Amniotic Products Market Size Analysis:

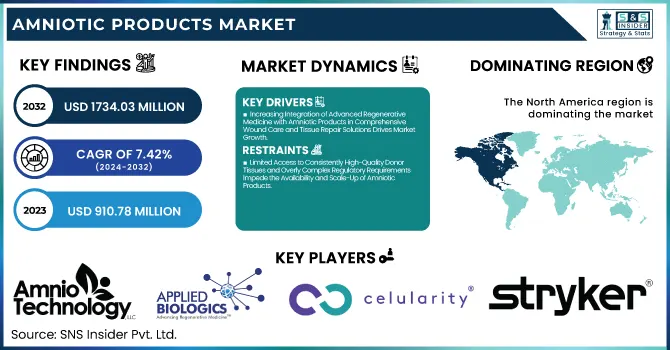

The Amniotic Products Market size was valued at USD 910.78 Million in 2023 and is expected to reach USD 1,734.03 Million by 2032, growing at a CAGR of 7.42% over the forecast period of 2024-2032.

Get More Information on Amniotic Products Market - Request Sample Report

The Amniotic Products Market is set for remarkable growth, driven by advancements in regenerative medicine and expanding applications across wound care, ophthalmology, and orthopedics. Our report provides a detailed cost-benefit analysis, comparing the long-term value and effectiveness of amniotic products against traditional treatments. It also highlights clinical trials and evidence supporting efficacy, underscoring their established role in modern healthcare. Ethical considerations related to amniotic product sourcing are explored, addressing responsible tissue collection practices. Additionally, the report examines the impact of sourcing on product quality, emphasizing consistency and clinical outcomes. Moreover, our report also gives about the funding and investment trends, revealing increased interest and financial backing in regenerative medicine, which is fueling further innovation in the amniotic products space.

The US Amniotic Products Market Size was valued at USD 68.48 Million in 2023 with a market share of around 75% and growing at a significant CAGR over the forecast period of 2024-2032.

The US Amniotic Products Market is experiencing robust growth due to increasing demand for advanced regenerative treatments in wound care, orthopedics, and ophthalmology. Factors such as growing awareness about the effectiveness of amniotic membranes in tissue repair and the rising prevalence of chronic conditions like diabetic ulcers and osteoarthritis are driving this growth. Key players, including MiMedx Group and Organogenesis, are actively contributing to market expansion with their innovative amniotic products. Furthermore, collaborations between US-based research institutions and manufacturers are accelerating technological advancements, solidifying the US as a leader in regenerative medicine. Supportive regulatory frameworks by organizations like the FDA further enhance the market's growth prospects.

Amniotic Products Market Dynamics

Drivers

-

Increasing Integration of Advanced Regenerative Medicine with Amniotic Products in Comprehensive Wound Care and Tissue Repair Solutions Drives Market Growth

The integration of advanced regenerative medicine with amniotic products has been transforming the healthcare landscape by providing innovative wound care and tissue repair solutions that outperform traditional methods. This driver is propelled by clinical evidence demonstrating that amniotic products offer enhanced healing properties, reduced scarring, and faster recovery times, which are especially critical in the treatment of chronic wounds and complex tissue injuries. Extensive research conducted in specialized medical centers has validated these benefits, thereby encouraging the adoption of these therapies in both acute care and long-term treatment regimens. In addition, academic collaborations and clinical partnerships have accelerated the translation of laboratory innovations into practical medical applications. This ongoing integration is further supported by investments in research and development, which are fueling product enhancements and the discovery of novel applications beyond conventional wound management. As hospitals and specialized clinics continue to recognize the clinical advantages and cost-effectiveness of these regenerative solutions, the market growth trajectory is being reinforced. This driver not only reflects the technological advancement but also mirrors the evolving patient care paradigms that prioritize holistic recovery and improved quality of life, making amniotic products a cornerstone in the future of regenerative medicine. The cumulative impact of these factors has generated a favorable market environment that stimulates continuous innovation and adoption across diverse clinical settings.

