Automotive Cybersecurity Market Report Insights

Get More Information on Automotive Cybersecurity Market - Request Sample Report

The Automotive Cybersecurity Market Size was valued at USD 3.37 Billion in 2023 and is expected to reach USD 16.24 Billion by 2032 and grow at a CAGR of 19.11% over the forecast period 2024-2032.

Automotive Cybersecurity Market is gaining importance as more and more connected and autonomous vehicles are adopted in the world, which calls for robust security concerns, and governments all over the world are framing policies to keep the cyber threats away from vehicles.

Rules to ban foreign advocates China and Russia-related connected vehicle technologies import or sale for vehicles have been proposed in the USA. All these regulations will be fully enacted and involve high-stringency levels of cybersecurity, especially for Vehicle Communication Systems (VCS) and Automated Driving Systems (ADS). China had its own standard on vehicle cybersecurity, GB 44495-2024, which requires the implementation of cybersecurity management systems and testing procedures compatible with international standards, particularly UNECE R155 and ISO/SAE 21434.

There is a deep integration requirement for AI-powered cybersecurity solutions to protect vehicles against various forms of threats in real-time; Argus Cyber Security is one of them. Blockchain can be further researched to create secure communications between vehicle-to-vehicle, based on its data exchanges being secure and tamper-proof. Auto-makers are also embracing secure over-the-air (OTA) updates, which allows for real-time fixes for software and vulnerabilities into those connected and autonomous vehicles.

The future of the market is being defined by several product launches that are set to take place during 2023 and 2024. Qualcomm's Snapdragon Ride Vision and GuardKnox's SOA platform are examples of new cybersecurity platforms that are designed to protect advanced vehicle systems from cyber threats.

Automotive Cybersecurity Market Dynamics

KEY DRIVERS:

-

Connected and autonomous vehicle adoption is raising cybersecurity needs.

The exigency of high security through robust cybersecurity systems has manifoldly amplified with the emergence of connected and autonomous vehicles. These automobiles comprise a great number of sensors, communication systems, and software that are vulnerable to cyberattacks. Thus, data and communications security will become all the more important when 12% of the total sales of cars are destined to be autonomous by the year 2030. Government regulations such as cybersecurity guidelines of the UNECE WP.29 are compelling manufacturers to put advanced cybersecurity solutions into vehicles, thereby leading to a growing demand for automotive cybersecurity systems.

-

Government regulations enforce serious cyber security at the vehicle level.

Governments across the world are implementing strict policies to safeguard connected vehicles against cyber security attacks. For example, the United States is mandating cyber security within the vehicle by enforcing a specific regulation. National Highway Traffic Safety Administration and the European Union's UNECE WP.29 mandate cybersecurity frameworks for all new vehicles, forcing manufacturers to secure communication networks and software updates. The regulation by Japanese Ministry of Land, Infrastructure, Transport and Tourism based on the ISO/SAE 21434 was specified about software and hardware systems that have to be in a secure status. So compliance has become one big driving force for the automobile industry to undergo cybersecurity solutions.

RESTRAIN:

-

Expensive integration cost of cybersecurity systems for a vehicle.

Advanced cybersecurity solutions for vehicles are expensive and out of reach for most mass-market vehicles. Cybersecurity systems have high-cost requirements: advanced software, superior hardware, and continuous updates to ensure their ability to not only function properly but also to identify, protect against, and control hazards. Furthermore, most of the low-tier manufacturers and the tier-2 suppliers lack the technical expertise and financial capability to implement the international cybersecurity standards like ISO/SAE 21434 or UNECE WP.29 strictly. For instance, advanced encryption and authentication require for security in V2X communication and OTA updates contributes to adding more to the already heavy cost. Therefore, with many such technologies being costly, it will act as a barrier to adoption, more so in price-sensitive markets.

