Embodied AI Market Size & Growth:

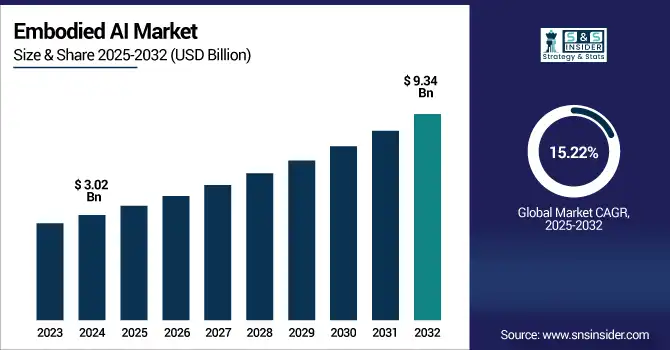

The Embodied AI Market Size was valued at USD 3.02 billion in 2024 and is expected to reach USD 9.34 billion by 2032 and grow at a CAGR of 15.22% over the forecast period 2025-2032.

The global embodied AI market is experiencing rapid growth, driven by advances in AI, Robotics, and Edge computing technologies. Growing deployment in the healthcare, automotive, and consumer sectors is further promising demand for robots that are able to physically interact with humans and their surroundings. Robotel’s socially intelligent robots work side by side with humans to deliver an enjoyable and engaging experience, while saving cost and providing additional safety. With industries in both established and emerging economies recognizing these smart systems, the market is picking up to assert itself as a game changer in the next wave of automation.

Embodied AI Market Size and Forecast

-

Market Size in 2024: USD 3.02 Billion

-

Market Size by 2032: USD 9.34 Billion

-

CAGR: 15.22% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2020–2023

To Get more information on Embodied AI Market - Request Free Sample Report

Embodied AI Market Trends:

-

Rapid adoption of AI-powered humanoid and mobile robots in logistics and manufacturing is rising, with industrial robot installations growing over 12% annually.

-

Increasing integration of vision, touch, and motion sensors is improving real-world interaction accuracy by 30–40% in embodied AI systems.

-

Growth in warehouse automation and service robotics is driving demand, as automated facilities are expected to exceed 45% penetration by 2030.

-

Advancements in edge AI and onboard processing are reducing latency by up to 50%, enabling real-time decision-making in physical environments.

-

Strong investments in human-robot collaboration (HRC) are expanding use cases, with cobot adoption projected to grow at a CAGR of over 15% through 2030.

U.S. Embodied AI Market Size Outlook

The U.S. Embodied AI Market size was USD 0.79 billion in 2024 and is expected to reach USD 2.19 billion by 2032, growing at a CAGR of 13.60% over the forecast period of 2025–2032. The US Embodied AI market growth is due to the growing adoption of humanoid robots in the healthcare and customer service, large application of AI-based devices in industrial automation and huge investment in robotics and machine learning. The U.S. also enjoys strong R&D capabilities, government funding support for advanced technologies, and early adoption in both commercial and defense markets.

According to research, over 70% of AI and robotics startups are based in the U.S., benefiting from advanced research ecosystems.

Embodied AI Market Key Drivers:

-

Rising Demand For AI-Powered Robotics In Healthcare, Retail, And Service Industries Is Fuelling Rapid Adoption Of Embodied AI Technologies.

Embodied AI is increasingly being deployed in patient care, rehabilitation, eldercare, and hospital automation. Retailers are integrating interactive AI avatars and service robots to enhance customer experience and streamline operations. Service industries benefit from virtual assistants and AI companions that offer emotionally intelligent interaction. The convergence of NLP, computer vision, and robotics is enabling more intuitive and adaptive systems, aligning with human behaviour. This multifaceted use across critical sectors is creating significant growth momentum in the embodied AI market globally. Additionally, AI-driven robots are now aiding in surgical procedures, mental health support, and multilingual customer interactions, further expanding the use cases and demand across high-tech and human-centric applications.

According to research, over 40% of hospitals worldwide are adopting AI-powered robots for patient care and rehabilitation.

Embodied AI Market Restrain:

-

Lack Of Standardization And Ethical Concerns Around AI-Human Interaction Are Slowing Down Global Adoption.

