AI For Customer Service Market Report Scope & Overview:

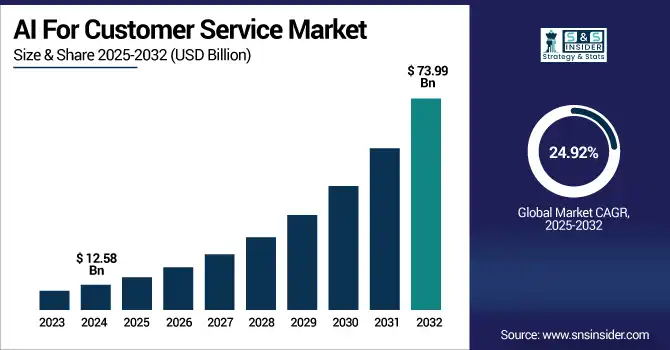

AI For Customer Service Market was valued at USD 12.58 billion in 2024 and is expected to reach USD 73.99 billion by 2032, growing at a CAGR of 24.92% from 2025-2032.

To Get more information on AI For Customer Service Market- Request Free Sample Report

The AI for Customer Service market growth is driven by increasing demand for 24/7 customer support, rising adoption of digital transformation across industries, and the need to reduce operational costs while enhancing customer experience. Businesses are leveraging AI-powered tools like chatbots, virtual assistants, and sentiment analysis engines to handle high volumes of queries efficiently.

-

A 2023 academic study by Brynjolfsson et al., analyzing 5,172 customer support agents, found that AI assistance increased the number of issues resolved per hour by an average of 15%, particularly helping less experienced agents improve performance.

-

Additionally, the U.S. Federal Reserve reports that 20–40% of U.S. workers now use AI on the job, especially in programming and support functions, highlighting its growing role in enterprise operations.

-

The Bureau of Labor Statistics also projects strong employment growth in AI-related roles, including +17.9% for software developers, +10.8% for database architects, and +8.2% for database administrators from 2023 to 2033 reflecting the expanding infrastructure needed to support AI-driven customer service systems.

Furthermore, advancements in Natural Language Processing (NLP), Machine Learning, and speech recognition have significantly enhanced AI’s ability to understand and respond to customer needs in real time. The growing consumer preference for personalized and responsive interactions is accelerating AI integration across customer-facing functions in sectors such as BFSI, retail, healthcare, and telecommunications.

U.S. AI For Customer Service Market was valued at USD 3.43 billion in 2024 and is expected to reach USD 20.02 billion by 2032, growing at a CAGR of 24.56% from 2025-2032.

The U.S. AI for Customer Service market is growing due to high adoption of automation, demand for personalized experiences, and strong technological infrastructure, supported by leading AI companies and increasing investments in enhancing digital customer engagement and operational efficiency.

AI For Customer Service Market Dynamics

Drivers

-

Rapid advancements in NLP and machine learning are enhancing AI’s ability to understand and personalize customer interactions at scale

Ongoing breakthroughs in natural language processing (NLP) and machine learning are significantly improving AI’s ability to understand context, sentiment, and intent in customer conversations. These improvements empower AI-driven platforms to handle more complex queries with personalized and human-like responses. As a result, businesses can offer tailored support experiences that drive loyalty and engagement. The increasing accuracy of sentiment analysis and multilingual capabilities further supports broader adoption across industries and regions. These technical advancements allow AI tools to be integrated into CRM systems, self-service portals, and contact centers, reshaping the future of scalable and intelligent customer service.

-

High-performing sentiment analysis tools whether lexicon-based or machine learning-driven can achieve approximately 70–80% accuracy, which is close to human-level agreement. Research indicates that even human evaluators typically reach consensus on sentiment only about 80% of the time, highlighting the growing reliability of automated sentiment detection.

Restraints

-

Concerns over data privacy and security remain a major barrier to the adoption of AI-driven customer service platforms

The implementation of AI in customer service often involves collecting and processing vast amounts of personal data, raising serious concerns around privacy and security. Enterprises must comply with data protection regulations like GDPR and CCPA, which require strict control over how customer information is handled. Breaches or misuse of such data can lead to reputational damage, legal repercussions, and loss of customer trust. Additionally, the use of third-party AI tools heightens risks due to potential vulnerabilities in external systems. These privacy and compliance concerns can slow down adoption and limit the integration of AI into sensitive customer-facing operations.

Opportunities

-

Expansion of omnichannel customer engagement strategies is creating new avenues for AI integration across multiple digital platforms

The growing importance of seamless customer experiences across channels such as chat, email, social media, and voice is encouraging businesses to adopt AI for unified customer service. AI technologies can efficiently manage queries across these platforms, enabling consistent communication regardless of the channel. Integration with CRM systems, social listening tools, and conversational analytics allows for real-time personalization and context-aware responses. As customer journeys become increasingly nonlinear and digital-first, the ability of AI to provide cohesive, automated support across all touchpoints presents a strong growth opportunity for solution providers and enterprises aiming to enhance customer engagement at scale.

