Endomyocardial Biopsy Market Report Scope & Overview:

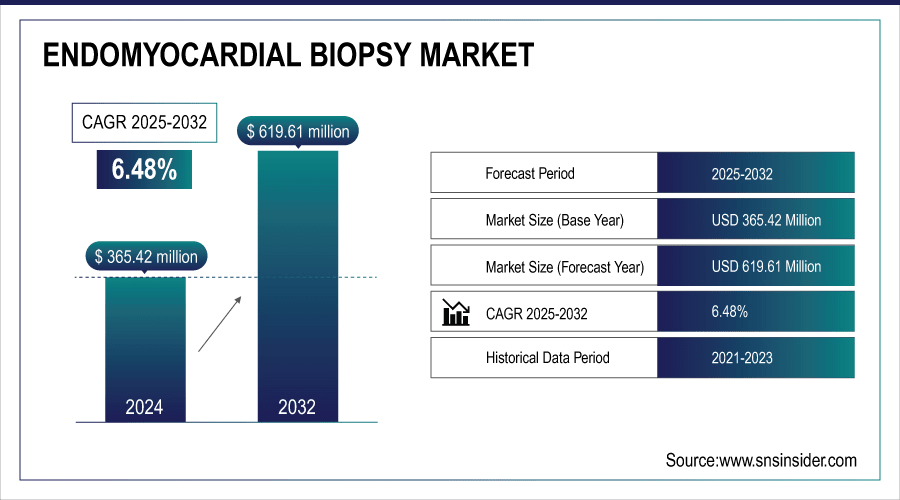

The Endomyocardial Biopsy Market was valued at USD 365.42 million in 2024 and is expected to reach USD 619.61 million by 2032, growing at a CAGR of 6.48% over the forecast period of 2025-2032.

The global endomyocardial biopsy market is growing on the back of mounting heart transplant numbers, the biopsies are necessary to detect early rejection and monitor for a long time. One of the important endomyocardial biopsy market trends is the improvement of the biopsy devices, including image-based systems, flexible catheters, and precision forceps, among others, which are helping in the safe and effective localization of the biopsy site for diagnosis. These advances are leading to increasing penetration of hospitals and cardiology centers, expanding the market globally.

For instance, in March 2025, the GODT reported a 6.8% global rise in heart transplants in 2024, boosting demand for endomyocardial biopsy in post-transplant monitoring.

To Get More Information On Endomyocardial Biopsy Market - Request Free Sample Report

Endomyocardial Biopsy Market Trends

-

Technological advancements drive adoption. Modern, minimally invasive, and image-guided EMB systems improve safety, sampling accuracy, and procedural efficiency in cardiac diagnostics.

-

Material and device innovations. Advanced bioptomes, steerable catheters, and stabilizing sheaths enhance tissue integrity, reduce complications, and improve diagnostic yield.

-

Customized and modular approaches. Tailored biopsy tools and protocols support diverse cardiac conditions, personalized patient management, and integration with molecular and genetic testing.

-

Rising demand from global cardiovascular health initiatives. The increasing incidence of cardiomyopathies, heart transplant monitoring, and myocarditis drives the need for diagnostic biopsy procedures globally.

-

Emerging regional infrastructure. Asia-Pacific, Latin America, and the Middle East are expanding cardiac care facilities, training programs, and diagnostic labs, accelerating the adoption of EMB procedures.

-

Focus on cost-effectiveness and rapid diagnosis. Reduced procedure times, outpatient-friendly designs, and integration with rapid pathology platforms enhance efficiency for both clinical and research applications.

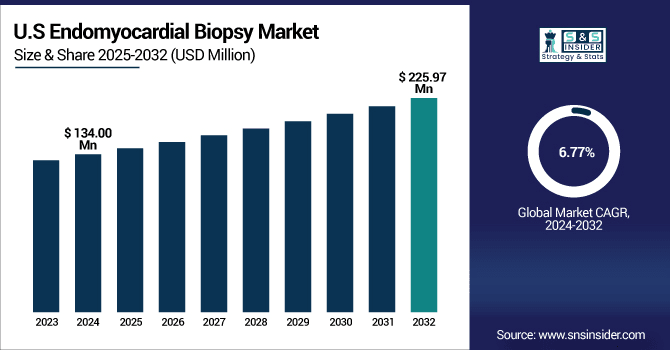

The U.S. Endomyocardial Biopsy Market was valued at USD 134.00 million in 2024 and is expected to reach USD 225.97 million by 2032, growing at a CAGR of 6.77% over 2025-2032.

