Restaurant Management Software Market Size & Overview:

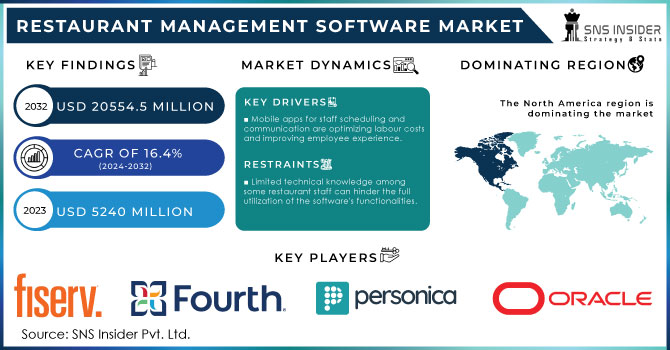

Restaurant Management Software Market was valued at USD 5.05 billion in 2023 and is expected to reach USD 18.73 billion by 2032, growing at a CAGR of 15.75% from 2024-2032.

Get More Information on Restaurant Management Software Market - Request Sample Report

The Restaurant Management Software sector is seeing strong growth because of the rising need for efficient operations in the food service sector. With increasing competition and the necessity for improved customer experiences, RMS platforms are becoming vital resources for restaurants. These solutions provide features like table bookings, order handling, inventory management, and employee scheduling, which enhance daily operations and boost operational efficiency. 62% of full-service customers currently favor contactless or mobile payment methods, underscoring the significance of digital solutions in improving customer experiences. The move towards digital transformation in the hospitality industry is driving the use of RMS, as 84% of delivery clients favor ordering through a restaurant's website, and 80% utilize a smartphone app for delivery. In October 2024, Fiserv launched new features through its Clover platform to aid small businesses, especially in the restaurant industry, thereby accelerating market growth.

The demand for RMS is also fueled by consumer desires for convenience and tailored experiences. Research indicates that 70% of consumers claim to order delivery, 70% say they pick up takeout, and 68% indicate they dine in, highlighting the necessity for restaurants to address various dining preferences. The increasing popularity of online ordering, delivery services, and contactless payments is prompting restaurants to implement sophisticated software solutions to efficiently handle these avenues. Moreover, collaborating with external platforms such as food delivery services, payment systems, and customer loyalty initiatives is increasingly essential. With consumers progressively looking for convenience and quickness in their dining experiences, restaurants need to implement software that can meet these expectations and provide prompt, precise service.

Looking forward, the future of the Restaurant Management Software industry is brimming with opportunities fueled by technological progress. The emergence of artificial intelligence and machine learning in RMS solutions is expected to provide improved predictive analytics for managing inventory, staffing requirements, and insights into customer behavior. Cloud-based solutions are expected to lead, providing scalable and adaptable choices for restaurants of various sizes. Furthermore, the growing use of Internet of Things devices, including smart kitchen appliances and integrated POS systems, will further enhance RMS functionalities. These advancements, along with a continuous emphasis on sustainability and efficiency, offer an optimistic perspective for the RMS market.

Market Dynamics

Drivers

-

Seamless Integration with Third-Party Delivery Platforms: Enhancing Restaurant Operations and Expanding Market Reach

The increasing prevalence of food delivery services has made it essential for restaurants to integrate their operations with third-party delivery platforms. Restaurant management software that seamlessly connects with services like Uber Eats, DoorDash, or Grubhub enables efficient order processing, tracking, and delivery management. This integration reduces the manual effort required to manage orders from multiple platforms, minimizing the risk of errors and delays. Additionally, it streamlines communication between the restaurant, delivery drivers, and customers, providing a smoother experience for all parties. By incorporating delivery service integration, restaurants can expand their reach to a wider audience, enhance their service offerings, and improve revenue generation, making this a key factor in the growing demand for advanced restaurant management solutions.

-

Rising Need for Operational Efficiency in the Restaurant Industry: The Role of Management Software in Streamlining Daily Operations

As the restaurant industry becomes more competitive, the demand for operational efficiency is escalating. Restaurant management software plays a pivotal role in optimizing day-to-day operations, such as inventory control, order processing, and staff scheduling. By automating routine tasks, these solutions reduce the risk of human error, prevent stock shortages, and ensure that restaurants can serve customers more effectively. Efficient order management allows for faster and more accurate processing, reducing wait times and improving the overall dining experience. Moreover, advanced scheduling tools ensure that labor resources are utilized efficiently, minimizing downtime and unnecessary costs. Through these capabilities, restaurant management software not only cuts down operational expenses but also boosts productivity, making it an essential tool for businesses aiming to stay competitive and deliver exceptional service.

Restraints

-

Challenges Posed by High Initial Costs: Financial Barriers for Small-Scale Restaurants Adopting Management Software

The initial financial investment required for implementing restaurant management software can be a significant hurdle for smaller establishments. These costs encompass not only the software licensing fees but also the necessary hardware upgrades and staff training programs. For many small restaurants, especially those with limited budgets, this upfront expenditure may be viewed as prohibitive. The financial strain of these initial costs can deter smaller operators from adopting advanced technology, even though it offers long-term operational benefits. Additionally, without a large-scale operation to offset these expenses, the return on investment might not seem immediate, further discouraging adoption. As a result, small-scale restaurants may continue relying on traditional methods, missing out on the efficiency and profitability that management software can bring to their business.

