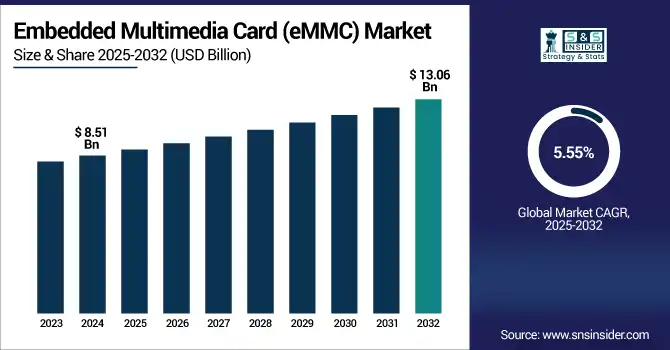

Embedded Multimedia Card (eMMC) Market Size Analysis:

The Embedded Multimedia Card (eMMC) Market size was valued at USD 8.51 billion in 2024 and is expected to reach USD 13.06 billion by 2032 and grow at a CAGR of 5.55% over the forecast period 2025-2032.

To Get more information on Embedded Multimedia Card (eMMC) Market - Request Free Sample Report

The global market provides an in-depth Embedded multimedia card (eMMC) market analysis of key growth patterns, regional dynamics, significant segments and competitive landscape. Global eMMC adoption driven by increasing demand for compact, reliable and cost-effective embedded storage for smartphones and tablets, automotive and industrial IoT devices. This growth is enhanced by continuous improvement in memory density, data transfer speeds, and easy integration with embedded systems in varied industry verticals.

For instance, over 70% of mid-range smartphones globally continue to rely on eMMC as their primary storage interface.

The U.S. Embedded Multimedia Card (eMMC) Market size was USD 2.14 billion in 2024 and is expected to reach USD 3.22 billion by 2032, growing at a CAGR of 5.28% over the forecast period of 2025–2032.

In the U.S. market, increasing demand for compact and economical storage in consumer electronics and automotive systems is contributing to high growth. Embedded multimedia card (eMMC) market growth is also driven by the expanding IoT infrastructure that is generating strong demand for foundational eMMC integration to accelerate the deployment of infotainment units, and increasing demand for reliable embedded memory in connected smart devices

For instance, over 75% of the U.S. smartphones in the mid-tier segment continue to use eMMC as standard embedded storage.

eMMC Market Dynamics:

Key Drivers:

-

Automotive Infotainment and ADAS Integration Accelerates Demand for Reliable Embedded Memory Solutions

With the increasing intelligence of vehicles and the centralization of automotive software, demand for embedded memory to support map, media, diagnostic, and real-time navigation update storage is also on the rise. Vehicle environments are already well suited for embedded multimedia card (eMMC) market with increased reliability, longevity, and small form factor integration. An ever-increasing number of Automotive OEMs incorporate eMMC into infotainment consoles, telematics systems, and Advanced Driver Assistance Systems (ADAS). Trends such as connected cars and V2X communications further drive a need for reliable embedded memory solutions such as eMMC in next-gen mobility platforms, as the electric vehicle (EV) ecosystem evolves.

For instance, over 85% of modern infotainment systems in vehicles use embedded memory modules, with eMMC being a primary choice.

Restraints:

-

Performance Limitations of eMMC Compared to UFS and SSD Technologies Hinder Market Penetration

For data transfer speed, scalability, and multitask use, embedded multimedia card (eMMC) market is getting beaten by layers of memory tech, such as Universal Flash Storage (UFS) and Solid-State Drives (SSDs). It provides full-duplex communication and has greater bandwidth than eMMC, which is better suited for high-performance applications. With OEMs now moving to these new-age solutions for mid to high-end devices and laptops, eMMC is likely to slowly lose its market share. eMMC has its own restrictions, such as half-duplex transmission and lower read/write speed which greatly limit the application range for high-end computing systems.

