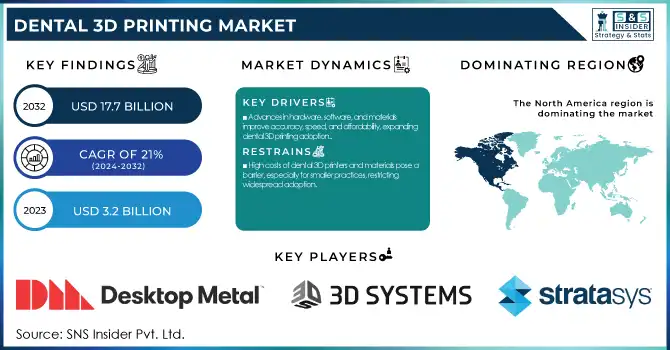

Dental 3D Printing Market Size Analysis:

The Dental 3D Printing Market size was USD 3.86 billion in 2024 and is projected to grow to USD 17.69 billion by 2032, with a CAGR of 20.97% during 2025-2032.

To get more information on Dental 3D Printing Market - Request Free Sample Report

The growing demand for customized dental solutions, advancements in technology, and an increase in the awareness of oral health have propelled the dental 3D printing market growth. Interest in digital dentistry practices has grown, with 3D printing technology finding its way into approximately 17% of dentists' practices, according to the American Dental Association's 2023 technology report. The growing incidence of dental disorders across the globe is another factor aiding this trend. The World Health Organization estimates that almost 3.5 billion people around the world are affected by oral diseases, demonstrating the urgent need for dental care advancements. US data from the National Institute of Dental and Craniofacial Research has shown that 92% of adults 20 to 64 have had dental caries in their permanent teeth, and as such it stands to reason that there is a large market for dental 3D printing applications.

This is because the combination of CAD/CAM systems with 3D printing has changed dental care by allowing fast, accurate, and economical fabrication of dental fillers implants, and orthodontic tools. In addition, the rising geriatric population, who needs dental treatment more as compared to younger people, and government initiatives to create awareness regarding oral health will also stimulate market growth. The U.S. Department of Health and Human Services announced the Healthy People 2030 initiative to improve oral health and the availability of dental facilities, indirectly increasing the demand for advanced dental technologies. Increasing demand for cosmetic dentistry and an escalating number of dental laboratories adopting 3D printing technology to enhance workflow and improve productivity are some of the other factors propelling this market growth.

Dental 3D Printing Market Dynamics

Drivers

-

Continuous improvements in hardware, software, and materials enhance accuracy, speed, and affordability, making dental 3D printing more accessible and attractive for various applications.

-

An increasing emphasis on personal appearance leads to a higher demand for cosmetic dental procedures. 3D printing offers more natural-looking and minimally invasive solutions, appealing to patients seeking aesthetic improvements.

The 3D printing technology advances are changing the dentistry industry and providing accuracy, efficiency, and customized solutions for different dental processes. As technology and methods continue to innovate and improve, the accuracy of 3D printing has reached levels that are unrivaled for the 3D printing of crowns, bridges, dentures, and orthodontic aligners. For example, the need for resin-based printers to be able to manufacture biocompatible materials in dental applications is growing because specific applications require a specific biocompatible material for extended use. One of the major advancements is the introduction of digital light processing (DLP) technology that delivers high-resolution and quicker printed parts than traditional stereolithography (SLA) printers. According to research, DLP-based printers are capable of constructing dental models with an accuracy of up to 20 microns, which makes an ideal fit for patient-specific requirements.

In 2023, the integration of artificial intelligence (AI) for even more efficient workflows in dental 3D printing. Thanks to advances in AI-powered software, dentists are now able to automatically design restorations tailored to a patient and fabricate them all in the same visit, minimizing human error while providing solutions on the same day. One such example is the AI-based platform of Formlabs Dental, which works along directly with a 3D printer allowing users to create complicated dental structures at ease. In addition to that, sustainability is now taking the forefront, and we have seen companies creating sustainable printing materials. From the development of biodegradable resins to minimizing the waste associated with subtractive manufacturing processes, the progress being made through 3D printing related to both functionality and the environmental impact of traditional manufacturing processes is astounding. This is expanding the potential of dental 3D printing, providing an accelerated adoption potential across dental indications globally.

Restraints

-

The substantial investment required for dental 3D printers and specialized materials can be a barrier, particularly for smaller dental practices. This financial hurdle may limit the widespread adoption of the technology.

-

Dental 3D printing materials must meet strict biocompatibility standards set by regulatory bodies to ensure patient safety. Navigating these complex regulations can pose challenges for manufacturers and slow market expansion.

The high initial capital investment needed for adopting dental 3D printing technology is one of the most important restraints of the dental 3D printing market. The initial cost of dental 3D printers, as well as of specialized software and materials, represents a substantial obstacle, particularly for small and medium-sized dental practices. In addition to the expense of the printer itself, money must be spent on training staff, maintaining the equipment, and upgrading current infrastructure, making it an even bigger financial burden.

