Paracetamol IV Market Size Analysis:

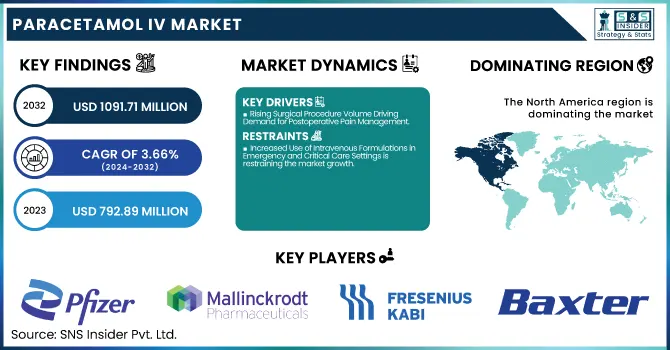

The Paracetamol IV Market size was valued at USD 792.89 million in 2023 and is expected to reach USD 1091.71 million by 2032, growing at a CAGR of 3.66% from 2024-2032.

To Get more information on Paracetamol IV Market - Request Free Sample Report

This Paracetamol IV Market report is distinguished from critical analysis by highlighting essential statistical observations. It features surgical and non-surgical procedure volumes by region, with a focus on clinical demand patterns for intravenous analgesics. The report also discusses regional intravenous paracetamol consumption habits and compares branded versus generic formulation market share. Also, it analyzes procurement trends by hospitals and institutions and examines public versus private healthcare expenditure on IV analgesics in worldwide markets. Such detailed metrics provide a data-based basis for insights into utilization trends and institutional dependency on IV paracetamol solutions.

The U.S. Paracetamol IV Market was valued at USD 243.20 million in 2023 and is expected to reach USD 321.72 million by 2032, growing at a CAGR of 3.20% from 2024-2032. The United States has a leading position in the North American Paracetamol IV Market due to a high number of surgical interventions, robust hospital infrastructure, and widespread usage of IV analgesics for managing post-operative pain. Moreover, favorable reimbursement policies and easy availability of branded and generic IV paracetamol formulations also support its market leadership.

Paracetamol IV Market Dynamics

Drivers

-

Rising Surgical Procedure Volume Driving Demand for Postoperative Pain Management.

The rise in the global surgical burden notably drives the market for intravenous analgesics like Paracetamol IV. As per the World Health Organization, approximately 313 million surgeries are conducted globally every year, and pain management following surgery is an essential part of rehabilitation. Paracetamol IV is typically preferred to opioids because of its limited side effects and potent analgesic effects, particularly in Enhanced Recovery After Surgery (ERAS) pathways. In May 2024, Baxter International recorded a 6% growth in revenue in its infusion therapy business, pointing towards a larger trend of increasing use of IV solutions within healthcare systems. This surge in operations and inclination towards non-opioid analgesia provides a strong, sustained need for Paracetamol IV within hospital and ambulatory care environments.

-

The Growing Use of Intravenous Preparations in Emergency and Critical Care Environments is driving the market growth.

Paracetamol IV is becoming more prevalent in emergency and intensive care units because of its quick onset, consistent pharmacokinetics, and usefulness in those unable to tolerate oral medication. The American Hospital Association estimates that more than 139 million emergency department visits take place in the United States alone annually, many concerning pain or fever management. Paracetamol IV is used to treat such patients quickly and safely. Additionally, innovations in infusion delivery systems and integration into clinical pathways are making its administration smoother. For instance, Fresenius Kabi and Baxter are some of the companies that have broadened their infusion product portfolios, indirectly benefiting the Paracetamol IV market. The ease and consistency of IV delivery in urgent conditions continue to propel demand in both developed and emerging healthcare systems.

Restraint

-

Increased Use of Intravenous Formulations in Emergency and Critical Care Settings is restraining the market growth.

One of the most important restraints on the expansion of the Paracetamol IV market is the elevated cost of intravenous preparations. Paracetamol IV solutions, as opposed to oral or other non-invasive forms, are considerably more costly as a result of the processes required to create sterile injectable medications. This increased cost could hamper their use, particularly in low-resource settings or in countries with tight healthcare budgets. Healthcare systems in developed and developing countries alike are more concerned with cost control, which can discourage the widespread adoption of more costly IV drugs when oral equivalents exist. In most instances, hospitals and healthcare professionals might use cheaper oral pain management or generics, which could constrain the growth of Paracetamol IV in some healthcare markets.

Opportunities

-

Expansion of Post-Operative Pain Management Solutions creates a significant opportunity in the market.

