Electrosurgical Devices Market Report Scope & Overview:

Get More Information on Electrosurgical Devices Market - Request Sample Report

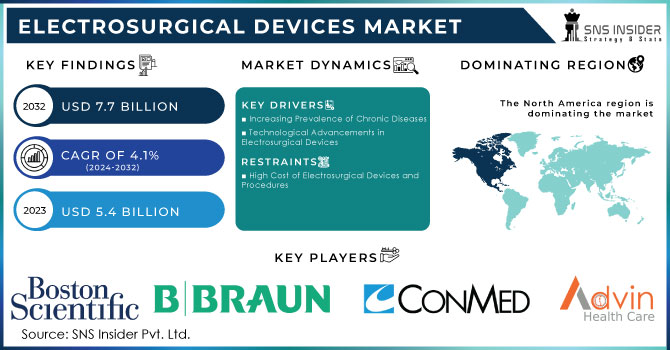

The Electrosurgical Devices Market Size was valued at USD 5.4 Billion in 2023, and is expected to reach USD 7.7 Billion by 2032, and grow at a CAGR of 4.1% over the forecast period 2024-2032.

The electrosurgical devices market is a highly dynamic one, characterized by innovations and enhancements in associated technologies that increase the accuracy of surgeries and, in turn, patient outcomes. The constant development of new electrosurgical devices is one of the major drivers for this market. Their applications today include minimally invasive procedures in which high-frequency electrical currents are used to either cut, coagulate, or desiccate tissue. Key market drivers are growing technological advancements, increased acceptance of minimally invasive surgeries, and growing demand for efficient and effective surgical tools.

Recently, the developments in the electrosurgical devices space took place in the July 2024 month when Innoblative, a major player, reached a milestone with first-in-human use of its novel electrosurgical device specially designed for the treatment of breast cancer. This novel electrosurgical device emanates the advances in electrosurgical technology by applying improved precision while minimizing related collateral damage that usually accompanies the use of traditional methods of electrosurgery. The successful testing and use of the device within the in vivo myocardial infarction setting demonstrates the increasingly specialized and effective developed solutions presented in the treatment of more complex conditions, thus further increasing demand for the latest tools of electrosurgery.

The other major breakthrough was done by Olympus in March 2024, when the company introduced the next-generation electrosurgical generator. This latest generation generator uses new technologies that enable improved surgery performance and safety. With improved power control and new safety mechanisms, this latest from Olympus goes a long way toward alleviating some of the most important concerns of modern electrosurgery. In many ways, it is the face of the next generation in generators. This new device exposes an industry that is using innovation and demanding devices that can respond to modern needs within the surgical setting.

In addition, the growing trend of chronic diseases and diseases that require surgical intervention played a significant role in the market growth of these electrosurgical devices. After all, with medical professionals turning to devices that offer more precision and efficiency in their work, an on-demand status will soon be assigned to top-notch electrosurgical devices. Moreover, most surgical specialties are embracing this technology, applied to most surgery types, including general surgery, gynecology, and orthopedic surgery. What is amazing is the fact that the industry keeps coming up with great devices designed to address particular surgical issues, showing how responsive the industry is to emerging medial needs.

Advancing much-needed technology and applications for electrosurgical devices are more into specialized solutions; this is a dynamic market. Nowadays, Innoblative and Olympus are in the first line of these revolutions by developing new innovative products to fit the needs of modern surgical practices. The electrosurgical devices market will keep up sustained growth significance in healthcare with the rise in prominence of minimally invasive and precise surgery for the ongoing improvements and acceptance of new advanced surgical technologies.

Market Dynamics:

Drivers:

-

Increasing Prevalence of Chronic Diseases

High prevalence rates of chronic diseases such as cardiovascular disorders, cancer, and other neurological disorders are offering a massive opportunity for electrosurgical device markets. Because most of these morbidities ultimately demand surgical intervention, the demand for advanced treatment procedures is high, ensuring the electrosurgical device markets an offer of precision and minimum invasion for shorter recovery time. These are increasingly done using electrosurgical devices, since they cut, coagulate, desiccate, or fulgurate tissue due to a high-frequency electrical current, which provides decreased blood loss and, hence, an improved surgical outcome. The devices are used massively in tumor resections and biopsies in the case of cancer surgeries, for instance. This is undergirded by the increase in cases of cancer around the world. In fact, by its estimation, the World Health Organization approximated the number of new cases of cancer at 19.3 million, while the deaths were around 10 million in the year 2020 alone. As the world population continues to get older, with an increase in lifestyle-related chronic conditions, demand for electrosurgical devices will accordingly rise.

