MEMS Electronic Oscillators Market Size & Overview:

Get more information on MEMS Electronic Oscillators Market - Request Sample Report

The MEMS Electronic Oscillators Market size was valued at USD 200.60 Billion in 2023. It is estimated to reach USD 2219.75 Billion by 2032, growing at a CAGR of 30.68% during 2024-2032.

The MEMS electronic oscillators market has seen a considerable increase in growth due to the growing need for small, dependable, and energy-saving timing solutions in different sectors. Due to their superior performance, miniaturization capabilities, and robustness against environmental factors like temperature and shock, these oscillators are quickly displacing traditional quartz-based ones. The trend of miniaturizing electronics has had a significant impact on the MEMS electronic oscillators market, being utilized across various industries such as consumer electronics and medical devices. Miniaturization has also been advantageous for wearable technology, such as smartwatches and fitness trackers. Approximately 55% of individuals who use smartwatches choose models that are smaller in size and more comfortable to wear, leading manufacturers to focus on making their products more compact. Miniaturization in the medical field has resulted in notable progress in the development of medical devices. As an example, current implantable cardioverter defibrillators (ICDs) and continuous glucose monitors (CGMs) are around 30% smaller than versions made ten years ago. Patient comfort and device functionality have been enhanced by these technological advances.

The medical electronics sector is also a developing market for MEMS electronic oscillators. Imaging tools like MRI machines, CT scanners, and ultrasound systems account for a significant share of the market, estimated to be worth approximately USD 90 billion in 2023. Patient monitoring systems, such as ECG monitors and blood glucose monitors, are estimated to be worth around USD 60 billion. Compact and dependable timing solutions are essential for medical devices like portable diagnostic equipment, implantable devices, and monitoring systems. MEMS oscillators are ideal for battery-powered medical devices that require a long operational lifespan due to their energy efficiency, precision, and stability.

MARKET DYNAMICS:

Drivers

-

Enhanced Performance and Reliability Over Traditional Quartz Oscillators.

MEMS electronic oscillators are becoming more popular because of their better performance and reliability when compared to traditional quartz oscillators. MEMS technology can surpass the limitations of quartz oscillators which have been the standard for many years. Moreover, MEMS oscillators provide improved long-term stability and reduced phase noise, crucial for precise tasks in fields like GPS, telecommunications, and data centers. Being able to stay accurate for an extended period without needing constant recalibration lowers maintenance expenses and prolongs the lifespan of the devices they are utilized in. The move towards MEMS technology is also motivated by the demand for increased capabilities in new uses such as 5G networks and advanced driver-assistance systems (ADAS). These apps need oscillators that offer stable and precise timing in more intricate settings. The superior performance and reliability of MEMS oscillators make them the top choice for these challenging applications.

-

Increasing Utilization of MEMS Oscillators in Automotive and Aerospace Sectors.

The automotive and aerospace sectors are more and more using MEMS electronic oscillators because of their excellent performance and dependability. MEMS oscillators are utilized in automotive applications for engine control units, infotainment systems, and advanced driver-assistance systems (ADAS). Components need to be able to endure harsh conditions like extreme temperatures and vibrations in vehicles. The durability of MEMS oscillators makes them well-suited for automotive applications, where precision and dependability are crucial.

MEMS oscillators are utilized in navigation systems, communication equipment, and essential applications within the aerospace sector. MEMS oscillators are preferred for aerospace applications because they can operate reliably in extreme conditions like high altitudes and rapid temperature changes. Moreover, the demand for lighter components in aerospace design also reinforces the use of MEMS technology, as these oscillators are usually smaller and lighter compared to quartz ones. As the automotive and aerospace sectors progress, the need for MEMS oscillators will increase. The growth of MEMS technology will be strengthened in the electric vehicles (EVs) and aerospace industries due to the increasing complexity of systems in these sectors.

Restraints

-

Competition from Established Quartz Oscillator Technology.

