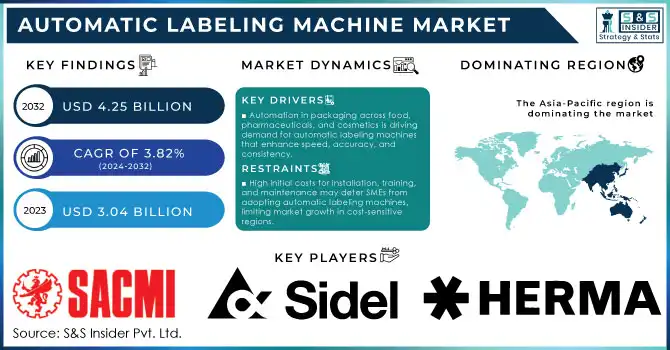

Automatic Labeling Machine Market Key Insights:

To Get More Information on Automatic Labeling Machine Market - Request Sample Report

The Automatic Labeling Machine Market size was estimated at USD 3.04 billion in 2023 and is expected to reach USD 4.25 billion by 2032 and growing at a CAGR of 3.82% during the forecast period of 2024-2032.

The Automatic Labeling Machine Market has seen remarkable growth, fueled by the rising demand for efficient packaging solutions across industries like food and beverages, pharmaceuticals, cosmetics, and chemicals. These machines offer a major advantage by enhancing productivity and precision, reducing human error and minimizing labor costs. Capable of applying labels at high speeds, they ensure consistency in packaging while optimizing production processes. Technological innovations have significantly contributed to the market's expansion. Advanced features such as real-time monitoring, system integration, and customizable labeling capabilities have made automatic labeling machines more efficient. The integration of smart technologies like IoT and AI has further enhanced operational control, predictive maintenance, and overall automation, driving demand for such solutions. These technologies not only streamline the labeling process but also enable greater adaptability to meet varying industry requirements.

The e-commerce sector has also played a crucial role in the growth of the market. Businesses involved in logistics and distribution require fast and accurate labeling for large volumes of goods. The pharmaceutical sector has been particularly impacted by the increasing need for automatic labeling machines due to stringent regulations on product labeling, which ensure safety and traceability. Similarly, the food and beverage industry benefits from these machines, as they help provide consumers with transparent information about ingredients, nutritional content, and allergens. In response to increasing environmental concerns, there is a growing trend toward sustainable labeling practices. Automatic labeling machines are being designed to work with eco-friendly materials and to reduce waste and energy consumption. This shift aligns with both manufacturers' and consumers' desire for greener solutions. As automation continues to be a priority, the demand for automatic labeling machines is expected to rise, offering more efficient, sustainable, and cost-effective solutions across various industries. The market's future looks promising, with automation continuing to redefine operational standards.

| Feature of Automatic Labeling Machine | Description | Commercial Products |

|---|---|---|

| High Speed Labeling | Automatic labeling machines offer rapid label application, suitable for high-volume production lines, minimizing downtime and boosting efficiency. | Pack Leader USA PL-501, HERMA 500 Label Applicator |

| Precision Label Placement | Equipped with advanced sensors and control systems, these machines ensure accurate label positioning on products, reducing errors and enhancing product presentation. | SATO CLNX Plus, Weber Legi-Air 6000 |

| Versatile Label Compatibility | Compatible with various label shapes and sizes, allowing for flexibility in branding and product information across different product lines. | Label-Aire 3115-NV Wipe-On Applicator, Videojet 9550 |

| Integration with the Production Line | Designed for seamless integration with existing production lines, these machines can synchronize with conveyors and filling or packaging systems. | Krones Contiroll, Accraply Labeler |

| Touchscreen Control Interface | User-friendly interface with touchscreen control for easy setup, adjustment, and monitoring, often equipped with diagnostics and error alerts. | Domino M-Series, Quadrel Q Series |

| Adjustable for Various Product Sizes | Adjustable components to handle a wide range of product sizes and shapes, ideal for industries with diverse product lines. | Labeling Systems LSI Series, ProMach ID Technology |

MARKET DYNAMICS

DRIVERS

- The increasing trend of automation in packaging across industries like food & beverages, pharmaceuticals, and cosmetics is driving the demand for automatic labeling machines that improve speed, accuracy, and consistency.

