Exoskeleton Market Size Analysis:

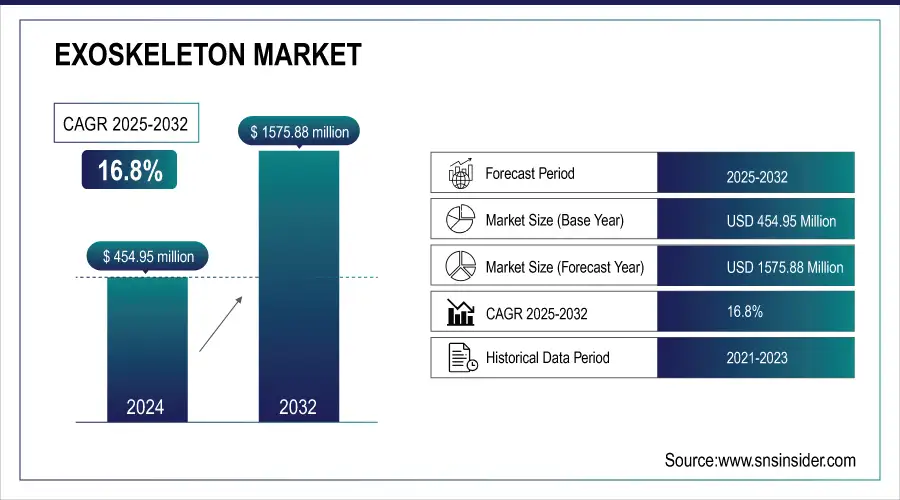

The Exoskeleton Market size was valued at USD 454.95 million in 2024 and is expected to grow to USD 1575.88 million by 2032 and grow at a CAGR of 16.8% over the forecast period of 2025-2032. An exoskeleton is a mechanical apparatus worn by a person for particular uses. In general, an exoskeleton is viewed as a rigid mechanical frame with joints that let human operator movement. Other exoskeleton kinds, supported by the internal skeleton of the human person, are softer and worn on the body. In this manner, the body can receive the forces generated by the associated actuators. According to their kind, frames in this class can either be anthropomorphic or pseudo-anthropomorphic, depending on how much they resemble the human body. Exoskeletons can also be divided into motorized and passive types. Any form of actuator can be used in a motorized frame, including hydraulic, electric, pneumatic, and others.

Get E-PDF Sample Report on Exoskeleton Market - Request Sample Report

A passive exoskeleton, on the other hand, lacks any kind of motor and functions to support individuals mechanically whether they are sitting or standing for extended periods of time, or to facilitate movement by storing energy in a spring. Although passive exoskeletons don't directly boost human capacities, they can be claimed to assist humans in physically demanding activities. Powered exoskeletons, however, can be either augmenting or helpful. Due to their independence, people with disabilities can walk with the aid of assistive frames. The purpose of assistive exoskeletons is to lessen the physical strain of a certain task, they can supply a portion of the energy required to walk, requiring the user to exert walking takes less effort. This is similar to the idea behind electric bicycles, which assist the user on inclines so they can peddle with the same force as on flat ground. When it comes to exoskeletons that increase power, its purpose is mainly focused on boosting the user's strength so they can, for instance, effortlessly carry big objects. By walking for longer lengths of time or working with heavy objects for longer amounts of time, they can also aid to increase physical stamina, motorized exoskeletons might be totally autonomous or coupled to a control computer and a hydraulic system.

Global Exoskeleton Market Trends and Opportunities 2025

-

Rising demand driven by the aging population, increasing muscle-related diseases, and workplace injury prevention.

-

Passive and powered exoskeletons are gaining adoption across healthcare, industrial, and defense sectors.

-

AI-integrated exoskeletons are boosting efficiency in hospitals, factories, and military applications.

-

High equipment costs remain a key restraint, though innovation and startup activity are expanding accessibility.

-

Healthcare adoption is accelerating for patient lifting, mobility assistance, and reducing musculoskeletal injuries.

-

Growing investments in advanced robotics and sensor technologies are shaping future market expansion.

Exoskeleton Market Drivers

-

The growing population of aging individuals across the globe

The rapidly increasing aging population is a major driver of the global exoskeleton market, as it directly correlates with the rising prevalence of mobility impairments and musculoskeletal disorders. According to the United Nations, the number of people aged 65 years or older is projected to reach 1.6 billion by 2050, up from 771 million in 2022. With age, individuals face declining muscle strength, balance issues, and higher risks of falls, which fuels demand for assistive mobility technologies. Exoskeletons, both passive and powered, offer critical support in daily living, rehabilitation, and elderly care facilities by reducing physical strain and enhancing independence. Countries such as Japan, Italy, and Germany—where over 20% of the population is already above 65 years—are witnessing faster adoption of robotic exosuits for elderly care. This demographic shift ensures that exoskeleton manufacturers find a sustained and expanding market, particularly in healthcare and rehabilitation applications.