-

Challenges in Integrating Restaurant Management Software with Existing Systems: The Need for Technical Expertise and Time Investment

Integrating restaurant management software with existing systems, such as POS, accounting, and inventory tools, presents a significant challenge. This process can be complex and time-consuming, often requiring specialized technical expertise to ensure compatibility and smooth operation. For restaurants without dedicated IT support, the integration process may cause disruptions to daily operations, leading to operational inefficiencies. Additionally, the need for professional assistance in configuring and customizing the software can increase costs, making it a burdensome investment. The complexity of integration can lead to delays in the adoption of the software, as staff may also require training to use the new system effectively. This barrier prevents some restaurants, particularly smaller establishments, from fully benefiting from the capabilities of advanced management software, hindering their growth and operational efficiency.

Segment Analysis

By Software

In 2023, the Front-end Software segment dominated the restaurant management software market with the highest revenue share of about 38%. This dominance can be attributed to the growing need for enhanced customer interaction and experience. Front-end software facilitates efficient order processing, customer reservations, and point-of-sale systems, which are critical for managing daily operations. As restaurants focus on improving service delivery and customer satisfaction, the demand for front-end solutions continues to rise, positioning them as the market leader.

The Table & Delivery Management segment is expected to grow at the fastest CAGR of about 19.19% from 2024 to 2032. The surge in demand for seamless online ordering and delivery services is a key driver of this growth. With the increasing popularity of food delivery platforms and the need for efficient table management, restaurants are turning to integrated software solutions that streamline these functions. As consumer preferences shift towards convenience, the Table & Delivery Management segment is poised to expand rapidly, supporting restaurant growth and profitability.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End-use

In 2023, the Full-service Restaurant (FSR) segment led the restaurant management software market, capturing the highest revenue share of about 43%. This dominance is largely due to the complexity and scale of operations within FSRs, which require sophisticated solutions for managing reservations, orders, inventory, and staff. These establishments prioritize delivering a premium dining experience, making efficient management software essential to maintaining smooth, high-quality service, and optimizing operational costs.

The Quick Service Restaurant (QSR) segment is expected to grow at the fastest CAGR of about 17.81% from 2024 to 2032. The rapid growth of QSRs is fueled by increasing consumer demand for fast, convenient dining options and the rising importance of efficient, automated systems. With a focus on high-volume, fast-paced operations, QSRs are adopting advanced restaurant management software to streamline order processing, enhance delivery efficiency, and reduce wait times, all of which are critical in meeting customer expectations and maintaining profitability.

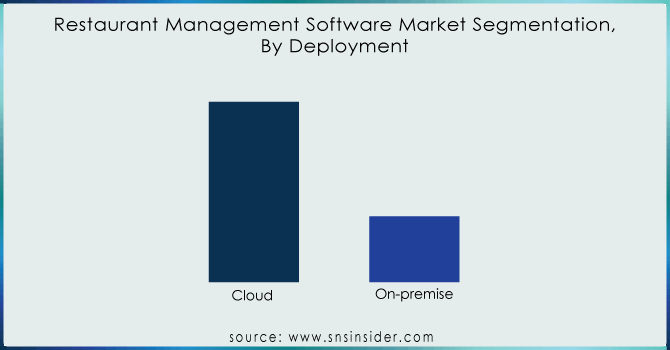

By Deployment

Cloud dominated the restaurant management software market with the highest revenue share of about 59% in 2023 and is expected to grow at the fastest CAGR of about 16.51% from 2024 to 2032. This dominance is driven by the scalability, flexibility, and cost-effectiveness that cloud-based solutions offer. Cloud technology enables restaurants to access management systems remotely, providing real-time updates and seamless integration across multiple locations, all while reducing the need for extensive IT infrastructure. The ability to scale easily, combined with lower upfront costs, makes cloud solutions highly attractive to both large chains and smaller establishments. Additionally, the enhanced data analytics, improved customer insights, and integration with third-party services further support the growth of cloud-based systems, positioning them as the preferred choice for restaurants looking to optimize operations and stay competitive in a dynamic market.

Regional Analysis

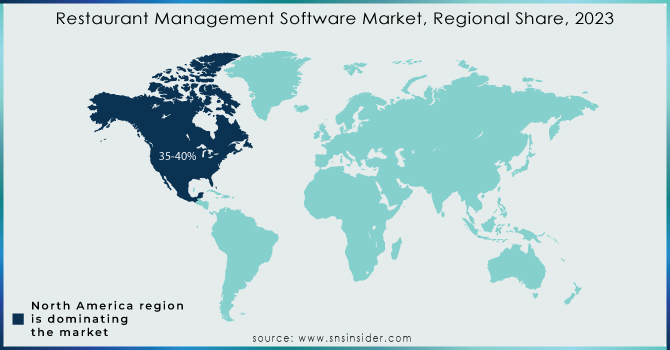

In 2023, North America dominated the restaurant management software market with the highest revenue share of about 38%. This dominance is driven by the region's advanced technological infrastructure and the high adoption rate of automation and digital solutions in the foodservice industry. North American restaurants increasingly rely on sophisticated management systems to optimize operations, enhance customer experience, and manage large-scale, diverse operations, making the market ripe for continued software integration and growth.