Although MEMS oscillators offer benefits, they encounter tough competition from traditional quartz oscillators. Quartz oscillators have been the norm for many years and are commonly utilized in a wide range of industries. The well-known reputation and established history of quartz oscillators make them a top pick for numerous uses, especially in industries where dependability and enduring stability are crucial. The cost-effectiveness of quartz oscillators is also due to their well-established manufacturing processes and extensive supply chain. On the other hand, even though MEMS oscillators are getting better, they are still considered relatively recent and may not be as cost-effective as quartz technology yet. The competition posed by quartz oscillators could act as a major limitation for the MEMS electronic oscillators market. Persuading industries to transition from a tried-and-true technology to a less established one involves overcoming reluctance to change and showcasing definite benefits. Despite the advantages of MEMS oscillators, their widespread adoption continues to be hindered by the dominant market position held by quartz oscillators.

-

Constraints in specific high-accuracy use due to technology limitations.

Even though MEMS oscillators have numerous benefits, they encounter technical constraints in specific high-precision scenarios. MEMS technology sometimes does not reach the same level of performance as quartz oscillators, especially when it comes to frequency stability and phase noise. Quartz oscillators may still be the top choice for certain communication systems, military applications, and scientific instruments that need extremely high precision. The constraints of MEMS technology in these fields may hinder the growth of the market, especially in sectors where accuracy is essential. Despite anticipated progress in MEMS technology, bridging the gap between MEMS and quartz oscillators in high-precision applications continues to be a challenge.

KEY MARKET SEGMENTATION:

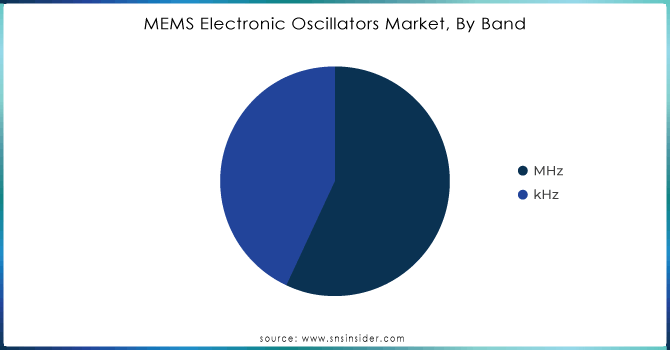

BY BAND

The MHz band captured a 55% market share and led the market in 2023. This frequency range is vital for high-demanding applications that require high precision and stability, such as telecommunications, automotive electronics, and consumer electronics. MEMS oscillators operating in the MHz frequencies are used in almost all smartphones, GPS, and network infrastructure, which require high consistency in the generated frequency for well-coordinated communication and signal processing. SiTime Corporation and Microchip Technology are such companies that offer MEMS oscillators in the MHz band for mobile, automotive, and wireless applications. The increasing demand for high-speed data transmission and innovations in the 5G technology will certainly put even more emphasis on the MHz band in the future development of the MEMS Electronic Oscillators Market.

The kHz band is the fastest-growing segment during the forecast period 2024-2032. It is attributed to the increasing usage of MEMS oscillators in low-demanding and cost-effective applications that require the lowest power and size, such as IoT sensors and medical and consumer devices. MEMS oscillators are low power because of their inherent structure and do not require extra power to maintain a certain temperature because they are very small in size. Abracon and Silicon Laboratories are such companies that specialize in offering MEMS oscillators for health monitoring and industrial sensor applications.

Get Customized Report as per your Business Requirement - Request For Customized Report

BY APPLICATION

Consumer electronics dominated in 2023 with a 32% market share. These are small and lightweight, thus favorable for use in these devices, like smartphones and laptops. These electronics are evolving to be handheld gadgets with multifunctional capabilities, which has fueled the demand for MEMS oscillators. MEMS oscillators provide greater timing solutions as compared to quartz and silicon oscillators, which are used in the manufacturing of these consumer electronics. Smartphones, tablets, and other similar devices heavily rely on MEMS oscillators for determining when to activate and release the various signals such as Wi-Fi, GPS, and Bluetooth. The consumer electronics segment is dominating the MEMS electronic oscillator market and is expected to continue to grow on account of the increasing adoption of both smart devices and wearable technology.

