Embedded Controllers Market Report Scope & Overview:

Get More Information on Embedded Controllers Market - Request Sample Report

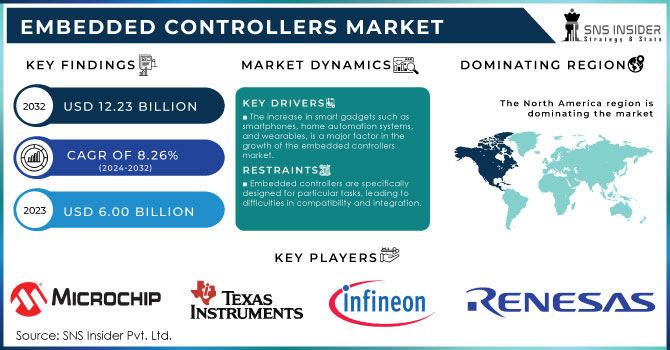

The Embedded Controllers Market was valued at USD 6.00 Billion in 2023 and is expected to reach USD 12.23 Billion by 2032, growing at a CAGR of 8.26% over the forecast period 2024-2032.

The embedded controllers market has become a crucial component of modern electronics, facilitating control, automation, and communication in a wide range of smart devices and systems. The rise of the Internet of Things (IoT) and smart technology has significantly expanded the scope of embedded controllers. With approximately 18.8 billion connected IoT devices globally as of 2024, this market is on a trajectory of rapid expansion, with forecasts predicting over 25 billion devices by 2030. Enterprise IoT continues to play a dominant role, accounting for about 73% of the total IoT market revenue as of 2024. The annual consumer smart home spending is projected to reach USD 173 billion by 2025, demonstrating a resilient and growing market driven by consumer demand for smart home technology. As of 2022, global consumer spending on smart home systems reached an estimated USD 135 billion, with projections suggesting that this figure will exceed USD 170 billion by 2025, reflecting a robust 26% growth rate. As devices become more interconnected and intelligent, the demand for controllers capable of managing complex tasks in real time has surged.

Additionally, the healthcare industry is another sector benefiting from the embedded controllers market. Medical devices such as insulin pumps, pacemakers, and medical imaging equipment utilize embedded controllers to provide precise control over critical functions, ensuring patient safety and device reliability. In this context, embedded controllers are pivotal in enabling real-time data processing and communication between healthcare systems, allowing for improved diagnostics and patient care.

Embedded Controllers Market Dynamics

Drivers

-

The increase in smart gadgets such as smartphones, home automation systems, and wearables, is a major factor in the growth of the embedded controllers market.

Embedded controllers act as the core for intelligent gadgets, managing instant processing and facilitating the incorporation of sophisticated functionalities like artificial intelligence (AI) and machine learning (ML). The increasing need for advanced embedded controllers that can efficiently perform complex tasks is driven by the rising demand for these devices in consumer electronics, healthcare, and automotive industries. With the increasing number of smart devices, manufacturers need controllers that are more powerful and consume less energy to handle tasks such as data processing, sensor management, and connectivity. The increasing use of Internet of Things (IoT) applications, in which embedded systems are crucial for connecting devices and managing data flow, has boosted demand even more. Embedded controllers play a vital role in the operation of smart home devices such as thermostats, security cameras, and lighting systems. They are in charge of multiple tasks, such as overseeing wireless connections and handling sensor information. The growing number of smart home users is driving up the demand for embedded controllers with enhanced capabilities. Smart wearables in the healthcare industry, like fitness trackers and health monitoring devices, depend on embedded controllers to handle biometric data instantly, providing precise and uninterrupted monitoring. The increased use of intelligent healthcare technologies is predicted to greatly boost the embedded controller market in the future.

-

The rising use of IoT in different sectors such as manufacturing, healthcare, and agriculture has generated a large need for embedded controllers.

In an Internet of Things environment, various devices must effectively communicate and exchange data, with embedded controllers playing a key role in overseeing these interactions. Embedded controllers handle information from sensors, oversee device connections, and guarantee smooth operations. Increased use of IoT in smart factories, smart cities, and connected agriculture will create a higher need for embedded controllers capable of managing intricate, multi-device settings. Embedded controllers are essential for automation processes in the industrial sector. They oversee robotics, machines, and assembly lines through sensor input control and real-time command execution. Embedded controllers are essential in smart factories, where machines communicate to improve production efficiency. They are essential in predictive maintenance systems as well, monitoring equipment health and sending alerts for necessary maintenance. With industries shifting towards increased automation and efficiency, there will be a growing need for embedded controllers to drive these systems.

Restraints

-

Embedded controllers are specifically designed for particular tasks, leading to difficulties in compatibility and integration.

