Medical Marijuana Market Report Scope & Overview:

To Get More Information on Medical Marijuana Market - Request Sample Report

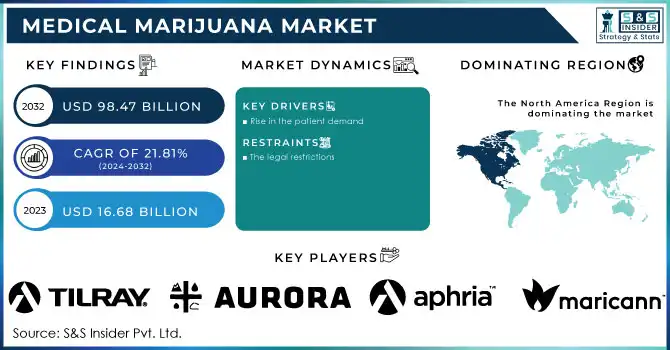

The Medical Marijuana Market Size was valued at USD 16.1 Billion in 2023 and is expected to reach USD 72.1 Billion by 2032, growing at a CAGR of 18.1% over the forecast period 2024-2032

Growing Legalization and Acceptance across Region Contributing to the Growth of Medical Marijuana Market More than 38 states in the U.S. have legalized medical marijuana by January 2023, which is indicative of an increasing number of patients. As of November 2023, the Connecticut Department of Consumer Protection reported that over $10.3 million in sales were generated from patients purchasing a total of 281,691 products at more than 20 medical marijuana dispensaries across the state. This surge in sales underscores the rising demand for medical marijuana as an alternative treatment option for various health conditions. According to the National Conference of State Legislatures, by April 2023, around 2.1 million people in the U.S. have medical cannabis licenses, and chronic pain misses the most states in the medical cannabis market as the qualifying condition.

Furthermore, studies have shown that continuous use of medical cannabis can lead to a significant reduction in opioid prescriptions, highlighting its potential role in addressing the opioid crisis. The increasing body of research supporting the efficacy of cannabis for pain management and other medical applications is further propelling its acceptance among healthcare providers and patients alike. Additionally, government initiatives aimed at expanding access to medical marijuana are contributing to the market's growth, as evidenced by the ongoing legislative changes across various states.

Market Dynamics

Drivers

-

An increasing number of countries and states are legalizing medical marijuana, reflecting a shift in societal attitudes and recognition of its therapeutic potential.

-

The increasing incidence of chronic conditions such as cancer, diabetes, and Alzheimer's disease has heightened the demand for medical marijuana as a complementary treatment option.

Increasing cannabis legalization and societal acceptance of cannabis for medical purposes is one of the primary factors fuelling the medical marijuana market. Over the past decade, the global landscape regarding the legalization of medical marijuana has shifted drastically, with more regions recognizing its therapeutic benefits. As of early 2024, over 40 countries, including Canada, Germany and Israel, had legalized medical marijuana in some form, transforming the availability and study of its medicinal properties. The expanding legal landscape mirrors the increasingly accepted use of marijuana for chronic pain, nausea, epilepsy, and other ailments. For instance, the approval of Epidiolex, a cannabis-derived drug by the FDA in 2018 for treating seizures associated with rare forms of epilepsy, marked a turning point in the medical acceptance of cannabis. Epidiolex is the first FDA-approved drug that contains a purified drug substance derived from marijuana.

Furthermore, societal attitudes towards cannabis have evolved. According to a 2023 Gallup poll, 68% of Americans now support marijuana legalization, with a strong emphasis on its medical applications. This shift is particularly noticeable among older generations who may have once opposed cannabis use but are now open to its medical benefits. The National Institutes of Health (NIH) concluded ‘medical cannabis can reduce chronic pain which makes it appealing for patients with pain who do not respond to conventional pharmaceutical treatment'. The rise in number of individuals seeking cannabis-based treatments along the decreasing societal stigmas serves to drive the demand for medical marijuana which, in turn, translates into further growth of the market.

