Elevators Market Report Scope & Overview:

To Get More Information on Elevators Market - Request Sample Report

The Elevators Market Size was esteemed at USD 65.24 billion in 2023 and is supposed to arrive at USD 111.49 billion by 2032 and develop at a CAGR of 6.10% over the forecast period 2024-2032.

The elevators market has witnessed substantial growth due to increasing urbanization, infrastructure development, and a rising demand for vertical transportation in residential, commercial, and industrial sectors. As cities expand vertically, elevators play a crucial role in optimizing space usage and ensuring mobility in high-rise buildings. The market's growth is further fueled by the development of smart cities, an aging population, and government investments in public infrastructure, particularly in emerging economies. Technological advancements are significantly shaping the elevators market, with manufacturers focusing on energy efficiency, safety, and smart features. The integration of AI, IoT, and predictive maintenance technologies is transforming elevator systems, allowing real-time monitoring, reducing operational costs, and enhancing user experience. For instance, IoT-enabled elevators can predict maintenance needs, preventing sudden breakdowns and minimizing downtime. Green elevators, designed to consume less energy, are becoming increasingly popular as part of the broader trend towards sustainable building solutions.

Recent trends indicate a growing demand for machine-room-less (MRL) elevators, which are compact and save building space. Additionally, the adoption of destination control systems, which optimize elevator travel by grouping passengers with similar destinations, is improving efficiency and reducing waiting times. Another emerging trend is the use of touchless control systems in response to heightened hygiene concerns, particularly after the COVID-19 pandemic, offering enhanced safety and convenience. The market is also seeing a rise in the retrofitting of elevators in older buildings, driven by safety regulations and the need for modernization. However, this segment is often challenged by high installation and maintenance costs, particularly in aging structures that require significant modifications.

On May 2023: Schindler Elevator announced that it had won a contract to supply 150 elevators for the One Vanderbilt building in New York City. The One Vanderbilt building is the tallest office building in New York City, and the elevators will be the first in the city to use Schindler's new "Intelligent Drive" technology.

MARKET DYNAMICS

DRIVERS

- Rapid urbanization in emerging economies is fueling the demand for elevators as the increasing population necessitates the construction of more high-rise buildings requiring efficient vertical transportation solutions.

Rapid urbanization in emerging economies is significantly driving the demand for elevators as cities expand and populations grow. As more people move into urban areas, there is a rising need for vertical space to accommodate housing, commercial spaces, and infrastructure. This has led to a surge in the construction of high-rise buildings, which require efficient vertical transportation systems like elevators. In countries such as India, China, and Brazil, urban centers are rapidly growing, and the limited horizontal space in these areas necessitates the construction of taller buildings. Elevators become essential for ensuring smooth and fast movement of people and goods within these structures, enhancing convenience and accessibility. Furthermore, modern elevators are increasingly equipped with advanced technologies such as energy efficiency, smart controls, and safety features, making them more appealing to developers and governments aiming for sustainable urban growth.

This trend is not only observed in residential buildings but also in the construction of commercial, retail, and mixed-use developments. As urbanization continues to accelerate, the demand for efficient, safe, and reliable vertical transportation solutions is expected to grow. The elevator industry is witnessing a boom in emerging economies due to this increasing urban density, driving both modernization of existing buildings and new installations, thereby supporting the overall development of these urban areas.

- Technological advancements, including smart elevators with IoT integration, energy efficiency, and enhanced safety features, are boosting user experience and making elevators more attractive to developers.

Technological advancements in elevators, particularly the integration of Internet of Things (IoT) technology, energy efficiency, and enhanced safety features, are significantly enhancing user experience and boosting their appeal to developers. Smart elevators equipped with IoT capabilities allow for real-time monitoring, predictive maintenance, and smoother operation by analyzing usage patterns. This not only reduces downtime and maintenance costs but also improves reliability and user satisfaction.

Energy efficiency is another crucial factor, as modern elevators now utilize energy-saving technologies like regenerative drives, which capture and reuse energy. This contributes to lower operational costs, aligning with sustainability goals that are increasingly prioritized in the construction and real estate industries. As a result, developers find these energy-efficient systems more appealing, as they contribute to building green certifications and reduced long-term expenses. Enhanced safety features, including advanced sensors, automated emergency systems, and improved braking mechanisms, provide greater protection for users. This focus on safety, coupled with seamless user experiences such as faster travel times and touchless interfaces adds to the growing demand for smart elevators in residential and commercial buildings.

RESTRAIN

- High installation and maintenance costs for elevators, especially in retrofitted buildings, can discourage developers and owners from making such investments.

The high installation and maintenance costs of elevators, particularly in retrofitted buildings, present a significant barrier for developers and property owners. Retrofitting older buildings with modern elevators often requires substantial structural modifications, adding to the complexity and expense of the project. In addition to the upfront installation costs, ongoing maintenance demands can be costly, including regular inspections, part replacements, and safety updates to comply with evolving regulations. These expenses can deter developers from investing in elevators, especially in smaller or low-budget projects where cost-efficiency is crucial. Furthermore, the long-term operational costs, including energy consumption and potential downtime for repairs, add to the financial burden. As a result, many developers and building owners may forgo elevator installations in retrofitting projects, opting for less expensive alternatives or delaying upgrades altogether, which can limit accessibility and building functionality.

