Spatial Omics Market Size & Overview:

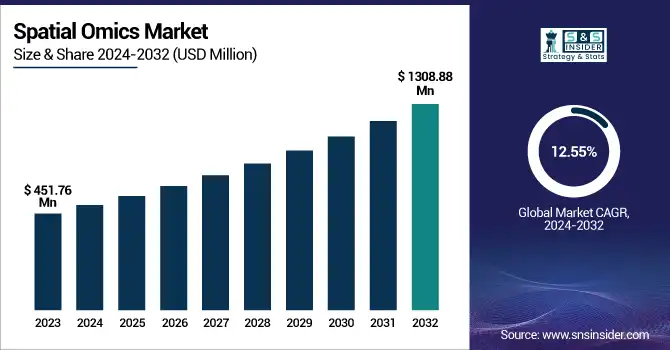

The Spatial Omics Market Size was valued at USD 451.76 Million in 2023 and is expected to reach USD 1,308.88 Million by 2032, growing at a CAGR of 12.55% over the forecast period of 2024-2032.

Get more information on Spatial Omics Market - Request Free Sample Report

The Spatial Omics Market is witnessing dynamic growth, propelled by technological breakthroughs and rising financial support. The study exposes significant funding patterns and investment trends, therefore underlining how capital flow is accelerating innovation. It also examines revised laws and norms guiding the safe implementation of innovative technologies. Emphasizing improved diagnosis and research accuracy, the customer value proposition and benefits become crucial as usage spreads.

The market analysis also highlights several green initiatives by major companies due to the increase in environmental awareness. Additionally, considering the world trade policies and their influence on market development, further revealing how tariffs and international norms influence it. These elements taken together suggest a market ready for exponential development.

The U.S. Spatial Omics Market Size was valued at USD 144.38 Million in 2023 with approximately 81% share and growing at a substantial CAGR over 2024-2032.

Owing to the large part to strong research programs, more financing, and biotechnology developments, the U.S. spatial omics market is growing significantly. Important factors include the great presence of premier institutions including the National Institutes of Health (NIH) and big businesses, such as 10x Genomics, who are leading in developing breakthrough spatial omics technologies. Growing demand for precision medicine combined with the need for more accurate diagnosis and treatments promotes industry development. Additionally, generating new possibilities and the surging integration of artificial intelligence in the geographical data analysis further expands market expansion.

Spatial Omics Market Dynamics:

Drivers:

- Unprecedented Growth in Spatial Omics Through Innovative Integration of Artificial Intelligence, Machine Learning, and Advanced Bioinformatics Platforms Drives Market Expansion

Owing to the rapid artificial intelligence, machine learning, and modern bioinformatics platforms incorporation, the spatial omics market witnessing exponential growth. The emerging technologies are also being utilized in the dynamic surroundings for converting complicated and large biological datasets into useful and valuable insights. the spatial gene expression, protein distribution, and tissue architecture are also being analyzed by using modern artificial intelligence algorithms and machine learning approaches increasingly. Mostly depending on advanced bioinformatics technologies, soaring integration of data sources and mapping of particular cellular processes and molecular interactions. Faster and more precise data interpretation made feasible by this integration helps to increase the speed of the research and clinical translation.

Moreover, the flawless link between computer models and experimental data provides predictive analytics supporting tailored treatment approaches. These technological developments taken together not only simplify research processes but also enable researchers to transcend earlier analytical constraints. Significant investments and an environment of ongoing improvement are being generated by this development path. The thorough investigation included in our research shows how these developments are transforming the Spatial Omics Market and generating discoveries that might completely transform diagnostic and therapeutic uses in many different fields of life sciences.

Restraints:

- High Operational and Infrastructure Costs Hinder Widespread Adoption of Advanced Spatial Omics Technologies Due to Complexity and Significant Investment Requirements

The high costs related to infrastructure and operations, which prevent large use of advanced spatial omics technologies constitute a main constraint hampering the spatial omics market growth. To handle and evaluate vast amounts of data, these technologies demand significant capital expenditure in specialized facilities, advanced instrumentation, and high-performance computer infrastructure. The intrinsic complexity of spatial omics systems, which combine several high-throughput technologies and sophisticated imaging systems, increases the running costs even further. Establishing and maintaining these state-of- the-art facilities is a major financial challenge for many research organizations, particularly smaller academic institutions and startups in biotechnology. The expenses also cover continuous costs for system calibration, software upgrades, data storage, and staff training in addition to simple equipment purchase.

