Electric Car Rental Market Report Scope & Overview:

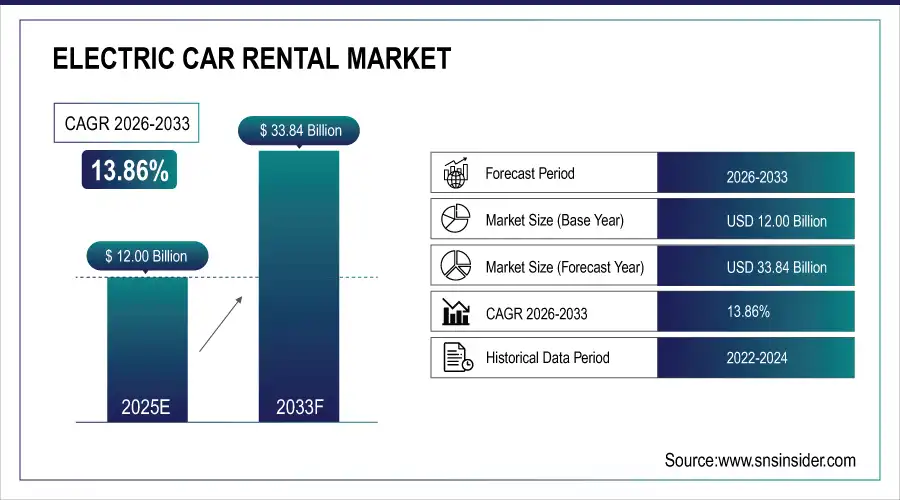

The Electric Car Rental Market size was valued at USD 12.00 Billion in 2025E and is projected to reach USD 33.84 Billion by 2033, growing at a CAGR of 13.86% during 2026-2033.

The Electric Car Rental Market analysis highlights the growing adoption of electric vehicles (EVs) in rental fleets across global regions, driven by increasing environmental awareness, government incentives, and expanding charging infrastructure. It emphasizes key market dynamics including consumer preferences, fleet operational efficiency, sustainability metrics, and customer satisfaction levels.

Consumer Preference Shift: By 2025, nearly 60% of travelers in urban markets actively preferred or requested EVs when booking rentals, citing environmental concerns and smoother driving experience as key motivators.

Market Size and Forecast:

-

Market Size in 2025E: USD 12.00 Billion

-

Market Size by 2033: USD 33.84 Billion

-

CAGR: 13.86% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Electric Car Rental Market - Request Free Sample Report

Electric Car Rental Market Trends

-

Rental companies increasingly electrify fleets, driven by sustainability goals, regulatory incentives, and growing consumer demand for greener mobility options.

-

Deployment of fast-charging stations at rental hubs and public locations enables longer trips and higher fleet utilization rates.

-

Flexible EV rental models, including subscriptions and driver-partner programs, attract urban customers seeking convenience and lower upfront costs.

-

Smart tracking, remote diagnostics, and usage-based pricing enhance operational efficiency, maintenance management, and customer experience.

-

Companies emphasize carbon footprint reduction, renewable energy charging, and green marketing to appeal to environmentally conscious consumers.

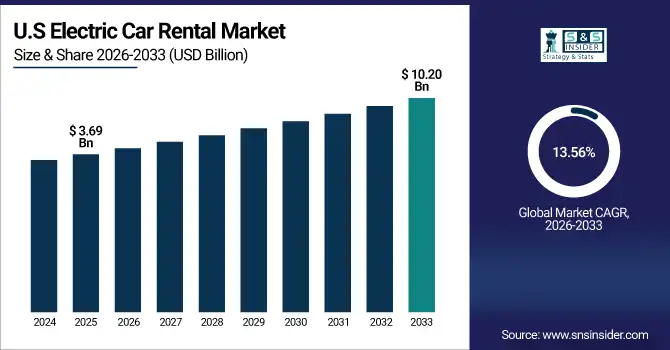

The U.S. Electric Car Rental Market size was valued at USD 3.69 Billion in 2025E and is projected to reach USD 10.20 Billion by 2033, growing at a CAGR of 13.56% during 2026-2033. Electric Car Rental Market growth is driven by rising consumer adoption of electric vehicles, supportive government incentives, and increasing investment in EV charging infrastructure. The market is characterized by a strong focus on sustainability, advanced fleet management technologies, and innovative rental models such as subscription-based services and peer-to-peer EV rentals.

