Electric Outboard Engines Market Report Scope & Overview:

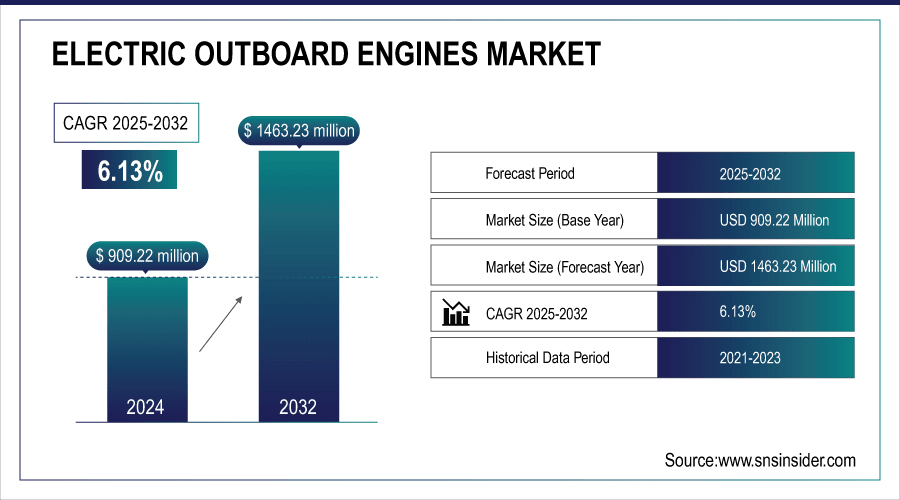

The Electric Outboard Engines Market size was valued at USD 909.22 Million in 2024 and is projected to reach USD 1463.23 Million by 2032, growing at a CAGR of 6.13% during 2025 – 2032.

The electric outboard engines Market is experiencing significant growth as boat owners seek eco-friendly, low-maintenance alternatives to traditional gas-powered motors. Key features driving adoption include lightweight designs, integrated batteries, quiet operation, and ease of installation and removal. Advanced functionalities such as variable power settings, LED indicators, and optional remote controls enhance usability for recreational and small commercial vessels. Increasing environmental awareness, combined with rising demand for sustainable boating solutions, is encouraging innovation and boosting Market penetration across global waterways.

September 2025 – The Remigo One is a 25-pound, 1,000-watt electric outboard ideal for small boats, offering easy mount-and-remove installation, quiet operation, and several miles of range. Its all-in-one tiller design, built-in battery, simple controls, and optional remote make boating hassle-free without dealing with gas.

To Get More Information On Electric Outboard Engines Market - Request Free Sample Report

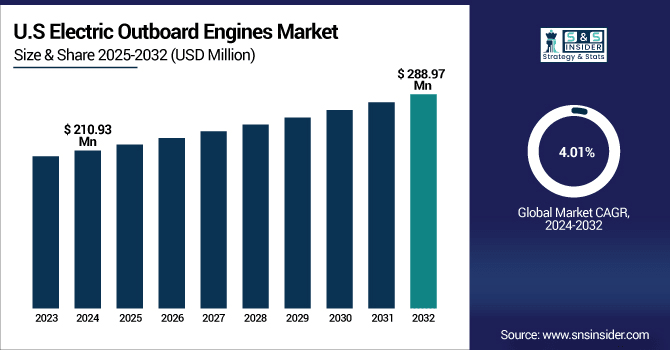

The U.S. Electric Outboard Engines Market size was valued at USD 210.93 million in 2024 and is projected to reach USD 288.97 million by 2032, growing at a CAGR of 4.01% during 2025–2032. The market growth is fueled by increasing adoption of environmentally friendly marine propulsion systems, rising demand for sustainable boating solutions, and advancements in electric motor technology, which together are driving the shift from traditional gasoline-powered outboards to cleaner, more efficient electric alternatives across recreational and commercial applications.

Electric Outboard Engines Market Highlights:

-

Lightweight, High-Power Designs – Development of compact, energy-dense outboards enhances vessel efficiency, maneuverability, and runtime, encouraging adoption among recreational and small commercial boats.

-

Exceptional Power Density – The EPT Falcon 130 delivers 130 kW continuous and 220 kW peak power at just 27 kg, improving handling and boating efficiency.

-

High Initial Costs – The higher upfront price of electric outboards and advanced batteries limits adoption among cost-sensitive buyers, slowing mainstream penetration.

-

Advanced Boat Control Systems – Integration of joystick maneuvering, autopilot, and digital steering increases precision, safety, and user convenience, appealing to diverse boat operators.