Key Market Segmentation

By Type

The traction type segment led the elevators market and accounted for 56.08% of the global revenue share in 2023. Traction elevators are commonly employed in industrial and commercial buildings. Furthermore, the increase in infrastructure developments for business structures such as offices, shopping centers, and stores will also stimulate market needs. Moreover, the building sector will benefit from favorable government measures, leading to profitable growth prospects in the global market.

By Business

The new equipment type segment led the market and accounted for 48.2% of the global revenue share in 2023, Due to the growth of urban areas, shifts in population, and a substantial rise in building projects. In the years ahead, the demand for a new type of elevator equipment will be influenced by the factors mentioned above.

By Application

The residential application segment accounted for the largest revenue share of 68.04% in 2023. Due to increasing urbanization and improving living standards in countries such as China and India, there will be a growing need for elevators in the coming years. The market for elevators used in residential settings will continue to grow with the construction of tall buildings, many of which are equipped with smart elevators.

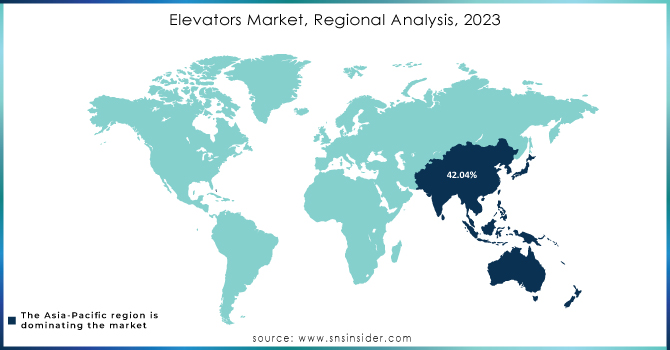

REGIONAL ANALYSIS

Asia Pacific region dominated the market share over 42.04% in 2023. The demand for elevators in APAC is on the rise due to the significant growth of the construction sector and increasing production in countries such as India, China, and South Korea, among others. Because of the fast increase in population, rural migration, and industrial development in recent years, the regional elevator market has experienced significant growth.

Do You Need any Customization Research on Elevators Market - Inquire Now

KEY PLAYERS

Some of the major key players of Elevators Market

- TK Elevator: (TWIN and MULTI systems)

- Schindler: (Schindler 7000, Schindler 5500)

- KONE Corporation: (KONE MonoSpace, KONE EcoSpace)

- Hitachi Ltd.: (Hitachi Super Vista, Hitachi Home Elevators)

- HYUNDAI ELEVATOR CO., LTD.: (Hyundai Smart Home Elevator, Hyundai Eco Elevator)

- Mitsubishi Electric Corporation: (M-Series, Diamond Vision elevators)

- Toshiba Group: (Toshiba Elevator H-Series, Eco-Friendly Elevator)

- FUJITEC CO., LTD.: (Fujitec Mini-MR, Fujitec MRL)

- Aritco Lift AB: (Aritco HomeLift, Aritco 4000)

- EMAK: (EMAK Home Elevator, EMAK Hydraulic Lift)

- Sigma Elevator Company: (Sigma MRL, Sigma Hydraulic Lift)

- Schumacher Elevator Company: (Schumacher Passenger Elevators, Schumacher Hydraulic Elevators)

- ESCON Elevators Pvt Limited: (ESCON Residential Elevators, ESCON Freight Elevators)

- Electra Elevators: (Electra Passenger Elevators, Electra Goods Elevators)

- CANNY ELEVATOR CO., LTD.: (Canny Residential Elevator, Canny Commercial Elevator)

RECENT DEVELOPMENTS

On March 2023: ThyssenKrupp Elevator announced that it had won a contract to supply 100 elevators for the Jeddah Tower in Saudi Arabia. The Jeddah Tower is the tallest building in the world, and the elevators will be the fastest in the world, with a speed of 20.5 meters per second.

On April 2023: Mitsubishi Electric announced that it had won a contract to supply 120 elevators for the Grand Tower in Ho Chi Minh City, Vietnam. The Grand Tower is the tallest building in Vietnam, and the elevators will be the first in the country to use Mitsubishi Electric's new "elevator of the future" technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 65.24 Billion |

| Market Size by 2032 | USD 111.49 Billion |

| CAGR | CAGR of 6.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hydraulic, Traction, Machine Room-Less Traction, Others) • By Business (New Equipment, Maintenance, Modernization) • By Application (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TK Elevator, Schindler, KONE Corporation, Hitachi Ltd, HYUNDAI ELEVATOR CO., LTD, Mitsubishi Electric Corporation, Toshiba Group, FUJITEC CO., LTD, Aritco Lift AB, EMAK, Sigma Elevator Company, Schumacher Elevator Company, ESCON Elevators Pvt Limited, Electra Elevators, CANNY ELEVATOR CO., LTD |

| Key Drivers | • Rapid urbanization in emerging economies is fueling the demand for elevators as the increasing population necessitates the construction of more high-rise buildings requiring efficient vertical transportation solutions. •Technological advancements, including smart elevators with IoT integration, energy efficiency, and enhanced safety features, are boosting user experience and making elevators more attractive to developers. |

| RESTRAINTS | • High installation and maintenance costs for elevators, especially in retrofitted buildings, can discourage developers and owners from making such investments. |