-

Technological Advancements in Electrosurgical Devices

Innovations in electrosurgical devices are technologically improving the safety, efficiency, and versatility of these instruments. Indeed, the electrosurgical device in its modern form has advanced features like real-time feedback systems, monitoring tissue impedance and power output, thereby reducing thermal damage to surrounding tissues. This has greatly improved the precision of electrosurgical procedures and made them safer and more effective for both patients and surgeons. A good example of this kind of innovation is that hybrid electrosurgical devices would be devolved to combine energies from ultrasonic and radiofrequency energies in their improved cutting and coagulation abilities. This becomes very important in difficult surgeries where precision is required, like laparoscopic or robotically assisted procedures. Other technologies in the pipeline include the incorporation of AI and ML technologies to enhance electrosurgical device performance further, allowing for surgical interventions that are person-centric and adaptive. These improvements can only be expected to increase the scope of application of electrosurgical devices, hence powering market growth.

Restraint:

-

High Cost of Electrosurgical Devices and Procedures

The major restrain for the global electrosurgical devices market includes the high cost of these devices and procedures for which they are used. The electrosurgical devices come pricey, especially those with advanced features and technologies. Additionally, treatments that require the use of such a device cost more compared to the conventional surgical technique, hence less accessible to patients in low- and middle-income countries. For example, the cost of a laparoscopic surgery with electrosurgical devices will drastically vary from an open surgery because of expensive equipment costs, specialized training required for surgeons, and increased procedure time in some cases. At this high cost, there is limited scope for the adoption of electrosurgical devices in resource-constrained health settings, especially in low- and middle-income countries where health expenditure is already below par. Moreover, the high cost may further lead to inequities in access to sophisticated surgical care, whereby patients in developing regions tend to have lower access as compared to counterparts living in developed regions. On the other hand, advanced surgical technologies have brought problems to health providers, for they need to weigh the benefits to institutions against the financial resources available at the institutions.

Opportunity:

- Growing Demand for Minimally Invasive Surgeries

The increasing procedures of minimally invasive surgeries provide a good opportunity for the market of electrosurgical devices. The technique has been evolving as a gold standard of treatment for surgical interventions, with much smaller incisions, less traumatic nature to the body, and fast recovery time as compared to open surgeries. Electrosurgical devices are, therefore, one of the most pivotal constituents because they provide the surgeon with appropriate precision and control for such delicate procedures. For instance, electrosurgical devices in one type of MIS known as laparoscopic surgeries, which are primarily used for cutting and coagulating tissue with minimal bleeding. The global shift towards MIS is directly linked to reduced hospital stays, less post-operative pain, and decreased risk of infection. The demand for electrosurgical devices is therefore expected to increase manifold as both patients and healthcare providers favor MIS procedures over conventional surgeries. Apart from that, technological advancement in the field of imaging and robotics continues to further the potential of MIS, thus opening up more opportunities for the adoption of electrosurgical devices. Robotic-assisted surgeries are increasingly incorporating electrosurgical tools and are on the rise, as they offer enhanced dexterity and precision; this, in turn, expands the market. This growing trend of outpatient surgeries, fueled by the need to reduce healthcare expenditure and increase convenience for patients, further fuels demand for electrosurgical devices in MIS.