Restraints

-

Limited Access to Consistently High-Quality Donor Tissues and Overly Complex Regulatory Requirements Impede the Availability and Scale-Up of Amniotic Products

A significant restraint in the amniotic products market arises from the limited access to consistently high-quality donor tissues coupled with overly complex regulatory requirements that impede the availability and scale-up of these innovative therapies. The sourcing of donor tissues for amniotic products necessitates strict adherence to quality control and ethical standards, yet variability in donor tissue quality can lead to inconsistencies in the final product. This inconsistency not only affects clinical outcomes but also creates challenges in establishing reliable manufacturing processes. Regulatory frameworks, while essential for ensuring safety and efficacy, often impose rigorous and sometimes non-standardized requirements across different regions. This regulatory complexity can delay product approvals, hinder cross-border collaborations, and increase the overall cost of development and commercialization. Manufacturers are frequently required to invest in additional quality assurance measures and conduct extensive clinical trials to meet these diverse regulatory criteria, which can limit the pace at which innovations are introduced to the market. Additionally, ethical concerns surrounding the procurement of donor tissues add another layer of complexity, demanding transparent sourcing practices and stringent compliance with international ethical guidelines. This combination of challenges creates significant barriers to scaling up production and widespread adoption, thereby restraining market growth. These factors highlight the need for harmonized regulatory processes and improved tissue sourcing methods to overcome this restraint and facilitate a more consistent supply of high-quality amniotic products.

Opportunities

-

Innovative Integration of Advanced Artificial Intelligence and Machine Learning Tools for Enhanced Product Development and Personalized Applications in Amniotic Products

The integration of advanced artificial intelligence and machine learning tools in the development of amniotic products presents a compelling opportunity to revolutionize product innovation and create personalized therapeutic applications. By harnessing the power of artificial intelligence, manufacturers can analyze large datasets from clinical trials, patient outcomes, and manufacturing processes to identify patterns and optimize product formulations. Machine learning algorithms can predict product performance, enhance quality control, and even suggest modifications to improve efficacy and safety profiles. This approach facilitates a data-driven development process, enabling the creation of more tailored products that cater to individual patient needs and specific clinical indications. The use of artificial intelligence and machine learning also enhances the efficiency of the research and development cycle, reducing time-to-market and accelerating the commercialization process. Moreover, these technologies can aid in regulatory submissions by generating comprehensive datasets and predictive models that demonstrate consistent product performance. The potential for personalized medicine, driven by these advanced tools, not only differentiates product offerings but also improves patient outcomes and satisfaction. As the healthcare industry increasingly embraces digital transformation, the incorporation of these innovative technologies stands to position amniotic products at the forefront of regenerative therapies. This strategic opportunity is likely to attract significant investment and foster collaborations that further enhance product development, ultimately driving market growth and improving therapeutic outcomes.

Challenge

-

Overcoming Critical Global Market Entry Barriers Posed by Uncertain Reimbursement Policies and Highly Fragmented Clinical Adoption Among Diverse Healthcare Providers

Overcoming market entry barriers remains a significant challenge for the amniotic products industry due to uncertain reimbursement policies and highly fragmented clinical adoption among diverse healthcare providers across different regions. The variability in reimbursement frameworks, which differ widely from one country to another, creates an unpredictable financial environment for manufacturers and healthcare institutions alike. In many cases, insufficient or inconsistent reimbursement can deter the adoption of advanced regenerative therapies, including amniotic products, even when clinical evidence supports their efficacy. Additionally, the fragmentation in clinical adoption arises from differences in medical practice patterns, varying levels of awareness about the benefits of amniotic therapies, and the existence of alternative treatment modalities that are more traditionally accepted. This scenario is further complicated by the need to navigate local regulatory environments and establish the clinical credibility of these products in regions where healthcare providers may be hesitant to shift from conventional treatment protocols. As a result, companies face significant hurdles in securing widespread acceptance and integrating these products into standard clinical practices. Addressing these challenges requires targeted educational initiatives, robust clinical evidence generation, and strategic collaborations with key opinion leaders and professional associations. By working closely with healthcare payers and policymakers to streamline reimbursement processes, the industry can gradually overcome these barriers and achieve more uniform market penetration on a global scale.