High heart transplant procedure volume, well-established cardiac care infrastructure, and robust reimbursement will make the U.S. a major market for endomyocardial biopsy. Two of the most well-known hospitals are using biopsies to monitor transplant rejection and diagnose myocarditis. As per the endomyocardial biopsy market analysis, technological advancements, clinical recommendations, and trained cardiologists are additional factors supporting the US as the leading market contributor globally.

Endomyocardial Biopsy Market Growth Drivers:

-

Prevalence of Myocarditis and Cardiomyopathies Is Driving the Endomyocardial Biopsy Market Growth

The rising incidence of myocarditis and cardiomyopathies is the primary factor driving the endomyocardial biopsy market. If noninvasive imaging is nondiagnostic, biopsies afford tissue-level information. This growing clinical demand is a major driving factor for the endomyocardial biopsy market growth, particularly in tertiary care centres, where accurate differentiation of inflammatory over genetic heart diseases is necessary to guide directed therapy.

For instance, in January 2025, the CDC reported a 17% rise in U.S. myocarditis cases in 2024, driving a 12.5% increase in endomyocardial biopsy procedures for diagnosis.

Endomyocardial Biopsy Market Restraints:

-

Emergence of Non-Invasive Diagnostic Alternatives is a Significant Restraint on the Endomyocardial Biopsy Market Growth

The increased support of non-invasive diagnostic modalities, including cardiac MRI, PET imaging, and circulating biomarkers, is reducing invasive biopsies, especially for myocarditis and transplant surveillance. These options also decrease procedural risk and optimize patient comfort, which limits the use of traditional biopsy. This transition remains challenging for the endomyocardial biopsy market share but is reported more in developed healthcare infrastructure.

Endomyocardial Biopsy Market Opportunities:

-

Minimally Invasive and Image-Guided Technologies Create Lucrative Opportunities for Innovative Testing Equipment

Minimal Invasive and image-guided technologies and device advancements include tools and catheters having steerable capability and novel imaging systems that would enable physicians to conduct endomyocardial biopsies with greater accuracy and lesser risk. These technologies decrease complications, including cardiac penetration, enhance the accuracy of tissue sampling, shorten procedure time, and improve satisfaction of patient satisfaction, making it more and more popularized in hospitals and individual departments of cardiology globally.

For instance, in June 2024, approximately 60–65% of heart transplant patients in North America underwent at least one endomyocardial biopsy, ensuring early detection of rejection and improved post-transplant outcomes.

Endomyocardial Biopsy Market Segment Analysis

-

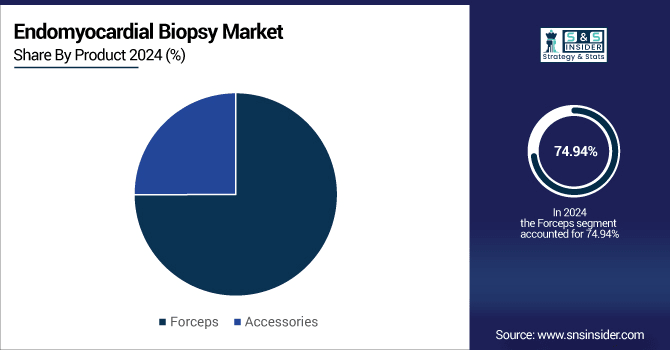

By product, forceps led the endomyocardial biopsy market with a 74.94% share in 2024, while accessories are the fastest-growing segment with a CAGR of 7.26%.

-

By tip, the maxi-curved dominated the market with a 35.83% share in 2024, whereas the pre-curved segment is expected to grow fastest with a CAGR of 7.55%.

-

By application, heart transplant rejection monitoring led the market with 42.86% share in 2024, while myocarditis diagnosis is registering the fastest growth with a CAGR of 7.40%.

-

By end user, hospitals held a 55.86% share in 2024, while ambulatory surgical centers (ASCs) are growing the fastest with a CAGR of 19.84%.

By Product, Forceps Lead Market, While Accessories Register Fastest Growth

In 2024, forceps led the endomyocardial biopsy market, holding the largest share, as they are responsible for the tissue extraction during biopsy. Their precision and enhanced safety features, and their availability in reusable and disposable forms, contribute to their popularity. Accessories are registering the fastest growth, owing to growing needs for advanced catheter kits, sheath systems, and guidewires to improve procedural speed and safety. This is driven by advancements in technology, increasing procedural volumes, and an increased focus on providing sterility.

