E-Signature Software Market Key Insights:

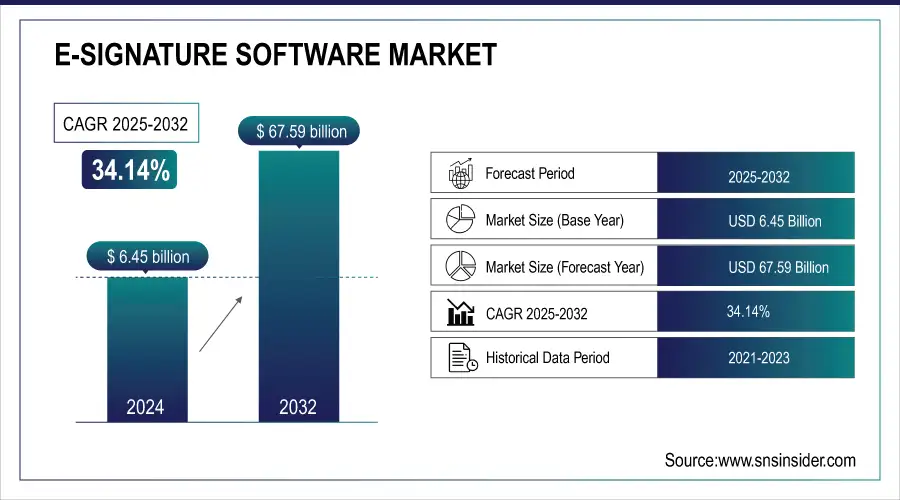

The E-Signature Software Market size was valued at USD 6.45 billion in 2024. It is estimated to reach USD 67.59 billion by 2032, growing at a CAGR of 34.14% during 2025-2032.

The e-signature software market has experienced significant growth in recent years, driven by the increasing need for efficiency and security in document signing processes across various industries. Organizations adopting e-signatures report an average cost reduction of 56%, eliminating expenses related to printing, scanning, and mailing documents. This transition speeds up transactions, with 79% of contracts signed within 24 hours, leading to a 15-day faster turnaround time. Additionally, e-signature technology reduces signing errors by 80% and eliminates up to 92% of scanning errors. Businesses also experience increased customer satisfaction, with over 70% of users reporting fewer customer complaints post-implementation.

Get more information on E-Signature Software Market - Request Sample Report

Environmentally, e-signature technology can save approximately 2.5 billion trees over two decades by cutting paper usage, thus lowering harmful emissions associated with paper production. Moreover, around 81% of users see a return on investment within 12 months, with rapid agreement completions driving further efficiency.

E-Signature Software Market Key Trends:

-

Growing adoption of e-signatures driven by remote work and digital transformation

-

Rising demand for mobile-friendly and cloud-based e-signature solutions

-

Increasing integration of e-signatures with CRM, ERP, and workflow platforms

-

Expansion of AI-powered automation for faster document processing and validation

-

Blockchain gaining traction for tamper-proof and auditable digital signatures

-

Strong emphasis on regulatory compliance and secure audit trails

-

Rapid uptake in BFSI, healthcare, government, and legal sectors.

In addition to improving efficiency, e-signature software also offers enhanced security features. Most solutions use advanced encryption and authentication methods to protect sensitive information and verify the identity of signers. This level of security is particularly important for industries such as finance, healthcare, and real estate, where the integrity of documents is paramount. For instance, in the healthcare sector, patient consent forms and medical records can be signed electronically, ensuring that they remain secure and easily accessible while complying with regulations such as the Health Insurance Portability and Accountability Act (HIPAA). HIPAA mandates safeguards to protect patient information, and healthcare organizations often refer to the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) for a legal framework governing e-signature.

E-Signature Software Market Drivers:

-

Growing adoption of e-signature software driven by business digitization and remote work trends.

The e-signature software market is significantly influenced by the digitization of businesses. With the transition to digital operations, companies are increasingly focusing on the importance of secure and efficient document management. E-signature software provides businesses with the ability to verify and authorize documents electronically, eliminating the reliance on physical paperwork, thus saving time and minimizing errors. The main driving factors behind this change include a greater emphasis on boosting efficiency, cutting expenses, and enhancing customer satisfaction. Digital tools such as electronic signature platforms help businesses simplify their operations and decrease inefficiencies related to manually managing paperwork. For example, agreements that usually need physical signatures can be finalized and handled more quickly through digital signatures, resulting in faster deal-making, procurement, and other operations.