-

A Salesforce survey reports that 88% of customer service representatives say balancing speed and quality across channels is challenging, and 81% believe customers expect a “personal touch” more than ever. Additionally, 82% of reps confirm that customers are demanding more support across all communication channels.

-

Supporting this trend, Salesforce’s Einstein AI engine part of the Customer 360 platform processes over 283 billion AI predictions and facilitates 3.2 million chatbot sessions, underscoring the scale and sophistication of AI-driven omnichannel customer engagement.

Challenges

-

Difficulty in maintaining context, accuracy, and empathy in complex interactions limits AI’s effectiveness in handling high-value service scenarios

While AI excels in resolving routine and repetitive queries, it often falls short in managing emotionally charged or context-heavy conversations. Lack of emotional intelligence, difficulty understanding nuanced human language, and inability to build rapport can lead to poor user experiences in critical support situations. Customers facing complex technical problems or sensitive service issues often prefer human agents for reassurance and resolution. As a result, businesses must carefully balance AI and human involvement, which complicates workflows and limits the level of automation. These limitations challenge the full potential of AI in customer service and hinder its broader acceptance in certain industries.

AI For Customer Service Market Segmentation Analysis

By Component

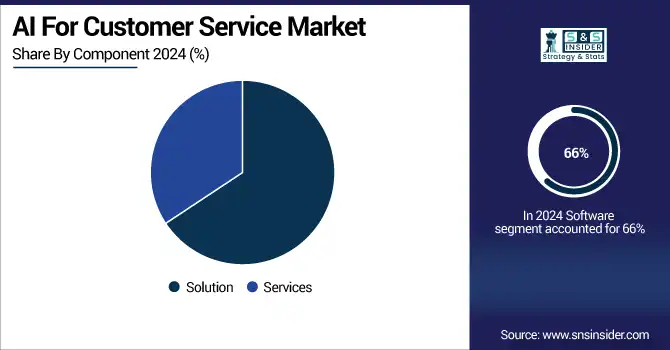

Software segment dominated the AI for Customer Service Market with the highest revenue share of about 66% in 2024 due to its scalability, flexibility, and high adoption across industries. Enterprises prioritize AI-driven platforms like chatbots, sentiment analyzers, and CRM integrations that are software-based, enabling automation and personalization at scale. Cloud-based deployment models also contributed to the dominance by ensuring cost-effectiveness, seamless updates, and easy integration with existing systems.

Services segment is expected to grow at the fastest CAGR of about 26.60% from 2025–2032 owing to increasing demand for consulting, deployment, and support services. Organizations adopting AI need expert guidance to customize solutions, train models, and ensure compliance. As AI deployments scale across industries, the need for ongoing technical support and managed services grows, particularly in data integration, system optimization, and performance tuning, thereby driving rapid growth in this segment.

By End Use

BFSI segment dominated the AI for Customer Service Market with the highest revenue share of about 22% in 2024 due to high customer interaction volumes and security requirements. Banks and insurers leverage AI to streamline operations, enhance customer experiences, and manage queries in real time. AI tools also help reduce fraud, process claims faster, and personalize financial advice, making them indispensable in the digitally transforming BFSI landscape.

Retail & E-commerce segment is expected to grow at the fastest CAGR of about 27.67% from 2025–2032 driven by rising consumer expectations for personalized, round-the-clock service. AI enables dynamic product recommendations, automated returns, and multilingual chat support, enhancing shopper experience. As online retail platforms scale globally, the demand for AI tools that handle large volumes of customer data and streamline interactions across channels is accelerating significantly.

By Application

Chatbots & Virtual Assistants segment dominated the AI for Customer Service Market with the highest revenue share of about 31% in 2024 because of their widespread adoption for handling routine queries. These tools reduce response times, cut operational costs, and offer 24/7 support, making them ideal for high-volume customer environments. Their integration into websites, messaging apps, and voice assistants further solidified their lead in automating first-level customer interactions.

Agent Assist & Knowledge Management segment is expected to grow at the fastest CAGR of about 28.28% from 2025–2032 as organizations invest in hybrid support models. AI-powered agent assist tools help human agents by providing real-time suggestions, sentiment detection, and contextual data. Knowledge management systems enable fast information retrieval, boosting efficiency. This synergy enhances service quality while reducing training time, driving accelerated adoption across complex support operations.

By Technology

Machine Learning & Deep Learning segment dominated the AI for Customer Service Market with the highest revenue share of about 40% in 2024 due to their core role in powering intelligent automation. These technologies enable pattern recognition, predictive analytics, sentiment analysis, and real-time decision-making. Their ability to continuously learn and improve from customer interactions allows businesses to deliver highly personalized and efficient service experiences, making them foundational to most AI service applications.