Restraints:

-

Despite growing acceptance, medical marijuana remains illegal at the federal level in many countries, leading to complex regulatory environments that can hinder market growth.

-

Due to its legal status, many financial institutions are reluctant to provide services to cannabis-related businesses, resulting in operational challenges and limited access to capital.

The presence of regulatory and legal challenges is one of the main restraints in the medical marijuana market. Although acceptance of medical marijuana is increasing, its legal status is complicated and often contradictory from area to area. The legal framework is still fragmented, as in many countries medical marijuana is illegal or merely restricted. For instance, while some U.S. states have legalized medical marijuana, it remains illegal at the federal level. Such duality creates an environment where businesses come under uncertain and legal risks, in particular with respect to cross-border transaction, production and distribution. Moreover, there are potentially very strict regulatory environments surrounding medical marijuana, that require organizations to work within very long licensing processes, product testing, and health and safety regulations. The disparate frameworks can vary widely by jurisdiction, creating barriers for companies seeking to do business across market borders. This inconsistency further drives up operational expenses and slows down the market expansion potential.

Segment analysis

By product type

In 2023, the oil and tincture segment dominated the medical marijuana market, capturing a 54% revenue share. A main reason for this popularity of oils and tinctures is their versatility and effectiveness in delivering cannabinoids without the need for smoking. Oils remain the preferred vehicles due to their use and dosing convenience particularly among patients needing continual therapeutic effects. Moreover, clinical studies have shown that non-psychoactive compounds like CBD found in these products can significantly alleviate symptoms such as chronic pain and anxiety.

The flower segment is expected to record a higher compound annual growth rate (CAGR) during the forecast period owing to the rising consumer inclination towards traditional consumption methods along with increasing product launches in flower-centric products. As more states continue to legalize recreational use alongside medical applications, the demand for flower products is expected to rise rapidly.

By application

Chronic pain was the largest application area of the medical marijuana market at 26% revenue share in 2023. The high prevalence of chronic pain conditions affecting millions globally has led to an increased reliance on medical cannabis as a viable treatment option. According to government statistics, around 62 percent of patients who apply for medical cannabis do so for pain relief and only for pain relief. This trend is also supported by some studies that indicate cannabinoids can effectively reduce pain intensity and improve overall quality of life in patients with conditions such as arthritis, fibromyalgia, and neuropathic pain. Moreover, research has shown that medical cannabis patients have lower self-reported pain levels than those using only conventional pharmacological therapy. This segment is projected to continue the highest market share in future, given the increasing knowledge amongst consumers about the potential health benefits of cannabis in treating chronic pain.

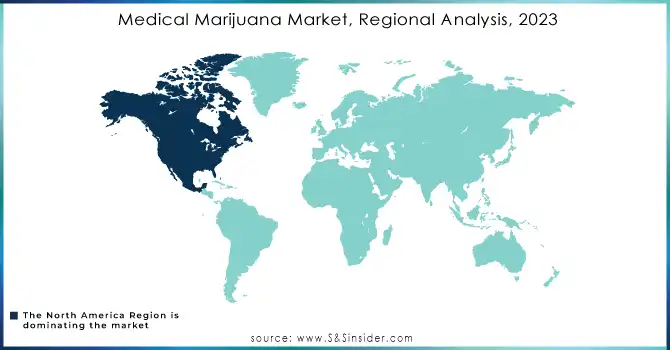

Regional analysis

In 2023, North America held the largest share of revenue in the medical marijuana market, accounting for around 74% of total revenue. This dominance comes from prior efforts at legalization as well as an established system of supporting medical and recreational cannabis supply chains. In fact, over the past decade, states within the U.S. have progressed rapidly, implementing regulatory frameworks that allow access to medical marijuana products. Both medical and recreational marijuana are now legal in Canada. The medicinal marijuana market was well-established, and authorised producers offered patients a range of goods.

On the other hand, the Asia Pacific is expected to have the higher CAGR over the forecast period as more acceptance and regulatory alterations in the use of medical cannabis approaches. Countries such as Australia and New Zealand are leading this growth trajectory by implementing supportive policies aimed at expanding access to cannabis-based therapies. Government initiatives promoting research into therapeutic applications further bolster this region's potential for growth.