The research paper also emphasizes all these financial problems and shows how high investment requirements could restrict access and slow down the market development. Emphasizing the need of creative finance models and cooperative funding techniques to help to reduce these cost-related problems, comprehensive case studies on the financial consequences of adopting spatial omics solutions have been presented. Dealing with these issues is still essential to enable more general realization of the advantages of spatial omics in many research and clinical environments.

Opportunities:

- Collaborative Innovations Between Industry and Academic Institutions Create Opportunities to Develop Breakthrough Spatial Omics Solutions for Advanced Clinical Applications Globally

Collaborative innovations between industry leaders and academic institutions are driving significant opportunities for the development of breakthrough spatial omics solutions aimed at advanced clinical applications globally. These cooperative ventures mix the advantages of modern research and commercial knowledge to foster an environment where new ideas and discoveries could flourish. The pooling of resources, knowledge, and data that collaborations serve to enable will help to overcome these technological challenges and hastening of the development of strong spatial omics platforms. This partnership has generated the co-creation of unique tools combining high-resolution imaging, multi-omics data integration, and sophisticated computational analysis. Such methods enable one to handle complex biological events and translate scientific discoveries into clinical diagnostics and tailored treatments.

The research report offers comprehensive analysis of several case studies where industry-academic collaborations have resulted in significant development, hence extending the opportunities for spatial omics technologies. Here also under debate are strategic frameworks enabling these alliances including combined funding projects, pooled research facilities, and coordinated training programs. The study underlines how these combined efforts are opening the road for novel therapeutic uses, therefore enhancing patient care and supporting the Spatial Omics Market trends to grow generally globally.

Challenges:

- Complex Data Integration and Management Pose Significant Challenges for Interpreting Spatial Omics Results Due to Heterogeneous and Large-Scale Data Generation

A critical challenge in the Spatial Omics Market expansion is the complex data integration and management required for interpreting spatial omics results, given the heterogeneous and large-scale data generation inherent to these technologies. The process involves the aggregation of diverse datasets, including high-resolution imaging, gene expression profiles, and proteomic information, each with its unique format and scale. The challenge lies in seamlessly integrating these varied data types into a coherent analytical framework that can deliver reliable and reproducible insights. Advanced computational tools are necessary to manage the massive volumes of data generated, yet these tools must also accommodate the inherent variability across different experimental platforms and research settings.

In the spatial omics market analysis, it is examined that the technical and infrastructural hurdles associated with data integration in the Spatial Omics Market. It details how researchers and companies are developing novel algorithms and data management systems to address these challenges, ensuring that data can be effectively standardized, processed, and analyzed. This comprehensive discussion highlights the importance of continued innovation in computational methodologies and data infrastructure to unlock the full potential of spatial omics research. The report also explores collaborative efforts between technology providers and research institutions aimed at creating unified data platforms, which are essential for advancing the field and achieving clinical translation.

Spatial Omics Market Segmentation Analysis:

By Product

Consumable products dominated the Spatial Omics Market in 2023 with a market share of 45.5%, largely because consumables such as reagents, antibodies, and specialized chemicals are critical to conducting high-precision spatial assays. This dominance is driven by the continual demand from research institutions and biotechnology companies for high-quality consumables that ensure reproducibility and reliability in experiments. For example, leading organizations such as 10x Genomics and NanoString Technologies rely on advanced consumable products to support their spatial analysis platforms, and industry associations including the Association for Molecular Pathology have highlighted the importance of standardized consumables in achieving consistent results. Government initiatives that fund innovative research projects have also underscored the necessity for dependable consumable supplies, further reinforcing their market dominance.

