Allergen Free Food Market Report Scope & Overview:

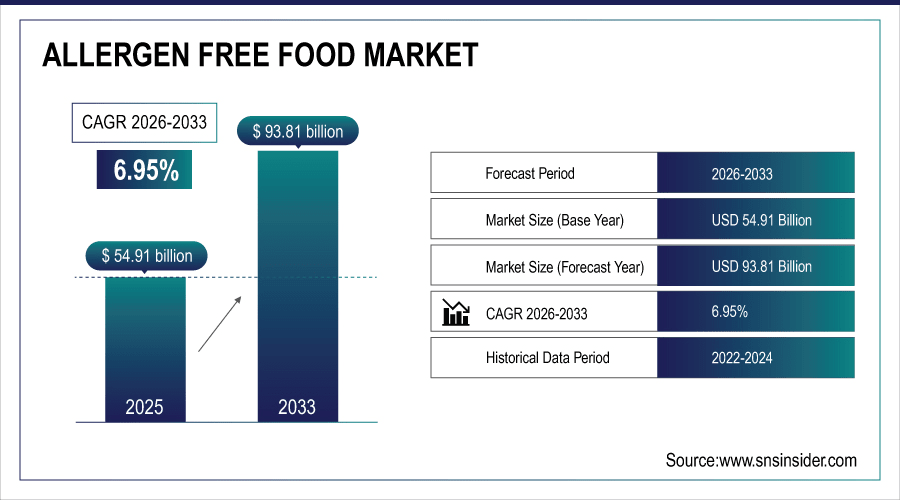

The Global Allergen Free Food Market size was valued at USD 54.91 Billion in 2025E and is projected to reach USD 93.81 Billion by 2033, growing at a CAGR of 6.95% during the forecast period 2026–2033.

The demand for allergen free food is rising globally as consumers prioritize safe, healthy, and inclusive nutrition. Foods that meet dietary preferences for dairy, soy, nuts and gluten are increasingly popular in homes and in the restaurant industry. At the same time, demand is being driven by the rising prevalence of food allergies, enhanced health awareness and consumers’ desire for clean-label offerings. Growing access in shops, super markets, and the internet provides major opportunities for international market growth and innovation.

About 45% of health-conscious consumers regularly purchase allergen free foods through supermarkets and online channels.

To Get More Information On Allergen Free Food Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 54.91 Billion

-

Market Size by 2033: USD 93.81 Billion

-

CAGR: 6.95% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Allergen Free Food Market Trends:

-

Demand for gluten-free products worldwide increased by 16% from 2018 to 2022 and is one of the fastest growing categories in the allergen free foods segment.

-

Plant-based allergen free snacking is becoming more popular with sales growing nearly 20% in dollar sales between 2022 and 2023 with granola bars, popcorn and baked goods driving the growth.

-

Product innovation is still high, with soy-free launches growing by 36% over the past five years, followed by a growth in nut-free products to cater to those consumers who suffer from allergies.

-

Organic, allergen free products now represent more than half the market, showcasing consumer demand for clean label, natural, and premium positioned offerings.

U.S. Allergen Free Food Market Insights

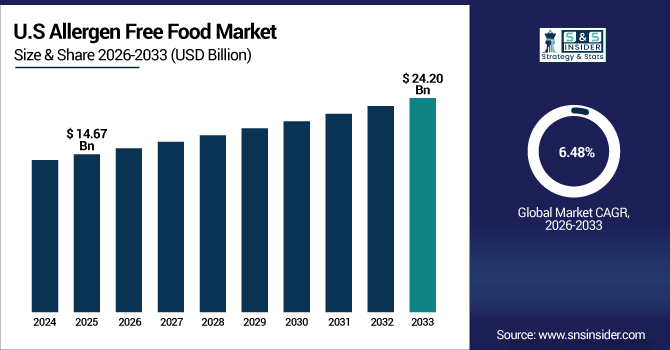

U.S. Allergen Free Food Market size was estimated at USD 14.67 Billion in 2025E which is projected to USD 24.20 Billion by 2033 growing at a CAGR of 6.48%. Increasing food allergy cases, consumer preference for dairy-free and gluten-free products, and increase in health consciousness are the key drivers of industry growth. Consumer adoption is supported by robust retail distribution, rising e-commerce and clean-label innovation; long-term market growth and confidence is also enhanced by premiumization trends and regulatory climate.

Allergen Free Food Market Growth Drivers:

-

Rising Food Allergies and Intolerance Cases are Accelerating Global Demand for Allergen Free Alternatives Across Multiple Food Categories.