Computer Vision segment is expected to grow at the fastest CAGR of about 28.63% from 2025–2032 as visual AI tools gain traction in customer service. Applications include facial recognition for identity verification, visual product searches, and automated image-based issue resolution. With growing use in industries like retail, banking, and telecom, computer vision enhances customer engagement and operational efficiency by enabling smarter, faster, and more intuitive service interactions.

AI For Customer Service Market Regional Outlook

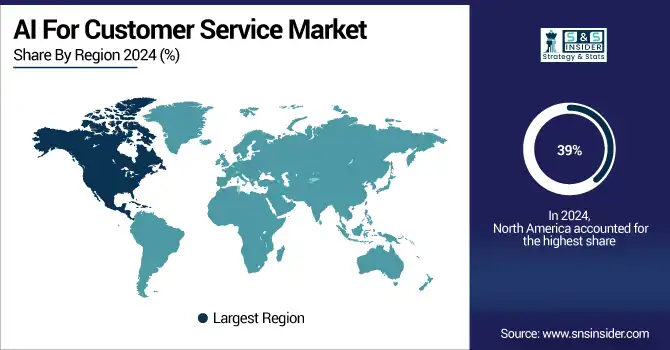

North America dominated the AI for Customer Service Market with the highest revenue share of about 39% in 2024 due to its advanced digital infrastructure, high AI adoption rate, and strong presence of key market players. Enterprises in the region, especially in the U.S. and Canada, have heavily invested in AI-driven customer engagement tools to enhance service quality, operational efficiency, and customer satisfaction across sectors like BFSI, retail, and telecommunications.

The United States is dominating the AI for Customer Service market due to early technology adoption, robust infrastructure, and presence of major AI solution providers.

Asia Pacific is expected to grow at the fastest CAGR of about 27.41% from 2025–2032, driven by rapid digital transformation, growing e-commerce, and increasing smartphone penetration. Emerging economies like China, India, and Southeast Asia are heavily investing in AI technologies to enhance customer service operations. Rising consumer expectations, government initiatives promoting AI, and large, diverse customer bases are further fueling adoption, making the region a key growth engine for the global market.

China is dominating the AI for Customer Service market in Asia Pacific due to massive digitalization, strong government support, and rapid enterprise-level AI deployment.

Europe is witnessing strong growth in the AI for Customer Service market due to rising demand for automation, enhanced customer experiences, and supportive digital transformation initiatives across various industries, including finance, retail, and telecommunications.

The United Kingdom is dominating the AI for Customer Service market in Europe due to strong digital maturity, tech investments, and high enterprise AI adoption rates.

Middle East & Africa and Latin America are emerging markets in the AI for Customer Service space, driven by increasing digitalization, mobile penetration, and growing interest in AI solutions to improve customer engagement, reduce service costs, and enhance operational efficiency.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

AI For Customer Service Market companies are Microsoft, Google LLC, IBM Corporation, Amazon Web Services (AWS), Salesforce, Inc., Oracle Corporation, Zendesk, ServiceNow, Freshworks Inc., SAP, HubSpot, Aisera, Ada, Sprinklr, OpenAI, NICE Ltd., Genesys, LivePerson, Intercom, Zoho Corporation.

Recent Developments:

-

2025: Swiss insurer Mobiliar deployed “Mobi‑ChatGPT” via Azure OpenAI Service, speeding email routing, automated ticket sorting, translation, and AI‑generated customer responses to improve service efficiency.

-

2025: OpenAI introduced a Responses API and Agents SDK for enterprises to create custom AI agents for customer support, data processing, and automated browsing with full enterprise-level control.

-

2024: Microsoft launched autonomous agents in Copilot Studio and Dynamics 365, enabling AI-powered workflows in service, finance, and sales, and empowering non-developers to design tailored customer support agents.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 12.58 Billion |

| Market Size by 2032 | USD 73.99 Billion |

| CAGR | CAGR of 24.92% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Technology (Machine Learning & Deep Learning, Natural Language Processing (NLP), Computer Vision, Speech Recognition) • By Application (Customer Support Automation, Chatbots & Virtual Assistants, Sentiment Analysis, Omnichannel Support, Agent Assist & Knowledge Management, Workflow Automation) • By End Use (BFSI, Retail & E-commerce, Healthcare, IT & Telecommunications, Media & Entertainment, Travel & Hospitality, Government, Utilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microsoft, Google LLC, IBM Corporation, Amazon Web Services (AWS), Salesforce, Inc., Oracle Corporation, Zendesk, ServiceNow, Freshworks Inc., SAP, HubSpot, Aisera, Ada, Sprinklr, OpenAI, NICE Ltd., Genesys, LivePerson, Intercom, Zoho Corporation |