Electric Powertrain Market Size & Overview

Get Sample Copy of Electric Powertrain Market - Request Sample Report

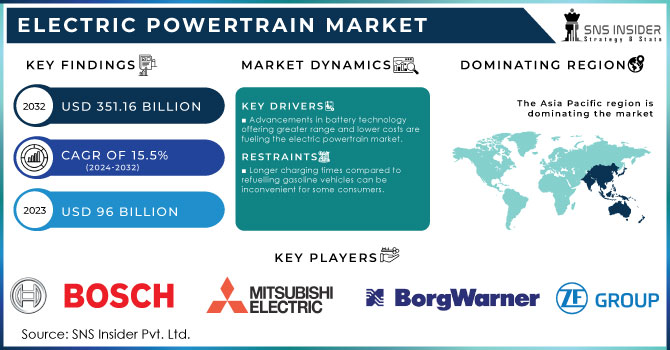

The Electric Powertrain Market size was valued at USD 96 billion in 2023 and is expected to reach USD 351.16 billion by 2032 and grow at a CAGR of 15.5% over the forecast period 2024-2032.

The electric powertrain market is rapidly expanding, driven by several factors. Growing environmental concerns and government regulations aimed at reducing emissions are pushing the automotive industry towards cleaner technologies. Electric vehicles offer significant advantages over traditional gasoline-powered cars, including lower running costs and environmental impact.

The market itself encompasses various components that make up an electric vehicle's drivetrain, including batteries, motors, inverters, and control systems. These components work together to propel the vehicle efficiently. As electric vehicle adoption increases, the demand for these components naturally rises, creating significant growth opportunities for manufacturers. Electric powertrains are not limited to just cars. They are finding application in a wider range of vehicles, including buses, trucks, and even two-wheeled scooters. This diversification broadens the market reach and fuels the further electric powertrain market growth.

MARKET DYNAMICS:

KEY DRIVERS:

-

Advancements in battery technology offering greater range and lower costs are fueling the electric powertrain market.

The electric powertrain market is experiencing a surge in growth due to advancements in battery technology. These advancements are making electric vehicles even more attractive to consumers. Batteries are now offering greater driving range on a single charge, reducing what is known as "range anxiety" for electric vehicle owners. The battery costs are decreasing, making electric vehicles more affordable overall. This combination of longer range and lower costs is a significant driver for the expansion of the electric powertrain market.

-

Increasing demand for electric vehicles across various segments like cars, buses, and trucks is creating growth opportunities for electric powertrains.

RESTRAINTS:

-

Longer charging times compared to refuelling gasoline vehicles can be inconvenient for some consumers.

-

High upfront cost of electric vehicles compared to traditional gasoline-powered cars can be a barrier for some consumers.

Compared to traditional gasoline-powered cars, electric vehicles can carry a significantly higher upfront cost. This price difference is primarily due to the expensive battery technology currently used in electric vehicles. While electric vehicles offer lower running costs and environmental benefits in the long run, the initial investment can be a significant barrier for some consumers, particularly those on a budget or with limited financial constraints.

OPPORTUNITIES:

-

Development of next-generation battery technology with improved range and faster charging can unlock new growth potential.

-

Advancements in motor and power electronics technology can enhance efficiency and performance, driving market growth.

CHALLENGES:

-

Reducing the upfront cost of electric vehicles, particularly the high cost of batteries.

-

Developing faster charging technologies to reduce charging times and improve convenience.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has disrupted the growth of the electric powertrain market. A major concern is the disruption to the supply chain for critical battery materials, particularly nickel. Russia is a significant producer of nickel, and the war has caused prices to surge by around 50% compared to pre-war levels. The conflict disrupts production and distribution for some car manufacturers who rely on Ukrainian factories for parts. This can lead to delays in vehicle production and delivery, frustrating both manufacturers and consumers. Thus, increasing gasoline prices are making electric vehicles a more attractive proposition for consumers seeking cost-effective alternatives. This surge in interest due to fuel price volatility could help offset some of the negative impacts caused by supply chain disruptions. This could lead to increased investment in domestic battery material production and electric vehicle manufacturing, ultimately strengthening the market.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can disrupt the electric powertrain market in several ways. With limited budgets, consumers may delay purchases of electric vehicles (EVs) which are typically more expensive upfront than gasoline cars. This could lead to a decline in sales and production of electric powertrains. The businesses may be hesitant to invest in research and development for new electric vehicle technologies, slowing down innovation in the sector. The economic downturns can lead to job losses and reduced consumer spending, impacting the demand for the raw materials needed for electric powertrain production, like lithium and cobalt. This could potentially disrupt supply chains and increase costs. Thus, the economic slowdown might cause a temporary setback but the underlying trends supporting electric powertrains are likely to prevail.

