Smart Headphones Market Size & Growth Trends:

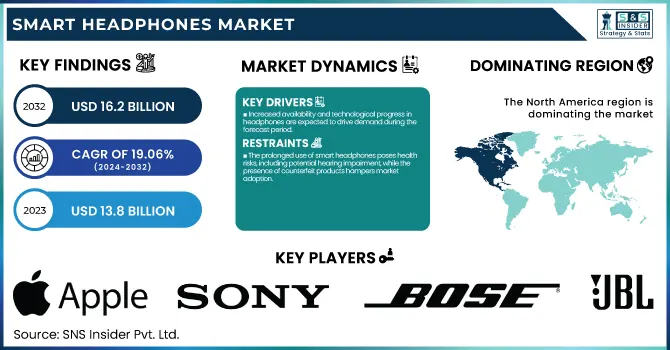

The Smart Headphones Market Size was valued at USD 16.43 Billion in 2024 and is expected to grow at a CAGR of 19.06% to reach USD 66.33 Billion by 2032. This report considers the Smart Headphones Market and analyzes key trends shaping its growth. Global smart headphone sales vary by region, with North America and Asia-Pacific leading due to high consumer demand and technological advancements. The adoption of noise-cancellation technology continues to rise as consumers seek immersive audio experiences for work and leisure.

The market is witnessing a strong shift toward wireless smart headphones, driven by convenience, improved battery life, and AI assistant integration. Additionally, average selling price trends indicate a growing demand for premium models, fueled by advanced features and brand positioning. The report also highlights emerging trends such as AI-powered functionalities and health-tracking capabilities.

Smart Headphones Market Size and Forecast

-

Market Size in 2024: USD 16.43 Billion

-

Market Size by 2032: USD 66.33 Billion

-

CAGR: 19.06% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Get more information on Smart Headphones Market - Request Sample Report

Smart Headphones Market Trends (with stats):

-

Growing adoption of ANC and adaptive audio is driving upgrades, with over 65% of premium headphone sales featuring active noise cancellation.

-

Rising demand for voice assistant integration is accelerating smart features, as nearly 55% of users prefer headphones with built-in AI assistants.

-

Expansion of wireless and true wireless (TWS) models dominates sales, accounting for over 70% of global headphone shipments.

-

Increasing focus on health and biometric tracking (heart rate, motion sensing) is emerging, with smart audio wearables growing at a CAGR above 12%.

-

Growth of gaming, streaming, and remote work is boosting demand for low-latency, high-fidelity audio, contributing to 20% annual growth in premium smart headphone demand.

Smart Headphones Market Growth Drivers:

-

Increased availability and technological progress in headphones are expected to drive demand during the forecast period.

Headphones serve as essential accessories for a wide range of electronic infotainment devices, including mobile phones, computers, automotive infotainment systems, digital music systems, and digital TVs, among others, all of which are experiencing rapid sales growth. Smart headphones offer numerous advantages such as portability, mobility, freedom from wire maintenance, ease of use, and high-definition sound quality. Consequently, the increased usage of infotainment devices is a key driver propelling the growth of the smart headphones market. Moreover, ongoing technological advancements are expected to create lucrative opportunities for the industry. Features like Bluetooth/NFC connectivity, Wi-Fi compatibility, language translation capabilities, noise-canceling technology, fitness and heart rate tracking functionalities, voice-based personal assistants, contextual location-based suggestions, environment-based noise suppression or audio enhancement, as well as gesture and touch-based control, have all contributed to the growing adoption of smart headphones in both consumer and commercial settings.

Smart Headphones Market Restraints:

-

The prolonged use of smart headphones poses health risks, including potential hearing impairment, while the presence of counterfeit products hampers market adoption.

Prolonged exposure to high sound levels from audio devices, exceeding 85 dB for eight hours or 100 dB for fifteen minutes, can lead to temporary or even permanent hearing loss. According to the World Health Organization (WHO), over 22 million young individuals have suffered impaired hearing due to excessive noise exposure from wireless devices. The detrimental effects of overusing headphones on consumers' hearing capabilities not only restrict their adoption but also hinder the market's growth. Another challenge impeding market expansion is the prevalence of counterfeit products in the market.