The demand for automatic labeling machines is rapidly increasing, driven by the broader trend of packaging automation across industries such as food & beverages, pharmaceuticals, and cosmetics. Automation in packaging helps companies achieve higher operational efficiency by reducing labor costs and increasing production speed. In the food & beverage sector, for instance, labeling machines can achieve speeds of up to 600 labels per minute, significantly enhancing throughput. Similarly, the pharmaceutical industry benefits from the precision that automatic labeling machines offer, ensuring compliance with stringent regulations for labeling accuracy. For example, pharmaceutical companies face penalties for labeling errors, making automated systems critical for minimizing human error and ensuring regulatory compliance. In cosmetics, automatic labeling helps meet the demand for diverse and customizable products, as brands increasingly focus on unique packaging and labels for various product lines. Moreover, companies can also integrate these machines with barcode scanners and RFID technology, adding an extra layer of functionality. The flexibility, accuracy, and efficiency offered by these systems make them indispensable for companies aiming to scale operations and maintain consistency in product labeling, ultimately driving significant growth in automation adoption.

- Technological advancements like RFID-enabled labels, smart labeling, and digital printing have enhanced the efficiency, accuracy, and versatility of automatic labeling machines, driving their widespread adoption across industries.

Technological advancements have significantly enhanced the capabilities of automatic labeling machines, making them more efficient and adaptable across different industries. The integration of RFID (Radio Frequency Identification) technology in labeling systems has revolutionized tracking and inventory management. RFID-enabled labels can store more information and can be read at a distance without direct line of sight, improving speed and accuracy in logistics and retail. Moreover, smart labeling technologies are gaining popularity for their ability to provide real-time data on product conditions, such as temperature and humidity, which is particularly beneficial in sectors like pharmaceuticals and food & beverages. This technology ensures better compliance with regulations and enhances product traceability. The rise of digital printing has also contributed to the market's growth. Digital printers offer high-resolution labeling with variable data printing capabilities, which is crucial for industries requiring personalized or batch-specific labels. According to research, more than 35% of businesses are expected to adopt RFID technology by 2025, highlighting the growing trend toward smarter and more efficient labeling systems.

RESTRAIN

- High initial investment costs, including installation, training, and maintenance, may deter small and medium-sized businesses from adopting automatic labeling machines, limiting market growth in cost-sensitive regions.

The adoption of automatic labeling machines is the high initial investment costs. The price of these machines can range significantly, with some advanced systems costing anywhere from USD 15,000 to USD 100,000 or more, depending on their complexity and features. This significant capital expenditure often deters small and medium-sized enterprises (SMEs) from investing in automation, especially in cost-sensitive regions. Additionally, the installation costs can add to the financial burden, with companies needing to allocate additional funds for training personnel and integrating the system with existing production lines. Maintenance and service contracts further increase the long-term operating expenses, as most machines require regular servicing to ensure optimal performance. While these systems provide long-term cost savings through increased efficiency, accuracy, and reduced labor costs, the initial outlay can be prohibitive for companies that do not have large capital reserves. According to the research over 30% of SMEs avoid automation due to the high costs involved, choosing manual labeling instead. As a result, the adoption rate of automatic labeling machines remains lower in developing regions and for businesses with smaller production volumes. This financial barrier is a key restraint limiting the broader uptake of automatic labeling systems.

KEY SEGMENTATION ANALYSIS

By Type

Self-adhesive labelers segment dominated the market share over 42.06% in 2023, due to their widespread use across various industries, including food and beverage, pharmaceuticals, cosmetics, and consumer goods. These labelers are preferred for their flexibility in labeling different products, such as bottles, jars, and containers. Their cost-effectiveness, ease of use, and ability to handle high volumes make them ideal for both small and large-scale production lines. As a result, they are the go-to choice for companies seeking efficient, reliable, and affordable labeling solutions.

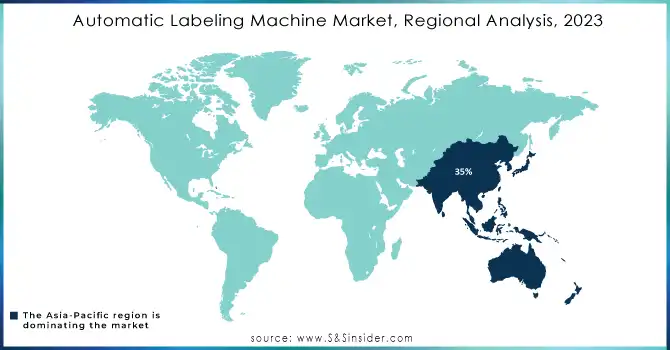

REGIONAL ANALYSIS

In 2023, the Asia-Pacific region dominated the market share over 35%. This dominance is expected to continue throughout the forecast period, driven by factors such as rapid industrialization, a large and expanding consumer base, and the growth of e-commerce. Countries like China and India lead this growth, as both nations are seeing significant advancements in their manufacturing and packaging sectors. China, with its extensive manufacturing sector and growing consumer goods industry, is particularly influential, supported by government policies favoring automation and ongoing investments in industrial automation. This strong market presence reflects Asia-Pacific’s robust manufacturing infrastructure and commitment to efficiency, making it the largest market for automated labeling machines.