-

Rising Demand in E-Commerce and Financial Services Drives the E-Signature.

The market has experienced growth due to the early adoption of e-signature technology by the e-commerce and financial services industries. In the rapidly moving world of online shopping, customers anticipate fast and smooth transactions. E-signatures are crucial for accelerating procedures like order confirmations, credit approvals, and account openings, providing a seamless experience for businesses and consumers alike. Financial institutions like banks, insurance companies, and real estate agencies have adopted e-signatures to simplify paperwork and remove obstacles linked with conventional approaches. E-signature solutions offer a required level of security and compliance for managing important financial paperwork like loan agreements, mortgage documents, and insurance policies. The capability to electronically sign documents decreases the time it takes to process them, ultimately improving the customer's overall experience. With the ongoing growth of e-commerce worldwide and financial institutions aiming for improved efficiency, the use of e-signature solutions will increase, leading to a larger market.

E-Signature Software Market Restraints:

-

The financial hurdles of e-signature software adoption for small and medium-sized enterprises.

The e-signature software's initial investment costs can pose a major obstacle for numerous organizations, especially small and medium-sized enterprises (SMEs). Even though e-signature solutions can result in cost savings over time through more efficient processes and decreased paper consumption, the initial expenses for licenses, setup, and training may be overwhelming for companies with limited financial resources. Furthermore, continuous expenses linked to upkeep, enhancements, and assistance can contribute to the financial strain. Companies might also have to make investments in extra cybersecurity measures to safeguard against possible threats, resulting in an additional rise in expenses. Viewing e-signature software as a cost rather than a money-saving tool can discourage organizations from transitioning. In sectors where old-fashioned methods are firmly established, companies might be hesitant to spend on e-signature solutions, seeing them as not necessary. Consequently, certain sectors may prove difficult for the market to enter, restricting potential growth overall.

E-Signature Software Market Segmentation Analysis:

-

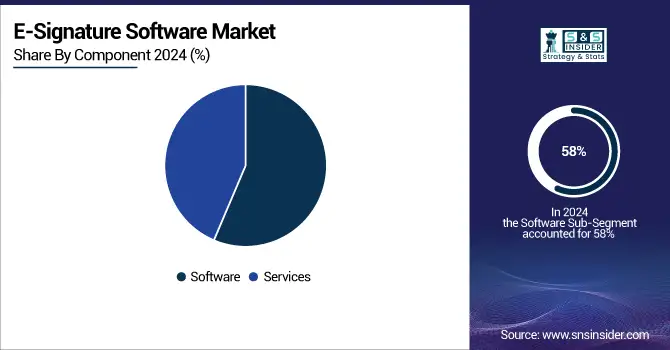

By Component, Software dominates the market, while Services are emerging as the fastest-growing segment.

The software segment dominated the market in 2024 with a market share of over 58%. This is mainly because there is a growing demand for secure and effective digital document signing solutions. E-signature software is widely adopted across industries due to its automation, user-friendliness, and improved adherence to legal regulations. For instance, Adobe Sign, DocuSign, and HelloSign offer customizable e-signature software that integrates with different document management systems, providing a user-friendly interface for contracts, agreements, and legal documents.

The services sector is accounted to have a rapid CAGR during 2025-2032 and become the fastest-growing segment. It consists of consulting, training, and support services designed to assist companies in implementing and maximizing their e-signature solutions. These services facilitate the seamless integration of e-signature software into company systems and ensure proper training for users. Some companies that offer services are OneSpan, which advises on implementing e-signatures, and SignNow, which provides extensive customer support and training.

-

By Deployment, Cloud leads the market, while On-Premise is expanding at the fastest pace.

The cloud led the market with above 60% of the market share in 2024 because it is easily accessible, requires minimal infrastructure, and has lower initial expenses. Cloud-based electronic signature platforms enable users to electronically sign documents from anywhere with an internet connection, providing convenience and boosting efficiency. The increase in remote work, international partnerships, and mobile business activities continues to push the adoption of cloud technology. For example, DocuSign provides a cloud-based electronic signature platform that is utilized in various sectors for contracts, sales agreements, and HR paperwork.

