Endpoint Detection and Response (EDR) Market Report Scope & Overview:

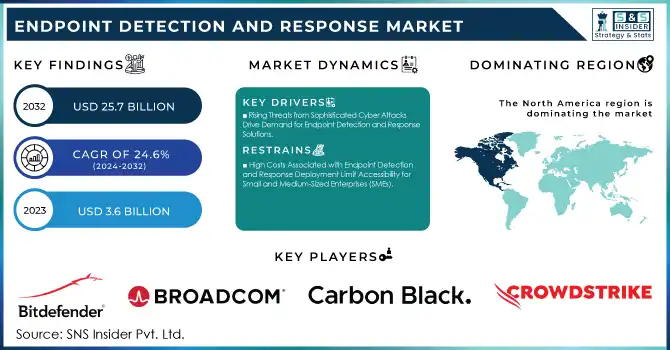

The Endpoint Detection and Response Market Size was USD 5.58 Billion in 2025E and will reach USD 32.47 Billion by 2033 and grow at a CAGR of 24.6% by 2026-2033.

The Endpoint Detection and Response market is evolving rapidly, driven by the increasing complexity of cyber threats and the need for advanced, real-time detection solutions. The market’s growth is propelled by enterprise demand for comprehensive security that combines endpoint monitoring, threat hunting, and automatic response capabilities. An example of recent innovation is seen in efforts by cybersecurity companies to integrate artificial intelligence and machine learning for improved anomaly detection and predictive insights, thus enhancing threat visibility and mitigation. In May 2024, CIO Influence highlighted trends showing how Endpoint Detection and Response solutions are evolving beyond traditional endpoint security to address multi-vector threats, emphasizing how companies are adapting their offerings to cover cloud environments and complex digital ecosystems.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 5.58 Billion

-

Market Size by 2033 USD 32.47 Billion

-

CAGR of 24.6% From 2026 to 2033

-

Base Year 2025

-

Forecast Period 2026-2033

-

Historical Data 2022-2024

Get more information on Endpoint Detection and Response Market - Request Free Sample Report

Endpoint Detection and Response (EDR) Market Trends:

• Rising adoption of AI and ML in endpoint detection and response solutions for proactive threat management.

• Increased deployment of advanced EDR solutions to combat sophisticated attacks like APTs and ransomware.

• Growing demand for real-time threat detection and automated response capabilities across hybrid and remote work environments.

• Expansion of EDR solutions into SMBs and enterprises due to evolving cyber threat landscapes and complex attack surfaces.

• Continuous improvement of detection algorithms and predictive capabilities, enhancing accuracy and reducing response times.

The U.S. Endpoint Detection and Response (EDR) market size was valued at an estimated USD 2.10 billion in 2025 and is projected to reach USD 12.20 billion by 2033, growing at a CAGR of 22.3% over the forecast period 2026–2033. Market growth is driven by the rising frequency and sophistication of cyberattacks, increasing adoption of cloud computing, and growing need for real-time threat detection and mitigation across enterprises. Enhanced focus on securing endpoints in remote work environments, integration of artificial intelligence and machine learning for proactive threat analysis, and regulatory compliance requirements further accelerate market expansion. Additionally, continuous innovation by leading cybersecurity vendors and strong enterprise investments in advanced security solutions support the robust growth outlook of the U.S. EDR market during the forecast period.

Endpoint Detection and Response (EDR) Market Growth Drivers:

-

Rising Threats from Sophisticated Cyber Attacks Drive Demand for Endpoint Detection and Response Solutions

With cyber threats growing in sophistication, organizations across industries are facing a pressing need for advanced endpoint detection and response solutions that offer comprehensive threat detection and mitigation. Targeted attacks, such as advanced persistent threats (APTs) and ransomware, continue to escalate, making traditional security measures insufficient. Endpoint detection and response solutions that incorporate artificial intelligence (AI) and machine learning (ML) are now essential, as they can analyze and respond to threats in real time, often predicting attacks before they occur. This proactive approach enables organizations to prevent data breaches and system compromises effectively, which has become especially crucial as hybrid and remote work models expand companies’ attack surfaces. The dynamic nature of cyber threats underscores the necessity for solutions that offer visibility, quick detection, and automated responses, pushing Endpoint Detection and Response technology adoption among enterprises and SMBs alike.

Endpoint Detection and Response (EDR) Market Restraints:

-

High Costs Associated with Endpoint Detection and Response Deployment Limit Accessibility for Small and Medium-Sized Enterprises (SMEs)

The high costs of implementing and maintaining Endpoint Detection and Response solutions can be a significant restraint, particularly for small and medium-sized enterprises (SMEs). Advanced Endpoint Detection and Response systems involve substantial investment not only in software but also in skilled personnel to monitor and manage the solution effectively. Additionally, the integration of Endpoint Detection and Response into existing IT infrastructures may require customization and training, further increasing expenses. For many SMEs, budget constraints make it challenging to allocate funds for high-end security solutions, which leaves them vulnerable to cyber threats despite their awareness of the risks. Cost-effective, scalable Endpoint Detection and Response solutions designed for smaller enterprises could address this gap, but until then, cost remains a considerable barrier, limiting widespread Endpoint Detection and Response adoption across all business sizes.