Electric Car Rental Market Growth Drivers:

-

Growing consumer demand and government incentives accelerating adoption of electric vehicles in rental car industry

The Electric Car Rental Market Growth is driven by increasing environmental awareness and strong consumer preference for eco-friendly transportation. Government incentives, tax rebates, and emission regulations further encourage fleet electrification. Rising fuel costs and the need to reduce operational expenses make EVs more attractive for rental operators. Additionally, expanding charging infrastructure and technological advancements in electric vehicles enhance convenience for customers.

Fleet Electrification Mandates: By 2025, more than 15 countries enforced low- or zero-emission zones in major cities, compelling rental operators to electrify at least 30% of urban fleets to maintain access and compliance.

Electric Car Rental Market Restraints:

-

High initial costs and limited charging infrastructure restraining widespread adoption of electric rental vehicles globally

Despite growing interest, high acquisition costs of electric vehicles and limited availability of charging stations restrict market growth. Range anxiety, long charging times, and lack of standardized fast-charging infrastructure further discourage potential renters. Small and medium rental operators often face financial barriers to adopt large EV fleets. Additionally, maintenance complexities and lower familiarity with EV technology compared to conventional cars create operational challenges. Regional differences in incentives, energy pricing, and infrastructure development also result in uneven adoption rates, slowing overall market expansion despite strong demand trends.

Electric Car Rental Market Opportunities:

-

Expansion of EV infrastructure and innovative rental models create growth opportunities in electric car rental market

The Electric Car Rental Market presents significant opportunities through expanding charging networks, government support, and rising urban EV adoption. Innovative models like subscription-based rentals, peer-to-peer sharing, and ride-hailing partnerships can attract new customer segments. Technological integration, including connected car platforms and telematics, enhances fleet management efficiency. Increased corporate sustainability initiatives and rising tourism demand further open avenues for market growth.

Charging Infrastructure Growth: By 2025, over 90% of major international airports and urban rental hubs featured on-site EV fast chargers, enabling seamless pick-up and return for electric rental vehicles.

Electric Car Rental Market Segment Analysis

-

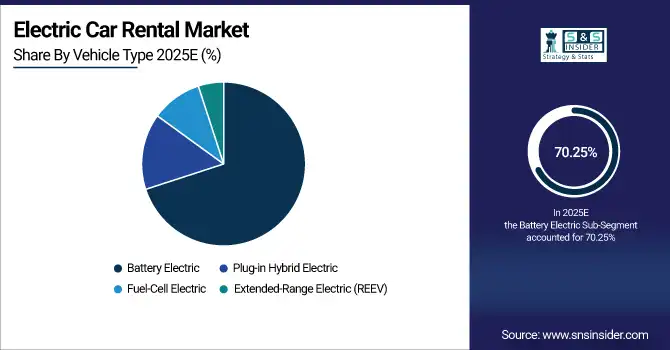

By Vehical Type, Battery Electric vehicles led the market with a 70.25% share in 2025, while Extended-Range Electric (REEV) registered the fastest growth at a CAGR of 19.32%.

-

By body type, SUVs dominated with a 40.64% share in 2025, whereas MUV/MPVs were the fastest-growing segment, showing a CAGR of 12.38%.

-

By consumer type, Leisure/Tourism led the market with 55.12% in 2025, while Ride-hailing Driver Subscription services registered the fastest growth with a CAGR of 15.37%.

-

By end-user, Airport Transport held the largest share at 38.61% in 2025, whereas Last-Mile Delivery was the fastest-growing segment, exhibiting a CAGR of 16.82%.

By Vehical Type, Battery Electric Leads Market While Extended-Range Electric (REEV) Registers Fastest Growth

Battery Electric Vehicles (BEVs) dominate the electric car rental market due to their lower operating costs, high availability, and consumer preference for fully electric options. BEVs are increasingly deployed in urban and airport rental fleets, benefiting from expanded charging infrastructure. Meanwhile, Extended-Range Electric Vehicles (REEVs) are registering the fastest growth, particularly in regions where charging stations are limited. REEVs offer flexibility with backup fuel engines, addressing range anxiety and appealing to long-distance and intercity rental consumers, driving rapid adoption across fleets globally.