Smart Headphones Market Opportunities:

-

Increasing Embrace of Wireless Technology

The increasing preference for wireless connectivity solutions, driven by consumer demand for mobility and convenience, is driving the adoption of Bluetooth-enabled smart headphones. Wireless headphones offer users freedom of movement without the constraints of tangled wires, making them ideal for active lifestyles and on-the-go usage. Bluetooth connectivity allows seamless pairing with a wide range of devices, including smartphones, tablets, and laptops, enabling versatile usage scenarios. Additionally, advancements in wireless technology, such as improved battery life and connectivity stability, further contribute to the growing popularity of wireless smart headphones among consumers. As a result, there is a growing market opportunity for manufacturers to capitalize on the rising trend towards wireless audio solutions.

Smart Headphones Market Segment Analysis:

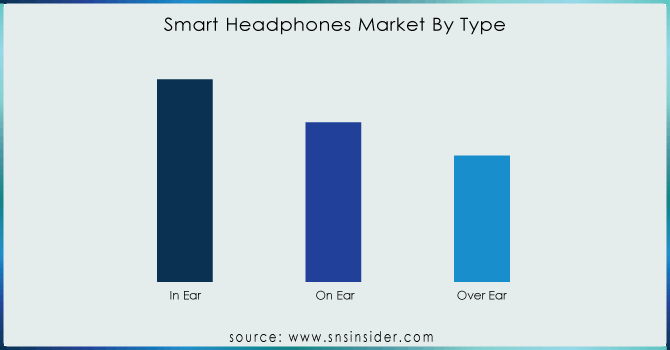

By Type

The in-ear category dominates the smart headphones market, thanks to its small form factor, portability, and progress made in true wireless stereo. The demand has been driven by the growing number of in-ear models with active noise cancellation well as improved battery life and AI integration. Consumers use in-ear headphones for fitness applications, travel, and daily use, increasing their market share. Enhancing this audio experience and with personalized sound features, the segment should remain dominant, with future innovations from the likes of Apple, Sony, Bose, etc.

The over-ear segment is anticipated to grow at the fastest rate owing to the rising requirement for high-fidelity sound and sound immersion. A growing list of applications in space audio, gaming, and professional-readiness are driving rapid growth in this category. On the other hand, if you don’t mind a slightly bulkier device, over-ear smart headphones have better noise cancellation and longer battery life; they work great for audiophiles and professionals alike.

By Connectivity

The wireless segment dominated the smart headphones market and accounted for 69% of revenue share, primarily due to Bluetooth adoption, true wired stereo earbuds, and consumer inclination towards a wire-free space. Other such features include active noise cancellation, AI-driven voice assistants, and effortless connectivity across devices, which have also been a pillar for growth. Big names like Apple, Sony, and Bose are still pushing the technology forward, too, thanks to increased battery life, spatial audio, adaptive sound, and more. The growing trend of consumers moving to wireless solutions for their fitness, work, and entertainment needs is expected to keep this segment dominant, over the coming years.

The wired segment is expected to register the fastest CAGR during the forecast period, driven by the rise in demand from audiophiles, gamers, and professional users. Wired headpieces deliver better sound quality with minimal latency hence, they're the preferred choice for studio recording and gaming applications. The trend toward high-resolution audio and lossless music streaming is also fueling interest in wired models.

By Distribution Channel

The online segment dominated the market and accounted for the largest share of the smart headphones market with the increasing penetration of e-commerce channels including Amazon, Flipkart, and Alibaba. Competitive prices and discounts and the convenience of online shopping and there is a wide variety of products available to consumers. Brands are using direct-to-consumer strategies and launching their products online exclusively to drive sales. Growth in consumers using digital forms of payment, and well-defined returns policies, also bolster consumer confidence.

