Enterprise Performance Management Market Report Scope & Overview:

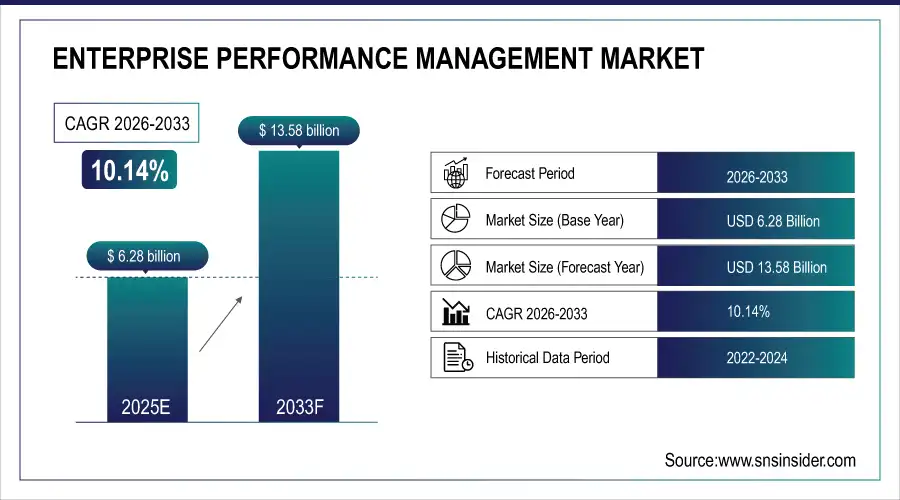

The Enterprise Performance Management Market Size was valued at USD 6.28 Billion in 2025E and is expected to reach USD 13.58 Billion by 2033 and grow at a CAGR of 10.14% over the forecast period 2026-2033.

The Enterprise Performance Management (EPM) market is experiencing significant growth, driven by several key factors. As more industries leverage digital transformation initiatives, the need for solutions that improve operational efficiency and strategic decision-making has grown amongst organizations. EPM systems offers you the tools you need to align your business goals and performance metrics, to drive data backed decisions, and efficient allocation of resources. Furthermore, Increased amount and complexity of business data have resulted in the need for analytical capabilities, which in turn allow organizations to gain actionable insights and forecast more accurately. In the case of the finance and IT & Telecom sectors, regulatory compliance, and data management are crucial and hence, this trend is more discernible. According to study, EPM adoption for forecasting and predictive planning is expected to increase by ~20% annually due to data complexity.

Market Size and Forecast:

-

Market Size in 2025: USD 6.28 Billion

-

Market Size by 2033: USD 13.58 Billion

-

CAGR: 10.14% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Enterprise Performance Management Market - Request Free Sample Report

Enterprise Performance Management Market Trends

-

Cloud-based EPM adoption grows, integrating ERP, CRM, HRMS systems efficiently.

-

Real-time analytics demand improves decision-making, resource allocation, business performance alignment.

-

Finance, IT, Telecom sectors lead EPM adoption, enhancing compliance management.

-

AI and ML integration automates tasks, forecasts accurately, detects risks timely.

-

Digital transformation expands, driving intelligent, analytics-driven EPM adoption globally rapidly.

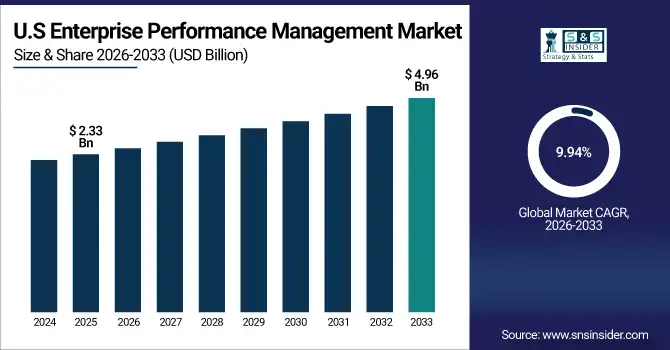

The U.S. Enterprise Performance Management Market size was USD 2.33 Billion in 2025E and is expected to reach USD 4.96 Billion by 2033, growing at a CAGR of 9.94% over the forecast period of 2026-2033, primarily driven by advanced digital transformation adoption, cloud-based and AI-enabled solutions, demand for real-time analytics, integration with ERP/CRM systems, and strong focus on regulatory compliance and data-driven decision-making across Finance, IT, and Manufacturing sectors.

