Edible Water Bottles Market Report Scope And Overview:

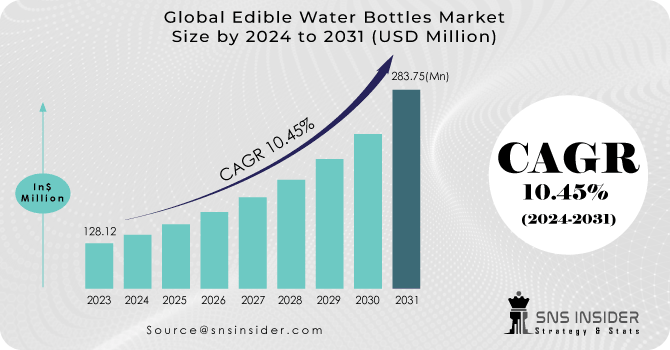

The Edible Water Bottles Market Size was valued at USD 128.12 million in 2023 and is expected to reach USD 283.75 million by 2031 and grow at a CAGR of 10.45% over the forecast period 2024-2031

The edible water bottle market is growing as plastic consumption rises and environmental awareness increases. The United States alone discards approximately 50 billion PET plastic water bottles each year, highlighting the need for eco-friendly alternatives. While conventional bottles are lightweight and portable, their extensive use, especially for water, has a significant environmental impact. Single-use plastic production, which accounts for over 50% of global plastic production, reached 400.3 million metric tonnes in 2022.

Get More Information on Edible Water Bottles Market - Request Sample Report

As global bottled water consumption rises to 15.9 billion gallons in 2022, environmental groups advocate for reduced plastic usage, promoting alternatives like edible water bottles. Governments are enacting regulations to restrict plastic bottle use, driving demand for edible options. These regulations reflect a shift away from single-use plastics. Edible water bottles, fully biodegradable and rapidly decomposable, allow consumers to consume the packaging after drinking, aligning with sustainability goals and driving market growth. Collaborative research and development initiatives are a prominent trend in the Edible Water Bottles Market. Stakeholders across academia, industry, and non-profits are joining forces to tackle challenges and explore opportunities in edible packaging. These collaborations drive innovation, expedite technology advancements, and promote standardization of materials.

MARKET DYNAMICS

KEY DRIVERS:

-

A trend towards healthier lifestyles and conscious consumer choices contributes to the adoption of edible water bottles.

-

Awareness of environmental issues and a commitment to sustainable practices.

The primary catalyst for the edible water bottles market is the worldwide increase in environmental awareness and the escalating focus on sustainability. As the harmful effects of single-use plastics on the environment become more apparent, consumers, governments, and businesses are actively pursuing alternatives. Edible water bottles, crafted from natural and biodegradable materials, offer a sustainable solution that aligns with the principles of a circular economy.

RESTRAIN:

-

The production of edible water bottles may involve higher manufacturing costs compared to traditional plastic bottles.

OPPORTUNITY:

-

The global trend towards health and wellness creates an opportunity for edible water bottles.

-

Advancements in technology pertaining to edible packaging materials.

The Edible Water Bottles Market is experiencing a rise in technological progress concerning edible packaging materials. Both researchers and companies are dedicating resources to innovate novel materials that not only meet edibility standards but also enhance the performance and user experience of edible water bottles. Progress in material science allows for the development of edible packaging materials with enhanced tensile strength, flexibility, and preservation properties. This trend not only propels market growth but also creates opportunities for a wide range of applications beyond beverages.

CHALLENGES:

-

Overcoming consumer scepticism and ensuring widespread acceptance of edible water bottles poses a significant challenge.

-

The cost implications and economic feasibility.

Impact of Russia Ukraine War

The ongoing Russia-Ukraine crisis has profound implications for global markets, potentially extending its impact to sectors like the edible water bottles market. The repercussions are diverse, influencing supply chains, the availability of raw materials, and market demand in various ways. Geopolitical tensions from the crisis could disrupt the supply of key raw materials essential for producing edible water bottles, such as seaweed extract, alginate, or other biopolymers. This disruption becomes especially critical if these materials are sourced from regions directly affected by the crisis. Additionally, increased logistical challenges and transportation costs, stemming from the geopolitical tensions, have the potential to impact the distribution networks and cost structures of edible water bottle products. The multifaceted nature of these challenges underscores the need for the industry to navigate a complex and evolving landscape amid the crisis.

Impact of Economic Slowdown

One notable concern is the potential rise in inflation rates, stemming from the crisis, which could escalate production costs for manufacturers of edible water bottles. These increased costs may be transferred to consumers, potentially influencing demand dynamics for these products. Another challenge arises from exchange rate volatility, where fluctuations in currency values can directly impact import and export costs for edible water bottles. Such uncertainties in international markets may affect the overall competitiveness of edible water bottles on a global scale

KEY MARKET SEGMENTS

By Material

-

Seaweed Extract

-

Alginate

-

Gelatin

Alginate-based are favored for their natural and sustainable characteristics, offering a gel-like texture capable of retaining water and other liquids, making them perfect for edible water bottle production. These bottles are frequently biodegradable, presenting a convenient and environmentally friendly substitute for conventional plastic water bottles. Moreover, seaweed extract, abundant in minerals and nutrients, further enhances the attractiveness of these edible water bottle from a health standpoint.