This challenge is particularly acute in regions with limited healthcare budgets or where dental practices operate on tight margins. This results in several potential adopters postponing or completely avoiding the integration of 3D printing tech and services due to its constrained adaptability. Solving this hurdle will require cheaper technology solutions, well-thought-out financing models, or public funding to incentivize smaller practices to adopt this impactful technology.

Dental 3D Printing Market Segmentation Overview

By Application

In 2023, the orthodontics segment accounted for the largest revenue share of 37% The prevalence of malocclusion is high, and there is a need for esthetic dental treatment, which is slightly contributing to this dominance. The American Association of Orthodontists states that 3 million teenagers in the United States and Canada are currently wearing braces, with the number of adults looking for orthodontic treatment continuously rising. The application of 3D printing in orthodontics has transformed the manufacture of clear aligners, tailored orthodontic bands, and further orthodontic devices to enhance efficiency and patient comfort. More than 60 percent of adolescents between 12 to 19 years old have suffered from some way of malocclusion according to the U. S. Centers for Disease Control and Prevention (CDC), which in turn fuels the growth of the market. With our modern, advanced 3D printing technology, orthodontists can turn around a digital model of a patient's teeth, giving them the ability to plan out a patient's treatment better than ever before.

In addition, the ability to manufacture personalized orthodontic appliances onsite has drastically decreased treatment time and expense, allowing a wider range of the population to avail of treatment. This is due to the increasing recognition of dental alignment's essential role in the overall health of the oral cavity, coupled with the rise in aesthetic significance in social and professional spheres, which are stimulating the demand for the orthodontics segment in the dental 3D printing market.

By end use

The dental laboratories segment was the market leader with 56% of revenue in 2023. The large share of the market is owing to the wide usage of advanced technologies in dental laboratories and the rise in demand for custom-made dental solutions. The National Association of Dental Laboratories estimates there are about 7,000 labs in the United States, many of which have been integrating 3D printing technology to improve their manufacturing processes. According to the U.S. Bureau of Labor Statistics, dental laboratory technician employment is expected to grow by 9% between 2020 and 2030, suggesting an ever-growing viable market for dental laboratory services.

3D printing is becoming increasingly popular in dental laboratories, enabling them to manufacture a variety of dental products, such as crowns, bridges, dentures, and implant components, faster and with higher precision. According to the Health Policy Institute of the American Dental Association, there is ever-increasing demand for prosthodontics and restorations, especially with an increasingly aging population. This technology enables dental labs to increase their work efficiency, waste less material, and implement quicker delivery times to both the dentist and the patient. Additionally, the capability to manufacture intricate geometries and use multiple biocompatible materials has increased the products and solutions that dental laboratories provide to their clientele, thus giving them an edge in the market.

By Technology

In 2023, the selective laser sintering (SLS) segment led the market with a 38% share. This leadership position can be attributed to the technology's capacity to deliver high-quality durable dental products with remarkable precision. There has been consistent growth in 510(k) clearance of dental devices made by SLS in the U.S. over the last ten years according to historical data from the U.S. Food and Drug Administration (FDA). In a previous report by the National Institute of Standards and Technology (NIST), they discussed the challenges and benefits of SLS in making a complex geometry of high precision, which is important for dental applications. SLS technology enables the printing of dental models, surgical guides, and even certain types of final prosthetics that require little post-processing. The American Dental Association has found that dental models made with SLS are dimensionally accurate, a key characteristic of dental models used to fabricate accurately fitting dental appliances. This has made the technology especially versatile in dental applications because it allows it to interact with a variety of materials, including biocompatible polymers and metals. According to historical data from the U.S. Patent and Trademark Office (USPTO), there has been a noted uptick in the volume of patents filed in the functional field of using SLS technology in the dental realm, suggesting continued efforts and investment to innovate in this space.

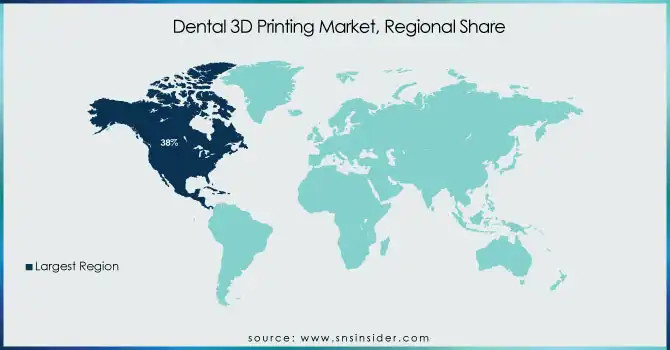

Dental 3D Printing Market Regional Insights

North America held the largest market share of 38% in the dental 3D printing market in 2023. The leadership status can be attributed to the established healthcare infrastructure, the widespread adoption of advanced dental technologies, and the sizeable expenditure for research and development in this field. The United States held a significant share of the global dental 3D printing market share, as cited by the U.S. Census Bureau, mainly due to the growing population and well-established dental care industry. According to the American Dental Association, there are more than 200,000 practicing dentists in the United States, including a growing number who use 3D printing technology in their practices. This has enabled the growth of the market of 3D-printed dental devices in the U.S.

