Engineering Software Market Report Scope & Overview:

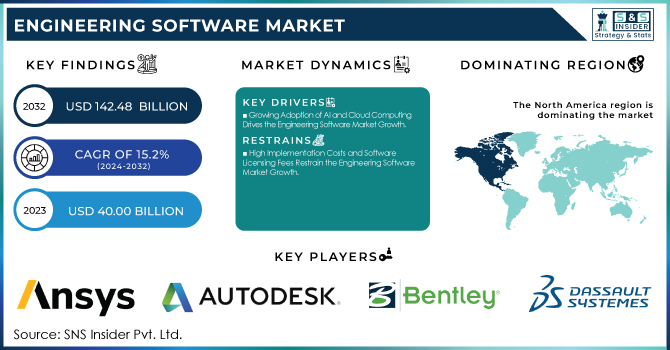

The Engineering Software Market Size was valued at USD 40.00 Billion in 2023 and is expected to reach USD 142.48 Billion by 2032 and grow at a CAGR of 15.2% over the forecast period 2024-2032. The Market is growing rapidly, driven by increased adoption in automotive, aerospace, and construction industries. AI, cloud computing, and digital twin technology advancements are transforming product design, simulation, and manufacturing. Companies are shifting to SaaS-based platforms, boosting demand for CAD, CAE, and PLM software. Rising R&D investments focus on AI-driven modeling, generative design, and real-time simulation. IoT, AR/VR, and data analytics are enhancing usability, while regulatory compliance is shaping software development. North America leads the market, but Asia-Pacific is the fastest-growing region. Major players like ANSYS, Autodesk, Siemens, and Dassault Systèmes are driving innovation, partnerships, and market expansion.

To get more information on Engineering Software Market - Request Free Sample Report

Market Dynamics

Key Drivers:

-

Growing Adoption of AI and Cloud Computing Drives the Engineering Software Market Growth

The increasing integration of AI, cloud computing, and digital twin technology is a key driver of the Engineering Software Market. AI-powered tools enhance design automation, real-time simulation, and predictive analysis, enabling engineers to optimize product development processes efficiently. Cloud-based engineering software provides scalability, remote collaboration, and cost-effectiveness, making it a preferred choice for businesses shifting to SaaS models. The growing adoption of Industry 4.0 and smart manufacturing is further accelerating the demand for advanced CAD, CAE, and PLM solutions. Additionally, AI-driven generative design and automation tools are transforming traditional engineering workflows, reducing time-to-market and improving innovation. Companies in sectors like automotive, aerospace, and construction are increasingly leveraging these technologies to improve efficiency and sustainability. As cloud-based platforms gain momentum, software providers are focusing on enhancing security, interoperability, and AI-powered automation features, ensuring sustained growth in the market.

Restraint:

-

High Implementation Costs and Software Licensing Fees Restrain the Engineering Software Market Growth

Small and medium-sized enterprises (SMEs) often struggle with the financial burden of purchasing and maintaining advanced engineering software solutions like CAD, CAE, and PLM systems. Perpetual and subscription-based licensing models demand substantial investment, especially for cloud-based solutions that involve recurring costs. Additionally, integration with existing legacy systems poses challenges, requiring businesses to invest in extensive training, customization, and IT infrastructure. The cost of upgrading software to remain compatible with evolving technologies adds to financial constraints. Companies must balance between adopting modern software and managing operational expenses. While vendors offer flexible pricing models, affordability remains a concern for businesses with budget limitations. This cost factor hinders market penetration, especially in emerging economies where cost-sensitive industries may hesitate to invest in high-end engineering solutions.

Opportunities:

-

Increasing Demand for Sustainable and Energy-Efficient Engineering Solutions Creates New Market Opportunities

Industries are prioritizing eco-friendly designs, lightweight materials, and energy-efficient product development, driving demand for advanced CAD and CAE software. Engineering software enables businesses to optimize resource utilization, minimize material waste, and reduce carbon footprints through simulation-driven design. The growing adoption of digital twins and AI-driven predictive analytics further enhances sustainable manufacturing processes. Government regulations promoting green technologies and carbon neutrality goals are pushing companies to integrate environmentally friendly engineering solutions. Additionally, the demand for smart infrastructure, renewable energy projects, and electric vehicles (EVs) is boosting investments in sustainable engineering software tools. Vendors are introducing AI-powered solutions that help companies achieve sustainability targets while optimizing efficiency. As industries embrace eco-friendly engineering practices, software providers focusing on sustainability-driven innovations can capitalize on this emerging market trend.

