Emission Control Catalysts Market Report Scope & Overview:

Get more information on Emission Control Catalysts Market - Request Sample Report

The Emission Control Catalysts Market Size was valued at USD 48.8 billion in 2023 and is expected to reach USD 88.2 billion by 2032 and grow at a CAGR of 6.8% over the forecast period 2024-2032.

The Emission Control Catalysts market is significantly influenced by technological advancements and the ongoing global push for environmental sustainability. Factors such as stringent emission regulations, particularly in regions like Europe, North America, and Asia-Pacific, have spurred innovation in catalyst technology. In August 2024, BCIL inaugurated an R&D lab in India to further enhance its automotive emissions control capabilities. This facility aims to improve the efficiency of emission reduction systems, thereby addressing the increasing demand for cleaner vehicles and compliance with evolving emission standards. Such developments reflect a broader trend where companies are investing in advanced research to create catalysts that can meet stricter regulations, such as those seen in the growing electric vehicle (EV) market.

Technological developments are also driving growth in the emission control catalyst market. The focus is on improving catalyst efficiency and durability, reducing the environmental footprint of vehicles, and creating cost-effective solutions for manufacturers. For instance, the integration of AI and machine learning in catalyst development is allowing for more precise optimization of materials. Companies are exploring novel materials like platinum and palladium to further enhance catalyst performance. Additionally, global environmental awareness has led to policy changes and investments in sustainable solutions, which are pushing manufacturers to accelerate the adoption of cleaner technologies. These developments are setting the stage for more efficient and eco-friendly emission control systems across industries.

Emission Control Catalysts Market Dynamics:

Drivers:

-

Growing Regulatory Pressure to Meet Emission Standards Across Global Markets Propels Emission Control Catalysts Demand

Increasing governmental pressure to meet stringent emission regulations is a key driver for the growth of the emission control catalysts market. As countries adopt tougher environmental standards to combat pollution and reduce carbon footprints, industries, particularly automotive and industrial manufacturing, are seeking efficient catalytic solutions. These regulations, such as the Euro 6 standards in Europe and upcoming regulations in emerging markets, are compelling companies to invest in advanced catalytic technologies that help in reducing harmful emissions like NOx and particulate matter. As stricter norms emerge, the need for more advanced catalysts continues to grow, boosting market demand. Furthermore, the automotive industry's shift toward electric vehicles (EVs) and hybrid vehicles also fuels the adoption of emission control catalysts to address emissions from traditional combustion engines in transitional models.

-

Technological Advancements in Catalyst Materials Drive Growth in the Emission Control Catalysts Market

Technological advancements in catalyst materials and processes have been driving the market forward. Innovations like the development of high-performance catalysts, using rare metals such as platinum, palladium, and rhodium, are significantly improving emission control efficiency. Newer materials are designed to withstand higher temperatures and offer longer life spans, addressing key challenges in emission control systems. Moreover, research and development in nanotechnology, artificial intelligence (AI), and machine learning are enabling better optimization of catalysts for higher performance and reduced environmental impact. Companies are also focused on developing catalysts that can work in a wider range of conditions, particularly in heavy-duty industrial applications, which boosts the overall market. This technological progress allows manufacturers to stay ahead of regulatory requirements while providing solutions that meet consumer demand for greener, more energy-efficient products.

Restraint:

-

High Costs of Advanced Catalyst Materials Limit Widespread Adoption in Price-Sensitive Markets

The high cost of advanced catalyst materials, such as platinum, palladium, and rhodium, remains a significant restraint for the emission control catalysts market. These precious metals are expensive and make up a considerable portion of the total cost of catalytic systems. As a result, the high upfront costs limit the adoption of emission control catalysts in price-sensitive markets, especially in developing regions where there is an ongoing demand for cost-effective solutions. For industries that require a large volume of catalysts, such as the automotive sector, the initial investment can be prohibitive. Although the market is shifting towards more cost-efficient alternatives, such as using fewer precious metals or increasing the lifespan of catalysts, these innovations are still being developed and may take time to achieve widespread commercialization. Therefore, the high material costs continue to pose a challenge, particularly for manufacturers who are unable to offset these costs through higher-end products.

Opportunity:

-

Rising Investment in Electric Vehicle (EV) Infrastructure Opens New Opportunities for Emission Control Catalysts

The rapid growth of the electric vehicle (EV) market presents a significant opportunity for the emission control catalysts market, particularly in hybrid and transitional vehicle segments. As governments and corporations heavily invest in EV infrastructure, there is a concurrent rise in the need for advanced emission control systems for hybrid and internal combustion engine (ICE) vehicles. Even though EVs are primarily designed to reduce emissions, hybrid vehicles still rely on internal combustion engines during certain driving conditions, necessitating efficient emission control systems. Moreover, the demand for zero-emission vehicles globally encourages innovation in clean energy solutions, which translates into a growing market for emission control catalysts in hybrid vehicles and legacy cars transitioning to greener solutions. This presents a unique opportunity for companies specializing in catalysts to diversify their product offerings, especially with the increasing popularity of fuel-efficient vehicles and government-backed initiatives to reduce pollution.