-

Increasing cases of muscle-related diseases

-

Technological advancements in sensor technologies

Exoskeleton Market Restraints

-

High Equipment cost

One of the key restraints hampering the growth of the global exoskeleton market is the high cost of equipment. Advanced powered exoskeletons, which integrate robotics, sensors, and AI technologies, often range from USD 40,000 to over USD 120,000 per unit, making them unaffordable for most individuals and even for smaller healthcare facilities. Even passive exoskeletons, while cheaper, still remain out of reach for large-scale adoption in cost-sensitive markets. The additional expenses associated with training, maintenance, and system integration further increase the total cost of ownership. For hospitals, rehabilitation centers, and defense organizations, such high initial investments pose budgetary challenges, especially in developing economies where healthcare spending is limited. This cost barrier slows down mass adoption and restricts usage mainly to high-income regions such as North America and Europe. As a result, manufacturers face pressure to innovate low-cost models and explore rental or subscription-based models to expand accessibility.

Exoskeleton Market Segment Analysis:

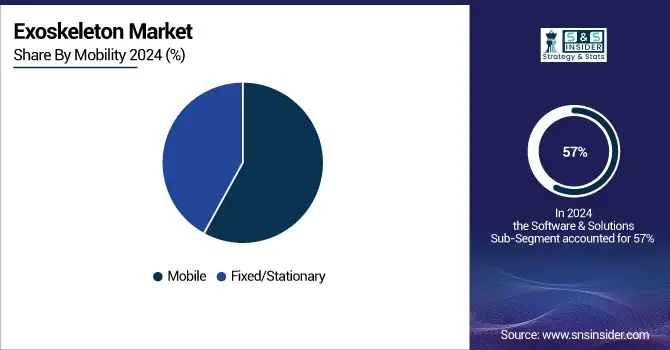

By Mobility

The mobile segment is expected to witness the fastest growth during the forecast period, driven by increasing research and development activities and growing demand for motor-equipped robots that assist human mobility. Favorable reimbursement policies in emerging and developing economies are further supporting its adoption.

The fixed or stationary segment is also projected to grow significantly due to rising demand for rehabilitation and assisted living solutions. These devices help patients with limited mobility by providing essential support for standing, posture correction, and stationary walking, with innovations such as advanced fixed-frame exoskeletons designed to enhance gait rehabilitation outcomes.

By Technology

The powered segment is experiencing significant adoption due to its ability to enhance safety, boost productivity, and reduce physical strain across industries. This growth is supported by ongoing innovations, including advanced powered exoskeletons that improve lifting motion, increase strength, and act as force multipliers for workers.

The non-powered segment is anticipated to grow rapidly, driven by the demand for cost-effective, lightweight solutions that assist with lifting and mobility without external power sources. Utilizing mechanical components like springs or elastics, these devices are gaining traction in industrial, construction, logistics, and healthcare sectors for fatigue reduction and improved manual labor efficiency.

By Extremity Outlook

The lower body segment holds a major share of the market, driven by increasing investments, rising cases of lower body disabilities, and higher adoption among geriatric and paralyzed patients for improved mobility and weight-bearing support. Innovations such as the CE-approved ABLE Exoskeleton, designed for spinal cord injury rehabilitation, further boost this segment.

The upper body segment is expected to grow at the fastest pace due to its effectiveness in supporting disabled communities and aiding rehabilitation for post-stroke, neurological, and musculoskeletal conditions. The rising prevalence of neurological disorders globally is also contributing to the growth of this segment.

By End Use

The healthcare segment leads the market, driven by increasing cases of spinal cord injuries, widespread use in rehabilitation centers, and rising awareness of advanced exoskeleton technologies. Regulatory approvals and product launches, such as Wandercraft SAS’s Atalante X for mobility-impaired individuals, further support its growth.

Meanwhile, the industry segment is expected to grow at the fastest pace, fueled by rising awareness of exoskeleton benefits in workplace safety, increasing occupational injuries, and growing adoption across construction, manufacturing, and distribution sectors, where these technologies enhance productivity and reduce physical strain on workers.

Exoskeleton Market Regional Analysis

North America Exoskeleton Market Trends

The North American exoskeleton market generated the most money in 2024. Significant investments in research activities, an increase in partnerships and collaborations among important players, and an increase in the prevalence of disabled people are the main drivers of this market's revenue growth. Other significant drivers of the market revenue growth include advancing technology, greater use of human augmentation in the industrial and military sectors, and rising demand for robotic rehabilitation in the healthcare industry. Due to the advent of soft actuators and the swift uptake of Al-enabled products in the US, the market there accounted for the biggest revenue share.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Asia Pacific Exoskeleton Market Trends

In 2024, the Asia Pacific exoskeleton market had the second-largest revenue share. One of the main factors propelling the market revenue growth in this area is the rising demand for exoskeleton suits for carrying ammunition in the defense industry. For instance, China unveiled a powered exoskeleton suit for military use that can be used for carrying ammunition after a previous type of non-powered exoskeleton suit entered service with People's Liberation Army (PLA) border defense troops in late 2020 for missions like supply delivery, patrol, and sentry duty.