By Consumer Type, SUV Dominate While MUV / MPV Shows Rapid Growth

SUVs currently lead the electric car rental market due to their spacious interiors, higher seating capacity, and strong demand among leisure and business travelers. They are favored for airport pickups, long-distance travel, and group rentals. Meanwhile, Multi-Utility Vehicles (MUVs) and Multi-Purpose Vehicles (MPVs) are showing rapid growth, driven by increasing family travel and ride-sharing services. Their larger capacity and versatility make them attractive for peer-to-peer and corporate rental segments, encouraging operators to expand MUV/MPV EV offerings in fleets.

By Consumer Type, Leisure / Tourism Lead While Ride-hailing Driver Subscription Registers Fastest Growth

Leisure / tourism consumers dominate the electric car rental market, as travelers increasingly prefer eco-friendly vehicles for vacations and airport transportation. Rental companies prioritize fleets for tourism hotspots, offering flexible pricing and diverse vehicle types. Meanwhile, ride-hailing driver subscription models are the fastest-growing segment. Subscription-based rentals for drivers on platforms such as Uber and Lyft provide consistent demand, predictable revenue, and enable EV adoption without large upfront costs. This model is gaining traction in urban markets globally.

By End-User, Airport Transport Lead While Last-Mile Delivery Grow Fastest

Airport transport remains the leading end-user segment in the electric car rental market, as travelers rely heavily on rental vehicles for short-term trips. High demand for convenient, eco-friendly airport pickups sustains fleet utilization. While, last-mile delivery is the fastest-growing segment, driven by the e-commerce boom and logistics electrification initiatives. Companies are increasingly adopting small EVs for efficient city deliveries, reducing operational costs and emissions. This segment’s growth is further supported by government incentives and expanding EV infrastructure in urban centers.

Electric Car Rental Market Regional Analysis:

North America Electric Car Rental Market Insights

In 2025 North America dominated the Electric Car Rental Market and accounted for 42.36% of revenue share, this leadership is due to the rising fuel prices, environmental concerns, and government incentives are encouraging both consumers and rental companies to opt for electric vehicles. Major rental agencies are incorporating EVs into their fleets, particularly in urban areas and tourist destinations. The growth is also supported by the development of charging infrastructure and advancements in EV technology, making electric rentals more accessible and convenient for users.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Electric Car Rental Market Insights

The U.S. electric car rental market is experiencing significant growth, driven by increasing consumer demand for sustainable transportation options and supportive government policies. Cities like San Francisco, Los Angeles, and New York are witnessing a surge in EV rentals, facilitated by the expansion of charging networks and the availability of various EV models.

Asia-pacific Electric Car Rental Market Insights

Asia-pacific is expected to witness the fastest growth in the Electric Car Rental Market over 2026-2033, with a projected CAGR of 14.56% due to increasing environmental awareness and government incentives for electric vehicles (EVs). Countries like China, Japan, and South Korea are leading the adoption, with expanding charging infrastructure and supportive policies. Urban centers are witnessing a surge in demand for eco-friendly transportation options, especially among tourists and business travelers.

China Electric Car Rental Market Insights

China stands at the forefront of the electric car rental market, propelled by its robust EV manufacturing capabilities and government-backed initiatives promoting green transportation. Major cities like Beijing and Shanghai are witnessing a significant uptick in EV rentals, fueled by favorable policies such as subsidies and tax incentives.

Europe Electric Car Rental Market Insights

In 2025, Europe's electric car rental market is expanding rapidly, fueled by stringent emission regulations and a strong push towards sustainability. Countries like Germany, France, and the Netherlands are leading the adoption, supported by comprehensive EV infrastructure and government incentives. The market is characterized by a growing fleet of electric vehicles in rental services, catering to both leisure and business travelers.

Germany Electric Car Rental Market Insights

Germany is a key player in Europe's electric car rental market, benefiting from its strong automotive industry and government initiatives promoting electric mobility. Cities like Berlin and Munich are witnessing an increase in EV rentals, supported by an extensive network of charging stations and favorable policies.