One of the most important market opportunities for the Paracetamol IV market is the growing need for optimal post-operative pain management options. More and more patients are going through surgeries, particularly in the older population, and the demand for efficient, fast-acting, and non-opioid pain management options is on the rise. Paracetamol IV options are a great solution for post-operative treatment since they offer pain relief without opioid side effects. While healthcare practitioners try to limit the use of opioid medications because of their addictiveness, demand for alternatives such as Paracetamol IV drugs is poised to increase. Additionally, the rising trend towards outpatient procedures and less invasive surgeries provides new opportunities for Paracetamol IV drugs, especially in post-op recovery environments.

Challenges

-

Regulatory Hurdles and Market Approval Delays are challenging the market growth.

One of the main challenges facing the Paracetamol IV market is regulatory barriers and possible delays in market approval. The process of approval for intravenous drugs is rigorous, involving extensive clinical trials and stringent testing to confirm safety and efficacy. This can be costly and time-consuming, which can hinder the introduction of new Paracetamol IV formulations into the market. Additionally, regulatory needs differ across regions, and this presents challenges to companies seeking to globalize. With a more competitive intravenous drug market, companies might struggle to comply with these regulatory environments, which could slow product introductions or limit market access in some geographies.

Paracetamol IV Market Segmentation Analysis

By Indication

The Pain segment dominated the Paracetamol IV Market with 40.19% market share in 2023, essentially because of the extensive use of intravenous paracetamol to treat acute pain in the healthcare environment. Intravenous paracetamol solutions are an effective choice for individuals who are under surgery, in trauma cases, or for coping with other sorts of severe pain since they facilitate quick action and effective relief of pain. Hospitals and clinics give greater importance to intravenous pain control to minimize the consumption of opioids as well as evade related side effects. The power of Paracetamol IV to deliver profound analgesia with fewer unwanted effects, especially in post-surgical pain, continues to stimulate its market domination. Additionally, the growing prevalence of pain control protocols emphasizing the use of non-opioid analgesics also sustains the demand for Paracetamol IV as a first-choice treatment.

The Pyrexia (Fever) segment is expected to experience the fastest growth during the forecast years with 3.99% CAGR because of growing interest in the management of fever in different clinical conditions, particularly in light of growing infections and diseases. Paracetamol is the most widely prescribed antipyretic in hospitals and healthcare institutions to lower fever in patients. As awareness of the danger of untreated fever, particularly among high-risk groups like the elderly and the chronically ill, continues to increase, the need for efficient, rapid fever management solutions such as Paracetamol IV will keep increasing. The desire for non-invasive, quick-acting drugs in acute care facilities will fuel this segment's growth as well. The continuous fears of infectious diseases, such as influenza and COVID-19, also add to the increasing demand for Paracetamol IV in fever control.

By Application

The Surgical segment dominated the Paracetamol IV Market with a 64.28% market share in 2023 because of the extensive application of intravenous paracetamol to manage pain after surgical operations. Paracetamol IV is favored during surgical operations because it is effective in suppressing moderate to severe pain without using opioids, which are commonly linked to side effects such as nausea, constipation, and dependence. Due to its onset of action and pharmacokinetic predictability, it is an excellent option for the control of acute pain after surgery. IV paracetamol is being increasingly used by hospitals and surgical facilities as part of multimodal pain management strategies to improve patients' comfort, minimize the amount of opioids taken, and decrease recovery time. Demand for efficient, opioid-sparing analgesia for both major and minor surgeries has largely contributed to the market domination of the Surgical segment.

By End-Use

The Hospitals segment dominated the Paracetamol IV Market with a 55.41% market share in 2023 because of the widespread application of intravenous paracetamol in hospitals for pain and fever control. Hospitals are the main facilities where patients receive surgeries, infection treatments, and other procedures that require efficient pain relief. Paracetamol IV is frequently used in hospitals as part of multimodal analgesia protocols to control postoperative pain and febrile illnesses. The regulated setting of hospitals makes it easier to control dosage and monitoring of intravenous therapy to maintain patient safety. Also, the increasing trend towards minimizing opioid use within hospitals for pain relief has contributed to an increase in the application of substitutes such as paracetamol IV. Coupled with hospitals' high volume of patients and complexity of care needs, this predisposed the influence of this segment in the market.

Paracetamol IV Market Regional Insights

North America dominated the Paracetamol IV Market with a 40.19% market share in 2023 because of its well-developed healthcare infrastructure, high incidence of surgeries, and a well-established network of hospitals that guarantee steady demand for intravenous pain relief solutions. The availability of large pharmaceutical firms such as Pfizer, Baxter, and Mallinckrodt also supports market penetration through constant product supply and innovation. Additionally, the region is blessed with good reimbursement policies, high patient awareness, and strict postoperative care practices, which give preference to quick-acting analgesics such as IV paracetamol. With increasing emphasis on minimizing opioid use for pain management, healthcare professionals are increasingly choosing non-opioid options, thus driving the use of IV paracetamol in clinical practices throughout the United States and Canada.

