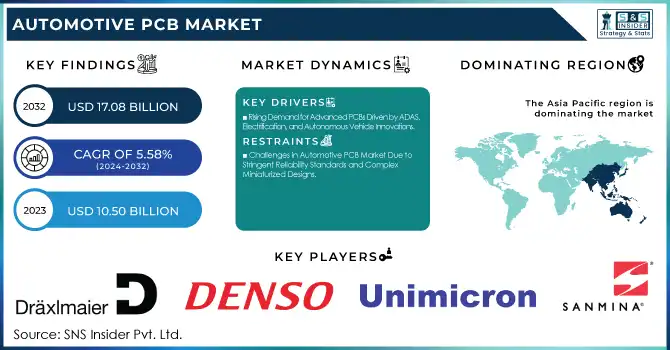

Automotive PCB Market Size & Growth:

The Automotive PCB Market Size was valued at USD 10.50 billion in 2023 and is expected to reach USD 17.08 billion by 2032, growing at a CAGR of 5.58% over the forecast period 2024-2032. Rising penetration of EVs, ADAS, and advanced infotainment systems is anticipated to boost demand for high-density and multi-layer PCBs, propelling the growth of the Automotive PCB market. On the technological side miniaturization, flexible PCBs, and heat-resistant materials makes it more durable. Increased thermal stability and vibration resistance but still all about reliability. With consumers preferring smart, connected vehicles, automakers are forced to incorporate high-performance electronics, catalyzing PCB innovation and market.

To Get more information on Aviation Crew Management Systems Market - Request Free Sample Report

Automotive Printed Circuit Board Market Dynamics

Key Drivers:

-

Rising Demand for Advanced PCBs Driven by ADAS, Electrification, and Autonomous Vehicle Innovations

The automotive PCB market is highly driven by the increasing implementation of advanced driver assistance systems (ADAS) and heightened electrification in vehicles. With safety norms tightening, automobile manufacturers are adding more and more electronic components, including sensors, cameras, and LiDAR, to vehicles, and, in turn, automotive electronics manufacturers need high-end PCBs. Moreover, PCB demand is bolstered by the fast-growing electric vehicle (EV) market, which requires a multitude of power electronics, battery management systems, and infotainment solutions for hybrid and fully electric vehicles. As the automotive industry transitions towards autonomous and semi-autonomous driving, the commencement of revolutionizing PCB in this sector also escalates, augmenting manufacturers to focus on new ventures and striving to create compact and more dependable PCB designs.

Restrain:

-

Challenges in Automotive PCB Market Due to Stringent Reliability Standards and Complex Miniaturized Designs

The high reliability and durability of the PCBs withstanding rough environmental conditions is one of the major barriers to the automotive PCB market. Automotive electronics are subjected to extreme temperatures, vibrations, and humidity, thus necessitating stringent testing and high manufacturing standards. High reliability with stringent industry certifications represents a challenge for manufacturers and results in increased development cycles. The rising miniaturization of electronic components has also made complex PCB designs with several layers and high-density interconnects very popular, but manufacturing at scale can be challenging with measurable performance loss.

Opportunity:

-

Expanding Opportunities in Automotive PCB Market with HDI Flexible Designs Smart Mobility and Sustainability

The growing requirement for higher density interconnect (HDI) and flexible PCBs in today's vehicles realizing better performance is one of the major opportunities. Growing investments in autonomous driving and vehicle connectivity create opportunities for PCB suppliers to broaden their portfolio. The introduction of smart mobility solutions and connected car ecosystems also drives new revenue channels for PCB manufacturers. The growing emphasis on eco-friendly and power-efficient equipment components is anticipated to provide the scope for sustainable and lightweight PCB solution-based companies in the automotive industry. The same will be true for companies that come up with new products that can be miniaturized, that are more resistant to the conditions in a car, and that manage heat and cooling better as automotive electronics continue to evolve.

Challenges:

-

Challenges in Automotive PCB Market with Rapid Tech Evolution Supply Chain Disruptions and Quality Demands

Keeping up with emerging automotive trends, such as autonomous driving and V2X (vehicle-to-everything) communication, has become increasingly difficult due to the rapid evolution of technology in the automotive space. This necessitates the need for PCB manufacturers to continue investing in research and development that can help meet the rising demand for high-speed, low-latency data transmission along with electromagnetic compatibility (EMC). Supply chain disruptions, specifically the sourcing of critical raw materials such as copper foil and specific substrates, represent another major challenge. Material shortages and geopolitical uncertainties have the potential to delay production schedules with ramifications for OEMs and Tier 1 suppliers. Besides, achieving high quality in mass production is still a challenge as automotive PCBs have to be free of defects otherwise critical system failure happens, leading to safety issues.