Europe Exoskeleton Market Trends

In terms of revenue share, Europe's exoskeleton market ranked third in 2024. The healthcare industry's significant investments have a significant impact on the market's revenue growth. Another important element driving the expansion of the market in this region is the growing awareness of the use of smart exoskeletons. Exoskeletons with intelligence help the elderly and others with disabilities avoid accidents.

Latin America Exoskeleton Market Trends

In 2024, the Latin American exoskeleton market recorded a moderate revenue share. Increasing focus on rehabilitation services, particularly for spinal cord injuries and stroke patients, is driving market growth. Brazil and Mexico are emerging as key adopters due to government-backed healthcare initiatives and rising interest in integrating wearable robotics into physiotherapy and assisted mobility programs. Industrial applications are gradually expanding as companies explore workforce support solutions.

Middle East & Africa (MEA) Exoskeleton Market Trends

The MEA exoskeleton market held a relatively smaller revenue share in 2024 but showed growing potential. Demand is fueled by increasing investments in advanced medical technologies and military modernization programs in countries such as the UAE and Saudi Arabia. Healthcare providers are adopting exoskeletons for rehabilitation and post-injury recovery, while early pilot projects in industrial sectors are paving the way for future adoption.

Key Exoskeleton Companies are:

-

Lockheed Martin Corporation

-

Otto bock

-

DIH Medical

-

Sarcos Technology and Robotics Corporation

-

BIONIK

-

aB-Temia

-

ReWalk Robotics

-

Myomo Inc.

-

Hocoma

-

Fourier Intelligence

-

Trexo Robotics

-

Neofect

-

NextStep Robotics

-

Panasonic (ActiveLink)

-

Parker Hannifin

-

Comau

-

Hyundai Motor Group Robotics Lab

-

Levitate Technologies

Exoskeleton Market Competitve Landscape

Parker Hannifin Corporation (NYSE: PH), headquartered in Cleveland, Ohio, is a Fortune 250 global leader in motion and control technologies, with $19.9 billion in revenue in fiscal 2024 and over 60,000 employees worldwide. In collaboration with Vanderbilt University, Parker developed the Indego powered exoskeleton, a lightweight, motorized lower-limb device designed to assist individuals with paralysis or mobility impairments through task-specific gait training. Indego was commercialized under the Human Motion & Control (HMC) business unit, offering both Indego Therapy and Indego Personal models, cleared by the FDA and CE-marked for clinical and community use.

-

Parker Hannifin Corporation's Human Motion and Control business segment was acquired by Ekso Bionics in December 2022. The items from the Indego lower limb exoskeleton range as well as the upcoming creation of robotically assisted orthotic and prosthetic devices are included in the acquisition. This complementary purchase increases Ekso's innovation pipeline, broadens its product offering across the continuum of care to home and community usage markets, and adds strategic partnerships with important business and research partners, including Vanderbilt University.

Ottobock SE & Co. KGaA, founded in 1919 and headquartered in Germany, is a global leader in prosthetics, orthotics, wheelchairs, and exoskeletons. With over 9,000 employees and strong revenues, Ottobock drives innovation through its Paexo exoskeleton line and the suitX acquisition, offering advanced solutions for industrial ergonomics and rehabilitation.

-

The release of Ottobock Shoulder, a new generation exoskeleton, was announced by Ottobock in April 2022. It offers assistance during demanding over-the-shoulder tasks in handicraft, production, maintenance, and logistics. The Paexo Shoulder has been improved upon in the latest exoskeleton. Ottobock announced the acquisition of 100% of the shares in November 2021.

-

Ottobock announced in November 2021 that it had acquired all of the shares of suitX. Ottobock and suitX pooled their knowledge and offerings to revolutionize the exoskeleton business and promote their use across the globe.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 454.95 Million |

| Market Size by 2032 | USD 1575.88 Million |

| CAGR | CAGR of 16.8% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Mobility (Mobile and Fixed/Stationary) • By Technology (Powered and Non-powered) • By Extremity Outlook(Upper Body(Lower Body and Full Body) • By End-Use (Healthcare, Military and Industry) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | CYBERDYNE Inc., Lockheed Martin Corporation, Ottobock, Ekso Bionics, DIH Medical, Sarcos Technology and Robotics Corporation, BIONIK, aB-Temia, ReWalk Robotics, Myomo Inc., Hocoma, Fourier Intelligence, Trexo Robotics, Neofect, NextStep Robotics, Panasonic (ActiveLink), Parker Hannifin, Comau, Hyundai Motor Group Robotics Lab, Levitate Technologies. |