Automotive Cybersecurity Market Segment Analysis

BY VEHICLE TYPE

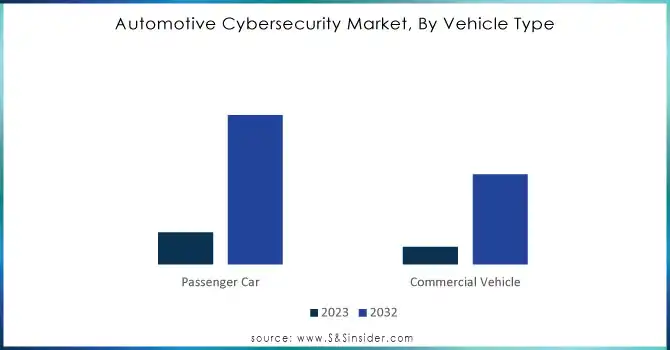

In 2023, the Passenger Cars segment dominated the market, holding a 64 % share of the total market. Passenger vehicles are in high demand with respect to connected features, including infotainment systems and advanced driver assistance systems. These factors have heightened the need for enhanced cybersecurity. Automakers are now highly emphasizing cybersecurity because such passenger cars, with intricate and integrable systems, are vulnerable to cyberattacks.

Commercial Vehicles have the highest CAGR of 19.88% in the predicted period (2024-2032). With the increasing number of fleet management systems as well as telematics in commercial vehicles, they are more susceptible to cyberattacks, and therefore boosting the demand for robust cybersecurity in this market.

Need Any Customization Research On Automotive Cybersecurity Market - Inquiry Now

BY APPLICATION

In 2023, the Infotainment segment dominated with 33% of the total share primarily due to the high adoption of multimedia, navigation, and internet connectivity in most vehicle models. Infotainment systems are very vulnerable to cyberattacks, hence this application requires a very high extent of cybersecurity. ADAS & Safety would have the highest CAGR of 19.82% during the forecast period. In the wake of deployment of ADAS in vehicles, both passenger and commercial, the cybersecurity of ADAS is very critical for ensuring safety and reliability of autonomous or semi-autonomous features.

BY SERVICE

In-Vehicle Cybersecurity solutions segment held the top position in 2023, accounting for 67%. The cybersecurity solution involves protection of automobile's internal systems, which encompasses communication networks, engine control units (ECUs), and infotainment systems inside the car. Electronics in automobiles are getting increasingly complex, thus increasing demand for in-vehicle cybersecurity.

External Cloud Services are forecasted to have the highest CAGR of 19.37% over the period. Cloud-based services are becoming increasingly vital as carmakers increasingly rely on third-party cloud platforms to provide over-the-air (OTA) updates, fleet management, and data analytics that demand security communication channels and robust cloud-based cybersecurity solutions.

Automotive Cybersecurity Market Regional Overview

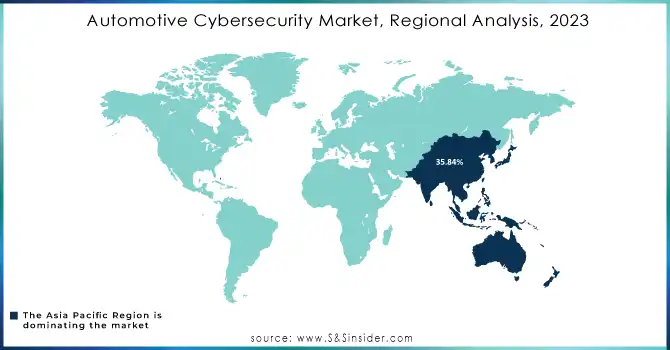

Asia Pacific led the world's market share of the automotive cybersecurity in 2023 by holding 35.84%, owing to highly rapid vehicle production and usage of connected as well as autonomous vehicles, thus mainly developing in China and Japan. Moreover, China's efforts to become a global leader in electric and autonomous vehicle production also boosts demand for high cybersecurity in this region.

Europe is expected to exhibit the highest growth during the forecast period with a CAGR of 20.77%. The implementation of a stringent regulatory environment by UNECE WP.29 and the EU focus on cybersecurity for connected vehicles has been a major growth driver for the market.

Key Plyera in Automotive Cybersecurity Market

Some of the major players in the Automotive Cybersecurity Market are

-

Harman International (Automotive cybersecurity solutions, Over-the-air software updates)

-

Continental AG (Telematics solutions, Automotive network security)

-

Denso Corporation (Intrusion detection systems, Secure gateways)

-

Bosch Group (Vehicle communication security, Security software for ECUs)

-

NXP Semiconductors (Secure vehicle gateways, Hardware security modules)

-

Argus Cyber Security (In-vehicle network protection, Threat detection)

-

Lear Corporation (Embedded cybersecurity solutions, Automotive software)

-

Karamba Security (Embedded cybersecurity, Automotive risk assessment)