Challenges:

-

Cybersecurity Threats and Data Privacy Concerns Pose Challenges in the Engineering Software Market

The increasing reliance on cloud-based engineering software has raised concerns over cybersecurity threats, data privacy, and intellectual property protection. As companies store sensitive product designs, simulations, and proprietary data in cloud environments, the risk of cyberattacks, data breaches, and hacking attempts is growing. Industries such as aerospace, defense, and medical devices handle confidential engineering data, making them prime targets for cyber threats. Unauthorized access, software vulnerabilities, and lack of robust encryption mechanisms further amplify security risks. Regulatory compliance with data protection laws such as GDPR and industry-specific cybersecurity standards adds complexity for businesses adopting cloud-based solutions. Additionally, concerns over data sovereignty and third-party cloud service providers hinder cloud adoption in certain industries. To overcome these challenges, engineering software vendors must invest in advanced cybersecurity solutions, end-to-end encryption, multi-factor authentication, and secure cloud frameworks to ensure data integrity and user trust.

Segments Analysis

By End-Use

The Automotive segment dominated the Engineering Software Market in 2023, holding a 27% revenue share due to the growing demand for automated design, simulation, and manufacturing solutions. The adoption of Computer-Aided Design (CAD), Computer-Aided Engineering (CAE), and Product Lifecycle Management (PLM) software has surged as automakers focus on developing electric vehicles (EVs), autonomous driving technology, and lightweight materials.

In 2023, ANSYS launched an advanced simulation suite for autonomous vehicle safety testing, while PTC expanded its Windchill PLM platform to enhance supply chain collaboration in the automotive sector.

The Aerospace & Defense segment is set to experience the highest CAGR of 17.81% during the forecast period, driven by increasing defense budgets, next-generation aircraft development, and stringent regulatory requirements. The sector is heavily reliant on advanced engineering software for structural analysis, aerodynamics simulation, and digital manufacturing.

In 2023, Hexagon AB introduced an AI-powered CAE software suite for aerospace design optimization, while Dassault Systèmes enhanced its 3DEXPERIENCE platform to improve collaborative design and virtual testing for defense applications.

By Application

The Product Design & Testing segment dominated the Engineering Software Market in 2023, accounting for 33% of total revenue. Industries such as automotive, aerospace, electronics, and medical devices are heavily investing in CAD, CAE, and PLM software to optimize product innovation, reduce prototyping costs, and enhance testing efficiency. Siemens Digital Industries Software launched the NX X software in 2023, offering cloud-based collaborative product design and real-time testing simulations.

The Drafting & 3D Modeling segment is set to grow at a CAGR of 16.11% over the forecast period, driven by rising demand for digital design visualization, architectural modeling, and real-time rendering across multiple industries. The adoption of advanced 3D modeling tools in construction, automotive, and industrial design has surged due to the need for precision, automation, and faster project execution. In 2023, Autodesk introduced AutoCAD 2024 with AI-powered automation and cloud-based collaboration features, improving workflow efficiency for architects and engineers. Hexagon AB launched a new 3D modeling solution that integrates AI-driven automation and virtual reality (VR) capabilities for enhanced design accuracy.

By Component

The Software segment dominated the Engineering Software Market in 2023, accounting for 72% of total revenue, driven by increasing demand for CAD, CAE, CAM, and PLM solutions across industries like automotive, aerospace, construction, and healthcare. The shift toward AI-driven automation, cloud-based platforms, and digital twin technology has accelerated software adoption, enabling companies to enhance product design, real-time simulation, and manufacturing efficiency.

PTC upgraded its Creo software with integrated augmented reality (AR) and IoT capabilities, improving collaboration in smart manufacturing. As businesses digitize their engineering processes to reduce costs and enhance innovation, the software segment continues to dominate the market, driving investments in cloud, AI, and real-time simulation solutions for next-gen product development.

The Service segment is expected to grow at a CAGR of 16.18%, fueled by increasing demand for software implementation, customization, training, and support services. As industries adopt complex engineering software solutions, the need for consulting, system integration, and cloud migration services has risen significantly.

Additionally, ANSYS introduced a remote simulation support service, enabling engineers to run real-time computational fluid dynamics (CFD) and finite element analysis (FEA) simulations in the cloud. As businesses prioritize scalability, cybersecurity, and regulatory compliance, demand for managed services, SaaS integration, and AI-driven engineering support continue to surge.