Automotive PCB Market Segmentation Outlook

By Type

Double-sided PCBs dominated the Automotive PCB Market and are expected to maintain the largest share of 38.6% in 2023 These printed circuit boards (PCBs) have been used in vehicle electronics for a long time, as they provide a great compromise between cost and overall performance, making them versatile for numerous applications. Because of their ability to support components on both sides of the PCB while still being relatively easy to manufacture, they are a favorable solution for critical automotive systems such as lighting, infotainment, and engine control units (ECUs).

The fastest-growing type of these PCBs will be the multi-layer with a compound annual growth rate (CAGR) from 2024 to 2032. The vehicle's transformation into a multipurpose mobile power wearable is increasing the demand for complex high-performance electronic systems, which is particularly crucial for autonomous and electric vehicles Ed. For advanced driver assistance systems (ADAS), battery management, and high-speed communication networks, higher durability, and circuit density signal integrity, require multi-layer PCBs. With the increasing integration of artificial intelligence (AI) and connectivity features in modern vehicles, multi-layer PCBs are among the key growth segments in the automotive industry.

By Vehicle Type

Passenger cars captured a massive 61.5% share of the automotive PCB market in 2023. Demand for PCBs has been significantly propelled by the increasing adoption of electronic components in passenger vehicles including infotainment systems, Advanced Driver Assistance System (ADAS) components, and electric powertrains. This boom has also been driven by the growing demand for connected, smart, and electric vehicles among consumers. Furthermore, strict safety regulations and emission norms have compelled OEMs to deploy a higher number of ECUs and advanced monitoring systems, which in turn has fueled the demand for high-performance PCBs in passenger cars.

Commercial vehicles are projected to grow at the fastest compound annual growth rate (CAGR) of the automotive PCB market between 2024 and 2032. This increase is being driven by the higher adoption of electric buses and trucks, as well as the expansion of fleet management technologies. The rise in government initiatives encouraging electric commercial vehicles to decrease carbon emissions will further nourish the growth of this segment for PCBs. Also, the increased use of telematics, V2X communication, and autonomous driving technology in heavy-duty and light commercial vehicles requires advanced PCB designs.

By Level of Autonomy

Conventional vehicles accounted for the most automotive PCB share, 66.9%, in 2023. Such dominance is fueled by the sustainable demand for internal combustion engine (ICE) vehicles worldwide too, even as the industry more gradually shifts towards electric and autonomous technologies and away from ICE vehicles PCBs play a vital role in conventional vehicles, powering critical systems like engine control unit (ECU), powertrain management, infotainment, and safety features. Fuel-powered vehicles are more affordable up front than electric and autonomous vehicles, and their availability has been kept widespread by manufacturers across all car segments.

The autonomous vehicle is expected to have the highest compound annual growth rate (CAGR) from 2024-2032 among vehicles, in the automotive PCB market. The increasing availability of artificial intelligence (AI), sensor technology, and vehicle-to-everything (V2X) communication is driving the spread of autonomous driving systems. These need orders of magnitude more PCBs to enable complex systems such as LiDAR, radar, high-speed computing, and real-time data processing systems. Also, growing investments from automobile manufacturers and technology companies in autonomous vehicle (AV) technology and pro-AV regulatory measures are pushing the adoption of AVs.

By Application

Infotainment components held a 30.7% share in 2023 in the automotive PCB market. This segment has witnessed significant growth due to rising demand for advanced in-vehicle entertainment, connectivity, and smart dashboard systems. Passenger cars and other modern vehicles commonly feature Touchscreen and display units, digital instrument clusters, navigation systems, and wireless communication modules all of which use high-performance printed circuit boards. The increasing consumer preference for better user experiences, seamless smartphone integration, and voice-controlled interfaces is another aspect that has accelerated the adoption of infotainment components one of the most prominent revenue-generating segments.

ADAS and basic safety components are likely to register the highest CAGR in the automotive PCB market from 2024 to 2032. As regulatory mandates for vehicle safety grow, so do the number of advanced driver assistance systems automakers are integrating automatic emergency braking, adaptive cruise control, and lane departure warnings forthcoming now. The growing usage of electric and semi-autonomous vehicles additionally drives the need for high-reliability PCBs intended for safety applications.