Enterprise Performance Management Market Growth Drivers:

-

Digital Transformation Boosts EPM Adoption Across Industries With Cloud Scalability

The increasing adoption of digital transformation initiatives across industries is a primary driver of Enterprise Performance Management Market growth. Companies are seeking solutions that allow them to become more efficient with their operations, make better decisions, and allocate their resources better. Cloud based EPM platforms especially are capturing traction as they provide scalability, reduced upfront spend, remote access and real-time data analytics. An EPM can be integrated with other business systems such as ERP, CRM, and HRMS, allowing decision making based on data across departments for enterprises. This finding is especially relevant in industries like Finance, IT & Telecom, and Manufacturing where it becomes critical to measure performance metrics, forecast predictions, and secure compliance to regulations.

Nearly 70% of EPM implementations involve integration with ERP, CRM, or HRMS systems for cross-departmental data visibility.

Enterprise Performance Management Market Restraints:

-

High Costs And Complex Integration Slow Enterprise EPM Implementation Worldwide

Despite the benefits, Enterprise Performance Management Market solutions typically nest high implementation costs and intricate within-solution integration requirements. Implementing an enterprise-wide EPM system is a costly commitment in terms of software licenses, infrastructure, training and consulting services. These costs may be prohibitive for smaller enterprises or mid-market firms. Moreover, deploying EPM to existing legacy systems could become challenging leading to data inconsistencies, higher deployment delays, and delayed ROI. That complexity can slow adoption, especially in shops that do not have robust IT support.

Enterprise Performance Management Market Opportunities:

-

AI And Predictive Analytics Transform EPM For Smarter Strategic Decisions

The fast adoption of cloud computing continues to be the right fit, and therefore the biggest growth area for the Enterprise Performance Management Market alongside embedding AI integration into these services. These cloud-based EPM platforms offer scalability, flexibility, and a reduced total cost of ownership, allowing organizations to access real-time insights from any location. Powered by AI: Predictive analytics, anomaly detection, and scenario modeling improves decision-making accuracy and operational efficiency in the ground. For more widespread access to these solutions, mid-sized enterprises and decentralized organizations are going for these solutions to break the mold of a traditional on-premise solution. With the increasing reliance on remote collaboration and data-driven decision making along with intelligent performance management, the demand for cloud and AI-enabled EPM solutions are set to take the global share of the market.

AI-powered EPM can automate ~25–30% of routine reporting and planning tasks, reducing manual workload.

Enterprise Performance Management Market Segmentation Analysis:

-

By Component: In 2025, Software led the market with share 70.04%, while Services are the fastest-growing segment with a CAGR 11.50%.

-

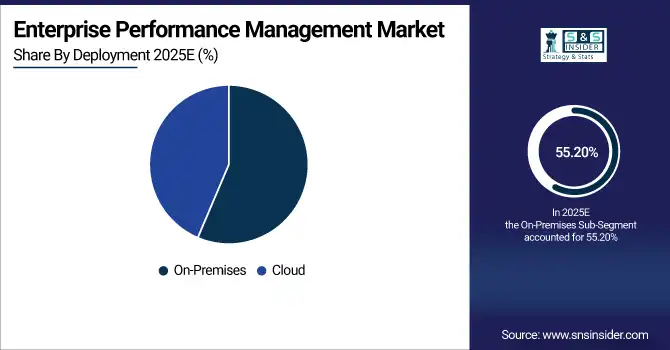

By Deployment: In 2025, On-premise the market 55.20%, while Cloud fastest-growing segment with a CAGR 12.34%.

-

By Function: In 2025 Finance led the market with share 40.14%, while Supply Chain the fastest-growing segment with a CAGR 12.20%.

-

By Industry: In 2025, BFSI led the market with share 27.56%, while Healthcare is the fastest-growing segment with a CAGR 12.30%.

By Component, Software Leads Market and Services Fastest Growth

The Software component is dominating the Enterprise Performance Management (EPM) market due to its widespread adoption for budgeting, forecasting, and performance monitoring across industry verticals. Software solutions offer rich analytics with real-time dashboards along with integration with ERP, CRM and HRMS systems for optimal decision-making and resource allocation. At the same time, the Services segment is experiencing the highest growth due to the increasing need for consulting services, implementation, and support for EPM deployment. Lastly, the rise in demand for seamless integration, customization, and training for cloud-based and AI-enabled EPM platforms have meant that organizations are leaning heavily on expert services to help them, aiding the overall market growth.