-

Quiet and Efficient Operation – Rim-drive propulsion and wide rudder angles enable silent, high-performance operation and compatibility with various vessel types.

-

Next-Generation Adoption Opportunities – Yamaha HARMO system exemplifies how smart controls and flexible mounting broaden Market reach and stimulate innovation in marine electric propulsion.

Electric Outboard Engines Market Growth Drivers:

-

Lightweight, High-Power Designs Increased Adoption of Electric Outboards

The development of lightweight, high-power electric outboard engines is a key driver for the Market, as it enhances vessel efficiency, handling, and operational range. By reducing motor weight while maintaining or increasing power output, manufacturers enable longer runtimes, improved maneuverability, and easier installation for both recreational and small commercial boats. High power density designs allow for smaller, more efficient battery integration, reducing overall vessel weight and maximizing performance. This shift toward compact, energy-efficient propulsion encourages consumers to adopt electric alternatives over traditional combustion engines, driving demand, promoting sustainability, and stimulating ongoing innovation and investment in the marine electric propulsion sector.

August 2025 – The EPT Falcon 130 is an ultralight, axial-flux electric outboard delivering 130 kW continuous power and 220 kW peak in just 27 kg, offering exceptional power density, improved maneuverability via a free-rotating prop, and streamlined design for efficient boating.

Electric Outboard Engines Market Restraints:

-

High cost of electric outboard engines limits adoption among cost-sensitive buyers.

Electric outboard engines typically carry a higher upfront price compared to traditional combustion-powered outboards, creating a significant barrier for cost-sensitive consumers and small-scale boat owners. Despite long-term savings in fuel and maintenance, the initial investment can deter buyers from switching to electric alternatives, particularly in regions where recreational boating budgets are limited. This price gap is often compounded by the cost of high-capacity batteries and advanced control systems, which are essential for performance and range. As a result, Market growth can be constrained, with adoption concentrated among enthusiasts, commercial operators, or environmentally conscious users willing to pay a premium, while broader mainstream penetration remains slower until prices become more competitive.

Electric Outboard Engines Market Opportunities:

-

Advanced Boat Control Systems Enable Wider Adoption of Electric Outboards

The integration of advanced boat control systems, such as intuitive joystick maneuvering, autopilot, and digital steering, presents significant growth opportunities for the electric outboard engines Market. By combining electric propulsion with smart control technologies, manufacturers can offer enhanced user convenience, precision, and safety, appealing to both recreational and commercial boat operators. Features like quiet rim-drive propulsion, wide rudder angles, and flexible mounting compatibility broaden the range of vessel types that can adopt electric systems. As consumers increasingly seek efficient, easy-to-use, and versatile boating experiences, these technological enhancements create opportunities for wider adoption, drive demand for next-generation electric outboards, and stimulate further innovation and investment in connected marine propulsion solutions.

March 2025 – Yamaha Motor will launch its next-generation HARMO boat control system in Japan, integrating an electric propulsion unit with the Helm Master(R) EX for intuitive joystick maneuvering, autopilot, and SetPoint(TM) features. The system uses rim-drive propulsion for quiet, high-efficiency operation, supports wide rudder angles, and offers bracket-style mounting for compatibility with a variety of recreational and commercial vessels.

Electric Outboard Engines Market Segment Highlights:

-

By Power – Dominating: Below 25 kW (45% in 2024), Fastest: 25–50 kW (7.2% CAGR)

-

By Speed – Dominating: Below 5 mph (40% in 2024), Fastest: 5–10 mph (7.5% CAGR)

-

By Application – Dominating: Recreational (50% in 2024), Fastest: Commercial (6.8% CAGR)

-

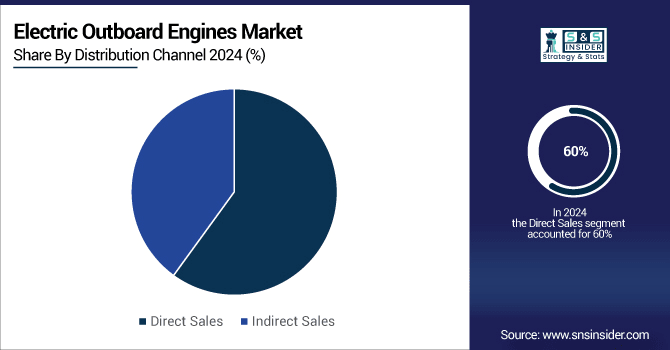

By Distribution Channel – Dominating: Direct Sales (60% in 2024), Fastest: Indirect Sales (7.0% CAGR)

Electric Outboard Engines Market Segment Analysis:

By Distribution Channel, Direct Sales Lead While Indirect Sales Grow Fastest

Direct sales dominate due to manufacturer-to-consumer convenience and support, while indirect sales through dealers and distributors are growing fastest. Expanding retail networks, partnerships, and third-party sales channels are enabling wider Market access, boosting adoption across both recreational and commercial boating applications.