-

Trillium Secure (Secure data management, Intrusion detection systems)

-

Infineon Technologies (Automotive microcontrollers, Secure embedded software)

-

Hewlett Packard Enterprise (Cloud security for vehicles, Data analytics for automotive)

-

GuardKnox (In-vehicle cybersecurity, Secure SOA architecture)

-

Symantec (now NortonLifeLock) (Automotive endpoint security, Intrusion detection)

-

T-Systems (Automotive cloud solutions, Cybersecurity services for automotive)

-

Upstream Security (Cloud-based automotive cybersecurity, Predictive threat analytics)

-

C2A Security (Endpoint protection, Secure firmware over-the-air updates)

-

Dell Technologies (Automotive cybersecurity infrastructure, Secure data storage)

-

Secunet Security Networks (Vehicle security architecture, Data protection services)

-

SafeRide Technologies (Artificial intelligence-driven threat detection, In-vehicle security)

-

BlackBerry QNX (Embedded automotive operating systems, Secure communication systems)

MAJOR SUPPLIERS (Components, Technologies)

-

Intel (Automotive chipsets, Processors)

-

Micron Technology (Automotive memory, Data storage)

-

NVIDIA (Graphics processing units for autonomous vehicles, AI computing platforms)

-

Texas Instruments (Automotive semiconductors, Microcontrollers)

-

STMicroelectronics (Microcontrollers, Vehicle sensors)

-

Renesas Electronics (Automotive microcontrollers, Embedded systems)

-

Broadcom (Vehicle networking chips, Wireless connectivity solutions)

-

Qualcomm (Automotive processors, Connectivity solutions)

-

Samsung (Memory modules, Semiconductors)

-

Xilinx (FPGA chips, Processing units for autonomous driving)

MAJOR CLIENTS

-

BMW Group

-

General Motors

-

Ford Motor Company

-

Volkswagen Group

-

Toyota Motor Corporation

-

Daimler AG (Mercedes-Benz)

-

Honda Motor Co., Ltd.

-

Hyundai Motor Company

-

Tesla, Inc.

-

Volvo Group

RECENT TRENDS

-

In August 2024, DENSO showcased its MobiQ aftermarket smart mobility and V2X solutions at the ITS conference, Transpo 2024, in Orlando. Leveraging 75 years of expertise, DENSO’s systems enhance vehicle-infrastructure coordination for safer transportation.+

-

August 2024: Kondukto Inc. announced a strategic partnership with ETAS GmbH, a Bosch subsidiary, to develop an integrated security orchestration solution for software-defined vehicles, addressing heightened cybersecurity needs in the evolving automotive landscape.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.37 Billion |

| Market Size by 2032 | US$ 16.24 Billion |

| CAGR | CAGR of 19.11 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Security Type (Network Security, Endpoint Security, Application Security, Wireless Security, Cloud Security), • By Vehicle Type (Passenger Cars, Commercial Vehicles), • By Application (Telematics, ADAS & safety, Body Control and Comfort, Infotainment, Communication Channels, BMS & powertrain systems, Charging management), • By Hardware (Hardware Security Modules (HSMs), Secure Vehicle Network Gateways, Trusted Platform Modules (TPM), Others), • By Software (Embedded Firewalls, Encryption & Cryptography, Biometrics & Authentication, Others), • By Service (In-Vehicle, External Cloud Services)), • By Approach (Intrusion Detection System, Intrusion Prevention System (IPS), Authentication System, Cryptography Solution, Security Operations Centre) • By Propulsion Type (ICE Vehicles, Electric Vehicles) • By Vehicle Autonomy (Non-Autonomous, Semi-Autonomous, Autonomous) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Harman International, Continental AG, Denso Corporation, Bosch Group, NXP Semiconductors, Argus Cyber Security, Lear Corporation, Karamba Security, Trillium Secure, Infineon Technologies, Hewlett Packard Enterprise, GuardKnox, Symantec (now NortonLifeLock), T-Systems, Upstream Security, C2A Security, Dell Technologies, Secunet Security Networks, SafeRide Technologies, BlackBerry QNX. |

| Key Drivers | • Connected and autonomous vehicle adoption is raising cybersecurity needs. • Government regulations enforce serious cyber security at the vehicle level. |

| Restraints | • Expensive integration cost of cybersecurity systems for a vehicle. |