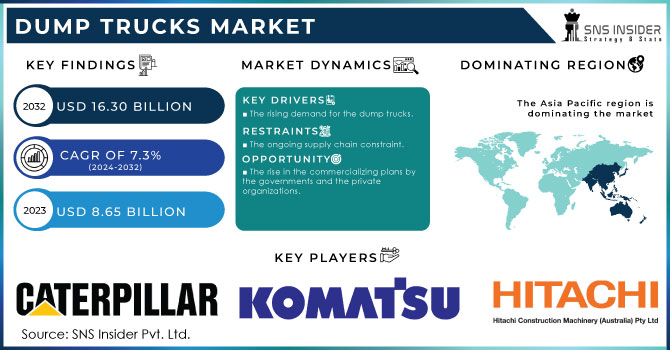

The Dump Trucks Market size is expected to reach USD 16.30 Bn by 2032 with a CAGR of 7.3%. The base value for dump truck market was recorded USD 8.65 Bn in 2023.

The dump trucks are basically commercial vehicle which helps several industries to carry out the on-site activities. When we mention on-site activities, the main activity includes carrying the raw materials from one site to another. It is considered the safest and the most efficient way of transporting the materials. There are two types of dump trucks haul trucks and articulated trucks. The use of the articulated dump is mostly done for the use of the pre-construction phases, as the cleaning of the land in terms of removing the big rocks, dirt can be done with the help of the articulated dumps. Whereas, the use of the dump trucks are done for carrying the inventories, from one place to another. Both types of dump trucks have their own advantages and their place to get the jobs done.

As we know the automotive industry is experiencing a great transformation in terms of technology, operation, pricing and so forth. If we primality focus on the operating and the functioning element, almost every automobile manufacturer is implementing the use of renewable energy sources which will help them to meet the goal of reducing the GHG emissions. The key players in this market have assured the increase in the production of commercial vehicles which will function on lithium ion-based batteries.

The market is experiencing a good curve as the rising demand for the dump trucks is driving the market. There are several factors which will contribute to the growth. The key players have stated the use of the dump trucks mostly helps them to reduce the efforts related to the transportation and the high expenses. There have been several investments and the strategic plans and programs aligned down the line which will help the market to attract good opportunities. The growth will be equivalent to the user's end and the investor's end. As we mentioned earlier technological advancement is shaping the automotive industry in to a more advanced field. That is equivalent to the Dump truck market as well, the companies are implementing the digitalization strategy to make the dump trucks more advanced. Digitalization will help the management to track the progress and will also add value to their operations.

Market Dynamics:

Drivers:

-

The rising demand for the dump trucks.

The rise in the demand for commercial vehicles is on the urge mostly if we consider the post-pandemic phase. The key players have witnessed an increase in the demand and the increase in the net sales. The rise in the construction and the advancement in the infrastructure all around the develop and the emerging countries of the several regions can be considered as the driving factor. The need for the dump trucks for carrying out the on-site activities is high because of the fewer substitute products available. The major goal of any company within diversified industries is to improve the operations by adding the value. Dump trucks help in saving time and improving the quality of the work by providing efficient results.

Restrains :

-

The ongoing supply chain constraint.

Opportunity :

-

The rise in the commercializing plans by the governments and the private organizations.

The market is slowly attracting good opportunities as the growth of the market is aligned with the rising commercializing plans and programs. Almost every nation is taking the initiative in improving a sustainable and high-quality infrastructure regardless of the economic conditions. If we focus on some major elements like transportation the governments are taking the initiative for the betterment and creating green mobility and ecosystems. For instance, the US government will be investing around $110 billion for the improvement and repair of the roads and bridges and will support the transformational projects.

The rising coal mining projects can also be considered the great opportunity for the market to attract growth. For instance, According to the (International Energy Agency) IEA, there has been an increase in the focus of investment by the Australia, Russia and South Africa for the coal mining. The projects are more advanced and primarily focus on exports.

Challenge:

-

Fluctuations in the prices of the raw materials and unavailability of raw materials.

Market Segmentation

By Type

-

Articulated

-

Rigid

By End Use

-

Mining

-

Construction

-

Waste Management

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Regional Analysis

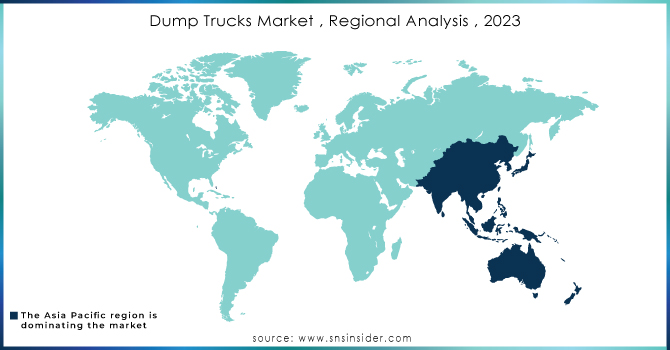

APAC is the region with the largest share. The key players have recorded the highest revenue especially from the developed countries like China, Japan and India. The rising government plans and programmes related to the mining and commercializing is creating opportunities for the market. Komatsu company has assured the rising demand for the commercial vehicles in the APAC region.

North America is the region which will be showing good growth because of the high demand of commercial vehicles in the developed counties of these regions. We will be providing the overall market values with the forecasted numbers in the final report.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

The major key players are Caterpillar, Komatsu, AB Volvo, Terex trucks, Hitachi Construction & Machinery, Dheere & Company, KGHM Zanam SA, DUX machinery Corporation and others.

Recent Developments :

Caterpillar : The company disclosed the new VisionLink, the main features of this application is, it allows customers the information about their products, also schedules task the workforce.

Hitachi construction & machinery : The business alliance agreement between the Japanese IoT startup Aptpod and Hitachi construction & machinery.

The final report will have all the details related to the latest development of the key players for this particular market.

| Report Attributes | Details |

| Market Size in 2023 | US$ 8.65 Bn |

| Market Size by 2032 | US$ 16.30 Bn |

| CAGR | CAGR of 7.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Articulated, Rigid) • By End User (Mining, Construction, Waste Management, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Caterpillar, Komatsu, AB Volvo, Terex trucks, Hitachi Construction & Machinery, Dheere & Company, KGHM Zanam SA, DUX machinery Corporation |

| Key Drivers | • The rising demand for the dump trucks. |

| Market Restraints | • The ongoing supply chain constraint. |