Amniotic Products Market Segmentation Analysis

By Type

The cryopreserved segment dominated the Amniotic Products Market in 2023 with a 58.7% market share, driven by its superior ability to preserve bioactive components and cellular integrity. Cryopreservation techniques maintain the native structure and growth factors inherent in amniotic tissues, thereby ensuring enhanced regenerative properties that are critical in clinical applications such as chronic wound care and reconstructive surgery. Healthcare providers and leading research institutions, including those recognized by the American Association of Tissue Banks, have validated these benefits through rigorous clinical studies and trials. Furthermore, regulatory agencies such as the United States Food and Drug Administration have endorsed cryopreserved products based on demonstrated safety and efficacy, spurring greater acceptance among hospitals and specialized clinics. This combination of preserved biological potency, robust clinical evidence, and regulatory support has made cryopreserved amniotic products the preferred choice for clinicians, ensuring that they continue to hold a dominant position in the market as advancements in regenerative medicine progress.

By Product

Amniotic membranes captured a dominant market share of 65.4% in 2023 due to their proven clinical benefits and versatile application in various medical fields. These membranes are renowned for their anti-inflammatory, anti-scarring, and regenerative properties, which have made them indispensable in procedures ranging from ophthalmic surgeries to wound management. Their ability to promote rapid healing by providing a natural extracellular matrix has been extensively documented in clinical research and endorsed by organizations like the United States Food and Drug Administration. Additionally, amniotic membranes are backed by robust clinical data, which has resulted in widespread acceptance among surgeons and healthcare professionals. Industry leaders, such as MiMedx Group and Organogenesis, have further cemented their market presence through continuous product innovation and strategic clinical partnerships. This combination of exceptional healing capabilities, strong clinical validation, and active support from regulatory bodies has firmly positioned amniotic membranes as the leading product segment in the regenerative medicine space.

By Application

In 2023, the wound care application of amniotic products dominated the market with a 47.8% share, reflecting the high demand for advanced healing solutions in managing chronic and acute wounds. Amniotic products used in wound care offer significant benefits such as accelerated healing, reduced infection rates, and minimized scarring, which are critical for patients suffering from conditions like diabetic ulcers and burn injuries. These benefits have been corroborated by clinical studies and supported by endorsements from associations such as the American Wound Care Association. Hospitals and specialized clinics have integrated these products into their treatment protocols, further driving their adoption. Government-backed initiatives and funding for regenerative medicine research have also contributed to this trend by validating the cost-effectiveness and clinical efficacy of amniotic products in wound management. This dynamic has resulted in increased investment and innovation in wound care solutions, ensuring that amniotic products remain at the forefront of regenerative therapies for wound healing.

By End-user

Hospitals dominated the end-user segment of the Amniotic Products Market in 2023 with a market share of 54.2%, reflecting their pivotal role in advancing regenerative therapies. As primary healthcare providers, hospitals are continuously seeking innovative treatments that offer improved clinical outcomes and reduced patient recovery times. Amniotic products have been widely incorporated into hospital treatment protocols for applications such as wound care, reconstructive surgery, and orthopedic procedures due to their proven ability to enhance tissue regeneration and reduce complications. Esteemed institutions like the American Hospital Association have highlighted the clinical benefits and cost-effectiveness of these products through published studies and clinical guidelines. Moreover, regulatory endorsements and favorable reimbursement policies further support their integration into standard hospital practices. The ongoing collaboration between hospital networks and leading manufacturers has facilitated access to advanced amniotic products, ensuring high-quality care for patients and reinforcing hospitals as the dominant end-user segment in the evolving landscape of regenerative medicine.

Regional Insights

North America dominated the Spatial Omics Market in 2023 with a market share of 42.3%, driven by the region’s advanced healthcare infrastructure and a robust innovation ecosystem. The United States, in particular, leads the market with significant investments in research and development from both government agencies such as the National Institutes of Health and private sector entities. This leadership is further reinforced by the presence of prominent organizations like the American Association for Cancer Research and various biotechnology companies, whose collaborations have spurred groundbreaking research in spatial omics. The region’s comprehensive regulatory framework, coupled with supportive policies from the United States Food and Drug Administration, has expedited product approvals and clinical trials, thereby attracting substantial funding and investments. Additionally, academic institutions in the United States and Canada are pioneering innovative spatial omics techniques, which have led to increased adoption in precision medicine. This multi-faceted approach, combining technological advancement, regulatory support, and strategic public-private partnerships, underpins North America’s dominance in the Spatial Omics Market.

