Automotive Active Spoiler Market Report Scope & Overview:

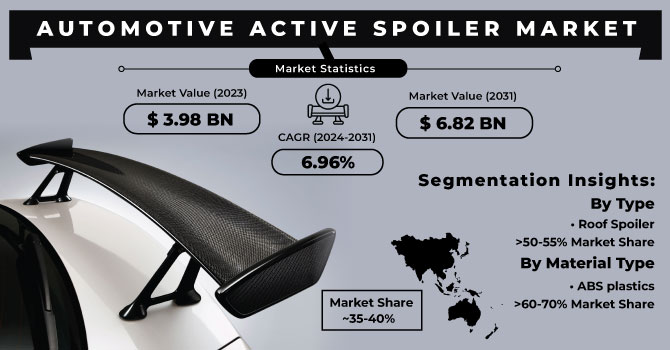

The Automotive Active Spoiler Market size was valued at USD 3.98 billion in 2023 and is expected to reach USD 6.82 billion by 2031 and grow at a CAGR of 6.96% over the forecast period 2024-2031.

The market for active spoilers, which automatically adjust to driving conditions, is thriving. This growth is fueled by the auto industry's need for better fuel efficiency and lower emissions. Active spoilers improve aerodynamics, especially at high speeds, which reduces drag and saves fuel. Stricter regulations on emissions are pushing automakers towards innovative solutions like active spoilers. The desire for improved performance and aesthetics is driving active spoiler adoption. They are common in performance and sports cars, enhancing both function and visual appeal. By adjusting dynamically, active spoilers improve handling and stability, particularly during high-speed activity. Sensor and control system advancements also play a role. Integration with advanced driver assistance systems (ADAS) allows real-time data analysis by the spoiler, optimizing aerodynamics and safety. This aligns with the industry's shift towards incorporating smart technologies for improved vehicle performance and safety.

Get More Information on Automotive Active Spoiler Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Active Spoilers Gain Traction as Automakers Target Improved Fuel Economy Through Enhanced Aerodynamics

Carmakers are looking to active spoilers as a game-changer for fuel efficiency. These smart wings automatically adjust to driving situations, particularly at high speeds. By reducing drag, they significantly improve a car's ability to travel farther on less fuel. This technology aligns perfectly with the tightening grip of global fuel economy regulations, offering automakers a crucial tool to meet stricter standards.

-

Enhancing Performance and Stability for Sports Car Enthusiasts

RESTRAINTS:

-

Complex technology in active spoilers raises their cost, potentially limiting use in budget-friendly cars.

Active spoilers face a hurdle due to their cost. These high-tech wings rely on advanced parts and control systems, making them expensive to produce. This can limit their use in budget-friendly cars, where affordability is key for buyers. In simpler terms, the high price tag of these advanced spoilers might prevent them from being widely available across all car segments.

OPPORTUNITIES:

-

Developing cost-effective designs with simpler mechanisms to reach budget-conscious car segments.

-

Integration with advanced driver-assistance systems for a comprehensive safety and performance package.

CHALLENGES:

-

High production costs due to advanced technology and components can limit widespread adoption.

-

Consumer awareness about the benefits of active spoilers might be low.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has impacted the automotive industry, disrupting even niche markets like active spoilers. Ukrainian supply chain disruptions for crucial components like wire harnesses could lead to a potential 20-30% production drop for European car models with active spoilers. Soaring material prices due to sanctions on Russia, a major exporter of metals like palladium and aluminium used in spoilers, could inflate production costs by 10-15%. Consumer confidence might also decrease due to economic uncertainty, potentially causing a 5-10% decline in demand for these features. Finally, automakers might prioritize essential components over features like spoilers to meet base model demand, potentially causing temporary production halts for some active spoiler models.

IMPACT OF ECONOMIC SLOWDOWN

A slowing economy can disrupt the market for active spoilers. Consumer spending tends to limit during economic downturns. Discretionary features like active spoilers, seen as more of a luxury than a necessity, could experience a 15-20% decline in demand. As affordability becomes a top concern, car buyers might opt for base models or lower trims that lack features like active spoilers. This shift could lead to a 10-15% reduction in active spoiler adoption across various car models. In a sluggish economic climate, automakers might prioritize production of core vehicles and focus on features that directly impact performance or fuel efficiency. This could result in a temporary delay in the development or launch of new active spoiler models. Economic slowdowns can also affect the aftermarket for car parts. Consumers might postpone the non-essential upgrades like aftermarket active spoilers, leading to a potential 5-10% decline in aftermarket sales.