Opportunities:

-

Industrial IoT Expansion Creates Demand for Durable and Compact Embedded Storage Solutions

Industrial and IoT devices need more and more high-endurance, non-volatile memory for boot, firmware, and sensor data. The extended temperature operation, shock resistance, and long write endurance of the embedded multimedia card (eMMC) market technology enable high reliability for embedded applications in smart meters, gateways, control systems, and edge devices. The rapid automation across sectors including manufacturing, utilities, and logistics, along with the advent of smart factories and edge computing, opens up attractive market opportunities for eMMC vendors to meet the durable memory needs of mission-critical IoT deployments.

For instance, over 70% of industrial edge devices rely on eMMC for local storage due to size and reliability.

Challenges:

- Complex Data Processing Architecture Requires Infrastructure Upgrades and Advanced Event-Based Software Compatibility

While eMMC memory integration have been standardized, incorporating it in a broad spectrum of devices with diverse firmware requirements, covered from smartphones to automotive ECUs, interface standards, and the remaining design cycles for performance optimization and tuning, can be extremely challenging. From a business standpoint, OEMs have to have their architectures aligned with processor architectures, I/O speeds and thermal limits. This added layer of integration complexity leads to prolonged product development cycles and surplus engineering overhead. In addition, the automotive and industrial use cases require extensive testing, which leads to the increasing of the overall design cycle. Such challenges restrict embedded multimedia card (eMMC) market from its deployment in fast-paced product segments which, in turn, have stringent launch schedules.

Embedded Multimedia Card Market Segmentation Analysis:

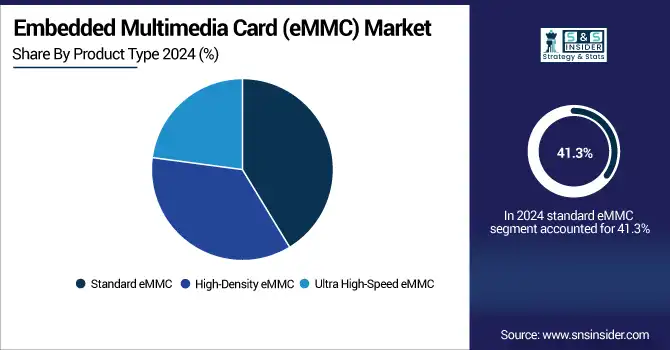

By Product Type

In 2024, the standard eMMC segment accounted for the largest revenue share of 41.3% on account of large-scale implementation in low-cost devices including budget smartphones, tablets, smart TVs, and STBs. Standard eMMC (in which eMMC is treated as a parallel peripheral device) is the most common and manufacturers prefer it for its cost-benefit balance and compatibility with embedded applications. Key memory solutions provider Micron Technology is ramping up supply of mainstream eMmc modules as usual. Furthermore, its widespread adoption across industries further solidifies its universal supremacy over mainstream consumer electronics globally.

Ultra High-Speed eMMC is expected to grow at the fastest rate of 6.14% CAGR during 2024–2032 owing to the increasing need for high-performance applications including gaming consoles and advanced infotainment systems. These apps need comparatively faster data processing capabilities and better response times. Samsung Electronics has been enhancing the speed eMMC as a new alternative for next-generation smart devices. The segment's rapid growth can be attributed to its NAND flash technology innovation.

By Application

In 2024, the Smartphones and Tablets category had the highest share in the market, at 46.2%, due to the mass production of mid-tier mobile devices globally. For many of these devices, eMMC fulfills two objectives, and it is a relatively low-cost solution that, aside from an initial set up time, consumes very little power, combined with the fact that its performance characteristics match its intended application. At SK hynix, one of the biggest semiconductor manufacturers globally, optimized eMMC solutions for mobile platforms are available. MPS' partnerships with large smartphone OEMs illustrate this segment's continued strength as an embedded memory opportunity.