Endpoint Detection and Response (EDR) Market Opportunities:

-

Growing Integration of Artificial Intelligence and Machine Learning in Endpoint Detection and Response Presents Expansion Opportunities

The increasing incorporation of artificial intelligence (AI) and machine learning (ML) in endpoint detection and response solutions is creating substantial growth opportunities within the market. AI and ML enhance Endpoint Detection and Response capabilities by automating threat detection, analyzing massive datasets, and identifying unusual patterns that may indicate potential breaches. This advanced technology enables endpoint detection and response to adapt and improve its detection algorithms over time, offering more proactive security. The integration of AI and ML not only strengthens Endpoint Detection and Response's effectiveness but also broadens its appeal to industries facing increasingly complex cyber threats. Companies developing AI-driven endpoint detection and response solutions are well-positioned to capture a growing share of the market, as AI-powered endpoint detection and response systems offer quicker response times and better accuracy compared to traditional models.

Endpoint Detection and Response (EDR) Market Segment Analysis:

By Offering

In 2025E, the software segment dominated the endpoint detection and response market with a market share of around 65%. This segment's strength stems from the continuous evolution of endpoint detection and response software solutions that incorporate AI and machine learning, allowing businesses to detect and respond to threats more efficiently. Companies such as CrowdStrike and SentinelOne have driven adoption by offering advanced software tools that provide comprehensive threat intelligence and real-time threat analysis, enabling proactive measures against cyber threats.

By Deployment

The cloud segment dominated the endpoint detection and response market in 2025E, holding a market share of approximately 60%. Cloud-based Endpoint Detection and Response solutions are increasingly favored for their scalability, accessibility, and lower upfront costs, making them suitable for businesses seeking flexible and cost-effective options. Cloud deployment allows companies to protect dispersed workforces and hybrid infrastructures, which became essential post-pandemic. Vendors like Microsoft and Palo Alto Networks have strengthened this trend with scalable cloud Endpoint Detection and Response platforms that support dynamic environments.

By Endpoint Device

In 2025E, network devices and servers dominated the endpoint detection and response market, capturing a 55% market share. This dominance is driven by enterprises prioritizing security for critical infrastructure, as these devices are often targeted by cyberattacks aimed at disrupting core operations. Companies like Cisco and McAfee have tailored Endpoint Detection and Response solutions to monitor and protect servers and network devices, ensuring that sensitive data and business continuity are safeguarded against sophisticated threats.

By Organization Size

The large enterprises segment dominated the endpoint detection and response market in 2025E, with a market share of around 70%. Large organizations, particularly in regulated industries, are more equipped to invest in comprehensive endpoint detection and response solutions to secure extensive networks. endpoint detection and response providers such as FireEye offer enterprise-level solutions that deliver advanced monitoring, incident response, and forensic capabilities to address complex security needs, which are critical for large-scale IT infrastructures facing advanced threats.

By End-use Industry

In 2025E, the BFSI segment dominated the endpoint detection and response market with a market share of approximately 30%. This industry’s focus on protecting financial transactions and sensitive customer data has driven strong Endpoint Detection and Response adoption. Endpoint Detection and Response solutions from vendors like Symantec and Trend Micro cater to BFSI needs by providing real-time monitoring and incident response, which are essential for compliance and safeguarding against financial fraud and data breaches.

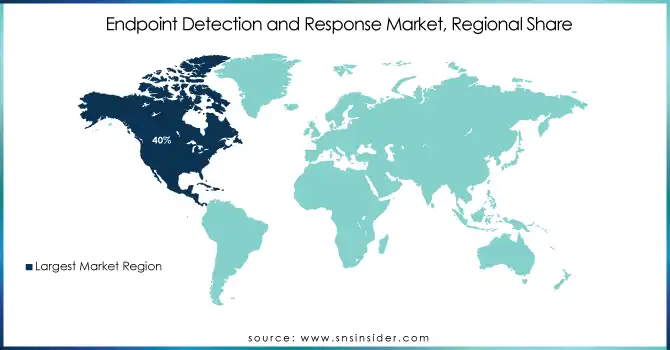

Endpoint Detection and Response (EDR) Market Regional Analysis:

North America Endpoint Detection and Response (EDR) Market Insights

In 2025E, North America dominated the endpoint detection and response market, holding a market share of approximately 40%. This region’s lead is largely due to the high concentration of prominent cybersecurity firms, a well-established IT infrastructure, and robust government initiatives focusing on cybersecurity resilience. Companies such as CrowdStrike, Palo Alto Networks, and Cisco are at the forefront, providing advanced Endpoint Detection and Response solutions tailored to address complex cyber threats. Additionally, the U.S. government’s strong emphasis on national cybersecurity enhances regional adoption across sectors.