Asia Pacific is experiencing the fastest growth in the Paracetamol IV Market with 4.11% CAGR over the forecast period, led by widespread healthcare infrastructure upgradation, high surgical volumes, and enhanced health expenditure in nations such as China, India, and Southeast Asia. The region is also witnessing greater awareness of pain management and post-surgery treatment, resulting in wider acceptance of IV formulations for quick relief. Moreover, a high population base, growing urbanization, and government efforts to enhance hospital infrastructure and access to medication are favoring market growth. Generic drug company entry and local production are reducing the cost of IV paracetamol and making it more accessible, fueling growth further in emerging economies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Paracetamol IV Market Key Players

-

Pfizer Inc. (Ofirmev, Paracetamol IV Solution)

-

Mallinckrodt Pharmaceuticals (Ofirmev, Acetaminophen Injection)

-

Fresenius Kabi AG (Paracetamol Kabi, Paracetamol 10 mg/mL Solution)

-

Baxter International Inc. (Paracetamol IV Infusion, Acetaminophen Injection)

-

Aurobindo Pharma Ltd. (Paracetamol IV Injection, Acetaminophen IV Solution)

-

Dr. Reddy's Laboratories Ltd. (Paracetamol Injection, Acetaminophen IV)

-

Hikma Pharmaceuticals PLC (Paracetamol IV Solution, Acetaminophen Injection)

-

Teva Pharmaceutical Industries Ltd. (Paracetamol IV, Acetaminophen Injection)

-

Sanofi S.A. (Doliprane IV, Paracetamol Solution for Infusion)

-

GlaxoSmithKline plc (GSK) (Panadol IV, Paracetamol Infusion)

-

Mundipharma International Ltd. (Paracetamol IV, Acetaminophen Injection)

-

B. Braun Melsungen AG (Paracetamol B. Braun, Paracetamol 10 mg/mL Infusion)

-

AdvaCare Pharma (Paracetamol Injection, Acetaminophen IV)

-

Themis Medicare Ltd. (Paracetamol IV, Acetaminophen Injection)

-

Yino Pharma Limited (Paracetamol Injection, Acetaminophen IV)

-

Aceso Pharma Limited (Paracetamol IV, Acetaminophen Injection)

-

Jiangsu Yabang Amino Acid Co., Ltd. (Paracetamol Injection, Acetaminophen IV)

-

Weifa ASA (Paracetamol IV, Acetaminophen Injection)

-

Granules India Ltd. (Paracetamol Injection, Acetaminophen IV)

-

Wockhardt Ltd. (Paracetamol Injection, Acetaminophen IV)

Suppliers (These suppliers provide critical raw materials and excipients such as active pharmaceutical ingredients (APIs), solvents, stabilizers, and packaging-grade compounds that are essential for the formulation, stability, and delivery of Paracetamol IV products) in Paracetamol IV Market.

-

BASF SE

-

Merck KGaA

-

Thermo Fisher Scientific Inc.

-

Lonza Group AG

-

MilliporeSigma

-

Evonik Industries AG

-

Spectrum Chemical Mfg. Corp.

-

Loba Chemie Pvt. Ltd.

-

Aceto Corporation

-

CordenPharma International

Recent Development in the Paracetamol IV Market

-

May 2024 – Baxter International Inc. increased its year-to-date annual profit estimate due to high demand for its dialysis products and infusion pumps. While paracetamol IV products were not mentioned specifically, the high demand for infusion-related solutions indicates the growing market for intravenous therapy, including paracetamol.

Paracetamol IV Market Report Scope:

Report Attributes Details Market Size in 2023 US$ 792.89 million Market Size by 2032 US$ 1097.71 million CAGR CAGR of 3.66 % From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Indication (Pain, Pyrexia (Fever))

• By Application (Surgical, Non-surgical)

• By End-use (Hospitals, Clinics, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles Pfizer Inc., Mallinckrodt Pharmaceuticals, Fresenius Kabi AG, Baxter International Inc., Aurobindo Pharma Ltd., Dr. Reddy's Laboratories Ltd., Hikma Pharmaceuticals PLC, Teva Pharmaceutical Industries Ltd., Sanofi S.A., GlaxoSmithKline plc (GSK), Mundipharma International Ltd., B. Braun Melsungen AG, AdvaCare Pharma, Themis Medicare Ltd., Yino Pharma Limited, Aceso Pharma Limited, Jiangsu Yabang Amino Acid Co., Ltd., Weifa ASA, Granules India Ltd., Wockhardt Ltd., and other players.