The automotive segment is anticipated to grow the fastest at a CAGR of 6.89% during 2024-2032 owing to the rising integration of advanced infotainment, ADAS, and connected features in modern vehicles. Automotive-class systems inherently require ruggedized embedded memory and find it essential. Recently, Kioxia Corporation has expanded its automotive eMMC lineup, offering memory solutions that satisfy the AEC-Q100 grade 2 standards. Its technology enables increasing requirements of long-lasting and high-endurance memory in new-generation electric and autonomous vehicles.

By Storage Capacity

The 8GB–16GB segment held the largest embedded multimedia card (eMMC) market share, with 37.60% in 2024, along with usage in smart wearables, low-end smartphones, and connected IoT devices, particularly utilized for the mass market in 2021, assisted in expansion of the segment. Such devices benefit from trustworthy storage at a low price point. The eMMC solutions in this range are offered by Western Digital and are used extensively in entry-level consumer electronics. Their cost-effectiveness, established architecture, and durability have kept these configurations popular in the low-to-mid tier market.

128GB-256GB segment is predicted to grow at the fastest CAGR of 6.93% during 2024-2032 due to the rising demand in AI-enabled devices, infotainment systems, and smart surveillance solutions. Such applications involve a lot of data operations, which need high-capacity memory. Kingston Technology is working on eMMCs with such capacities for embedded spaces that require fast and reliable components. The company now has a range of high-density flash modules to meet these storage needs in a growing list of next-gen electronics and industrial applications.

By End-User

The Consumer Electronics segment held the largest Embedded multimedia card (eMMC) market share owing to high-volume production of devices, such as TVs and other devices with DSLR cameras and tablets, recording a revenue share of 39.80% in 2024. These devices use eMMC for transparent storage. ADATA Technology, a leading manufacturer of high-performance SSD, DRAM modules, and consumer electronic products, provides eMMC solutions for many smart consumer devices. The company has a diversified presence globally in various electronics manufacturing which helps its unit sustain a dominant position due to maintained supply and innovation in this segment.

Automotive segment of embedded storage is expected to experience the highest growth in terms of CAGR of 7.12% during 2024-2032, driven by the growing use of embedded storage in electric and autonomous vehicles for navigation purposes, telemetry, and user interface (UI) purposes. The automotive industry requires durable, long-lifecycle memory. Swissbit AG provides automotive-grade eMMC, suitable to work under extreme conditions. Through automotive-compliant solutions, it addresses the memory requirements of next-generation vehicle architectures and the changing face of in-vehicle infotainment.

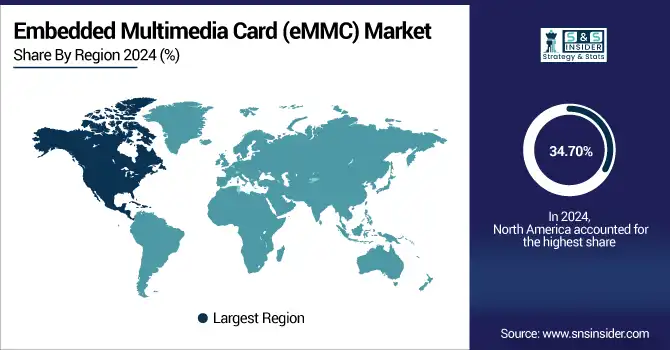

Embedded Multimedia Card (eMMC) Market Regional Insights:

North America has dominated the Embedded multimedia card (eMMC) market with about 34.70% of the revenue share owing to the high penetration rate of consumer electronics, automotive electronics, and embedded computing systems in the region. Moreover, the dominance can be attributed to the robust R&D ecosystem in the region, and presence of widespread digitalization and high adoption of advanced infotainment and telematics solutions in the automotive sector in the region. The U.K. semiconductor manufacturers, and early technology adopters in the U.S. and Canada, remain positioned for solid market leadership.

-

The U.S. dominates the North American eMMC market due to its strong presence in consumer electronics manufacturing, advanced automotive technology adoption, and early integration of embedded memory in IoT devices, supported by leading semiconductor companies and high R&D investments.