The offline segment is expected to register the fastest CAGR during the forecast period, Due to the growing preference for product testing in stores and the expansion of branded retail outlets. Physical retail, from specialized electronics stores to hypermarkets, offers customers an opportunity to get hands-on experience and seek expert help on avant-garde products — and best of all, their product availability instant. Moreover, collaboration between manufacturers and retail chains is fuelling offline sales.

Get Customized Report as per your Business Requirement - Request For Customized Report

Smart Headphones Market Regional Analysis:

North America Smart Headphones Market Insights

North American region dominated the market and accounted for 38% of the revenue share, driven by high consumer willingness to spend on high-end audio devices, availability of established brands, and the early adoption of advanced technologies. Apple, Bose, and Beats are some of the major players in this well-established consumer electronics industry. Market growth is driven by factors including the increasing demand for AI-powered voice assistants, increasing adoption of wireless audio solutions, and the rise of remote work and fitness activities.

Asia Pacific Smart Headphones Market Insights

Asia-Pacific region is anticipated to witness the fastest CAGR during the forecast period, owing to increasing disposable incomes, growing smartphone penetration, and high demand for enhanced audio quality experiences. Rapid urbanization and a growing tech-savvy populace position countries like China, India, and Japan as major contributors to the growth of this market. Regional players such as Sony, Xiaomi, and OnePlus, along with manufacturing advantages help to accelerate the growth of the market.

Europe Smart Headphones Market Insights

The Europe smart headphones market is witnessing strong growth, fueled by rising adoption of wireless audio devices, increasing consumer spending on premium electronics, and a growing preference for noise-canceling and AI-enabled features. Demand is further driven by expanding music streaming, gaming, and remote work trends, positioning Europe as a significant market for innovation and premium offerings

Latin America (LATAM) and Middle East & Africa (MEA) Smart Headphones Market Insights

The LATAM and MEA smart headphones market is expanding steadily, supported by rising smartphone penetration, increasing internet connectivity, and growing adoption of affordable wireless audio solutions. Younger demographics and music-centric lifestyles are accelerating demand. Additionally, e-commerce expansion and falling device prices are making smart headphones more accessible, driving growth opportunities across these emerging markets.

Smart Headphones Market Key Players:

-

Apple – AirPods Pro 2

-

Sony – WH-1000XM5

-

Bose Corporation – QuietComfort Ultra Headphones

-

Samsung – Galaxy Buds 2 Pro

-

Sennheiser – Momentum 4 Wireless

-

JBL – JBL Tour One M2

-

Beats by Dre – Beats Studio Pro

-

Anker Soundcore – Soundcore Space Q45

-

Jabra – Jabra Elite 7 Pro

-

Shure – Shure AONIC 50

-

Bang & Olufsen – Beoplay HX

-

Logitech – Ultimate Ears Fits

-

Razer – Razer Barracuda Pro

-

Skullcandy – Skullcandy Crusher ANC 2

-

boAt – boAt Nirvana 751 ANC

-

Plantronics (Poly)

-

Harman Kardon

-

Philips

-

Pioneer

-

Lenovo

Competitive Landscape for Smart Headphones Market:

Apple dominates the smart headphones market with its AirPods lineup, particularly the AirPods Pro 2, which feature active noise cancellation, spatial audio, and seamless integration with the Apple ecosystem. Leveraging its strong brand presence, advanced technology, and loyal customer base, Apple continues to drive innovation and premium demand in wireless audio solutions.

-

September 2024: Apple updated the AirPods Max, introducing USB-C charging and new color options, including Midnight, Starlight, Blue, Purple, and Orange.

| Report Attributes | Details |

| Market Size in 2024 | USD 16.43 Billion |

| Market Size by 2032 | USD 66.33 Billion |

| CAGR | CAGR of 19.06% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (In Ear, On Ear, Over Ear) • By Connectivity (Wired, Wireless) • By Distribution Channel (Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Apple, Sony, Bose Corporation, Samsung, Sennheiser, JBL, Beats by Dre, Anker Soundcore, Jabra, Shure, Bang & Olufsen, Logitech, Razer, Skullcandy, boAt, Plantronics (Poly), Harman Kardon, Philips, Pioneer, Lenovo. |