Challenge:

-

Environmental Impact of Catalyst Manufacturing and Disposal Poses Long-Term Sustainability Concerns

While emission control catalysts play a vital role in reducing vehicle emissions, the environmental impact of their manufacturing and disposal presents a long-term challenge. The production of catalysts, particularly those involving precious metals like platinum and palladium, has a significant environmental footprint due to the mining processes required for these materials. Additionally, the disposal of catalysts at the end of their life cycle can lead to environmental hazards if not managed properly, particularly with the heavy metals involved. The market faces increasing pressure from regulators and environmentalists to ensure that catalytic solutions are both effective in emission control and sustainable throughout their life cycle. Companies are now exploring ways to recycle catalysts and reduce waste, but these efforts are still in the early stages. Therefore, managing the environmental impact of catalyst production and disposal remains a major challenge for the emission control catalysts industry.

Emission Control Catalysts Market Segmentation Overview

By Catalyst Material

In 2023, palladium-based catalysts dominated the emission control catalysts market, accounting for approximately 40% of the market share. Palladium is favored for its ability to effectively reduce harmful emissions in automotive catalytic converters, especially in gasoline engines, where it provides better performance in controlling CO2, hydrocarbons, and NOx. Its high catalytic activity and cost-effectiveness compared to platinum and rhodium have made it a go-to material for manufacturers. As global regulations become stricter, the demand for palladium-based catalysts continues to rise, particularly in the automotive industry.

By Catalytic Type

In 2023, the Three-Way Catalysts (TWC) segment dominated the emission control catalysts market, holding a market share of around 55%. This catalytic type is widely used in gasoline-powered vehicles to simultaneously reduce three major pollutants: carbon monoxide (CO), hydrocarbons (HC), and nitrogen oxides (NOx). TWCs are essential in meeting regulatory emission standards and are commonly found in passenger cars. With stringent emission regulations and the transition to cleaner vehicles, the demand for TWCs remains strong, further solidifying its position as the leading catalytic type in the market.

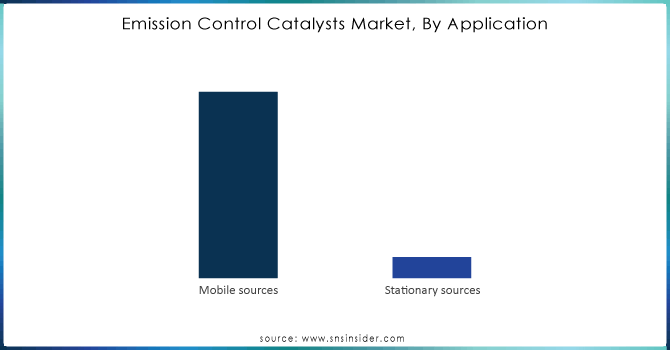

By Application

In 2023, the automotive sector led the emission control catalysts market, capturing a 60% market share, with passenger cars being the dominant subsegment with a market share of around 55%. The increased demand for passenger vehicles globally, coupled with tightening emission standards, drives this segment’s growth. For instance, automotive manufacturers are heavily investing in emission control technologies to comply with regulations like Euro 6 and stricter standards in countries like the U.S. and China. This demand for efficient emission reduction in gasoline-powered cars, combined with the ongoing transition to electric and hybrid vehicles, continues to contribute to the automotive sector's dominance.

Get Customized Report as per your Business Requirement - Request For Customized Report