By Tip, Maxi-curved Dominates, While the Pre-Curved Shows Rapid Growth

By Tip, the Maxi-curved dominates the endomyocardial biopsy market, as compared to the endomyocardial biopsy, which is more maneuverable, superior in tissue sampling accuracy, and has a lower risk of complications and therefore is widely accepted as the first choice of cardiologists in transplant surveillance and diagnosis of myocarditis. The pre-curved is showing rapid growth as it provides better steerability in complex anatomies, enhances procedure efficiency, shortens the learning curve, and enables further expansion in emerging cardiac care centers globally.

By Application, Heart Transplant Rejection Monitoring Lead, While Myocarditis Diagnosis Registers Fastest Growth

By Application, heart transplant rejection monitoring leads the endomyocardial biopsy market, as it is essential in monitoring early rejection in organ transplantation. Factors include a growing number of heart transplants globally, clinical guidelines recommending regular biopsy monitoring. While myocarditis diagnosis is registering the fastest growth, owing to the high prevalence of viral infections and post-COVID heart involvement. Factors driving the market include the increasing public awareness of the risk of myocarditis, improved techniques for biopsy, and early detection.

By End User, Hospitals Lead While Ambulatory Surgical Centers (ASCs) Grow Fastest

By end user, hospitals lead the endomyocardial biopsy market, owing to their more developed infrastructures, the availability of dedicated cardiology units, and the presence of expert interventional cardiologists. Market growth can be attributed to factors, including the growing number of heart transplant procedures. Whereas ambulatory surgical centers (ASCs) are growing the fastest, with their cost-effectiveness, shorter hospitalization, and greater prevalence of minimally invasive heart procedures. The market is propelled by improvements in portable biopsy device technology.

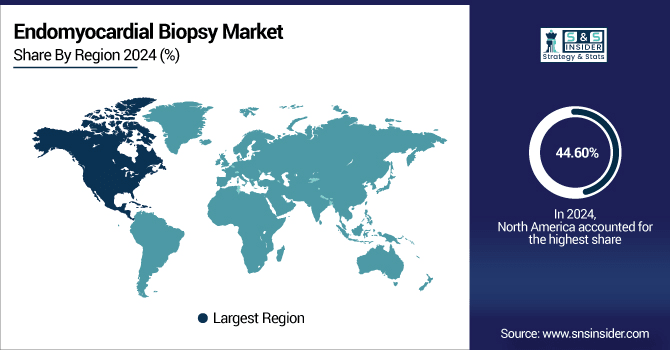

Endomyocardial Biopsy Market Regional Analysis:

North America Endomyocardial Biopsy Market Insights

In 2024, North America dominated the endomyocardial biopsy market and accounted for 44.60% of the revenue share. owing to its modern medical facilities, high prevalence of CVDs, and easy access to advanced diagnostic tools. The market is also being driven by the availability of major medical device manufacturers, a growing number of heart transplants, and favourable reimbursement. This is also part of the reasons for the endomyocardial biopsy market growth in North America, along with a growing geriatric population, high clinical research activity, and supportive regulations for cardiac diagnostics combine to make North America the globally leading region in endomyocardial biopsy adoption and innovation.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Endomyocardial Biopsy Market Insights

The Market in the U.S. for Endomyocardial Biopsy is dominated by a well-developed cardiac health care infrastructure and increasing numbers of patients suffering from cardiovascular diseases and high government support. Impetus of innovation from industry and academia, and early adoption of minimally invasive technologies, perpetuate its dominant standing and expansion

Asia-Pacific Endomyocardial Biopsy Market Insights

Asia-Pacific is expected to witness the fastest growth in the endomyocardial biopsy market over 2025-2032, with a projected CAGR of 7.60%, propelled by the growing cardiovascular disease incidence, surge in heart transplant procedures, and development of cardiac diagnostics. Rise in healthcare infrastructure in countries including China, India, and Japan, and growing access to sophisticated diagnostic tools and technologies. Furthermore, government efforts to provide better cardiac care, rising healthcare R&D investments, and rising medical tourism, especially for cost-effective cardiac treatment, are also driving the market growth. An increasing number of trained cardiologists, private hospital chains, and rising endomyocardial biopsy utilization are driving higher adoption of the procedure. Moreover, the increasing geriatric population and the transition toward the detection of heart illnesses in initial stages are other essential reasons driving the growth of the endomyocardial biopsy market in the Asia Pacific.

