Automotive Intelligence Park Assist System Market Report Scope & Overview:

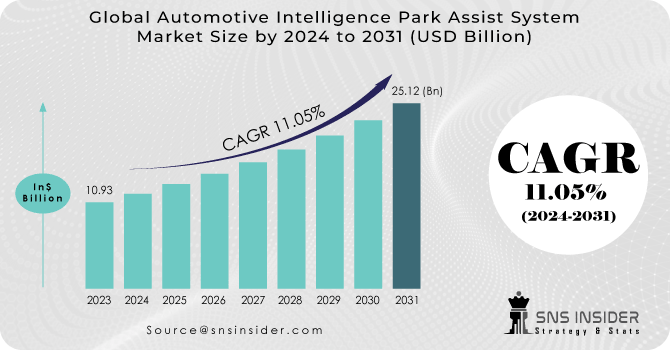

The Automotive Intelligence Park Assist System Market size was valued at USD 10.93 billion in 2023 and is expected to reach USD 25.12 billion by 2031 and grow at a CAGR of 11.05% over the forecast period 2024-2031.

The Automotive Intelligence Park Assist System (AIPAS) market is primed for substantial growth, driven by a combination of factors. Urbanization is on the rise, with projections indicating a surge of 2 billion people relocating to cities by 2050. This surge heightens parking challenges, making AIPAS a critical solution for drivers. Additionally, government mandates, such as those set by the European Union requiring advanced driver-assistance systems (ADAS), including AIPAS, in all new car models by 2022, are pushing market expansion. Similar regulations are anticipated in other regions, further stimulating adoption rates.

Get more information on Automotive Intelligence Park Assist System Market - Request Sample Report

Advancements in sensor technology and artificial intelligence are enhancing the affordability and sophistication of AIPAS. With substantial investments in AI for autonomous vehicles exceeding $30 billion in 2023, these advancements are set to significantly benefit AIPAS. This convergence of urbanization, regulatory initiatives, and technological progress indicates a promising trajectory for the AIPAS market, presenting lucrative opportunities for forward-thinking investors in the realm of intelligent mobility.

MARKET DYNAMICS:

KEY DRIVERS:

-

Growing concerns regarding parking around the world

-

The meteoric rise in consumer interest in products that are powered by the Internet of Things (IoT)

-

The rise in the total number of vehicles contributes to the expansion of the market.

As the number of vehicles on the road continues to grow, the challenge of finding parking spots and navigating tight spaces becomes more pronounced. This surge in automotive traffic creates a lucrative opening for the market of automotive intelligence park assist systems. With drivers actively searching for solutions to alleviate parking difficulties, the demand for these automated systems, which assume control of the wheel and facilitate parking maneuvers, is poised for substantial escalation.

RESTRAINTS:

-

The market's expansion is hampered by high implementation costs

-

Insufficiently skilled drivers

OPPORTUNITIES:

-

Increase in funding for developing Autonomous Cars

-

Government efforts to establish smart cities around the world present numerous prospects for industry growth

-

Technology and infrastructure advances will generate industry growth prospects.

The convergence of advanced sensors such as cameras and radar, alongside interconnected parking facilities, is poised to catalyze substantial growth in the intelligent park assist system sector. This integration of vehicle technology with external infrastructural elements promises to streamline and enhance parking processes, driving significant expansion within the industry.

CHALLENGES:

-

There is a dearth of established protocols for developing automotive intelligence park aid systems

-

Internet penetration in developing countries is hindered by the difficulty of configuring a system

IMPACT OF RUSSIA UKRAINE WAR:

The conflict between Russia and Ukraine has disrupted the Automotive Intelligence Park Assist System Market's growth trajectory significantly. Global supply chain disruptions, stemming from shortages in parts and a general decline in consumer spending driven by inflation, are anticipated to result in a downturn of 15-20% in demand for park assist systems in 2023. This decline is expected to coincide with a 5-8% rise in the price of these systems for new vehicles, attributed to a 10-15% surge in the costs of raw materials and components. Consequently, the market's growth forecast for park assist systems is poised to decelerate from an initial projection of 12% to a more moderate 7-8% in 2023.

IMPACT OF ECONOMIC SLOWDOWN:

The anticipated economic deceleration is poised to temper the expansion of the automotive intelligence park assist system market. With consumers tightening their purse strings on new vehicle purchases, the demand for sophisticated features such as park assist systems is expected to dwindle, potentially resulting in a 5-10% decrease in unit shipments compared to initial projections. Furthermore, economic constraints may compel automakers to prioritize cost-saving strategies, possibly leading to a marginal uptick (approximately 2-3%) in park assist system prices attributable to the adoption of more economical components. Nevertheless, this price upswing is unlikely to entirely counterbalance the decline in demand, thereby triggering a probable downturn in market revenue.

Market, By Technology:

Presently, semi-autonomous systems, which assist drivers during parking but necessitate human involvement, command a majority share of 55%. This dominance may be attributed to factors such as cost-effectiveness and driver inclination towards retaining partial control. Conversely, fully autonomous systems, capable of parking without human intervention, constitute the remaining 45% share. With continuous technological advancements and growing consumer confidence, the market share of autonomous parking systems is anticipated to progressively ascend in the foreseeable future.