By Deployment, On-Premises Leads Market and Cloud Fastest Growth

In terms of Deployment, On-Premises segment will lead the market in Enterprise Performance Management (EPM) market as majority of large enterprises still prefer deploying the system internally largely to have better control, security and compliance to internal IT policies. These systems enable organizations to handle sensitive data seamlessly with existing enterprise applications. Nevertheless, the segment of Cloud deployment is growing rapidly because of its scalability, lower initial cost, availability from remote locations and real-time analytics. In a bid to making agile decisions using data, and increasing collaboration between decision-makers, cloud-based EPM solutions are being adopted by enterprises, especially by a decentralized and mid-sized enterprise.

By Function, Finance Leads Market and Supply Chain Fastest Growth

In terms of Function, Finance function dominates the Enterprise Performance Management (EPM) market as enterprises are focused on budgeting, forecasting, and monitoring of financial performance in order to comply with regulations and manage the limited resources optimally. EPM solutions are heavily relied on by finance teams for real-time reporting, scenario modeling, and strategic decision-making. On the other hand, the fastest-growing function is the Supply Chain one, supported by the growing trend for integrated Planning, Inventory Management, and Operational Efficiency across verticals. With EPM tools, organizations are harnessing the capabilities to facilitate supply chain visibility, procurement optimization, and demand forecast, laying the foundation for supply chain agility, cost benefits, and performance across end-to-end SC operations.

By Industry, BFSI Leads Market and Healthcare Fastest Growth

The Enterprise Performance Management (EPM) market, the BFSI (Banking, Financial Services, and Insurance) industry occupies a distinctive market share as it has been historically and is very forthcoming in terms of advisement focused towards regulatory compliance, risk portfolio management and exuberance in aesthetic financial performance. Banks, financial service providers and insurance companies depend on EPM solutions for budgeting, forecasting, and real-time analytics for enhancing the operational efficiency of their business processes, and strategic decision-making. On the other side, Healthcare is the fastest growing industry since it requires efficient allocation of human and non-human resources to be cost-sensitive and monitor overall patient performance. More healthcare providers are implementing cloud-based and AI-driven EPM solutions to drive transparency, predictive planning and data-driven decisions across their enterprise.

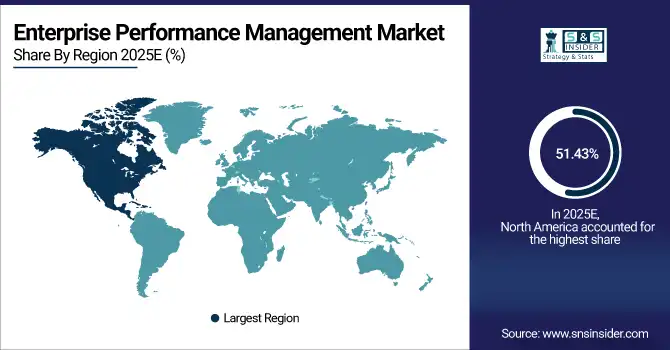

Enterprise Performance Management Market Regional Analysis:

North America Enterprise Performance Management Market Insights:

The Enterprise Performance Management Market in North America held the largest share 51.43% in 2025, owing the to the availability of advanced IT infrastructure, high adoption of digital transformation initiatives and adoption of cloud based and AI powered solution. Businesses in the region, specially across industries such as Finance, IT & Telecom, and Manufacturing, are leveraging EPM for budgeting, forecasting, performance tracking, and regulatory compliance. In North America, organizations leverage real-time analytics and data-driven decision-making to achieve more efficient operations and utilization of resources. The increasing demand for cloud deployments, predictive analytics, and frictionless integration with ERP, CRM, and HRMS systems will continue to drive the market growth with the region being a zone of innovation with EPM solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Dominates Enterprise Performance Management Market with Advanced Technological Adoption

U.S. dominates the Enterprise Performance Management market due to advanced technology adoption, early cloud and AI integration, strong IT infrastructure, and high demand for real-time analytics and data-driven decision-making.

Asia-Pacific Enterprise Performance Management Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Enterprise Performance Management Market, projected to expand at a CAGR of 11.67%, due to the ongoing digital transformation, growing cloud adoption, and industrialization taking place in China, India, Japan and several other countries. With the intent to improve operational efficiency, financial planning as well as data-driven decision-making, enterprises of the region are investing in EPM solutions. The accelerating adoption in the market for AI-enabled business practices, real-time reporting, integrated business systems and predictive analytics is driven by the growing demand for these. Moreover, the expansion of government-supported digital infrastructure, robust IT budgets, and an increasing number of SMEs adopting cloud-based EPM platforms will continue to generate growth opportunities, presenting a large enablement potential for EPM vendors in the Asia-Pacific region.

