Electric Scooters Market Report Scope & Overview:

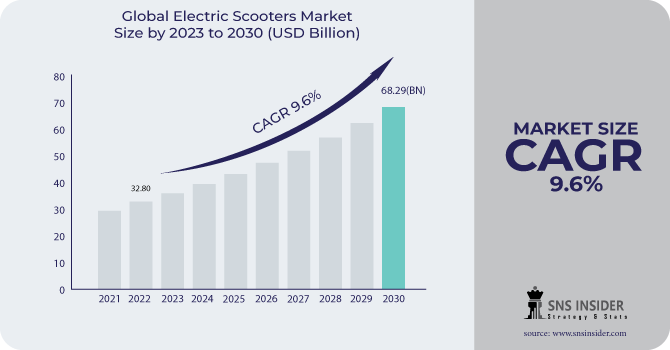

The Electric Scooters Market size was valued at USD 37.3 Bn in 2023 and is expected to reach USD 80.5 Bn by 2031 and grow at a CAGR of 10.1% over the forecast period of 2024-2031.

Although there are many different designs for electric scooters, they typically have a platform or deck where the user stands, handlebars for steering, and an electric motor to move the scooter forward. For simple storage and mobility, they frequently have a foldable shape. Lithium-ion batteries that can be recharged power e-scooters. The range and speed of the scooter might be impacted by the capacity of these batteries. Depending on the type, the top speed of an electric scooter can range from 15 to 30 miles per hour (24 to 48 km per hour). There are scooters with variable speed settings. How far an electric scooter can go on a single charge is referred to as its range. Depending on the scooter's battery capacity and other elements like rider weight and topography, this can range greatly from 10 miles (16 km) to over 40 miles (64 km). Electric scooters may be charged by plugging them into a regular socket. Although charging periods can differ, a full charge typically takes a few hours. When utilising electric scooters, safety is a major concern.

Riders should use safety equipment including helmets, observe traffic regulations, and pay attention to their surroundings. Additionally, there are rules and limitations on where and how to use e-scooters in various cities. Electric scooter rental services have been developed in numerous locations all over the world. E-scooters can be rented through these services for quick trips, and customers often utilise a smartphone app to find, unlock, and pay for the scooters. In this market, there are a number of well-known players, including Lime, Bird, and Spin.

Some people opt to buy their very own electric scooters for private use. These can be used for leisurely travel, running errands, or commuting. Since electric scooters don't emit any emissions directly, they are thought to be a more environmentally friendly form of transportation than gas-powered cars. In metropolitan locations, they may help lessen traffic congestion and air pollution. Local laws governing the use of electric scooters may differ. Some cities have rigid regulations.

Market Dynamics

Driver

- The rise in demand for electric scooters

Electric scooter demand has increased for a number of reasons, including its practicality, economy, and environmental advantages. The following are some of the main causes behind the rising popularity of electric scooters: metropolitan Mobility Solutions: In crowded metropolitan areas, electric scooters offer a useful and effective mode of mobility. For quick excursions and last-mile connectivity, they provide a quicker and more adaptable substitute to traditional transportation methods like vehicles and public transportation. Electric scooters are an environmentally benign form of transportation because they emit no pollutants at the exhaust. Many individuals are looking for more environmentally friendly travel options as awareness of climate change and air pollution rises.

Restrain

- The high cost of vehicles

Opportunity

- The government initiatives for climate control

As part of their sustainable mobility programmes, certain local governments and municipalities have aggressively promoted the use of electric scooters. To make room for e-scooters, rules and infrastructure upgrades have been made. Riding an electric scooter has some potential health advantages because it necessitates movement to balance and control the scooter. Many regard it as a simple and enjoyable method to stay active. Electric scooters frequently appeal to younger generations who are more receptive to alternative modes of mobility and technologically based solutions. This group of people has helped e-scooters become more and more popular.

Challenge

- The lack of infrastructure in the emerging and undeveloped countries.

Impact of recession

Consumers frequently reduce their discretionary spending during recessions, which may include buying electric scooters. People could put off purchasing personal mobility equipment like e-scooters in favour of vital costs. The demand for electric scooters, particularly more expensive versions, may diminish as disposable income declines and economic uncertainty rises. Non-essential purchases might be postponed or reconsidered by consumers. Manufacturers and merchants of electric scooters may see a slowdown in sales and a decline in growth as a result. Businesses in the sector might have a harder time luring in new clients, especially if they cater to a segment of the population that has been particularly hard hit by the crisis.

Impact of Russia Ukraine

Global economic turbulence may be caused by geopolitical conflicts like the Russia-Ukraine war. This unpredictability may have an influence on consumer confidence, investment choices, and general economic stability, which may have an impact on e-scooter demand. E-scooter producers frequently import parts and supplies from several nations, including those in Asia and Europe. Geopolitical concerns and trade interruptions brought on by the conflict may cause supply chain delays, higher costs, and difficulties locating vital components for e-scooters. Price increases can be brought on by higher production costs, higher transportation costs, or tariffs resulting from geopolitical conflict. This may lower consumer demand for electric scooters by making them more expensive.

Market Segmentation

By Battery

-

Lithium Ion

-

Lead-Acid

By Drive Type

-

Belt Drive

-

Hub Motor

By End Use

-

Personal

-

Commercial

.png)

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Regional Analysis

APAC is the region with the highest share for the e scooter market. The high demand for the e scooter in the developed and the emerging countries of the region is contributing to the growth of the market. The key players have noticed the highest revenue from this region specially countries like China, Japan, and India have been contributing the highest to the revenue of the companies. Also, the component which is used for the production of E scooter is highly available in the domestic market of this region and all these factors contribute to the growth of market in this region.

Whereas NA and Europe will be also experiencing a good growth during the forecasted period, as a reason the key players are trying to understand this market and are working towards finding the opportunity to grow in these regions.

Key Players

The major key players are BMW Motoradd international, BOXX Corp, Gogoro, Green energy Motors, Greenwit technologies, Honda Motor, KTM AG, Mahindra GenZe, AllCell Technologies, Jiangsu Xinri E-Vehicle and others.

BMW Motoradd international-Company Financial Analysis

| Report Attributes | Details |

| Market Size in 2023 | US$ 37.3 Bn |

| Market Size by 2031 | US$ 80.5 Bn |

| CAGR | CAGR of 10.1% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Battery (Lithium Ion, Lead-Acid), • By Drive Type (Belt Drive, Hub Motor), • By End Use (Personal, Commercial), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | BMW Motoradd international, BOXX Corp, Gogoro, Green energy Motors, Greenwit technologies, Honda Motor, KTM AG, Mahindra GenZe, AllCell Technologies, Jiangsu Xinri E-Vehicle |

| Key Drivers | • The rise in demand for electric scooters |

| Market Restraints | • The lack of infrastructure in the emerging and undeveloped countries. |