Latin America (LATAM) and Middle East & Africa (MEA) Electric Car Rental Market Insights

The combined Latin America and Middle East & Africa (LATAM & MEA) electric car rental market is in its nascent stages but shows promising growth potential. In LATAM, countries like Brazil and Argentina are beginning to embrace electric mobility, with initiatives to promote EV adoption and infrastructure development. In the MEA region, nations such as the UAE and Saudi Arabia are investing in sustainable transportation solutions, including electric vehicle rentals, as part of their Vision 2030 goals. The market's growth is supported by increasing environmental awareness, government incentives, and the expansion of charging networks in these regions.

Electric Car Rental Market Competitive Landscape:

Zipcar offers flexible, short-term electric vehicle rentals in urban areas, targeting environmentally conscious consumers and young professionals. Its app-based platform allows users to reserve EVs quickly, promoting shared mobility. The company is expanding EV fleet availability, integrating sustainability initiatives, and leveraging technology to optimize fleet utilization and enhance user convenience.

-

In September 2025, Zipcar expanded its electric vehicle fleet to over 1,000 units, aiming for a fully electric fleet by 2030. The company emphasizes the need for improved rapid charging infrastructure in London to support this transition.

Avis Budget Group is expanding its electric vehicle rental fleet across airports and urban centers, focusing on sustainability and cost efficiency. The company integrates EVs into corporate and leisure segments, offers charging solutions, and leverages digital platforms for seamless bookings. Growing environmental awareness and government incentives drive EV adoption in its rental offerings.

-

In July 2025, Avis Budget Group announced a multi-year strategic partnership with Waymo to launch and scale a fully autonomous ride-hailing service in Dallas, with Avis handling fleet operations and Waymo providing the self-driving technology.

Enterprise Holdings actively promotes electric car rentals through its Enterprise Rent-A-Car and National Car Rental brands. The company is increasing EV availability in key cities, investing in charging infrastructure, and emphasizing sustainable mobility solutions. Corporate clients, tourists, and ride-hailing drivers increasingly choose its EV fleet, boosting market share and brand reputation.

-

In July 2025, Enterprise Holdings reported that its car rental market is expected to experience strong growth over the coming years, indicating a positive outlook for the sector and increasing demand in both consumer and corporate segments.

Europcar Mobility Group is a leading European car rental provider advancing electric mobility. The company integrates EVs into leisure, corporate, and peer-to-peer rental services. Investments in charging infrastructure, digital platforms, and customer awareness programs support adoption. Focus on sustainability, fleet expansion, and urban mobility trends strengthens Europcar’s position in the electric rental market.

-

In June 2025, Europcar Mobility Group UK launched a new long-term rental product for businesses looking to operate electric vehicles (EVs) and plug-in hybrids, supporting the transition to sustainable mobility solutions in the corporate sector.

Electric Car Rental Market Key Players:

Some of the Electric Car Rental Market Companies are:

-

Zipcar

-

Avis Budget Group

-

Enterprise Holdings Inc.

-

Europcar Mobility Group

-

The Hertz Corporation

-

Sixt SE

-

Bluelndy

-

DriveElectric

-

Easirent

-

Zoomcar

-

Green Motion International

-

Turo

-

UFODrive

-

EvCard

-

Onto

-

EVision Electric Vehicles

-

Localiza

-

HP Autonomy

-

WeFlex

-

Eco Rent A Car

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 12.00 Billion |

| Market Size by 2033 | USD 33.84 Billion |

| CAGR | CAGR of 13.86% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Battery Electric, Plug-in Hybrid Electric, Extended-Range Electric (REEV), and Fuel-Cell Electric) • By Body Type (Hatchback, Sedan, SUV, MUV/MPV, and Sports Coupe) • By Consumer Type (Leisure/Tourism, Business/Corporate, Peer-to-Peer Host, and Ride-Hailing Driver Subscription) • By End-User Industry (Local Commute, Airport Transport, Inter-City/Outstation, and Last-Mile Delivery) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Zipcar, Avis Budget Group, Enterprise Holdings Inc., Europcar Mobility Group, The Hertz Corporation, Sixt SE, Bluelndy, DriveElectric, Easirent, Zoomcar, Green Motion International, Turo, UFODrive, EvCard, Onto, EVision Electric Vehicles, Localiza, HP Autonomy, WeFlex, Eco Rent A Car |