The automotive segment is accounted to have a faster growth rate during the forecast period. This growth is fueled by the expanding integration of advanced electronics such as ADAS, infotainment systems, autonomous vehicles, and electric vehicles. MEMS oscillators can withstand shock and vibration, have greater temperature tolerances, and provide reliable and precise timing. ADAS systems, such as those by Bosch and Tesla, and infotainment systems rely on MEMS oscillators to perform all the vehicle-related time-sensitive actions. The electric vehicle sector is spearheading the use of these segments of the oscillators, although internal combustion vehicles are also integrating MEMS oscillators in their onboard electronics.

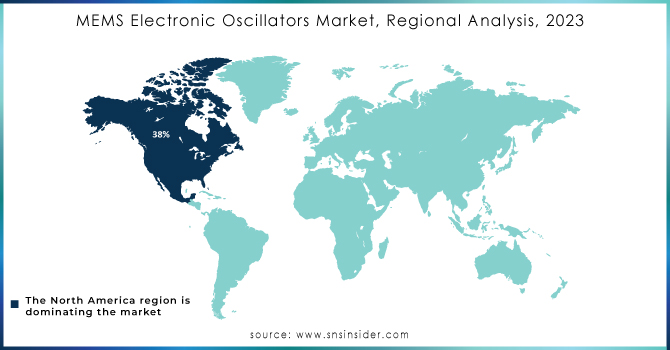

REGIONAL ANALYSIS:

North America led the MEMS electronic oscillators market in 2023 with a market share of over 38%, owing to the leading technological infrastructure and the presence of leading semiconductor companies in the region. The increasing demand in several applications, such as telecommunications, automotive, and consumer electronics, helps the region maintain a superior position in the market. Leading companies such as SiTime Corporation, help the North American market by designing and producing innovative MEMS electronic oscillators at mass levels. Furthermore, the leading technology in 5G and the advancement in the automotive system further enhance the demand for MEMS oscillators attracting significant investments. MEMS oscillators are also integrated into GPS for better performance, as well as Internet of Things devices and other high-frequency applications in defense and aerospace helping the region maintain its superior position.

Asia-Pacific is expected to be the fastest-growing market in MEMS electronic oscillators during 2024-2032, owing to the rapid growth in the production of consumer electronic devices. Countries such as China, Japan, and South Korea are the hub of MEMS electronic manufacturing. The increasing demand for miniaturization and energy-efficient oscillators in smartphones, wearables, and other automotive systems supports the growth of the market in the region. Key companies in the market such as Epson in Japan and TXC Corporation in Taiwan take advantage of the large-scale production and favorable cost production facilities in the region.

KEY PLAYERS:

The key players in Global MEMS Electronic Oscillators Market are Micrel, Discera, IQD, NXP, TXC, IDT, Eclipteck, Seiko Epson, Sand9, Silicon Labs, SiTime, Vectron, Abracon, and other players.

Recent Development

-

In May 2024, SiTime Corporation launched a new ultra-low-power MEMS oscillator designed specifically for wearable and IoT applications, offering improved battery life and enhanced performance.

-

In September 2023, SiTime Corporation introduced the Endura series, which is a series of rugged MEMS oscillators designed for extreme environments. These oscillators are aimed at the aerospace, defense, and other high-reliability markets and provide high resilience to shock, vibration, and temperature cycling.

-

In May 2023, TXC Corporation launched a new series of MEMS oscillators with ultra-low jitter performance. The QTM216E series is a new type of low-jitter oscillator, which targets high-speed communication and data center markets. The new oscillators have a better phase noise performance, making them suitable for 5G and cloud infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 200.60 Billion |

| Market Size by 2032 | USD 2219.75 Billion |

| CAGR | CAGR of 30.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (SSPMO, TCMO, VCMO, FSMO, DCMO, SSMO) • By Band (MHz, kHz) • By Application (Telecommunication, Networking, Industrial, Consumer Electronics, Automotive, Healthcare, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Micrel, Discera, IQD, NXP, TXC, IDT, Eclipteck, Seiko Epson, Sand9, Silicon Labs, SiTime, Vectron, Abracon |

| Key Drivers | • Enhanced Performance and Reliability Over Traditional Quartz Oscillators. • Increasing Utilization of MEMS Oscillators in Automotive and Aerospace Sectors. |

| RESTRAINTS | • Competition from Established Quartz Oscillator Technology. • Constraints in specific high-accuracy use due to technology limitations. |