The on-premise segment is going to become the fastest-growing segment during 2025-2032 as it is attractive to sectors like finance, healthcare, and government that have stringent data privacy and security regulations. On-site solutions give companies complete authority over their data as they store it on their servers, providing better data security and customization choices. For instance, Adobe Sign provides customized e-signature solutions for big businesses, such as legal departments and heavily regulated sectors like HSBC in finance, to meet security protocol requirements.

E-Signature Software Market Regional Analysis:

-

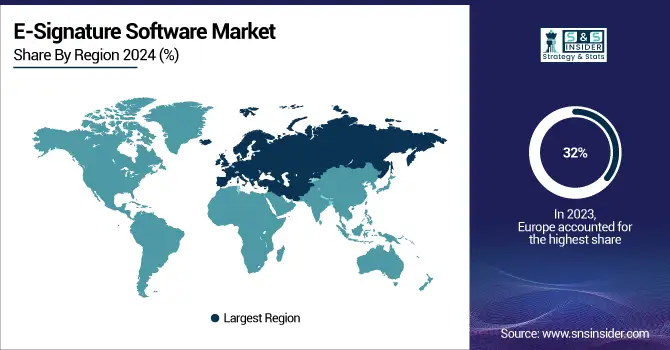

Europe Enterprise WLAN Market Insights

In 2024, Europe dominates the Enterprise WLAN Market with an estimated share of 32%, driven by strong digital transformation initiatives, rapid expansion of smart city projects, and rising enterprise demand for secure, cloud-managed wireless networks. The region benefits from advanced IT infrastructure and widespread adoption of Wi-Fi 6/6E technologies, supporting scalability, security, and seamless connectivity across industries.

Need any customization research on E-Signature Software Market - Enquiry Now

-

Germany Leads Enterprise WLAN Market in Europe

Germany dominates the European market due to its advanced Industry 4.0 adoption, strong investments in smart manufacturing, and large-scale enterprise IT infrastructure. Enterprises across sectors like automotive and industrial automation are integrating AI-powered WLAN systems with IoT applications, enabling smart factories and efficient operations. Germany’s robust regulatory standards and digital-first ecosystem reinforce its leadership position in Europe.

-

North America Enterprise WLAN Market Insights

North America is the fastest-growing region in 2024, with an estimated CAGR of 11.5%, fueled by the hybrid work culture, rapid cloud adoption, and large-scale enterprise digitization. The region benefits from early adoption of Wi-Fi 6/6E and heavy investments in AI-driven, cloud-managed networking solutions, enhancing productivity and connectivity across enterprises.

-

United States Leads Enterprise WLAN Market in North America

The U.S. dominates North America due to its large-scale technology adoption, robust investments in cloud networking, and demand from key industries like IT, education, and healthcare. Leading providers such as Cisco and CommScope drive continuous innovation, enabling secure, scalable, and energy-efficient WLAN solutions. The country’s mature enterprise ecosystem and advanced infrastructure reinforce its leadership.

-

Asia Pacific Enterprise WLAN Market Insights

In 2024, Asia Pacific emerges as a major growth hub, driven by large-scale enterprise digitization, government-backed smart infrastructure projects, and increasing demand for mobile workforce connectivity. The region is seeing strong WLAN adoption across manufacturing, healthcare, and education, supported by cloud expansion and competitive vendor offerings that drive enterprise efficiency and scalability.

-

China Leads Enterprise WLAN Market in Asia Pacific

China leads the regional market due to rapid 5G deployment, government-driven digitalization policies, and widespread enterprise adoption of WLAN for IoT and industrial automation. Enterprises are investing in AI-driven and cloud-managed WLAN solutions to support smart campuses, smart factories, and advanced connectivity models. This strong integration of technology and policy support makes China the dominant force in Asia Pacific.