Despite technological advances, the absence of universal protocols or ethical guidelines for embodied AI deployment across sectors hinders growth. Concerns about user privacy, machine autonomy, emotional manipulation, and regulatory compliance remain unaddressed. This uncertainty makes businesses cautious and governments hesitant to create supportive regulatory environments. Furthermore, differing regional policies and ethical stances on humanoid robots and AI behaviour create fragmented adoption patterns, obstructing scalable, cross-border deployment of embodied AI technologies. These challenges are compounded by fears of job displacement, cultural sensitivities, and lack of transparency in AI decision-making processes.

Embodied AI Market Opportunities:

-

Adoption Of Embodied AI In Education And Interactive Learning Environments Is Rapidly Growing With Digital Transformation.

Schools and training institutions are incorporating AI tutors, humanoid assistants, and emotion-aware learning tools that adapt to student behaviour and learning pace. These systems provide personalized feedback, foster inclusivity, and support hybrid learning models. Embodied AI helps bridge language, emotional, and attention gaps in education. As EdTech spending increases globally, embodied AI presents an opportunity to enhance engagement, retention, and learning outcomes, particularly in early childhood development and special education segments. Additionally, it promotes collaborative learning, real-time performance tracking, and supports educators in managing diverse classroom dynamics more effectively.

According to research, institutions using embodied AI report a 25% improvement in student engagement and retention rates.

Embodied AI Market Challenges:

-

Public Mistrust And Cultural Resistance Toward Humanoid Robots And Emotionally Aware Machines Restrict Market Growth.

Despite technological readiness, acceptance of embodied AI is still evolving due to concerns around job displacement, surveillance, and emotional manipulation by machines. Cultural perceptions about AI differ globally, with some regions more reluctant to embrace humanoid interaction. These hesitations limit embodied AI’s role in public-facing applications such as education, retail, or hospitality. Until these psychological and social barriers are addressed through awareness, design ethics, and regulation, widespread user adoption will remain a challenge. Religious beliefs, generational attitudes, and fear of overdependence on machines further compound resistance in various societies.

Embodied AI Market Segment Analysis:

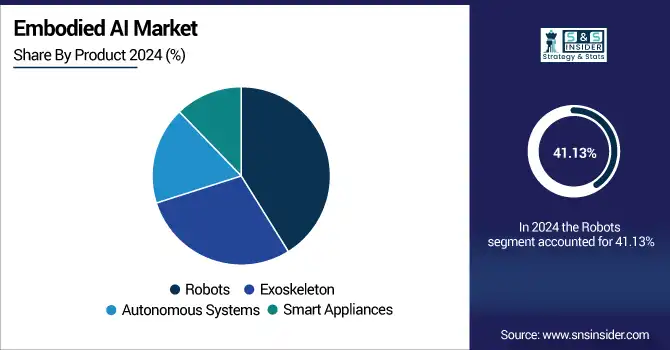

By Product

The robots segment dominated for the highest revenue share of 41.13% in 2024, driven by its broad integration across industries such as healthcare, education, retail, and defense. These robots, capable of interacting socially and performing complex physical tasks, are essential in environments requiring both emotional intelligence and dexterity. Their ability to function autonomously in dynamic settings enhances efficiency and reduces human workload. Boston Dynamics has been a pioneer in developing advanced embodied robots with high mobility and human-like interaction capabilities, reinforcing this segment’s dominance.

The exoskeleton segment is projected to witness the fastest CAGR of about 16.47% from 2025 to 2032 due to rising demand in rehabilitation, elderly care, and industrial support applications. These AI-powered wearable machines enhance human mobility, reduce strain-related injuries, and assist individuals with physical impairments. Increasing military investments for augmented soldier capabilities and rising workplace ergonomics awareness are also key growth drivers. Cyberdyne Inc. is a notable player, offering AI-integrated exoskeletons that support both medical rehabilitation and physical labor, significantly advancing the segment’s expansion.

By Application

The automation and manufacturing segment dominated the Embodied AI Market share of around 31.25% in 2024. This dominance stems from the growing reliance on intelligent machines for precision, consistency, and operational efficiency. Embodied AI systems are extensively used for assembly, inspection, and quality control tasks, offering significant productivity gains. The push for smart factories and Industry 4.0 initiatives has further accelerated adoption. ABB Ltd., with its AI-powered collaborative robots, is at the forefront of this trend, enabling seamless human-machine integration on production floors.