By Power, Below 25 kW Leads While 25–50 kW Shows Fastest Growth

In the electric outboard engines Market, motors below 25 kW currently lead in adoption due to affordability and suitability for small vessels, while the 25–50 kW segment is experiencing the fastest growth. Higher power outputs cater to larger boats, supporting expanded applications and driving increased demand for mid-range electric propulsion systems.

By Speed, Low-Speed Units Lead While Mid-Speed Engines Grow Fastest

Low-speed units currently dominate due to their efficiency and suitability for small boats and recreational use, while mid-speed engines are growing fastest. Increasing adoption of versatile mid-speed models supports larger vessels and diverse boating applications, driving Market expansion and broader consumer interest in electric propulsion.

By Application, Recreational Leads While Commercial Shows Fastest Growth

The recreational segment currently leads due to widespread use in small boats and leisure activities, while the commercial segment is experiencing the fastest growth. Expanding adoption in sightseeing, transport, and service vessels drives demand for electric propulsion, encouraging innovation and broader Market penetration across industries.

Electric Outboard Engines Market Regional Highlights:

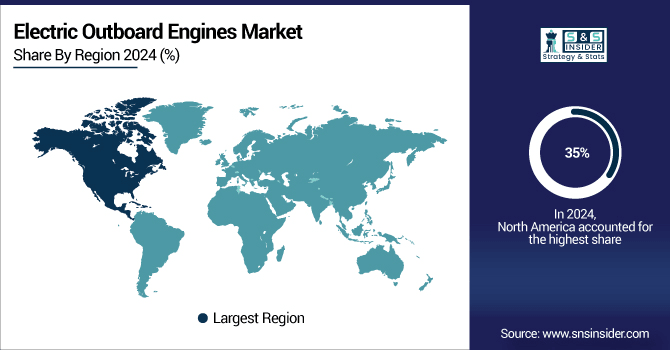

By Region – Dominating: North America (35% in 2024), Fastest: Asia-Pacific (20% in 2024 → 28% in 2032, CAGR 7.0%)

Electric Outboard Engines Market Regional Analysis:

North America Electric Outboard Engines Market Insights:

North America leads the electric outboard engines Market, driven by widespread adoption of recreational boating, stringent environmental regulations favoring electric propulsion, and well-developed marine infrastructure. High consumer awareness, growing investment in sustainable boating solutions, and advanced technological adoption further support Market dominance, making the region a key hub for both manufacturers and early adopters of electric outboard systems.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

U.S. Electric Outboard Engines Market Insights:

The U.S. leads North America’s electric outboard engines Market, fueled by rising demand for eco-friendly recreational and commercial vessels, technological advancements, and government incentives promoting sustainable marine propulsion solutions.

Asia-Pacific Electric Outboard Engines Market Insights:

Asia-Pacific is the fastest-growing region in the electric outboard engines Market, driven by rapid urbanization, increasing disposable incomes, and expanding recreational and commercial boating activities. Growing consumer awareness of sustainable alternatives and investment in marine infrastructure are further accelerating the adoption of electric propulsion systems across the region.

-

China Electric Outboard Engines Market Insights:

China leads Asia-Pacific in electric outboard adoption, driven by expanding leisure boating, growing commercial ferry services, rising disposable incomes, and government initiatives promoting environmentally friendly and sustainable marine propulsion solutions.

Europe Electric Outboard Engines Market Insights:

The European electric outboard engines Market is expanding steadily, driven by strong environmental regulations, rising demand for sustainable recreational boating, and advancements in electric propulsion technology. High consumer awareness, growing investments in marine infrastructure, and government incentives for clean energy adoption are further boosting the popularity of electric outboards across both leisure and commercial boating segments.

-

Germany and Norway Electric Outboard Engines Market Insights:

Germany and Norway lead Europe’s electric outboard engines Market, supported by advanced maritime infrastructure, environmentally conscious consumers, strict regulations, and government incentives promoting sustainable marine propulsion solutions.

Latin America Electric Outboard Engines Market Insights:

The Latin American electric outboard engines Market is emerging, driven by increasing recreational boating activities, rising environmental awareness, and growing interest in sustainable marine solutions. Investments in port infrastructure and government incentives for clean energy adoption are encouraging the transition from conventional combustion engines to electric propulsion, creating opportunities for Market expansion across both leisure and small commercial vessels.