-

Latin America and Middle East & Africa Enterprise WLAN Market Insights

In 2024, Latin America and the Middle East & Africa (MEA) witness steady growth in the Enterprise WLAN Market, driven by increasing enterprise mobility, smart city adoption, and demand for cost-effective wireless connectivity. Latin America benefits from rising digital penetration in Brazil and Mexico, while MEA experiences accelerated adoption due to UAE and Saudi Arabia’s smart city programs.

-

Regional Leaders in Latin America and MEA

Brazil leads Latin America due to its expanding digital economy, growing enterprise mobility, and adoption of cloud-managed WLAN solutions. In MEA, the UAE dominates, supported by government-led smart city initiatives, luxury business hubs, and the rapid expansion of digitally integrated enterprises. Both regions show rising demand for scalable, secure WLAN deployments to enable digital-first growth.

Competitive Landscape of E-Signature Software Market:

HelloSign

HelloSign, now rebranded as Dropbox Sign, is a leading e-signature solution provider known for its simple, secure, and API-driven digital signing services. It empowers businesses to streamline workflows, automate approvals, and integrate document signing into everyday operations. In the Enterprise WLAN market, HelloSign benefits from high-speed, secure wireless networks that ensure seamless accessibility for remote teams and mobile users. WLAN solutions enhance the performance of its cloud-based platforms, supporting real-time collaboration, encrypted transactions, and legally binding e-signatures across industries, making digital workflows more efficient and reliable.

-

March 2024: HelloSign announced new workflow automation features that allow users to create custom signing workflows. This improvement aims to increase productivity by simplifying the signing process across various platforms.

SignNow

SignNow is a versatile e-signature platform offering legally binding document signing, workflow automation, and secure integrations with popular business applications. It caters to enterprises and SMEs across industries by improving document turnaround times and reducing operational costs. In the Enterprise WLAN market, SignNow leverages robust wireless networks to enable fast, mobile-first access to digital contracts and agreements. WLAN ensures seamless integration of its services into enterprise systems, supports mobile workforce connectivity, and strengthens security protocols, allowing businesses to rely on SignNow for efficient, scalable, and collaborative digital document management across distributed teams.

-

January 2024: SignNow released an updated mobile app that includes improved functionalities for document signing on the go. This update enhances user experience with a focus on accessibility and ease of use.

DocuSign

DocuSign is a global leader in e-signature and digital agreement technologies, serving millions of users and enterprises worldwide. Its platform enables secure electronic signatures, contract lifecycle management, and AI-driven document intelligence, helping businesses accelerate digital transformation. Within the Enterprise WLAN market, DocuSign relies on high-performance wireless connectivity to power its cloud-based services across industries. WLAN facilitates secure, real-time signing experiences, supports remote workforces, and ensures compliance with global standards. By integrating with enterprise WLAN infrastructure, DocuSign enables faster, more reliable, and mobile-friendly digital agreement execution, reinforcing its role as a trusted enabler of paperless business operations.

-

April 2023: DocuSign introduced IAM to enhance how organizations create, commit to, and manage agreements using AI integration. This solution aims to transform the efficiency and effectiveness of agreement management for businesses of all sizes.

E-Signature Software Market Companies:

The key players in the E-Signature Software market are:

-

Esign Geni

-

HID Global

-

Legalesign Limited

-

RPost

-

Thales S.A.

-

U-SIGN-IT

-

Zoho Corporation

-

PandaDoc

-

SignNow

-

HelloSign (Dropbox)

-

RightSignature (Citrix)

-

SignRequest

-

Sertifi

-

CocoSign

-

Eversign

-

GetAccept

-

SignEasy

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.45 Billion |

| Market Size by 2032 | USD 67.59 Billion |

| CAGR | CAGR of 34.14% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Services, Software) • By Deployment (Cloud, On-premise) • By Method (General Electronic Signature, Qualified Electronic Signature, Advanced Electronic Signature) • By End-User (Manufacturing, BFSI, Pharmaceuticals, Government Agencies, Legal, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Adobe Inc., DocuSign, Inc., Esign Geni, HID Global, Legalesign Limited, OneSpan, RPost, Thales S.A., U-SIGN-IT, Zoho Corporation, PandaDoc, SignNow, HelloSign (Dropbox), RightSignature (Citrix), SignRequest, Sertifi, CocoSign, Eversign, GetAccept, SignEasy |