Asia Pacific Endpoint Detection and Response (EDR) Market Insights

Moreover, the Asia-Pacific region is expected to emerge as the fastest-growing segment in the endpoint detection and response market from 2026-2033. The rapid digital transformation in countries like India, China, and Japan, along with rising cyber threats in these economies, drives demand for endpoint detection and response solutions. Investments in cybersecurity infrastructure by both government and private sectors further fuel growth. For instance, Japan’s commitment to cybersecurity ahead of the 2023 events, and China’s focus on data protection laws, are encouraging enterprises to adopt advanced endpoint detection and response technologies to safeguard their digital assets.

Europe Endpoint Detection and Response (EDR) Market Insights

The European EDR market is growing steadily, driven by stringent data protection regulations, rising cyberattacks, and increasing adoption of AI-powered threat detection. Enterprises across finance, healthcare, and government sectors are investing in proactive endpoint security solutions to safeguard sensitive data, ensure compliance, and mitigate advanced persistent threats effectively.

Latin America (LATAM) and Middle East & Africa (MEA) Endpoint Detection and Response (EDR) Market Insights

The LATAM and MEA EDR markets are expanding due to rising digitalization, growing cybercrime, and increasing awareness of cybersecurity best practices. Organizations in banking, telecommunications, and government sectors are adopting advanced EDR solutions to protect endpoints, enhance threat visibility, and maintain business continuity across complex network environments.

Need any customization research on Endpoint Detection and Response Market - Enquiry Now

Competitive Landscape for Endpoint Detection and Response (EDR) Market:

Cybereason Inc. is a cybersecurity company specializing in endpoint detection and response (EDR) solutions. Its platform combines AI-driven threat detection, real-time monitoring, and automated response to protect enterprises from advanced persistent threats, ransomware, and sophisticated cyberattacks. Serving industries including finance, healthcare, and government, Cybereason empowers organizations to enhance endpoint security, ensure rapid incident response, and strengthen overall cyber resilience across hybrid, remote, and cloud-based environments.

September 2023: Cybereason Inc. completed an expanded funding round totaling USD 120 million, aimed at scaling global operations and strengthening its capabilities in prevention, detection, and response.

Endpoint Detection and Response (EDR) Market Key Players:

-

Bitdefender (GravityZone, Endpoint Security, Advanced Threat Security)

-

Broadcom, Inc. (Symantec Endpoint Security, Advanced Threat Protection, EDR)

-

Carbon Black Inc. (CB Defense, CB Response, CB ThreatHunter)

-

Check Point Software Technologies Ltd. (Harmony Endpoint, SandBlast Agent, Threat Extraction)

-

Cisco Systems, Inc. (Secure Endpoint, Umbrella, Threat Response)

-

Crowdstrike Inc. (Falcon Prevent, Falcon Insight, Falcon OverWatch)

-

Cybereason Inc. (Endpoint Detection Platform, RansomFree, Cybereason MDR)

-

Elastic N.V. (Elastic Endpoint Security, Elastic Security, Elastic Agent)

-

FireEye (Endpoint Security, Helix, Mandiant Threat Intelligence)

-

Fortinet, Inc. (FortiEDR, FortiClient, FortiAnalyzer)

-

Intel Corporation (Intel Endpoint Management, Intel Security Essentials, Threat Detection Technology)

-

Kaspersky Lab (Kaspersky Endpoint Security, Anti Targeted Attack, Threat Intelligence)

-

McAfee, LLC (MVISION EDR, Endpoint Security, Active Response)

-

Microsoft Corporation (Defender for Endpoint, Sentinel, Advanced Threat Protection)

-

Palo Alto Networks (Cortex XDR, Prisma Access, WildFire)

-

RSA Security LLC (NetWitness Endpoint, SecurID, Incident Response)

-

SentinelOne (Singularity, Vigilance, Ranger)

-

Sophos Ltd. (Intercept X, XG Firewall, Managed Threat Response)

-

Symantec Corporation (Endpoint Protection, Advanced Threat Protection, Cloud Workload Protection)

-

VMware Carbon Black (CB Defense, CB Response, CB ThreatHunter)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 5.58 Billion |

| Market Size by 2033 | USD 32.47 Billion |

| CAGR | CAGR of 24.6% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Software, Service) • By Deployment • By Endpoint Device • By Organization Size • By End-use Industry |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Bitdefender, Broadcom, Inc., Carbon Black Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc., Crowdstrike Inc., Cybereason Inc., Elastic N.V., FireEye, Fortinet, Inc., Intel Corporation, Kaspersky Lab, McAfee, LLC, Microsoft Corporation, Palo Alto Networks, RSA Security LLC, SentinelOne, Sophos Ltd., Symantec Corporation, VMware Carbon Black |