-

Brazil Electric Outboard Engines Market Insights:

Brazil leads Latin America’s electric outboard engines Market, fueled by expanding recreational boating, growing tourism, and increasing awareness of eco-friendly marine solutions, driving adoption across both leisure and small commercial vessels.

Middle East & Africa Electric Outboard Engines Market Insights:

The Middle East & Africa electric outboard engines Market is gradually expanding, driven by rising recreational boating, luxury tourism, and growing environmental awareness. Investments in marine infrastructure and government initiatives promoting sustainable boating solutions are encouraging adoption, creating opportunities for both recreational and commercial electric propulsion applications across the region.

Competitive Landscape for Electric Outboard Engines Market:

Raider Outboards, Inc. Founded in 2011, Raider Outboards specializes in advanced outboard motor technology, including electric and hybrid propulsion systems. The company serves recreational, commercial, and military Markets, offering innovative solutions such as beaching propellers and integrated marine electronics, with a focus on sustainability, performance, and global expansion.

-

March 18, 2025 – Raider Outboards, Inc. acquired Pure Watercraft’s electric outboard operations, expanding into commercial and military Markets while driving global growth. The company plans facility expansion to support production of outboards and integrated marine systems.

Torqeedo GmbH Founded in 2005, Torqeedo GmbH is a global leader in electric and hybrid marine propulsion systems. The company offers innovative solutions for small leisure boats to large yachts, focusing on sustainable mobility, energy-efficient drives, and integrated onboard energy management, serving both recreational and professional boating Markets worldwide.

-

January 19, 2024 – Torqeedo showcased its full range of electric and hybrid marine drives at boot 2024 in Düsseldorf, featuring Travel XP, Deep Blue systems, and sustainable innovations. Yamaha Motor Co., Ltd. announced plans to acquire Torqeedo, enhancing its expertise in electric marine propulsion

Mercury Marine Founded in 1939, Mercury Marine, a division of Brunswick Corporation, is a global leader in marine propulsion systems. The company designs and manufactures innovative outboard and inboard engines, including electric and hybrid solutions, serving recreational, commercial, and professional boating Markets with a focus on performance, reliability, and sustainability.

-

June 4, 2024 – Mercury Marine launched the Avator™ 75e and 110e electric outboards, expanding its award-winning lineup with high-performance, sustainable propulsion for pontoons, skiffs, and runabouts. The new models feature transverse flux motors, flexible battery integration, and digital controls, offering extended range, instant torque, and user-friendly operation.

Hitachi Energy Founded in 2020, Hitachi Energy is a global leader in sustainable energy solutions, specializing in power grids, electrical equipment, and electric mobility infrastructure. The company provides advanced technologies for utilities, industries, and transportation, including EV charging systems, promoting energy efficiency, reliability, and the transition to a low-carbon future.

-

January 25, 2024 – Hitachi Energy acquired Italian manufacturer Coet to expand its electric mobility and EV charging infrastructure capabilities. Coet will remain autonomous, supporting grid-eMotion charging solutions for electric bus and truck fleets globally.

Electric Outboard Engines Market key Players:

-

Torqeedo GmbH

-

Mercury Marine

-

Yamaha Motor Co., Ltd.

-

Minn Kota (Johnson Outdoors)

-

Pure Watercraft

-

Evoy AS

-

Bellmarine

-

Elco Motor Yachts

-

Vision Marine Technologies

-

Oceanvolt

-

EPropulsion

-

Greenline Yachts

-

Hitachi Ltd.

-

SeaFoil Electric

-

Brunswick Corporation

-

Suzuki Motor Corporation

-

Radinn

-

Electric Ocean

-

Yamaha

-

X Shore

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 909.22 Million |

| Market Size by 2032 | USD 1463.23 Million |

| CAGR | CAGR of 6.13% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Power(Below 25 kW, 25 – 50 Kw and 50 – 150 kW) • By Speed (mph)(Below 5 mph, 5-10 mph, 10-15 mph and Above 15 mph) • By Application(Commercial, Recreational and Military) • By Distribution channel(Direct Sales and Indirect Sales) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Torqeedo GmbH, Mercury Marine, Yamaha Motor Co., Ltd., Minn Kota (Johnson Outdoors), Pure Watercraft, Evoy AS, Bellmarine, Elco Motor Yachts, Vision Marine Technologies, Oceanvolt, EPropulsion, Greenline Yachts, Hitachi Ltd., SeaFoil Electric, Brunswick Corporation, Suzuki Motor Corporation, Radinn, Electric Ocean, Yamaha, X Shore |