North America is the fastest-growing region in the automated labeling machine market. This growth is primarily attributed to rising demand for automation in industries such as food and beverages, pharmaceuticals, and logistics, where precise labeling and efficiency are critical. The United States, in particular, benefits from a strong research and development environment and technological innovations in industrial automation, making it a significant player in the adoption of automated labeling machines. Approximately 161 million Americans, or 80% of American women, use cosmetics daily, with the average American woman using at least 16 skincare or cosmetic products each day and spending an estimated USD 250 monthly on such products.

Do You Need any Customization Research on Automatic Labeling Machine Market - Inquire Now

Key Players

-

Krones AG (Contiroll HS, Autocol, Canmatic)

-

SACMI (Modular Labelling Machine, Opera Rotary Labelling)

-

Sidel Group (RollQUATTRO Evolution, EvoDECO Multi)

-

HERMA GmbH (HERMA 500, HERMA Basic)

-

KHS GmbH (Innoket Neo, Innoket Roland 40)

-

Fuji Seal International, Inc. (Linear Labelling Machines, Rotary Labelling Machines)

-

ProMach, Inc. (EPI Flex-Pac, ID Technology LSI 250)

-

Marchesini Group (BL A420 CW, Neri BL400)

-

IMA Group (C2000 Labeler, CP4 Carton Labeling Machine)

-

Accutek Packaging Equipment Co., Inc. (APS-206 Labeler, Labelette FS Labeler)

-

Barry-Wehmiller Companies, Inc. (Accraply Sirius 100, Accraply 2040)

-

Multivac (L 310, L 330)

-

Weber Packaging Solutions (Alpha Compact, Legi-Air 4050)

-

Novexx Solutions GmbH (XLS 2.0, ALS 206)

-

Quadrel Labeling Systems (EconoLine, ModuLine)

-

Label-Aire, Inc. (3115 Wipe-On, Inline 5100)

-

Bizerba SE & Co. KG (GLM-Ievo, GLM-Bmaxx)

-

Markem-Imaje (SmartDate X60, 2200 Series)

-

Videojet Technologies, Inc. (9550 Print & Apply, Labeljet 4700)

-

ALTech UK Ltd (ALstep, ALritma)

Suppliers for Supplies labeling solutions including print-and-apply and linerless labeling machines of Automatic Labelling Machine Market:

-

Packleader USA, LLC

-

APACKS

-

Arca Labeling & Marking

-

P.E. Labellers S.p.A.

-

LabelPack Automation

-

Blister Packaging

-

CTM Labeling Systems

-

In-Line Labeling Equipment, Inc.

-

Auto Labe, Inc.

-

Advanced Labelling Systems Ltd (ALS)

RECENT DEVELOPMENTS

-

In May 2024: Krones AG launched its new Krones Varioline labeling machine, equipped with advanced modular technology to handle a broader range of container sizes and shapes. This innovation addresses the rising demand for flexible and efficient labeling solutions in the beverage and food industries.

-

In June 2024: Sacmi Imola S.C. unveiled an upgraded version of its Labelling Machine CFS, now featuring enhanced digital controls and an advanced inspection system for improved accuracy and speed. This update is designed to optimize performance in high-speed production settings and meet the growing need for precision labeling in the food and beverage sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.04 Billion |

| Market Size by 2032 | USD 4.25 Billion |

| CAGR | CAGR of 3.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Self-Adhesive/Pressure-Sensitive Labelers, Shrink-Sleeve Labelers, Glue-based Labelers) • By Industry (Food & Beverages, Pharmaceuticals, Consumer Products, Personal care & Cosmetics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Krones AG, SACMI, Sidel Group, HERMA GmbH, KHS GmbH, Fuji Seal International, Inc., ProMach, Inc., Marchesini Group, IMA Group, Accutek Packaging Equipment Co., Inc., Barry-Wehmiller Companies, Inc., Multivac, Weber Packaging Solutions, Novexx Solutions GmbH, Quadrel Labeling Systems, Label-Aire, Inc., Bizerba SE & Co. KG, Markem-Imaje, Videojet Technologies, Inc., ALTech UK Ltd. |

| Key Drivers | • The increasing trend of automation in packaging across industries like food & beverages, pharmaceuticals, and cosmetics is driving the demand for automatic labeling machines that improve speed, accuracy, and consistency. • Technological advancements like RFID-enabled labels, smart labeling, and digital printing have enhanced the efficiency, accuracy, and versatility of automatic labeling machines, driving their widespread adoption across industries. |

| RESTRAINTS | • High initial investment costs, including installation, training, and maintenance, may deter small and medium-sized businesses from adopting automatic labeling machines, limiting market growth in cost-sensitive regions. |