The logistics and supply chain segment is expected to grow at the fastest CAGR of approximately 16.83% from 2025 to 2032, fueled by surging e-commerce demand and the need for real-time, intelligent automation in warehouse and distribution operations. Embodied AI technologies, such as autonomous mobile robots and intelligent picking systems, optimize material handling, inventory management, and last-mile delivery. Embodied AI companies such as GreyOrange, a leader in AI-driven warehouse automation, is revolutionizing logistics with its robotic systems that adapt in real-time, enhancing throughput and reducing operational costs.

Embodied AI Market Regional Outlook:

North America dominated the global Embodied AI Market in 2024 with a revenue share of about 40.99%, supported by strong technological infrastructure, robust R&D investments, and a high concentration of leading AI firms. The region's early adoption of advanced robotics in healthcare, defense, and manufacturing sectors further contributes to its market leadership. Government support, favorable policies, and the presence of major academic institutions pioneering embodied cognition and AI research also foster innovation and accelerate the commercialization of advanced embodied AI solutions.

-

The U.S. dominates the North American Embodied AI Market due to its advanced AI ecosystem, strong government and private R&D funding, and early adoption across healthcare, defense, and manufacturing. Major tech firms and innovation hubs further accelerate market leadership in embodied intelligence technologies.

Asia Pacific is expected to experience the fastest CAGR of around 16.43% from 2025 to 2032, propelled by increasing industrial automation, aging populations, and surging investments in AI technologies by countries like China, Japan, and South Korea. The region is rapidly integrating embodied AI in sectors such as healthcare, logistics, and education to address labor shortages and improve service quality. Additionally, rising government initiatives supporting smart cities, robotics, and digital transformation are creating fertile ground for the rapid expansion of embodied AI technologies across Asia Pacific.

-

China leads the Asia Pacific Embodied AI Market, driven by massive investments in AI, robotics, and smart infrastructure. Government-backed initiatives, rapid industrial automation, and a vast domestic manufacturing base position China as a regional powerhouse in embodied AI development and deployment.

Europe’s Embodied AI Market is steadily growing, supported by strong regulatory frameworks, ethical AI standards, and investments in robotics and human-machine collaboration. Countries like Germany, France, and the UK are emphasizing AI integration in healthcare, eldercare, and industrial automation. Additionally, collaborative R&D efforts and EU-funded innovation programs are fostering cross-border advancements in embodied cognitive systems and assistive technologies, ensuring sustained market expansion.

-

Germany dominates the European Embodied AI Market due to its advanced manufacturing ecosystem, strong robotics industry, and leadership in Industry 4.0 initiatives. Government support, active research institutions, and partnerships with tech firms accelerate AI integration across industrial automation, healthcare, and mobility sectors.

The Middle East & Africa region is led by the UAE, which is advancing rapidly through smart city projects, AI strategies, and robotics in healthcare and defense. In Latin America, Brazil dominates with rising adoption of embodied AI in agriculture, logistics, and manufacturing, supported by strong government and private investments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Embodied AI Companies are:

-

Boston Dynamics,

-

NVIDIA,

-

KUKA AG,

-

Toyota Motor Corporation,

-

ABB,

-

Apptronik,

-

Covariant,

-

Avidbots.

Embodied AI Market Trends:

-

March 2024, Covariant launched Robotics Foundation Model‑1 (RFM‑1), boosting Covariant Brain’s embodied AI capabilities with advanced reasoning, perception, and object manipulation for real-world warehouse and logistics applications.

-

July 2025, Boston Dynamics’ Spot robot autonomously patrols construction sites like Long Island’s South Shore Hospital wing, enhancing safety measures and providing real-time site mapping through advanced embodied AI capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.02 Billion |

| Market Size by 2032 | USD 9.34 Billion |

| CAGR | CAGR of 15.22% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Robots, Exoskeleton, Autonomous Systems, Smart Appliances) • By Application (Healthcare, Automation & Manufacturing, Automotive, Logistics and Supply Chain, Defense and Security, Retail, Education, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Boston Dynamics, SoftBank Robotics, NVIDIA, KUKA AG, Toyota Motor Corporation, ABB, Agility Robotics, Apptronik, Covariant, Avidbots. |