Moreover, the Asia Pacific region emerged as the fastest growing segment in the Spatial Omics Market, with a significant growth rate during the forecast period of 2024 to 2032. This rapid growth is primarily fueled by the region’s expanding healthcare infrastructure, increasing government investments in biotechnology, and a rising emphasis on precision medicine. Countries such as China, South Korea, and Japan are at the forefront, with significant research funding from national bodies like China’s Ministry of Science and Technology and South Korea’s Ministry of Health and Welfare. These nations are investing heavily in spatial omics research, fostering innovation through collaborations between leading universities and biotech firms. Furthermore, the swift integration of cutting-edge technologies into clinical practice, along with supportive regulatory environments, has accelerated the adoption of spatial omics applications in diagnostics and therapeutics. Rising patient awareness and a growing middle class are also contributing to the increasing demand for advanced medical technologies. This dynamic growth trajectory is supported by an ecosystem of emerging startups and established research institutions that continue to push the boundaries of spatial omics, making the Asia Pacific region a vibrant and rapidly evolving market.

Need any customization research on Amniotic Products Market - Enquiry Now

Amniotic Products Market Key Players

-

Amnio Technology LLC (AmnioExcel, AmnioFix)

-

Applied Biologics LLC (Genesis, PrimeMatrix)

-

BioTissue Holdings, Inc. (formerly TissueTech, Inc.) (AmnioGraft, AmnioGuard, AmnioBand)

-

Celularity Inc. (Biovance, Interfyl)

-

Human Regenerative Technologies, LLC (Skye Biologics Holdings Company) (BioECM, BioDFense)

-

Integra LifeSciences Holdings Corporation (AmnioExcel Plus, PriMatrix)

-

Lucina Biosciences (AmnioPlex, LucinaVita)

-

MiMedx Group, Inc. (EpiFix, AmnioFix, EpiCord)

-

NuVision Biotherapies Ltd (Omnigen, OmniLenz)

-

Next Biosciences (Amniotic Membrane Allograft, Amniotic Fluid Injectable)

-

Organogenesis Holdings, Inc. (ReNu, NuShield)

-

Skye Biologics Holdings, LLC (ProMatric, BioVera)

-

Smith & Nephew Plc (Grafix, Clarix)

-

StimLabs LLC (Revita, Relese, Genesis)

-

Surgenex (SurGraft, SurForce)

-

Stryker (BIO4, Vitagraft)

-

Tides Medical (Artacent AC, Artacent Flex)

-

Ventris Medical, LLC (AmnioWrap, AmnioMatrix)

-

Vivex Biologics (Cygnus, GrafixPL)

-

Katena Products, Inc. (Amniograft, AmbioDisk)

Recent Developments in the Amniotic Products Market

-

February 2024: Verséa launched a point-of-care platform for amniotic membrane grafting. This innovation enhances patient care in ophthalmology by enabling rapid and effective testing, offering immediate diagnostic results and treatment options.

-

December 2023: NovaBay drives amniotic membrane adoption in ophthalmology via woo university partnership. The partnership includes a free webinar offering continuing education credits and covers clinical applications, patient selection, and billing for amniotic membranes, with a focus on NovaBay's Avenova Allograft, which supports ocular surface repair.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 910.78 Million |

| Market Size by 2032 | USD 1,734.03 Million |

| CAGR | CAGR of 7.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Cryopreserved, Dehydrated) •By Product (Membranes, Suspensions) •By Application (Wound Care, Ophthalmology, Orthopedics, Others) •By End User (Hospitals, Specialized Clinics, Ambulatory Surgical Centers, Research Centers & Laboratory, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | MiMedx Group, Inc., Organogenesis Holdings, Inc., Integra LifeSciences Holdings Corporation, Smith & Nephew Plc, Stryker, BioTissue Holdings, Inc. (formerly TissueTech, Inc.), Celularity Inc., StimLabs LLC, Surgenex, Amnio Technology LLC and other key players |