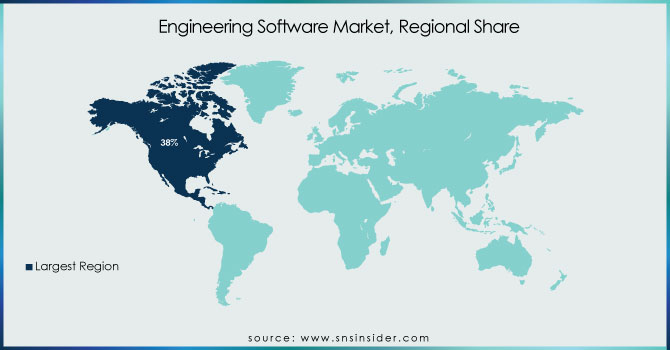

Regional Analysis

North America led the Engineering Software Market in 2023, accounting for an estimated 38% market share, driven by technological advancements, strong industrial infrastructure, and high adoption of AI-driven engineering tools. The presence of leading software providers such as Autodesk, PTC, ANSYS, and Dassault Systèmes has contributed to the region’s dominance. The automotive, aerospace, and construction industries in the U.S. and Canada are rapidly adopting CAD, CAE, and PLM software for product development and digital transformation.

For example, Tesla uses Siemens NX and ANSYS simulation software to optimize electric vehicle (EV) design and safety. Additionally, Boeing integrates Dassault Systèmes’ 3DEXPERIENCE platform for aircraft manufacturing and lifecycle management.

The Asia Pacific region is projected to grow at the highest CAGR of 17.5%, driven by rapid industrialization, government initiatives for digital transformation, and increasing adoption of cloud-based engineering software. Countries like China, India, Japan, and South Korea are experiencing a surge in demand for CAD, CAE, and CAM solutions across sectors such as automotive, electronics, and construction.

For instance, Huawei has invested heavily in AI-driven engineering design software, while BYD, a leading EV manufacturer, integrates PTC’s Creo and Siemens’ Teamcenter for product lifecycle management.

In Japan, Toyota and Honda are leveraging Autodesk’s generative design tools for lightweight vehicle engineering. With expanding cloud adoption, rising R&D investments, and strong government support, Asia Pacific is set to lead the future growth of the Engineering Software Market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Engineering Software Market are:

-

ANSYS, Inc (ANSYS Mechanical, ANSYS Fluent)

-

Autodesk Inc. (AutoCAD, Fusion 360)

-

Bentley Systems, Incorporated (MicroStation, OpenRoads Designer)

-

Dassault Systèmes (CATIA, SOLIDWORKS)

-

ESI Group (VA One, ProCAST)

-

Siemens (NX, Solid Edge)

-

3D Systems Inc. (Geomagic Design X, 3DXpert)

-

PTC (Creo, Windchill)

-

Mastercam (Mastercam Mill, Mastercam Lathe)

-

Hexagon AB (MSC Nastran, Simufact)

-

ZWSOFT CO., LTD. (ZWCAD, ZW3D)

-

SAP SE (SAP ECTR, SAP PLM)

-

Aras (Aras Innovator, Aras Simulation Management)

-

Centric Software, Inc. (Centric PLM, Centric Visual Innovation Platform)

-

Oracle Corporation (Oracle Agile PLM, Oracle AutoVue)

-

ComplianceQuest (CQ EQMS, CQ PLM)

Recent Trends

-

In November 2024, Ansys Inc. reported its third-quarter financial results, revealing a revenue of USD 601.9 million, a 31% increase compared to the same period in 2023. The company's GAAP diluted earnings per share stood at USD 1.46, up from USD 0.64 in the previous year. Net income reached USD 128.2 million, marking a 131% year-over-year growth. The gross margin improved to 88.5%, with operating cash flows of USD 174.2 million. Deferred revenue and backlog were reported at USD 1,463.8 million, indicating a strong outlook for future revenue.

-

In November 2024, Autodesk's stock price reached a 52-week high of USD 315.87, reflecting robust growth and strong market momentum. Over the past six months leading up to November 2024, the company's stock demonstrated a 27.76% return, underscoring its positive performance in the engineering software market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 40.0 Billion |

| Market Size by 2032 | USD 142.48 Billion |

| CAGR | CAGR of 15.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software [Computer-Aided Design (CAD) Software, Computer-Aided Manufacturing (CAM) Software, Computer-Aided Engineering (CAE) Software, Others], Services [Development Service, Training, Support & Maintenance]) • By Deployment (Cloud, On-Premises) • By Application (Design Automation, Product Design & Testing, Plant Design, Drafting & 3D Modelling, Others) • By End-Use (Automotive, Aerospace & Defense, Electronics, Medical Devices, Architecture, Engineering and Construction (AEC), Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ANSYS, Inc., Autodesk Inc., Bentley Systems, Incorporated, Dassault Systèmes, ESI Group, Siemens, 3D Systems Inc., PTC, Mastercam, Hexagon AB, ZWSOFT CO., LTD., SAP SE, Aras, Centric Software, Inc., Oracle Corporation, ComplianceQuest. |