By Type

-

Plain Water

-

Mineral Water

-

Sparkled Water

-

Flavored Water

-

Others

The flavored water segment holds the largest share in the global edible water bottles market, driven by increased consumer spending on flavored water in affluent countries like the U.S. Growing global demand for low-sugar, low-carb, and low-calorie soft drinks is fueling market growth. Meanwhile, the mineral water market is expected to expand over the forecast period. Mineral water stands out from other bottled water types because it contains consistent levels of minerals and trace elements from the source. According to the Safe Drinking Water Foundation (SDWF), adding minerals to mineral water is prohibited.

By Distribution Channel

-

Direct Sales

-

E-Commerce Sales

-

Retail Sales

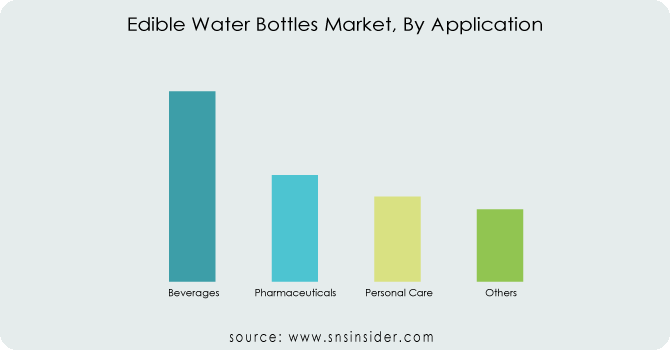

By Application

-

Beverages

-

Pharmaceuticals

-

Personal Care

-

Others

Get Customized Report as per Your Business Requirement - Request For Customized Report

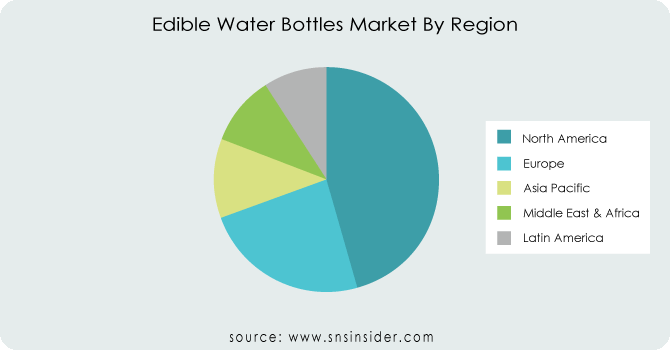

REGIONAL ANALYSIS

The Asia Pacific region is positioned for significant expansion in the coming years, driven by proactive government initiatives encouraging the use of eco-friendly materials in bottle manufacturing. Public awareness of the environmental risks associated with plastic water bottles is fostering a positive trend, with consumers increasingly opting for edible water bottles. This shift, supported by government encouragement, is expected to propel the regional market's growth. Rapid urbanization and evolving lifestyles further contribute to the adoption of edible water bottles, as health-conscious consumers seek sustainable alternatives to conventional disposable options. Additionally, global efforts to protect marine life from the detrimental impact of plastic pollution contribute to the market's momentum.

In North America, a steady Compound Annual Growth Rate (CAGR) is anticipated during the forecast period, driven by the increasing number of individuals engaging in outdoor activities. The demand for edible water bottles as a sustainable substitute for single-use plastic bottles is gaining traction, particularly among those participating in outdoor pursuits. This growth is underscored by heightened consumer awareness regarding the adverse effects of using traditional mineral water bottles for outdoor activities, reinforcing the region's commitment to sustainable and eco-friendly alternatives.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some of the major players in the Edible Water Bottles Market are Skipping Rocks Lab, Notpla Limited, BluCon BioTech, LiquiGlide, Ooho, Evoware, AquaBall, Water Wand, WikiFoods, WataCup and other players.

Skipping Rocks Lab -Company Financial Analysis

RECENT TRENDS

In 2020, Skipping Rocks Lab Limited introduced Ooho, an edible water bottle brand, which has become a prominent choice in Europe and the U.S. The promotional campaigns led by Skipping Rocks Lab are significantly increasing awareness of edible water bottles worldwide.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 128.12 Million |

| Market Size by 2031 | US$ 283.75 Million |

| CAGR | CAGR of 10.45 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Seaweed Extract, Alginate, Gelatin) • By Type (Plain Water, Mineral Water, Sparkled Water, Flavored Water, Others) • By Distribution Channel (Direct Sales, E-Commerce Sales, Retail Sales) • By Application (Beverages, Pharmaceuticals, Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Skipping Rocks Lab, Notpla Limited, BluCon BioTech, LiquiGlide, Ooho, Evoware, AquaBall, Water Wand, WikiFoods, WataCup |

| Key Drivers | • A trend towards healthier lifestyles and conscious consumer choices contributes to the adoption of edible water bottles. • Awareness of environmental issues and a commitment to sustainable practices. |

| Challenges | • Overcoming consumer scepticism and ensuring widespread acceptance of edible water bottles poses a significant challenge. • The cost implications and economic feasibility. |