China and India Propel Rapid Growth in Enterprise Performance Management Market

China and India are driving rapid growth in the Enterprise Performance Management market through accelerated digital transformation, increasing cloud adoption, AI-enabled analytics, and rising demand for data-driven decision-making across industries.

Europe Enterprise Performance Management Market Insights

The Enterprise Performance Management (EPM) market has a significant share in Europe, due to developed economies, increased requirement of regulatory compliance, and growing use of digital transformation initiatives. EPM solutions are being deployed by companies in the Finance, Manufacturing, and IT sectors to assist in budgeting, forecasting, performance monitoring, and risk management. Moving towards the cloud-based platforms and using the AI-enabled predictive analytics will improve its operational efficiency and decision making. Furthermore, EPM vendors presence, good IT infrastructure and increasing spending on business intelligence and analytics solutions drive the market in Europe which is a stable and mature region for EPM adoption.

Germany and U.K. Lead Enterprise Performance Management Market Expansion Across Europe

Germany and the U.K. lead Enterprise Performance Management market expansion in Europe, driven by advanced digital adoption, strong regulatory compliance, cloud-based EPM solutions, and increasing demand for data-driven decision-making.

Latin America (LATAM) and Middle East & Africa (MEA) Enterprise Performance Management Market Insights

Enterprise Performance Management (EPM) market in Latin America and Middle East & Africa (MEA) is at the early-adopter stage and is poised to gain from growing digital transformation initiatives, cloud adoption and rise in demand for data-driven decision-making. Companies in Brazil, Mexico, South Africa and Gulf countries are upgrading their budgeting, forecasting, performance monitoring, and operational efficiency capabilities with EPM solutions. Market growth is further propelled by the adoption of predictive analytics powered by AI and ERP and CRM system integration. Also, the gradual adoption of EPM–platforms across LATAM and MEA, driven by favorable government policies, developing IT infrastructure, and growing awareness of SMEs regionally.

Enterprise Performance Management Market Competitive Landscape

Oracle is a leading EPM solutions provider, offering cloud-based and on-premises platforms that streamline financial planning, forecasting, consolidation, and reporting. Its AI-enabled tools and integration with ERP, CRM, and HRMS systems help organizations enhance decision-making, optimize resource allocation, and drive operational efficiency across industries like Finance, IT, and Manufacturing.

-

In May 2025: Oracle released updates to its EPM Cloud platform, introducing new capabilities across Planning, Financial Close, Reporting, and AI functionalities

SAP provides robust EPM solutions through its S/4HANA and SAP Analytics Cloud platforms, enabling enterprises to perform real-time planning, financial consolidation, and predictive analytics. Its AI-driven functionalities and seamless integration with ERP systems allow businesses to align strategy with performance, improve forecasting accuracy, and maintain compliance in complex regulatory environments.

-

In December 2024: SAP announced plans to phase out SAP ECC by December 2027, urging customers to adopt S/4HANA for future ERP needs.

IBM offers EPM solutions through IBM Planning Analytics, integrating AI, predictive analytics, and automation to improve budgeting, forecasting, and performance monitoring. Its platforms enhance operational efficiency, risk management, and data-driven decision-making for large enterprises, particularly in Finance, Telecom, and IT sectors, positioning IBM as a key EPM market leader.

-

In May 2025: IBM introduced webMethods Hybrid Integration at IBM Think 2025, aiming to unify integration experiences across various scenarios in the AI era.

Enterprise Performance Management Market Key Players:

Some of the Enterprise Performance Management Market Companies are:

-

Oracle

-

SAP

-

IBM

-

Anaplan

-

Workday

-

Infor

-

Board International

-

Unit4

-

OneStream Software

-

Wolters Kluwer (CCH Tagetik)

-

Epicor

-

Prophix

-

Solver

-

Kepion

-

Vena Solutions

-

Planful

-

Jedox

-

Broadcom

-

Lucanet

-

Corporater.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 6.28 Billion |

| Market Size by 2033 | USD 13.58 Billion |

| CAGR | CAGR of 10.14% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Solution, Services) • By Function (Finance, Human Resources, Supply Chain, Sales and Marketing, Others) • By Deployment (On-Premises, Cloud) • By End Use (BFSI, Retail, Healthcare, IT & Telecom, Government & Education, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Oracle, SAP, IBM, Anaplan, Workday, Infor, Board International, Unit4, OneStream Software, Wolters Kluwer (CCH Tagetik), Epicor, Prophix, Solver, Kepion, Vena Solutions, Planful, Jedox, Broadcom, Lucanet, Corporater., and Others. |