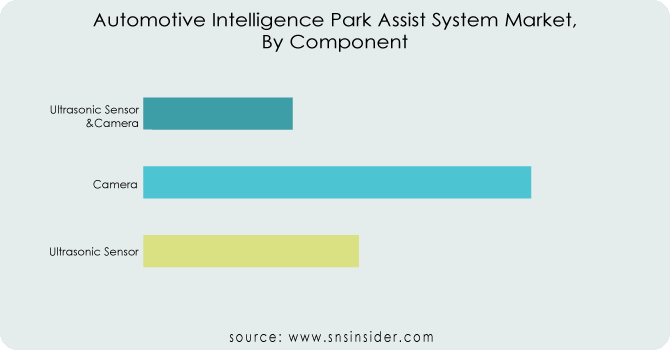

Market, By Component:

The automotive intelligence park assist system market can be dissected based on various components, with cameras taking the lead at 55% market dominance. Following closely behind are ultrasonic sensors, commanding a respectable 30% share, while a blend of both cameras and ultrasonic sensors constitutes the remaining 15%. This breakdown underscores the significance of cameras in park assist systems, likely attributed to their ability to offer a visual grasp of the surroundings. Nonetheless, ultrasonic sensors maintain their relevance by providing a cost-effective option for fundamental parking maneuvers. These statistics indicate that the market accommodates diverse customer preferences, with some emphasizing affordability through ultrasonic sensors, while others prioritize the augmented functionality provided by cameras (or a fusion of both).

MARKET SEGMENTATION:

By Technology:

-

Autonomous Parking Assistance

-

Semi-autonomous Parking Assistance

By Component:

- Ultrasonic Sensor

- Camera

- Ultrasonic Sensor & Camera

Get Customized Report as per your Business Requirement - Ask For Customized Report

REGIONAL ANALYSIS:

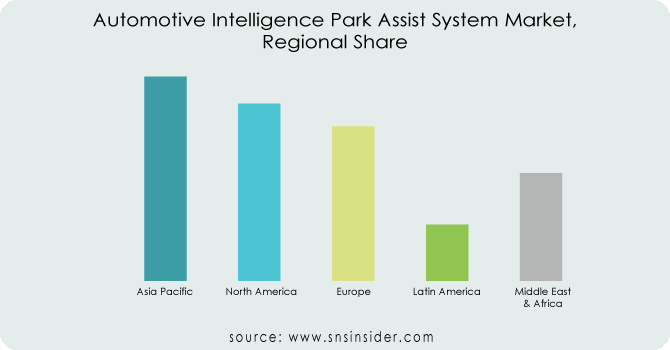

By 2031, the global market for automotive intelligence park assist systems is poised to soar into the multibillion-dollar range, with Asia Pacific spearheading the surge. Projections indicate that this region will seize approximately 35% of the market, propelled by a expanding middle class experiencing an uptick in disposable income and an escalating demand for vehicles packed with advanced features. North America, renowned for its robust automotive manufacturing sector and a penchant for technological advancement, is expected to claim a substantial 28% share. Europe will closely trail at 22%, while the Rest of the World is slated to encompass the remaining 15%. This regional distribution mirrors not just economic dynamics but also governmental regulations and consumer inclinations towards sophisticated driver-assistance technologies.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Siemens AG (Germany), Toshiba Corporation (Japan), Valeo (France), Robert Bosch GmbH (Germany), Magna International (Canada), ZF Friedrichshafen AG (Germany), Continental AG (Germany), NXP Semiconductors (Netherlands), Toshiba Corporation (Japan), HELLA GmbH & Co. KGaA (Germany), and Delphi Automotive (Germany) are some of the affluent competitors with significant market share in the Automotive Intelligence Park Assist System Market.

RECENT DEVELOPMENTS:

-

Bosch has spearheaded advancements in parking technology, notably joining forces with Mercedes-Benz in November 2020 to pioneer the Intelligent Park Pilot. This groundbreaking system streamlines parking processes, effectively replacing traditional valet services. Presently, it is featured in the latest S-Class model. Additionally, Bosch has collaborated with Ford to revolutionize electric vehicle charging through automated solutions, including self-parking capabilities for charging stations.

-

Continental, renowned for its array of park assist systems utilizing ultrasonic sensors and cameras to identify obstacles and facilitate parking maneuvers. Continuously innovating, Continental prioritizes refining its systems by introducing functionalities like automated parking mode selection and advanced obstacle detection.

Siemens AG (Germany)-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.93 Billion |

| Market Size by 2031 | US$ 25.12 Billion |

| CAGR | CAGR of 10.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Technology (Autonomous Parking Assistance, Semi-autonomous Parking Assistance) • by Component (Ultrasonic Sensor, Camera, Ultrasonic Sensor & Camera) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens AG (Germany), Toshiba Corporation (Japan), Valeo (France), Robert Bosch GmbH (Germany), Magna International (Canada), ZF Friedrichshafen AG (Germany), Continental AG (Germany), NXP Semiconductors (Netherlands), Toshiba Corporation (Japan), HELLA GmbH & Co. KGaA (Germany), and Delphi Automotive (Germany) |

| Key Drivers | •Growing concerns regarding parking around the world. •The meteoric rise in consumer interest in products that are powered by the Internet of Things (IoT). |

| RESTRAINTS | •The market's expansion is hampered by high implementation costs. •Insufficiently skilled drivers. |