Do You Need any Customization Research on Medical Marijuana Market - Enquire Now

Key Players

Key Service Providers/Manufacturers

-

Canopy Growth Corporation (Tweed, Spectrum Therapeutics) – (Smiths Falls, Canada)

-

Aurora Cannabis (Aurora Sky, Aurora Drift) – (Edmonton, Canada)

-

GW Pharmaceuticals (Epidiolex, Sativex) – (Cambridge, UK)

-

Tilray (Tilray THC, Tilray CBD) – (Nanaimo, Canada)

-

Cronos Group (Cove, Spinach) – (Toronto, Canada)

-

Charlotte's Web (Charlotte's Web Hemp Extract, CBD Oil) – (Boulder, USA)

-

Green Thumb Industries (Incredibles, Dogwalkers) – (Chicago, USA)

-

Aphria Inc. (Alcanna, Apollon) – (Leamington, Canada)

-

Hexo Corp. (Hexo Extracts, Redecan) – (Gatineau, Canada)

-

Columbia Care (Columbia Care CBD) – (New York City, USA)

-

Organigram Holdings (OGI CBD, Edison Cannabis Co.) – (Moncton, Canada)

-

MedMen (MedMen Premium Cannabis, MedMen Dispensaries) – (Los Angeles, USA)

-

Cureleaf (Curaleaf Cannabis, Select CBD) – (Wakefield, USA)

-

Cronos Group (Peace Naturals, Good Buds) – (Toronto, Canada)

-

Vireo Health International (Vireo, Mary’s Medicinals) – (Minneapolis, USA)

-

Trulieve (Trulieve THC, Trulieve CBD) – (Tallahassee, USA)

-

Liberty Health Sciences (Liberty Dispensary, Liberty CBD) – (Gainesville, USA)

-

The Green Organic Dutchman (TGOD Organic Cannabis, TGOD CBD) – (Headquarters: Oakville, Canada)

-

Icanic Brands Company (CaniBrands, Icanic THC) – (Los Angeles, USA)

-

Harvest Health & Recreation (Harvest CBD, Beekeeper's Naturals) – (Tempe, USA)

Recent developments

-

In January 2024, New York State published findings indicating that long-term use of medical cannabis significantly reduces opioid prescriptions among chronic pain patients.

-

The FDA released guidance in June 2023 meant to ease the drug development process for cannabinoids.

-

In March 2024 Jesse Ventura began selling cannabis edibles through a partnership with Columbia Heights-based Retro Bakery which is producing hemp-derived THC edibles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.1 Billion |

| Market Size by 2032 | USD 72.1 Billion |

| CAGR | CAGR of 18.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Flower, Oil & Tinctures) • By Application (Cancer, Chronic Pain, Diabetes, Depression and Anxiety, Arthritis, Epilepsy, Glaucoma, Migraines, Multiple Sclerosis, Parkinson's Disease, AIDS, Amyotrophic Lateral Sclerosis, Alzheimer’s Disease, Post-Traumatic Stress Disorder (PTSD), Tourettes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Canopy Growth Corporation, Aurora Cannabis, GW Pharmaceuticals, Tilray, Cronos Group, Charlotte's Web, Green Thumb Industries, Aphria Inc., Hexo Corp., Columbia Care, Organigram Holdings, MedMen, Cureleaf, Vireo Health International, Trulieve, Liberty Health Sciences, The Green Organic Dutchman, Icanic Brands Company, Harvest Health & Recreation |

| Key Drivers | • An increasing number of countries and states are legalizing medical marijuana, reflecting a shift in societal attitudes and recognition of its therapeutic potential. • The increasing incidence of chronic conditions such as cancer, diabetes, and Alzheimer's disease has heightened the demand for medical marijuana as a complementary treatment option. |

| Restraints | • Despite growing acceptance, medical marijuana remains illegal at the federal level in many countries, leading to complex regulatory environments that can hinder market growth. |