The robust supply chain networks, rapid product development cycles, and continuous improvements in product quality have enabled consumables to not only meet the rigorous demands of advanced spatial omics research but also drive market growth by offering improved sensitivity and accuracy in molecular imaging and profiling. This comprehensive focus on consumables reflects the broader trend in life sciences toward optimizing laboratory workflows and ensuring data integrity, ultimately making consumable products a foundational pillar of the Spatial Omics Market.

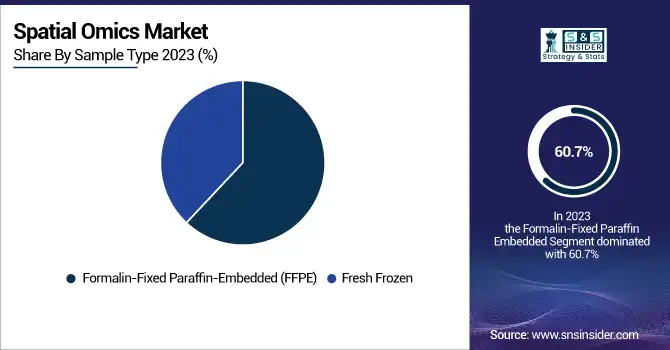

By Sample Type

Formalin-Fixed Paraffin-Embedded samples dominated the sample type segment with a market share of 60.7% in 2023, reflecting their widespread use in clinical and research laboratories due to their excellent preservation of tissue morphology and long-term stability. FFPE samples are extensively utilized in pathology laboratories and diagnostic centers, as they enable retrospective studies and provide archival tissue resources for biomarker discovery. Prominent organizations, such as the American Society of Clinical Pathology have advocated for the continued use of FFPE due to its cost-effectiveness and reliability, while recent governmental funding announcements have further boosted research initiatives using these samples.

This robust preference is also supported by the established protocols and validation studies available for FFPE, which have been refined over decades. The ease of handling and the ability to perform multiplexed analyses using FFPE samples have positioned them as the backbone of spatial omics applications, particularly in oncology and personalized medicine. The strong market position of FFPE samples underscores their critical role in enabling comprehensive spatial profiling and molecular diagnostics, thereby contributing significantly to the overall expansion of the Spatial Omics Market.

By Technology

Spatial Transcriptomics emerged as the dominating technology in 2023 with a market share of 40.9%, driven by its ability to map gene expression within intact tissue architecture and reveal cellular heterogeneity at unprecedented resolution. The technique has revolutionized our understanding of complex biological systems by allowing researchers to visualize gene expression patterns in the spatial context of tissues, thereby facilitating breakthroughs in areas such as cancer research and developmental biology. Esteemed institutions including the National Institutes of Health and leading companies including 10x Genomics have embraced spatial transcriptomics due to its high resolution and versatility.

Regulatory bodies have also recognized its potential in improving diagnostic accuracy, further spurring its adoption. Additionally, recent government-sponsored research programs and collaborations between academic institutions and industry partners have accelerated the development and refinement of spatial transcriptomics platforms. The technology’s ability to combine imaging with molecular data has provided researchers with a powerful tool for identifying novel therapeutic targets and understanding disease mechanisms, making it an indispensable component of the Spatial Omics Market.

By Application

Diagnostics dominated the application segment with a market share of 49.4% in 2023, owing to the critical need for precise and early disease detection facilitated by spatial omics technologies. The integration of spatial omics into diagnostic workflows has led to significant advancements in identifying molecular signatures within tissues, thereby enhancing the accuracy of cancer diagnoses and other complex diseases. This dominance is supported by initiatives from government health agencies and research institutions, such as the National Cancer Institute, which emphasize the importance of early detection in improving patient outcomes.

Leading companies have leveraged spatial omics to develop diagnostic assays that offer high sensitivity and specificity, thereby enabling more personalized treatment strategies. Regulatory endorsements and clinical trial successes have further reinforced the credibility of spatial omics-based diagnostics, establishing them as a key driver in the medical community. The transformative potential of spatial omics in diagnostics is not only reshaping clinical practices but is also paving the way for novel therapeutic interventions, making diagnostics a central pillar in the growth of the Spatial Omics Market.