Challenge:

-

Stringent Regulatory Requirements hamper the growth of the Electrosurgical Devices market

One of the big challenges to the electrosurgical devices market is the stringent regulatory requirements outlined by health authorities across the globe. The concerned entities are expected to guarantee safety and efficacy in the operations using electrosurgical devices. The thing is that approval procedures are at times complex, lengthy, and rigid and might not permit on-time launch time to market; thus, they act as a hindrance to innovation and eventually slow down the growth of the market. For instance, electrosurgical devices in the United States require testing under the full review of the FDA. That will call for very strict testing right from the preclinical level to clinical trials in order to ensure the safety and effectiveness of the device. That's pretty straightforward, and, for example, the Medical Device Regulation within the European Union features very strict requirements for new device approval. In particular, these regulatory hurdles are quite steep for SMEs, which might not have the resources to get through such complex procedures. Further, once approved, a stream of many other requirements brings an added layer of burden on manufacturers in terms of post-market surveillance compliance for reporting adverse events and quality management systems. Failure to comply with these regulations may lead to stringent punitive measures, product recalls or market withdrawals, hence creating even more complexity in the marketplace for those firms operating in the current environment. On the other hand, regulatory frameworks do provide a safe avenue for patients but are also a big challenge that companies have to overcome to actually make a profit in the marketplace for electrosurgical devices.

MARKET SEGMENTATION ANALYSIS

By Product

In the year 2023, the Electrosurgery Instruments & Accessories segment dominated in the electrosurgical devices and was mainly contributed to by Bipolar Instruments and Monopolar Instruments. The large market share of this segment is close to approximately over 40% of all the market share. Therefore, acceptance in huge numbers of different surgical procedures characterized by precision, versatility, and safety has played a role in being dominant in these segments. Bipolar instruments, advanced sealing with minimal thermal spread, and bipolar forceps are chosen because they are effective in the sealing of blood vessels with minimal thermal spread, thus making collateral damage occur minimally in the surrounding tissue. For example, laparoscopic surgeries are increasingly employing advanced vessel sealing systems when control of bleeding is important. Equally important across a broad spectrum of surgical services extending from those in dermatology to general surgery, the most common monopolar instruments that were commercially available are the electrosurgery pencils and the electrodes, without which an operating room will be considered incomplete. The said segments were further strengthened in their market positions come 2023 due to the boom in performing minimally invasive surgeries, in which these two instruments are critical.

By Application

The general surgery segment dominated with a revenue share of approximately 35% in 2023, since the electrosurgical devices find wide applications in most general surgeries, including appendectomies, hernia repairs, and gastrointestinal surgeries. These electrosurgical tools, such as an electrosurgery pencil and bipolar forceps, are essential to do tasks like cutting, coagulating, and sealing tissues at these operations, which at the same time, facilitates minimal loss of blood and reduces operation time. For instance, the use of an electrosurgical device in laparoscopic cholecystectomy, which is performed to remove the gallbladder, is extended to dissect blood vessels and tissues safely by cutting and sealing with precision and without complications. Such is the versatility and critical role of electrosurgical devices in general surgery that this segment continues to hold the leading position in the market, with the volume of surgeries done globally coupled with the incremental trend of minimally invasive procedures.

By End-user

In 2023, Hospitals dominated the electrosurgical devices market as a large segment, accounting for around 50% of market share. Hospitals have surgical facilities and sophisticated healthcare personnel that can handle virtually all categories of surgical procedures that are available, ranging from the non-life threatening to the life-threatening surgeries many of which necessarily involve advanced electrosurgical gadgets. Hospital settings have the greatest potential in using advanced electrosurgical devices. For example, hospitals are involved with high numbers of operations for both cardiovascular and cancer. Electrosurgical equipment, among other electrosurgery generators and advanced vessel sealing instruments, it is greatly demanded within these hospitals to effect quality incisions, coagulation, and reduce blood loss in any operation. In addition to this, as hospitals get higher funding, they can buy the most modern of medical technologies, which further enhances the lead in the electrosurgical devices market.