KEY MARKET SEGMENTS:

By Type

-

Front Spoiler

-

Lighted Spoiler

-

Pedestal Spoiler

-

Roof Spoiler

-

Lip Spoiler

Roof Spoiler is the dominating sub-segment in the Automotive Active Spoiler Market by type holding around 50-55% of market share. Roof spoilers offer the most significant aerodynamic benefit by influencing downforce and reducing drag. This is crucial for enhancing vehicle stability, particularly at high speeds. Additionally, roof spoilers are often integrated with the car's design, offering a more streamlined and aesthetically pleasing look.

By Material Type

-

ABS plastics

-

Fiberglass

-

Silicon

-

Carbon fibre

ABS Plastics is the dominating sub-segment in the Automotive Active Spoiler Market by material type holding around 60-70% of market share. ABS plastics are the most cost-effective option, making them accessible for a wider range of vehicles. They are also lightweight, which helps maintain vehicle performance, and relatively durable for everyday use.

REGIONAL ANALYSIS:

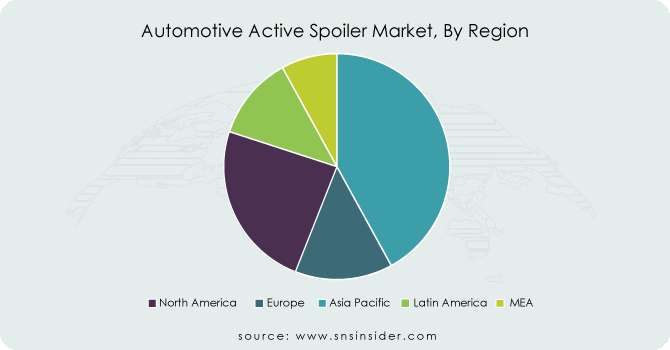

The Asia Pacific is the dominating region in the Automotive Active Spoiler Market holding 35-40% of market share. Manufacturers cater to both performance needs and a growing consumer appetite for sporty aesthetics. The government fuel efficiency initiatives incentivize active spoiler adoption due to potential aerodynamic improvements.

Europe is the second highest region in this market which boasts a rich history of high-performance car manufacturing and a passionate enthusiast base. This fosters demand for active spoilers that optimize handling and stability, especially for luxury and sports cars.

North America experiences the fastest growth with the CAGR of 8-10%. Renewed interest in muscle cars, sports cars, and performance upgrades fuels demand for active spoilers to enhance performance and project a more aggressive look.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

- US

- Canada

- Mexico

Europe

- Eastern Europe

- Poland

- Romania

- Hungary

- Turkey

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Switzerland

- Austria

- Rest of Western Europe

Asia Pacific

- China

- India

- Japan

- South Korea

- Vietnam

- Singapore

- Australia

- Rest of Asia Pacific

Middle East & Africa

- Middle East

- UAE

- Egypt

- Saudi Arabia

- Qatar

- Rest of the Middle East

- Africa

- Nigeria

- South Africa

- Rest of Africa

Latin America

- Brazil

- Argentina

- Colombia

- Rest of Latin America

KEY PLAYERS

The major key players are AUDI AG (Germany), Bugatti Automobiles (France), BMW AG (Germany), Porsche AG (Germany), Daimler AG (Germany), Lexus (Japan), McLaren (UK), Koenigsegg Automotive AB (Sweden), Pagani Automobili (Italy), Ferrari (Italy) and other key players.

Bugatti Automobiles (France)-Company Financial Analysis

RECENT DEVELOPMENT

-

In Sept. 2023: British electric sedan, the Emeya, challenges Porsche Taycan with its innovative dual active rear spoiler. This design pushes boundaries beyond traditional single wings, potentially offering finer control over downforce for enhanced performance and stability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.98 Billion |

| Market Size by 2031 | US$ 6.82 Billion |

| CAGR | CAGR of 6.96% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Front Spoiler, Lighted Spoiler, Pedestal Spoiler, Roof Spoiler, Lip Spoiler) • By Material Type (ABS plastics, Fiberglass, Silicon, Carbon fibre) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AUDI AG (Germany), Bugatti Automobiles (France), BMW AG (Germany), Porsche AG (Germany), Daimler AG (Germany), Lexus (Japan), McLaren (UK), Koenigsegg Automotive AB (Sweden), Pagani Automobili (Italy), Ferrari (Italy) |

| Key Drivers | • Active Spoilers Gain Traction as Automakers Target Improved Fuel Economy Through Enhanced Aerodynamics • Enhancing Performance and Stability for Sports Car Enthusiasts |

| Restraints | • Complex technology in active spoilers raises their cost, potentially limiting use in budget-friendly cars. |