The market for allergen-free foods is being driven by the rise in food allergies and intolerances as consumers actively look for inclusive and safe dietary options. The need for allergen-free substitutes is continuously rising due to the rise in incidences of lactose intolerance, nut allergies, gluten sensitivity, and soy intolerance. In addition to offering healthier options, these items accommodate lifestyle preferences, which fosters innovation and increases consumer acceptance of many international food categories.

Over 70% of consumers with food allergies or intolerances actively seek allergen free alternatives, with gluten-free and dairy-free products emerging as the leading segments in the global market.

Allergen Free Food Market Restraints:

-

High Production Costs and Premium Pricing are Major Restraints, Limiting the Affordability and Wider Adoption of Allergen Free Food Products.

In the market for foods free of allergens, high production costs and premium price continue to be significant barriers. In order to prevent cross-contamination, specialized sourcing of components like dairy substitutes, gluten-free grains, and nut-free formulations frequently calls for more stringent safety regulations and specialized manufacturing facilities. Higher operating costs as a result of these additional procedures translate into higher retail pricing. Because of this, foods free of allergens are frequently more expensive for the general public, which limits their uptake to affluent demographics and slows their mainstream market penetration.

Allergen Free Food Market Opportunities:

-

Expanding Awareness of Food Allergies and Intolerances is Creating Strong Opportunities for Growth and Innovation in Allergen Free Food Products Worldwide.

Opportunities for the market for allergen-free foods are growing as more people become aware of food allergies and intolerances. Consumers' awareness of the danger’s gluten, dairy, nuts, and soy pose to their health is driving up demand for trustworthy and safe substitutes. Customers are being encouraged to choose allergen-free products as a result of increased media coverage, medical advice, and education efforts. Wider worldwide adoption, product diversification, and innovation are all aided by this expanding body of information.

Over 60% of global consumers are willing to pay a premium for allergen free and clean-label products, driving strong demand for gluten-free, dairy-free, and nut-free alternatives across multiple food categories.

Allergen Free Food Market Segmentation Analysis:

-

By Product Type, gluten-free emerges as the most adopted allergen free category with a 38.00% share of the market in 2025E and dairy-free substitutes are estimated to be the fastest-growing, at a 7.5% CAGR during 2026–2033.

-

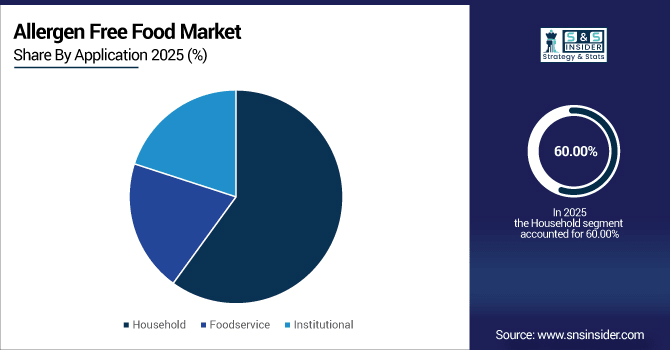

By Application, household consumption remains the largest in 2025E at 60. 00% of volume share as it sees growing consumer demand for allergen free staples as supplied to the everyday diet, while foodservice is the fastestgrowing channel at a 7.2% CAGR with cafés, bakeries and restaurants adding allergen free offerings to their menus.

-

By Distribution Channel, supermarkets and hypermarkets account for 48.00% share in 2025E, while online retail is the fastest growing at 7.8% CAGR, driven by e-commerce penetration and subscription models.

-

By Form, solid products (like allergen free bakery products, snacks, and packaged are estimated to hold market share of 46.00% in 2025E as liquid (comprising allergen free beverages and dairy substitutes) type grow at a highest CAGR of 7.4% during forecast period.

By Application, Household Consumption Dominates While Foodservice Expands Quickly:

Household consumption leads the market as allergen free foods become pantry staples for families managing food allergies or adopting healthier lifestyles. There's more of a need for consumer-friendly, clean-label, safe products for cooking, snacking and every day meal solutions. And with bakeries, restaurants and coffee houses increasingly catering to with a growing presence in the foodservice business, too. Restaurants are adapting to meet the demand for creative, inclusive and safe allergen-friendly dining brought about by increasing consumer awareness.

By Product Type, Gluten-Free Leads While Dairy-Free Grows Rapidly:

Gluten-free products dominate the allergen free food market as they are widely accepted across a broad consumer base, including those with celiac disease, gluten intolerance, and health-conscious buyers. Now, however, they're making a big comeback due to their use in packaged products, snacks and bakery items. Meanwhile, the rapidly expanding dairy-free market is gaining momentum thanks to the ever-increasing number of people opting for vegan and lactose-free diets. Dairy-free options in beverages and sweets attract consumers seeking plant-based, allergy-friendly diets.