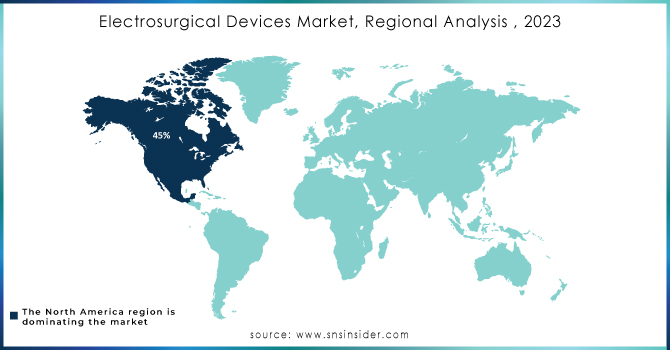

Regional Analysis

In 2023, North America held a share of approximately 45% in the electrosurgical devices market. This could be attributed to the fact that this region possesses a well-developed healthcare infrastructure and is also maintaining a high adoption rate of advanced medical technologies, accompanied by considerable investments in research and development. The U.S. is one of the key factors in this dominance, powered by the huge network of hospitals and surgical centers that require frequent usage of electrosurgical devices for a host of procedures. For instance, major medical centers like the Cleveland Clinic or Mayo Clinic use electrosurgical tools to carry out complex surgeries with high precision and minimum invasiveness. Moreover, stringent regulatory and quality standards in North America promote the availability and usage of advanced electrosurgical technologies, thereby strengthening its lead role in the global market.

Moreover, Asia Pacific emerged as the fastest-growing region in the electrosurgical devices market which accounted for about 25%. This high growth could be attributed to improving healthcare infrastructure, rising numbers of surgical procedures, and increased investment in advanced medical technologies. Rapidly increasing incidence of chronic diseases with large populations has made countries like China and India very suitable for any kind of healthcare facility and hence advanced surgical equipment related to it. For instance, main hospitals in metropolitan cities like Shanghai and Mumbai are rapidly adopting electrosurgical devices with the intention of increasing precision in surgeries and enhancing the outcome of patients. In addition, governmental initiatives in providing access to healthcare and improvement in quality, along with the funds, are some of the drivers for the growth of the electrosurgical devices market in the Asia-Pacific region. This market can also be said to be the most rapidly growing in the world because of a combination of growing healthcare needs and investment in medical technology.

Need any customization research on Electrosurgical Devices Market - Enquiry Now

Recent Developments

July 2024: Innoblative Designs, Inc. completed its first human use case in a first-in-human clinical trial. This was performed at the Istanbul Oncology Hospital by Dr. Cem Yılmaz, treating a 64-year-old lady with histologically proven stage II, luminal A breast cancer.

January 2024: Olympus Corporation announced the launch of its ESG-410™ Surgical Energy Platform, now available with conventional monopolar, bipolar, ultrasonic dissection, and hybrid energy applications.

June 2023: Olympus Corporation launched its new ESG-410 electrosurgical generator to enhance BPH and NMIBC treatment

April 2023: SIRA RFA Electrosurgical Device received Breakthrough Device Designation from U.S. FDA to be used to conduct breast-conserving surgeries in breast-conserving surgeries

Key Players

Some of the major players in the Electrosurgical Devices Market are Advin Health Care, AG Boston Scientific Corporation, B. Braun Melsungen AG, Boston Scientific Corporation, Bovie Medical Corporation, BOWA-electronic GmbH & Co.KG, BPL Medical Technologies, CONMED Corporation, Erbe Elektromedizin GmbH, Innoblative Designs, Johnson & Johnson (Ethicon US, LLC.), Medtronic, Olympus Corporation, Smith & Nephew Plc., STERIS Healthcare, Symmetry Surgical Inc., Utah Medical and other key players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.4 Billion |

| Market Size by 2032 | USD 7.7 Billion |

| CAGR | CAGR of 4.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Electrosurgical Generators, Active Electrodes, Dispersive Electrodes, Electrosurgery Instruments & Accessories, Argon and Smoke Management Systems, Others) • By Application (General Surgery, Gynecology Surgery, Urologic Surgery, Orthopedic Surgery, Cardiovascular Surgery, Cosmetic Surgery, Neurosurgery, Others) • By End-user (Hospitals, Specialty Clinics, Ambulatory Surgical Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Advin Health Care, AG Boston Scientific Corporation, B. Braun Melsungen AG, Boston Scientific Corporation, Bovie Medical Corporation, BOWA-electronic GmbH & Co.KG, BPL Medical Technologies, CONMED Corporation, Erbe Elektromedizin GmbH, Innoblative Designs, Johnson & Johnson (Ethicon US, LLC.), Medtronic, Olympus Corporation, Smith & Nephew Plc., STERIS Healthcare, Symmetry Surgical Inc., Utah Medical |

| Key Drivers | • Increasing Prevalence of Chronic Diseases • Technological Advancements in Electrosurgical Devices |

| RESTRAINTS | • High Cost of Electrosurgical Devices and Procedures |