Asia-Pacific region is estimated to experience the highest CAGR during the forecast period. Growth in this region will be driven by increasing healthcare spending, increasing oral care awareness, and the burgeoning adoption of digital dentistry, especially in China, Japan, and India. India has the fastest-growing dental market all over the world where the Indian Dental Association estimates that the market is growing with an annual growth rate of 20–30%, and 3D printing technology has been playing a larger role in recent years. For example, the number of dental clinics and hospitals in China has been rapidly increasing, with many of these institutions using advanced 3D printing technology. Similarly, The Japanese government's initiatives to promote digital healthcare, including in dentistry, are also contributing to the region's rapid growth in the dental 3D printing market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Recent Developments

-

In April 2024, Desktop Health, a brand of Desktop Metal, announced its Flexcera™ family of resins validated for use with Asiga® 3D printers. This step helps bring high-quality Digital Dental Applications to a global audience and improves the production of durable and comfortable printed dentures.

-

Stratasys Ltd. launched TrueDent a solution for 3D printing of full-color permanent dentures in February 2023 This resin enables dental labs to create realistic gums and precise tooth structures with customizable shades and translucency in a single seamless print.

List of Key Players in Dental 3D Printing Market

Key Service Providers/Manufacturers

-

Stratasys Ltd. (J5 DentaJet™, TrueDent™)

-

3D Systems, Inc. (NextDent™ 5100, ProJet™ MJP 2500)

-

Desktop Metal, Inc. (Flexcera™ Smile Ultra+, Einstein™ Series)

-

Formlabs Inc. (Form 3B+, Dental LT Clear Resin)

-

Dentsply Sirona Inc. (Primeprint Solution, Lucitone Digital Print™)

-

Carbon, Inc. (M Series, KeySplint Soft™)

-

EnvisionTEC (now part of Desktop Metal) (Vida HD, E-Dent 100)

-

EOS GmbH (EOSINT M 270, Dental CAD/CAM Solutions)

-

Roland DG Corporation (DWX-42W, DWX-52D)

-

Planmeca OY (Planmeca Creo™ C5, Planmeca DentalCAM)

-

SprintRay Inc. (Pro95 S, SprintRay Resin)

-

Ultimaker BV (Ultimaker S5, Tough PLA)

-

Asiga (MAX UV, PRO 4K)

-

GE Additive (Concept Laser Mlab, Arcam EBM Q10plus)

-

Sisma S.p.A. (DLP Stereolithography, mysint100)

-

Prodways Group (ProMaker LD Series, PLASTCure Dental Series)

-

Shining 3D (AccuFab-D1, AutoScan-DS-EX Pro)

-

Renishaw plc (AM250, DS30 Dental Scanner)

-

Kulzer GmbH (cara Print 4.0, dima Print C&B)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.86 Billion |

| Market Size by 2032 | USD 17.69 Billion |

| CAGR | CAGR of 20.97% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Service (Services, Materials (Plastics, Metals, Other Materials), Equipment (Dental 3D Scanners, Dental 3D Printers) • By Technology (Vat Photopolymerization, Stereolithography, Fused Deposition Modelling, Digital Light Processing, Polyjet Technology, Selective Laser Sintering, Others) • By Application (Orthodontics, Prosthodontics, Dentures, Permanent Tooth, Temporary Tooth, Implantology) • By End-use (Dental Clinics, Dental Laboratories, Academic And Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stratasys Ltd., 3D Systems, Inc., Desktop Metal, Inc., Formlabs Inc., Dentsply Sirona Inc., Carbon, Inc., EnvisionTEC (now part of Desktop Metal), EOS GmbH, Roland DG Corporation, Planmeca OY, SprintRay Inc., Ultimaker BV, Asiga, GE Additive, Sisma S.p.A., Prodways Group, Shining 3D, Renishaw plc, Kulzer GmbH |

| Key Drivers | • Continuous improvements in hardware, software, and materials enhance accuracy, speed, and affordability, making dental 3D printing more accessible and attractive for various applications. • An increasing emphasis on personal appearance leads to a higher demand for cosmetic dental procedures. 3D printing offers more natural-looking and minimally invasive solutions, appealing to patients seeking aesthetic improvements. |

| Restraints | • The substantial investment required for dental 3D printers and specialized materials can be a barrier, particularly for smaller dental practices. This financial hurdle may limit the widespread adoption of the technology. |