Various devices and systems could utilize various communication protocols, operating systems, or hardware architectures, causing challenges in seamlessly integrating embedded controllers. This problem is especially common in IoT environments, where various devices from different makers must cooperate. The absence of uniformity among devices and platforms may result in integration problems, raising both the level of complexity and expenses. Manufacturers frequently have to dedicate time and resources to create tailored solutions to guarantee that embedded controllers can communicate and operate effectively in a broader system. The absence of compatibility among devices and systems may restrict the expansion of solutions, diminishing the attractiveness of embedded controllers in extensive industrial or IoT implementations. Compatibility problems could also hinder the integration of embedded controllers in new markets or applications.

Embedded Controllers Market Segmentation Overview

By Type:

Simple Programmable Logic Devices (SPLDs) led the market with over 55% market share in 2023, due to their cost-effectiveness, simplicity, and widespread adoption in various industries. SPLDs are commonly utilized for simple control tasks and digital logic operations that do not need intricate programming. SPLDs are utilized in consumer electronics, automotive systems, and industrial controls, offering effective solutions for embedded system designs. Examples of SPLDs commonly utilized in simple control and interface tasks include Altera’s MAX series and Lattice Semiconductor’s GAL devices.

Complex Programmable Logic Devices (CPLDs) are anticipated to be the fastest-growing segment because of their advanced features and increased complexity. CPLDs are preferred over SPLDs for advanced applications needing complex digital logic and interfacing tasks due to their superior logic density, flexibility, and speed. These devices play a vital role in industries such as telecommunications, aerospace, and high-performance industrial systems. Xilinx's CoolRunner and Intel's MAX 10 CPLDs are commonly utilized in advanced networking gear and automotive systems, offering improved flexibility for customized logic and control operations.

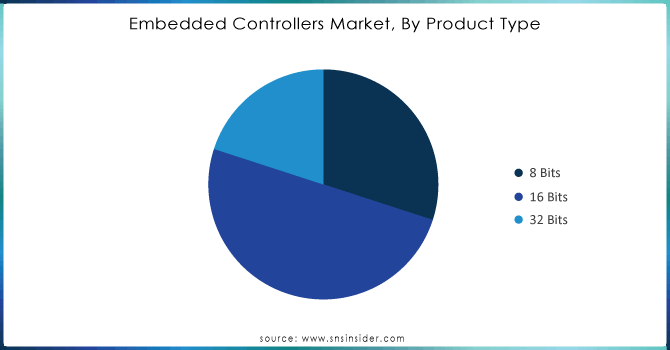

By Product Type

The 16 Bits segment led the market in 2023 with a 50% market share because of its well-rounded performance, affordability, and flexibility. These controllers offer enough processing power and memory for various uses, leading to their popularity in the automotive, industrial, and consumer electronics industries. For example, companies such as Texas Instruments and Microchip Technology provide 16-bit controllers for automotive systems such as ADAS and ECUs, as well as for robotics and factory control systems in industrial automation.

The 8 Bits segment is going to be the fastest-growing segment in 2023 because of its low energy consumption and cost, making it perfect for basic, energy-saving gadgets. These controllers are frequently utilized in intelligent devices, IoT technologies, and simple automation duties, prioritizing ease of use and minimal energy consumption. Atmel and STMicroelectronics offer widely used 8-bit controllers in products such as household appliances and basic IoT devices, contributing to the fast expansion of this market segment.

Need Any Customization Research On Embedded Controllers Market- Inquiry Now

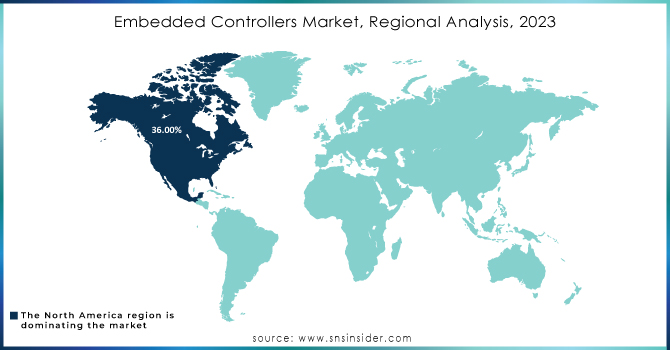

Embedded Controllers Market Regional Analysis

North America led the market in 2023 with a 36.00% market share, due to its strong technological infrastructure, innovation, and high demand from sectors such as automotive, aerospace, and healthcare. The presence of top companies such as Intel, Texas Instruments, and Microchip Technology places the U.S. at the forefront of the region. These companies play a crucial role in integrating controllers into sophisticated technologies like electric cars, medical equipment, and smart houses. Furthermore, the increasing use of IoT (Internet of Things) and smart automation technologies in both industrial and consumer industries helps drive the demand. The area's robust research and development capabilities enhance its global market position even more.