By Workflow

Instrumental Analysis claimed dominance in the workflow segment with a market share of 43.8% in 2023, as it forms the critical backbone for data acquisition in spatial omics studies. High-performance instruments, such as advanced microscopy and mass spectrometry systems, are indispensable for capturing high-resolution spatial data from tissue samples, enabling detailed molecular characterization. The widespread adoption of sophisticated imaging platforms by research organizations and biotechnology companies underscores the essential role of instrumental analysis.

Regulatory agencies and government-funded research programs have continually emphasized the importance of robust analytical instrumentation in enhancing the reproducibility and accuracy of scientific data. For instance, associations, such as the American Association for Cancer Research highlight how state-of-the-art instruments drive innovation in diagnostic and therapeutic applications. The continuous technological advancements and increasing investments in research infrastructure have made instrumental analysis a focal point in the Spatial Omics Market, ensuring that data collection is both precise and comprehensive, ultimately propelling market growth.

By End-use

Academic and Translational Research Institutes dominated the end-use segment with a market share of 40.8% in 2023, primarily due to their pivotal role in pioneering spatial omics research and innovation. These institutes, including renowned universities and government-funded research centers, drive forward the development of novel spatial technologies through extensive collaborative projects and public–private partnerships. The academic sector’s commitment to advancing biomedical research is reflected in substantial investments in cutting-edge facilities and training programs, which foster the integration of spatial omics into routine laboratory practice. For instance, initiatives supported by organizations such as the National Institutes of Health and the Association of American Medical Colleges have bolstered research capabilities by funding projects that incorporate spatial omics methodologies.

Additionally, translational research institutes serve as a bridge between laboratory discoveries and clinical applications, accelerating the process of converting scientific insights into practical diagnostic and therapeutic solutions. This robust engagement from the academic and translational research community has not only enhanced the technological landscape but also contributed significantly to the sustained growth of the Spatial Omics Market, reinforcing its status as an essential driver of innovation and progress in modern biomedical research.

Spatial Omics Market Regional Insights:

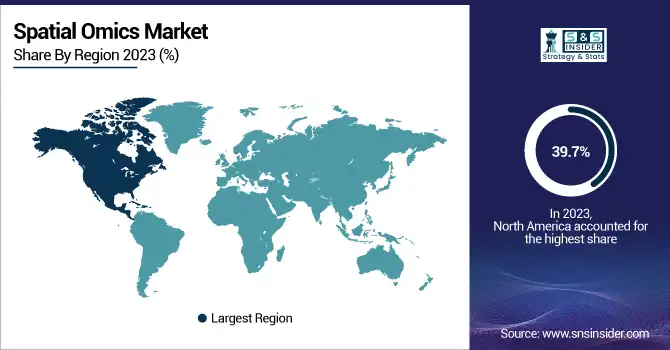

North America dominated the Spatial Omics Market in 2023 with a spatial omics market share of 39.7%, reflecting a highly developed infrastructure and a strong emphasis on biomedical research and innovation. The region is home to leading research institutions such as the National Institutes of Health and top-tier universities, which foster a conducive environment for spatial omics advancements. Prominent companies based in the U.S., including 10x Genomics and NanoString Technologies, have significantly contributed to the market by continuously developing and refining state-of-the-art spatial omics platforms. Government initiatives and funding programs, including those from the National Cancer Institute, have further accelerated research and commercialization of these technologies. The integration of robust regulatory frameworks and supportive trade policies has also enhanced market growth, making North America a hub for cutting-edge diagnostics and precision medicine. With extensive collaborations between academia, industry, and government agencies, the region remains a critical driver of innovation and a leading force in shaping the future of spatial omics research and clinical applications.

On the other hand, Asia Pacific emerged as the fastest growing region in the Spatial Omics Market, with a substantial growth rate over the forecast period of 2024 to 2032, driven by rapid technological adoption and increased investments in life science research. Key markets in countries including China, Japan, and South Korea are experiencing accelerated growth due to the establishment of advanced research centers and increased government support for biotechnology initiatives. Regional governments are implementing strategic policies and funding programs to enhance research capabilities, while local companies are investing heavily in spatial omics infrastructure and innovation.