Asia Pacific is expected to grow at the fastest CAGR of about 18.09% from 2024 to 2032, driven by rapid urbanization, changing consumer lifestyles, and growing disposable incomes. The region's fast-growing foodservice sector, along with a rising demand for convenience and digitalization in restaurants, is propelling the adoption of management software. As more restaurants in emerging markets adopt technology to streamline operations and cater to a tech-savvy customer base, Asia Pacific is poised for significant growth in the restaurant management software market.

Key Players

-

Fiserv, Inc. (Clover POS, Heartland Payment Systems)

-

Personica (Fishbowl Inc.) (Fishbowl POS, Fishbowl Inventory)

-

Fourth Enterprises LLC. (Fourth HR, Fourth Workforce Management)

-

Jolt (Jolt Scheduling, Jolt Task Management)

-

NCR Corporation (Aloha POS, NCR Silver)

-

OpenTable, Inc. (OpenTable Reservations, OpenTable Guest Center)

-

Oracle Corporation (Oracle MICROS POS, Oracle Hospitality Cloud)

-

Revel Systems (Revel POS, Revel Back Office)

-

Square Capital, LLC (Square POS, Square Appointments)

-

TouchBistro (TouchBistro POS, TouchBistro Payments)

-

Toast Inc. (Toast POS, Toast Payroll & Team Management)

-

Square Inc. (Square POS, Square Online Store)

-

Upserve Inc. (Upserve POS, Upserve Payments)

-

Lightspeed POS Inc. (Lightspeed Restaurant POS, Lightspeed Analytics)

-

Clover Network, Inc. (Clover POS, Clover Dining)

-

Agilysys, Inc. (Agilysys POS, Agilysys Property Management System)

-

POSist Technologies Pvt. Ltd. (POSist Cloud POS, POSist Inventory Management)

-

Brink POS (Brink POS, Brink Reporting)

-

ShopKeep Inc. (ShopKeep POS, ShopKeep Inventory Management)

-

Maitre'D POS (Maitre'D POS, Maitre'D Restaurant Management)

-

Squirrel Systems (Squirrel POS, Squirrel Back Office)

-

Heartland Payment Systems (Heartland POS, Heartland Payment Solutions)

-

Breadcrumb (Breadcrumb POS, Breadcrumb Reporting)

-

Epos Now Ltd (Epos Now POS, Epos Now Inventory Management)

-

Zomato Media Private Ltd (Zomato Order Management, Zomato Reservations)

-

7shifts (7shifts Scheduling, 7shifts Team Communication)

-

ADP (ADP Workforce Management, ADP Payroll)

Recent Developments:

-

In October 2024, Fiserv introduced enhanced all-in-one Clover solutions tailored for restaurants, retailers, and service businesses. These solutions aim to improve efficiency by combining customizable hardware with sector-specific software.

-

In June 2024, Oracle announced that restaurants are increasingly relying on Oracle Cloud to enhance revenue and operational efficiency through solutions like Oracle Simphony and Oracle Payments.

-

In 2024, Zomato launched a Point of Sale (POS) developer platform to enhance restaurant operations and food delivery services. The platform integrates services for better order management, payment processing, and customer interactions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.05 Billion |

| Market Size by 2032 | USD 18.73 Billion |

| CAGR | CAGR of 15.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Software (Front-end Software, Accounting & Cash Flow, Purchasing & Inventory Management, Table & Delivery Management, Employee Payroll & Scheduling, Others) • By Deployment (Cloud, On-premise) • By End-use (Full-service Restaurant [Fine Dine, Casual Dine], Quick Service Restaurant, Institutional, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fiserv, Inc., Personica (Fishbowl Inc.), Fourth Enterprises LLC., Jolt, NCR Corporation, OpenTable, Inc., Oracle Corporation, Revel Systems, Square Capital, LLC, TouchBistro, Toast Inc., Square Inc., Upserve Inc., Lightspeed POS Inc., Clover Network, Inc., Agilysys, Inc., POSist Technologies Pvt. Ltd., Brink POS, ShopKeep Inc., Maitre'D POS, Squirrel Systems, Heartland Payment Systems, Breadcrumb, Epos Now Ltd, Zomato Media Private Ltd, 7shifts, ADP |

| Key Drivers | • Seamless Integration with Third-Party Delivery Platforms: Enhancing Restaurant Operations and Expanding Market Reach • Rising Need for Operational Efficiency in the Restaurant Industry: The Role of Management Software in Streamlining Daily Operations |

| RESTRAINTS | • Challenges Posed by High Initial Costs: Financial Barriers for Small-Scale Restaurants Adopting Management Software • Challenges in Integrating Restaurant Management Software with Existing Systems: The Need for Technical Expertise and Time Investment |