By Distribution Channel, Supermarkets Dominate While Online Retail Grows Rapidly:

Supermarkets and hypermarkets remain the leading distribution channel as they provide wide assortments and easy access to allergen free products in one place. This is something that having long stayed in the aforesaid industry, they are the preferred option for all those customers who are keen to use secure, and also approved options. But internet shopping is growing fast, in part because it is so easy, and there is such variety, and there are plenty of clever ways to package the product and get it to the consumer, tactics very different from the drugstore approach of putting things on shelves. Subscription services are also making allergen-free food more accessible on a daily basis, and e-commerce platforms are enabling smaller firms to serve a global client base.

By Form, Solid Products Lead While Liquid Alternatives Expand Quickly:

Solid allergen free foods, including bakery items, snacks, and packaged meals, dominate consumption as they are versatile, convenient, and widely integrated into daily diets. Households find them appealing due to the name and selection. Conversely, liquid options such as dairy alternatives and allergen-free beverages are proliferating rapidly. As their presence in plant-based diets, fitness routines, and even the daily grind continues to grow, the message is clear – there is a trend toward more inclusive, benefit-driven, and healthier liquid options.

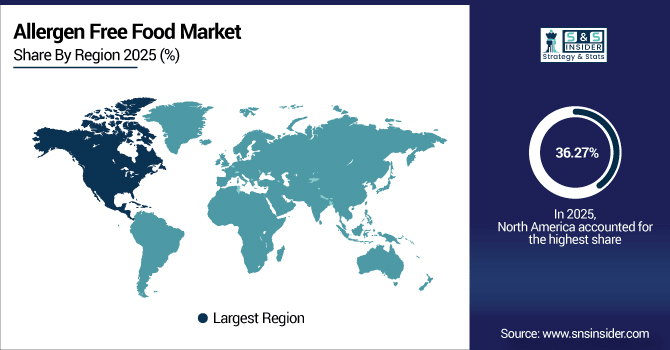

Allergen Free Food Market Regional Analysis:

North America Allergen Free Food Market Insights:

North America dominates the global allergen free food market, holding a 36.27% share in 2025E. The Leading position of the region is strengthened by a high prevalence of food allergies, in particular gluten and dairy, and high levels of consumer awareness of health and wellness. Because the United States has advanced foodservice and retail networks offering a wide variety of baked goods, snacks, and beverages that are allergen-free, such foods are leading the way in terms of innovation. High-end offerings, established certification protocols and a growing focus on clean-label diets are certainly going to help North America maintain that edge.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Allergen Free Food Market Insights

The U.S. leads the allergen free food market within North America, driven by a high prevalence of gluten and dairy intolerances and strong consumer demand for clean-label diets. Sophisticated retail and eCommerce channels broaden availability of allergen-free baked goods, snacks, and drinks, and certification programs build trust. The U.S. is well-placed to grow the global market for allergen-free foods as a result of premiumization, product innovation including plant-based, and escalating health-awareness.

Asia-Pacific Allergen Free Food Market Insights:

Asia-Pacific is the fastest-growing region, projected to expand at a 7.41% CAGR during 2026–2033. Urbanization, growing middle-class, and increase in disposable income is generating demand for safe and superior food alternatives. Demand for allergen-free alternatives is growing in such countries as China, India and Japan, due to an increase in lactose intolerance and wheat allergies. The Asia-Pacific has become the most adapted market for allergen-free food as there is high penetration of e-commerce, indigenous growth of the plant based diet and increasing influence of western cuisines on the food offerings.

China Allergen Free Food Market Insights

China holds the largest market for allergen-free food ingredients market in the Asia-Pacific region, owing to its huge population, growing lactose intolerant population and growing awareness about health. Fast urbanization, Western dietary influence, strong e-commerce presence are driving demand for dairy-free, gluten-free, and clean-label products, and China is the key growth driver in the region.

Europe Allergen Free Food Market Insights:

Europe represents a strong market for allergen free foods due to strict regulatory frameworks, consumer demand for transparency, and widespread adoption of gluten-free and dairy-free alternatives. The UK, Germany and France emerge as leading countries when it comes to product innovation, with a focus on the baking and beverage workplaces. Growth continues to be propelled by health-conscious lifestyles and the growing vegan and vegetarian movements. Europe remains a developed yet fast-growing market for allergen-free food products due to its strong retail base and supportive labelling legislation.

UK Allergen Free Food Market Insights

Europe's allergen free food market is dominated by the UK where the prevalence of gluten and dairy intolerance is high, regulation is tight and consumer awareness strong. UK at the heart of the region with an evolution in bread and beverage innovation, rising vegan trends, and a mature retail arena, the UK leads the way in the region.