For instance, research institutions in China have recently partnered with global companies to develop localized spatial omics solutions, further bolstering market expansion. The growing presence of regional conferences and academic symposia in these countries is also fostering knowledge exchange and collaboration, accelerating the integration of spatial omics into clinical practice. This combination of strong governmental backing, industry collaborations, and an expanding research ecosystem is setting the stage for Asia Pacific to become a major player in the global Spatial Omics Market, driving forward a new era of innovation and precision diagnostics.

Do You Need any Customization Research on Spatial Omics Market - Enquire Now

Spatial Omics Market Key Players:

-

10x Genomics (Visium Spatial Gene Expression, Xenium In Situ Gene Expression)

-

Akoya Biosciences, Inc. (PhenoCycler-Fusion, Phenoptics)

-

Bio-Techne (RNAscope, Advanced Cell Diagnostics - RNAScope)

-

Bruker Corporation (MALDI Imaging, TIMS-TOF Pro)

-

Dovetail Genomics (Cantata Bio.) (Hi-C, Micro-C)

-

Illumina, Inc. (NextSeq 1000, NovaSeq 6000)

-

Ionpath, Inc. (MIBI, MIBI-TOF)

-

NanoString Technologies, Inc. (GeoMx Digital Spatial Profiler, nCounter Analysis System)

-

RareCyte, Inc. (CyteFinder System, CyteJet)

-

Vizgen, Inc. (MERSCOPE, MERFISH)

-

Advanced Cell Diagnostics, Inc. (RNAscope, BaseScope)

-

Biognosys AG (SpectroMine, Panorama)

-

Fluidigm Corporation (CyTOF, Helios)

-

Lunaphore Technologies S.A. (PhenoImager, PhenoCycler)

-

Molecular Machines & Industries GmbH (Molecular Machine Imaging System, Spatial Protein Profiling)

-

PerkinElmer, Inc. (Vectra Polaris, Opera Phenix)

-

Rebus Biosystems, Inc. (REBUS Imaging Platform, REBUS Scanning Technology)

-

Standard BioTools Inc. (CellStream, IonFlux)

-

Zeiss Group (ZEISS LSM 980, ZEISS Axio Imager)

-

GE Healthcare (Inveon PET, Discovery MI)

Recent Developments in the Spatial Omics Market:

-

February 2025: Illumina announced a groundbreaking spatial transcriptomics technology designed to analyze millions of cells per experiment. This innovation offers a capture area nine times larger and four times the resolution of existing technologies. It is compatible with Illumina's NextSeq and NovaSeq sequencers and is slated for commercial release in 2026.

-

January 2025: Researchers at the University of Pennsylvania's Perelman School of Medicine developed an AI-powered tool named MISO (Multi-modal Spatial Omics). MISO can detect cell-level characteristics of cancer by analyzing data from extremely small tissue samples, enhancing the precision of cancer diagnostics and potentially guiding personalized therapies.

-

November 2024: MGI Tech entered into a partnership with the Human Cell Atlas consortium to advance global human cell mapping efforts. Under this collaboration, MGI committed to providing HCA members with discounted access to its single-cell and spatial omics technologies, along with support in experimental design and bioinformatics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 451.76 Million |

| Market Size by 2032 | USD 1,308.88 Million |

| CAGR | CAGR of 12.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Sample Type (Formalin-Fixed Paraffin-Embedded (FFPE), Fresh Frozen) •By Technology (Spatial Transcriptomics, Spatial Genomics, Spatial Proteomics) •By Application (Diagnostics, Translation Research, Cell Biology, Single Cell Analysis, Others) •By Workflow (Sample Preparation, Instrumental Analysis, Data Analysis) •By End-use (Academic & Translational Research Institutes, Pharmaceutical & Biotechnology Companies, Contact Research Organizations (CROs), Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 10x Genomics, NanoString Technologies, Inc., Bio-Techne, Ionpath, Inc., Akoya Biosciences, Inc., Dovetail Genomics (Cantata Bio.), Bruker Corporation, Illumina, Inc., RareCyte, Inc., Vizgen, Inc. and other key players |