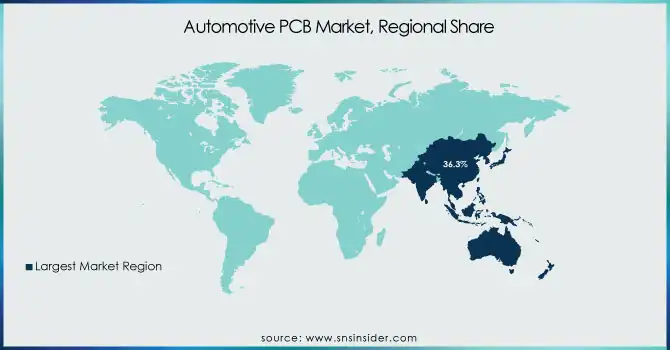

Automotive PCB Market Regional Analysis

The automotive PCB market was dominated by Asia Pacific in 2023, which accounted for 36.3% of the total market share, and is projected to continue growing at the fastest CAGR from 2024 to 2032. This is powered by robust automotive manufacturing footprints in China, Japan, and South Korea, and rising demand for EVs and advanced vehicle technology. In addition, the government initiatives regarding EV adoption, including China’s NEV (New Energy Vehicle) policy and India’s FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme are driving PCB requirements in the region. BYD and NIO, are top Electric Vehicle manufacturers in China that extensively use PCBs in their battery management systems and autonomous driving systems. High-performance PCBs are in growing demand as companies such as Toyota and Honda in Japan, constantly push themselves to innovate with hybrid and electric vehicle technology. The other one is the South Korean automobile manufacturer Hyundai, along with its subsidiary Kia, which is broadening its extensive EV and connected car portfolio, contributing even more to the PCB market in Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Automotive PCB Market are:

-

Dräxlmaier Group (High-voltage battery systems, Wiring harness systems)

-

Denso Corporation (Engine control modules, Instrument clusters)

-

Unimicron Technology Corporation (High-density interconnection boards, Flexible PCBs)

-

Sanmina Corporation (Printed circuit boards, Backplanes)

-

Yazaki Corporation (Wire harnesses, Instrument clusters)

-

Visteon Corporation (Digital instrument clusters, Infotainment systems)

-

TTM Technologies (Rigid PCBs, HDI PCBs)

-

Meiko Electronics Co., Ltd. (Multilayer PCBs, Double-sided PCBs)

-

Nippon Mektron, Ltd. (Flexible printed circuits, Rigid-flex PCBs)

-

Shenzhen Kinwong Electronic Co., Ltd. (Automotive PCBs, Medical device PCBs)

-

Tripod Technology Corporation (Multilayer PCBs, HDI boards)

-

HannStar Board Corporation (Motherboards, Graphics cards)

-

AT&S Austria Technologie & Systemtechnik AG (Advanced driver-assistance system PCBs, Engine control unit PCBs)

-

Fujikura Ltd. (Flexible printed circuits, Automotive wire harnesses)

-

KCE Electronics Public Company Limited (Single-sided PCBs, Multilayer PCBs)

Recent Trends

-

In March 2024, DRÄXLMAIER selects Ivalua’s Spend Management platform to digitize direct and indirect procurement, enhancing efficiency and supplier management.

-

In November 2024, Japan's DENSO partners with Telangana's T-Hub to establish an automotive innovation hub, fostering AI, electrification, and ADAS advancements.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.50 Billion |

| Market Size by 2032 | USD 17.08 Billion |

| CAGR | CAGR of 5.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Double-Sided PCB, Multi-Layer PCB, Single-Sided PCB) • By Vehicle Type (Passenger Car, Commercial Vehicle) • By Level of Autonomy (Autonomous Vehicles, Conventional Vehicles, Semi-Autonomous Vehicles) • By Application (ADAS and Basic Safety, Body, Comfort, and Vehicle Lighting, Infotainment Components, Powertrain Components) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dräxlmaier Group, Denso Corporation, Unimicron Technology Corporation, Sanmina Corporation, Yazaki Corporation, Visteon Corporation, TTM Technologies, Meiko Electronics Co., Ltd., Nippon Mektron, Ltd., Shenzhen Kinwong Electronic Co., Ltd., Tripod Technology Corporation, HannStar Board Corporation, AT&S Austria Technologie & Systemtechnik AG, Fujikura Ltd., KCE Electronics Public Company Limited. |