Latin America Allergen Free Food Market Insights:

Latin America is experiencing growing demand for allergen free foods, driven by rising health awareness and the influence of global dietary trends. Brazil and Mexico are among the key markets where demand for gluten-free bread and other bakery goods, and lactose-free dairy is on the rise. Urbanization and rapid expansion of modern retail formats is also driving the market. You can access the full edition at this link (for free) Although price concerns still rule the day, the comparatively young population and evolving dietary preferences of the area are paving the way to a greater innovation in allergen-free options.

Middle East & Africa Allergen Free Food Market Insights:

The demand of allergen-free food is increasing in the Middle-East and Africa due to the growing health awareness and increasing incidence of celiac disease and lactose intolerance. Prospective The most advanced aspects related to the development of what is described as premium allergen-free human food goods: these high value products are beginning to gain visibility even in Gulf countries, comprising United Arab Emirates and Saudi Arabia.

Allergen Free Food Market Competitive Landscape:

Nestlé S.A., a leading worldwide food and beverage company, dominates the market for allergen-free foods thanks to its extensive line of clean-label, dairy-free, and gluten-free products. The company's R&D muscles are flexed in snacks, drinks, and baby food. In keeping with increased awareness about allergies, brands such as Gerber and Garden of Life emphasize inclusivity, safety and nutrition. Nestlé is a player thanks to long-standing relationships, global penetration, strong brand presence, and commitment to health and well-being influences.

-

In June 2025, Nestlé promised to remove artificial colors from its entire U.S. portfolio by mid-2026, doubling down on its commitment to clean-label ingredients.

Danone S.A.'s robust plant-based and dairy-free product lines, marketed under names like Silk and Alpro, are essential to the market for allergen-free foods. Increasing consumer demand for vegan and lactose free alternatives, particularly in drinks and yogurts, was benefitting the business, she said. Its commitment to clean label innovation, nutrition and sustainability strengthens its positioning even more. Thanks to its global presence combined with local customization, Danone can address diverse consumer needs, and drive continuous growth in allergy-free product segments.

-

In March 2025, Danone launched a new range of dairy-free yogurt alternatives than carry on its well-established Alpro brand, and tapped into the growing consumer need for plant-based and allergen-free alternatives.

Unilever PLC has made a substantial presence in the allergen free food market with brands that concentrate on plant-based and allergy-friendly products such as Ben & Jerry’s Non-Dairy and The Vegetarian Butcher. And it has a global footprint and some serious marketing muscle to drive meatless and dairy-free products in front of consumers. In addressing allergy concerns, as well as appealing to vegans and flexitarians, Unilever is following other trends in sustainability, wellness and health. With a worldwide retail presence and continuous product development Unilever is competitive on this front.

-

In June 2025, Unilever’s unit Breyers recalled more than 6,600 cases of Rocky Road ice cream that was mislabeled and could have put at risk consumers allergic to nuts.

Allergen Free Food Market Key Players:

Some of the Allergen Free Food Market Companies are:

-

Nestlé S.A.

-

Danone S.A.

-

Unilever PLC

-

General Mills, Inc.

-

The Hain Celestial Group, Inc.

-

The Kraft Heinz Company

-

Mondelēz International, Inc.

-

Conagra Brands, Inc.

-

Kellogg Company

-

Blue Diamond Growers, Inc.

-

Daiya Foods, Inc.

-

Dr. Schär AG/SpA

-

Enjoy Life Foods, Inc. (a subsidiary of Mondelēz International)

-

Amy’s Kitchen, Inc.

-

Abbott Laboratories, Inc.

-

Boulder Brands, Inc. (a subsidiary of Pinnacle Foods)

-

SunButter LLC

-

Nature’s Path Foods, Inc.

-

Free2b Foods, LLC

-

Earth’s Best Organic (a subsidiary of The Hain Celestial Group, Inc.)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 54.91 Billion |

| Market Size by 2033 | USD 93.81 Billion |

| CAGR | CAGR of 6.95% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Gluten-Free, Dairy-Free, Nut-Free, Soy-Free, and Others) • By Application (Household, Foodservice, and Institutional) • By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online Retail, and Direct Sales) • By Form (Solid, Liquid, and Semi-Solid) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nestlé S.A., Danone S.A., Unilever PLC, General Mills, Inc., The Hain Celestial Group, Inc., The Kraft Heinz Company, Mondelēz International, Inc., Conagra Brands, Inc., Kellogg Company, Blue Diamond Growers, Inc., Daiya Foods, Inc., Dr. Schär AG/SpA, Enjoy Life Foods, Inc. (a subsidiary of Mondelēz International), Amy’s Kitchen, Inc., Abbott Laboratories, Inc., Boulder Brands, Inc. (a subsidiary of Pinnacle Foods), SunButter LLC, Nature’s Path Foods, Inc., Free2b Foods, LLC, Earth’s Best Organic (a subsidiary of The Hain Celestial Group, Inc.). |