Asia Pacific is anticipated to witness the highest growth, in terms of CAGR of 6.47%, during the upcoming years. High electronics manufacturing hub in China, South Korea, Japan, and India are some prominent factors augmenting the market growth in the Asia Pacific region. The rapid growth in the region is attributed to the increasing smartphone penetration, expanding automotive production, and extensive government support for digital transformation and smart infrastructure. Asia Pacific continues to be the key regions with high expansion potential for eMMC adoption due to the emergence of low-cost manufacturing combined with the increasing demand from regional origin equipment manufacturers (OEM).

-

China leads the Asia Pacific eMMC market owing to its massive electronics production capacity, growing smartphone and automotive sectors, and cost-effective manufacturing ecosystem, with strong government support and domestic giants such as Huawei and Xiaomi driving high-volume eMMC demand.

In Europe, the growth of Embedded Multimedia Card (eMMC) market is decent, mainly due to the developments in automotive electronics, industrial automation and smart consumer devices. eMMC integration in infotainment and ADAS systems is on the rise owing to the strong automotive manufacturing base in the region, particularly Germany and France. Moreover, the market growth in Europe is also attributed to the increasing adoption of IoT and embedded technologies in healthcare and energy sectors.

-

Germany dominates Europe’s eMMC market due to its strong automotive industry, where embedded memory is essential for infotainment and ADAS. Its leadership in industrial automation, electronics manufacturing, and sustained R&D investments further solidify Germany’s position in the regional embedded storage landscape.

UAE dominates the Middle East & Africa Embedded multimedia card (eMMC) market given the presence of smart city projects, increasing electronics consumption and well-developed digital infrastructure. Brazil accounts for the bulk of the global market for Israel in Latin America, as the country has a well-established consumer electronics manufacturing ecosystem, a growing automotive sector and an emerging demand for embedded memory in connected and smart devices.

Get Customized Report as per Your Business Requirement - Enquiry Now

Embedded Multimedia Card Companies are:

Major key players in Embedded Multimedia Card (eMMC) Market are Samsung Electronics, SK hynix, Micron Technology, Toshiba Corporation, Western Digital, Kingston Technology, Kioxia Holdings Corporation, Intel Corporation, ADATA Technology, Transcend Information Inc., Swissbit AG, Phison Electronics Corporation, Greenliant Systems, Silicon Motion Technology Corporation, STMicroelectronics, Nanya Technology Corporation, Winbond Electronics Corporation, Macronix International Co., Ltd., Viking Technology, and Shenzhen Longsys Electronics Co., Ltd and others.

Recent Developments:

-

In July 2025, Samsung’s eMMC 5.1 flash modules achieved sequential read/write speeds up to 330 MB/s and 200 MB/s (64 GB), enhancing performance efficiency for slimmer mobile designs.

-

In April 2025, Micron released an automotive-optimized eMMC variant with 25% faster data rates and improved thermal endurance, aimed at infotainment and ADAS systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.51 Billion |

| Market Size by 2032 | USD 13.06 Billion |

| CAGR | CAGR of 5.55% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Standard eMMC, High-Density eMMC and Ultra High-Speed eMMC) • By Application (Smartphones and Tablets, Consumer Electronics, Automotive and Industrial Devices) • By Storage Capacity (2GB-4GB, 8GB-16GB, 32GB-64GB and 128GB-256GB) • By End-User (Automotive, Aerospace and Defense, Consumer Electronics, IT and Telecom, Healthcare and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Samsung Electronics, SK hynix, Micron Technology, Toshiba Corporation, Western Digital, Kingston Technology, Kioxia Holdings Corporation, Intel Corporation, ADATA Technology, Transcend Information Inc., Swissbit AG, Phison Electronics Corporation, Greenliant Systems, Silicon Motion Technology Corporation, STMicroelectronics, Nanya Technology Corporation, Winbond Electronics Corporation, Macronix International Co., Ltd., Viking Technology and Shenzhen Longsys Electronics Co., Ltd. |