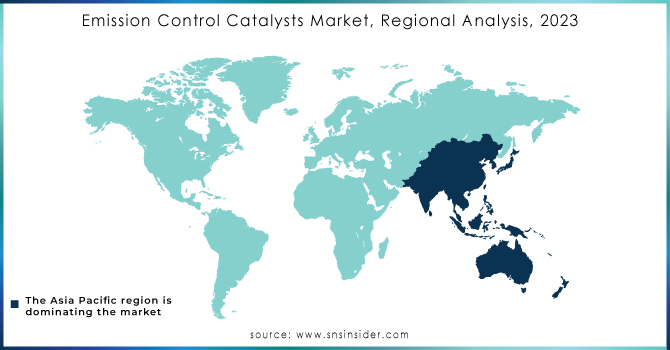

Emission Control Catalysts Market Regional Analysis

Asia Pacific region dominated the emission control catalysts market in 2023 with a market share of around 45%. This dominance is largely due to the region's massive automotive production and the rapid industrialization seen in emerging economies like China and India. China, the largest vehicle manufacturer globally, played a significant role in this, as the country has stringent environmental regulations for vehicle emissions and a large fleet of vehicles that require advanced emission control technologies. In 2023, China was responsible for over 25% of the global automotive emissions control catalyst market, driven by its continuous efforts to reduce air pollution and meet national standards like China VI for vehicle emissions. India, another key player, is also expanding its automotive sector rapidly while tightening emission standards, spurring demand for effective catalytic solutions. Moreover, the expansion of industrial activities in countries like South Korea and Japan has led to increased adoption of catalysts for industrial applications, further boosting the region's market share. Japan, a leader in automotive innovation, particularly in hybrid vehicles, also continues to push for cleaner technologies, driving the need for emission control catalysts. The government policies favoring green technologies and electric vehicles in the region further contributed to the market dominance, helping the region maintain a robust growth trajectory.

Recent Developments

August 2024: BASF Catalysts India opened a new R&D lab for automotive emissions control solutions. The facility will support the development of advanced technologies to meet stringent emissions standards, reinforcing BASF's commitment to sustainable automotive innovation and environmental protection.

Key Players in Emission Control Catalysts Market

-

BASF Catalysts LLC (BASF Emission Control Catalysts, Catalytic Converters)

-

BASF SE (Three-Way Catalysts, Diesel Oxidation Catalysts)

-

Ceram-Igni (Ceramic Diesel Particulate Filters, Catalytic Converter Substrates)

-

Clariant AG (Clariant Selective Catalytic Reduction, Clariant Diesel Oxidation Catalysts)

-

Corning Inc. (Corning Diesel Particulate Filters, Corning Honeycomb Substrates)

-

Ferro Corporation (Ferro Automotive Catalysts, Ferro Ceramic Filters)

-

Haldor Topsoe A/S (Selective Catalytic Reduction Systems, Diesel Oxidation Catalysts)

-

Honeywell International Inc. (Honeywell Selective Catalytic Reduction Technology, Honeywell Three-Way Catalysts)

-

Johnson Matthey PLC (JM Emission Control Catalysts, Diesel Oxidation Catalysts)

-

McDermott International, Inc. (Emission Control Solutions, SCR Systems)

-

Nippon Steel Corporation (Nippon Steel SCR Catalysts, NOx Reduction Catalysts)

-

Orion Engineered Carbons (Orion Engineered Catalysts, Activated Carbon for Emission Control)

-

Palladium Ltd. (Palladium Catalysts, Diesel Catalysts)

-

Peugeot Citroen (Peugeot Emission Control Systems, PSA Group SCR Technology)

-

Platinum Group Metals Ltd. (Platinum-based Catalysts, Automotive Catalysts)

-

Rio Tinto (Rio Tinto Platinum Group Metals, Emission Control Catalysts)

-

Sabic (Sabic Selective Catalytic Reduction, Emission Control Additives)

-

Shell Catalysts & Technologies (Shell SCR Catalyst, Shell Gasoline Catalysts)

-

Umicore S.A. (Umicore Automotive Catalysts, Umicore SCR Catalysts)

-

Volkswagen AG (Volkswagen Diesel Particulate Filters, Volkswagen SCR Systems)

Automotive OEMs:

-

Toyota

-

Volkswagen

-

Ford

-

Honda

Technology Providers:

-

Clean Diesel Technologies (CDTi)

-

Magna International

Industrial Manufacturers:

-

Honeywell UOP

-

Clariant

-

Albemarle Corporation

Research and Development Entities:

-

National Renewable Energy Laboratory (NREL)

-

Fraunhofer UMSICHT

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 48.8 Billion |

| Market Size by 2032 | US$ 88.2 Billion |

| CAGR | CAGR of 6.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Catalyst Material (Palladium based, Platinum based, Rhodium based, Others) •By Catalytic Type (Three-Way Catalysts (TWC), Selective Catalytic Reduction (SCR), Diesel Oxidation Catalysts (DOC), Lean NOx Traps (LNT), Four-Way Catalytic Catalysts (FWC)) •By Application (Automotive [Passenger Cars, Commercial Vehicles], Industrial, Off-Road Vehicles & Equipment, Marine, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Johnson Matthey PLC, Umicore S.A., BASF Catalysts LLC, Honeywell International Inc., Corning Inc., Rio Tinto, Clariant AG, Ferro Corporation, Haldor Topsoe A/S and other key players |

| Key Drivers | • Growing Regulatory Pressure to Meet Emission Standards Across Global Markets Propels Emission Control Catalysts Demand • Technological Advancements in Catalyst Materials Drive Growth in the Emission Control Catalysts Market |

| RESTRAINTS | • High Costs of Advanced Catalyst Materials Limit Widespread Adoption in Price-Sensitive Markets |