China Endomyocardial Biopsy Market Insights

China dominates the regional endomyocardial biopsy market with growing infrastructure for heart care and strong support from the government. Factors including local device production, clinical research initiatives, and the increasing prevalence of CVD are contributing to the acceleration of EMB adoption and investment in several regions in the country.

Europe Endomyocardial Biopsy Market Insights

Europe has a significant share in the endomyocardial biopsy market owing to well-established healthcare infrastructure, high awareness of early detection of cardiac diseases, and rising prevalence of heart failure and myocarditis. The area has supported health systems, facilities for advanced diagnostics, and involvement in cardiovascular research. Furthermore, the input of academia and industry is responsible for the innovation, with Europe as an important innovation partner globally.

Germany Endomyocardial Biopsy Market Insights

Germany is dominating the European endomyocardial biopsy market, owing to its strict regulation on healthcare and more concern towards patient safety. EMB has been incorporated into the practice of advanced cardiac centers and transplant programs, enabling precise diagnostics and rejection monitoring, which can be carried out in an efficacious and dependable manner, avoiding non-invasive tools with lower precision.

Latin America (LATAM) and Middle East & Africa (MEA) Endomyocardial Biopsy Market Insights

The endomyocardial biopsy market in Latin America is expected to grow because of increasing burden of cardiovascular diseases, enhanced cardiac care infrastructure, and the investment which the government is making in specialized hospitals. In the Middle East & Africa, market growth is driven by a developing health care infrastructure, growing transplant programs, and partnerships with international device manufacturers, but high costs and lack of expertise are the major market restraints.

Endomyocardial Biopsy Market Competitive Landscape:

Boston Scientific is a frontrunner in cardiovascular devices, providing game-changing biopsy catheters and interventional devices. Strong R&D, globally presence, and concentration in minimally invasive cardiac technologies underpin our market leadership and penetration.

-

In March 2025, Boston Scientific expanded its structural heart portfolio by introducing an advanced steerable biopsy catheter, designed for improved tissue sampling precision and reduced complications in transplant rejection monitoring.

Medtronic leads with biopsy solutions as part of its cardiac portfolio. Its focus on safety, accuracy, and international collaborations contributes to the diffusion of EMB in the field of transplant monitoring and cardiomyopathy diagnosis.

-

In January 2025, Medtronic announced clinical trial results validating its next-generation biopsy catheter system integrated with real-time imaging, demonstrating 30% higher accuracy in diagnosing myocarditis compared to traditional EMB techniques.

Abbott combines diagnostics and cardiovascular with its experience base to extend EMB applications. Its robust U.S. and globally presence, along with advances in image-guided technologies, fuel a higher level of biopsy accuracy and treatment success.

-

In September 2024, Abbott launched a new imaging-assisted EMB platform in Europe, combining biopsy tools with intracardiac echocardiography, improving safety and adoption in transplant centers and specialized cardiology hospitals.

Endomyocardial Biopsy Market Key Players:

Some of the endomyocardial biopsy market Companies are:

-

Boston Scientific Corporation

-

Medtronic plc

-

Abbott Laboratories

-

B. Braun Melsungen AG

-

Teleflex Incorporated

-

Merit Medical Systems, Inc.

-

Cook Medical LLC

-

Cardinal Health, Inc.

-

Terumo Corporation

-

Johnson & Johnson

-

BD

-

AngioDynamics, Inc.

-

Olympus Corporation

-

Smiths Medical

-

Vascular Solutions, Inc.

-

LeMaitre Vascular, Inc.

-

Penumbra, Inc

-

Cardiovascular Systems, Inc.

-

EndoChoice

-

Stryker Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 365.42 million |

| Market Size by 2032 | USD 619.61 million |

| CAGR | CAGR of 6.84% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Forceps, Accessories) • By Tip (Maxi-curved, Straight, Pre-curved, Others) • By Application (Myocarditis Diagnosis, Cardiomyopathy Evaluation, Heart Transplant Rejection Monitoring, Unexplained Heart Failure) • By End User(Hospitals, Cardiac Specialty Clinics, Ambulatory Surgical Centers (ASCs), Academic & Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, B. Braun Melsungen AG, Teleflex Incorporated, Merit Medical Systems, Inc., Cook Medical LLC, Cardinal Health, Inc., Terumo Corporation, Johnson & Johnson, BD, AngioDynamics, Inc., Olympus Corporation, Smiths Medical, Vascular Solutions, Inc., LeMaitre Vascular, Inc., Penumbra, Inc, Cardiovascular Systems, Inc., EndoChoice, Stryker Corporation, and other players. |