KEY MARKET SEGMENTS:

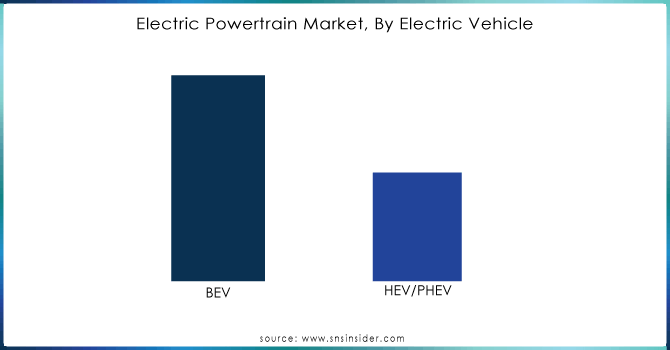

By Electric Vehicle

-

BEV

-

HEV/PHEV

BEV (Battery Electric Vehicle) is the dominating sub-segment in the Electric Powertrain Market by electric vehicle holding around 70-75% of market share. BEVs rely solely on electric power for propulsion, offering the most significant environmental benefits. Government incentives and falling battery costs are driving BEV adoption, leading to a higher demand for BEV-specific powertrains.

Get Customized Report as per Your Business Requirement - Enquiry Now

By Component

-

Motor/Generator

-

Battery

-

Power Electronics Controller

-

Converter

-

Transmission

-

On-Board Charger

The battery is the dominating sub-segment in the Electric Powertrain Market by component holding around 60-65% of market share. Battery technology directly impacts an EV's range, performance, and overall cost. Advancements in battery capacity and density are crucial for the entire electric vehicle industry, making batteries a central focus for market growth.

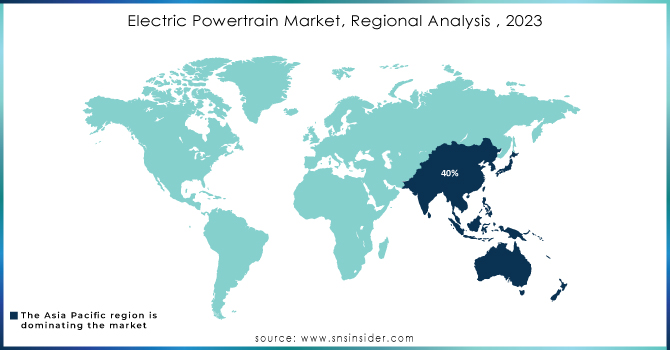

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the electric powertrain market holding around 40% of market share, driven by the government incentives, a massive auto industry primed for EV adoption, and pressing environmental concerns in major cities.

Europe is the second highest region in this market with stringent emission regulations pushing automakers towards electric solutions, environmentally conscious consumers embracing the technology, and national sustainability goals prioritizing EVs.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are ZF Friedrichshafen AG (Germany), Robert Bosch GmbH (Germany), BorgWarner Inc. (US), Mitsubishi Electric Corp (Japan), Magna International Inc. (Canada), Continental AG (Germany), Valeo, Magneti Marelli Ck Holdings, Nidec Corporation, Schaeffler AG and other key players.

RECENT DEVELOPMENT

-

In April 2023: Denso announced its first inverter using silicon carbide (SiC) for enhanced efficiency. This component will be integrated into the Lexus RZ electric vehicle's eAxle electric powertrain system, developed by BlueE Nexus Corporation.

-

In Feb. 2023: Continental AG launched a new electric motor sensor (eRPS) in February 2023. Designed for EVs, this sensor uses inductive technology to precisely detect rotor position, leading to smoother operation and potentially increased efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 96 Billion |

| Market Size by 2032 | US$ 351.56 Billion |

| CAGR | CAGR of 15.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• by Type (BEV, HEV/PHEV) • by Components (Motor/Generator, Converter, Battery, Transmission, Power Electronics Controller, On-Board Charger) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ZF Friedrichshafen AG (Germany), Robert Bosch GmbH (Germany), BorgWarner Inc. (US), Mitsubishi Electric Corp (Japan), Magna International Inc. (Canada), Continental AG (Germany), Valeo, Magneti Marelli Ck Holdings, Nidec Corporation, Schaeffler AG |

| Key Drivers | •Electrical vehicle manufacture and sales are a direct influence on the electric vehicle powertrain market. •Development of electric car manufacturing facilities in several regional markets. |

| RESTRAINTS | •The lack of standard development processes for the Electric Vehicle Powertrain is a market barrier. •Market growth is expected to be hampered by strict emission regulations and saturation in growing markets. |