APAC is accounted to experience the most rapid growth rate during 2024-2032 in the embedded controllers market, fueled by industrialization and technological progress in nations such as China, Japan, and South Korea. Renesas Electronics and Fujitsu are dominant in the market, offering embedded controllers for various applications such as consumer electronics, telecommunications, and automotive systems. The increasing demand for smart devices, 5G infrastructure, and electric vehicles in countries like India and China is also driving the growth of APAC, fueling the adoption of embedded controllers across various sectors.

Key Players in Embedded Controllers Market

The major key players in the Embedded Controllers Market are:

-

Microchip Technology Inc. (PIC Microcontrollers, AVR Microcontrollers)

-

NXP Semiconductors (LPC Microcontrollers, Kinetis Microcontrollers)

-

Texas Instruments (MSP430 Microcontrollers, Tiva C Series Microcontrollers)

-

STMicroelectronics (STM32 Microcontrollers, SPC560 Microcontrollers)

-

Infineon Technologies (AURIX Microcontrollers, XMC Microcontrollers)

-

Renesas Electronics (RX Microcontrollers, RL78 Microcontrollers)

-

Analog Devices (ADuC Microcontrollers, Blackfin Processors)

-

Atmel Corporation (ATmega Microcontrollers, SAM Microcontrollers)

-

Broadcom Inc. (BCM2837 SoC for Raspberry Pi, Broadcom Microcontrollers)

-

Cypress Semiconductor (PSoC Microcontrollers, Traveo Microcontrollers)

-

Silicon Labs (EFM32 Gecko Microcontrollers, EFR32 Wireless Microcontrollers)

-

Microsemi Corporation (SmartFusion2 SoC, IGLOO2 FPGAs)

-

Raspberry Pi Foundation (Raspberry Pi Compute Module, Raspberry Pi Pico)

-

Espressif Systems (ESP8266, ESP32 Microcontrollers)

-

ON Semiconductor (RSL10 Bluetooth Low Energy SoC, S32K Microcontrollers)

-

Nordic Semiconductor (nRF52 Series, nRF91 Series)

-

Qualcomm (Snapdragon Ride Platform, QCC Series Audio SoCs)

-

Infineon Technologies (XMC1000 Microcontrollers, AURIX TC3xx Microcontrollers)

-

Lattice Semiconductor (ECP5 FPGAs, iCE40 FPGAs)

-

Cavium (a Marvell Technology Group company) (ThunderX Processors, OCTEON Processors)

Suppliers of Embedded Controllers

-

Digi-Key Electronics (Various microcontrollers and development boards)

-

Mouser Electronics (Embedded controllers from multiple manufacturers)

-

Arrow Electronics (Microcontrollers, SoCs from various manufacturers)

-

Newark (Embedded microcontrollers and evaluation kits)

-

Farnell (Microcontrollers and development boards)

-

RS Components (Embedded systems and microcontroller units)

-

Future Electronics (Microcontrollers and related components)

-

element14 (Microcontroller solutions and development kits)

-

TME (Transfer Multisort Elektronik) (Embedded controllers and accessories)

-

Allied Electronics & Automation (Microcontrollers and embedded system components)

Recent Development

-

June 2024: Texas Instruments released its TMS570LC43x series of embedded controllers designed for automotive safety-critical applications. This series boasts real-time performance and enhanced security features, adhering to automotive safety standards such as ISO 26262.

-

February 2024: Microchip launched its PIC32CX-BZ2 family of microcontrollers focused on IoT and wireless communication applications. It supports Bluetooth Low Energy and Zigbee protocols, targeting smart home and industrial IoT systems.

-

January 2024: STMicroelectronics released the STM32MP13 series, expanding its STM32 family. These controllers are designed for energy-efficient edge computing, offering low-power operation and enhanced connectivity, making them ideal for smart devices and industrial applications.

| Market Size in 2023 | USD 6.00 Billion |

|---|---|

| Market Size by 2032 | USD 12.23 Billion |

| CAGR | CAGR of 8.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Simple Programmable Logic Devices, Complex Programmable Logic Devices) • By Product Type (8 Bits, 16 Bits, 32 Bits) • By Application (Telecommunication, Automotive, Consumer Electronics, Healthcare, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microchip Technology Inc., NXP Semiconductors, Texas Instruments, STMicroelectronics, Infineon Technologies, Renesas Electronics, Analog Devices, Atmel Corporation, Broadcom Inc., Cypress Semiconductor, Silicon Labs, Microsemi Corporation, Raspberry Pi Foundation, Espressif Systems, ON Semiconductor, Nordic Semiconductor, Qualcomm, Lattice Semiconductor, Cavium |

| Key Drivers | • The increase in smart gadgets such as smartphones, home automation systems, and wearables, is a major factor in the growth of the embedded controllers market. • The rising use of IoT in different sectors such as manufacturing, healthcare, and agriculture has generated a large need for embedded controllers. |

| RESTRAINTS | • Embedded controllers are specifically designed for particular tasks, leading to difficulties in compatibility and integration. |