Oil and Gas Security and Service Market Report Scope & Overview:

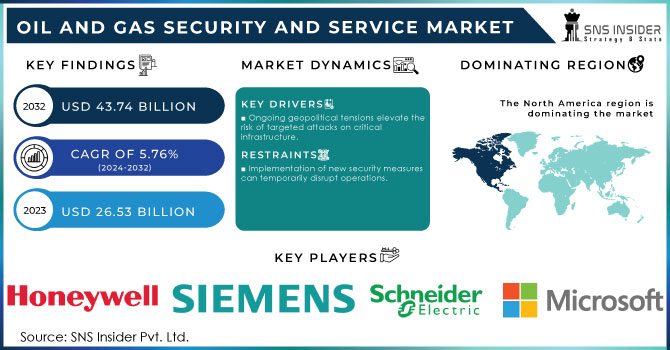

The oil and Gas Security and Service Market was worth USD 26.53 Billion in 2023 and is predicted to reach USD 43.74 Billion by 2032, growing at a CAGR of 5.76% from 2024-2032.

Technologies and security threats, rising regulatory compliance, increasing adoption of advanced technologies, and focus on operational safety are driving the growth of the market. The oil and gas industry faces numerous security threats such as terrorism, piracy, theft, and sabotage. As these threats grow increasingly sophisticated, companies in the sector are ramping up investments in security measures to safeguard their assets and personnel.

To Get More Information on Oil and Gas Security and Service Market - Request Sample Report

The increase in the adoption of cloud technologies in the oil and gas sector has heightened its sensitivity to cyber threats. Historically, the industry has safeguarded data and maintained privacy by isolating networks and strengthening external defenses. However, the shift towards cloud computing introduces both challenges and opportunities, pushing the sector to improve and update its security measures through advanced cybersecurity practices.

The oil and gas security and service market is expanding rapidly due to increasing threats such as cyberattacks, terrorism, theft, and sabotage. As the industry adopts digital technologies like cloud computing, IoT, and automation, the need for robust security measures has intensified. The growing geopolitical tensions, stricter regulations, and environmental concerns are also driving the demand for enhanced security services. This market's scope continues to broaden with the integration of AI, machine learning, and predictive analytics, offering improved threat response capabilities. As a result, security in the oil and gas sector is evolving from a defensive necessity to a proactive and strategic investment.

Market dynamics

Drivers

-

Ongoing geopolitical tensions elevate the risk of targeted attacks on critical infrastructure.

-

The use of AI, IoT, and machine learning to predict and manage potential threats.

-

Stricter safety and security regulations require companies to implement advanced security measures.

Stricter safety and security regulations are compelling oil and gas companies to enhance their security measures significantly. Governments and industry bodies are imposing more rigorous standards to protect critical infrastructure from various threats, including cyberattacks, terrorism, and environmental hazards. These regulations mandate comprehensive risk assessments, advanced surveillance systems, and robust cybersecurity protocols to ensure the safety and integrity of operations. Companies must adopt advanced technologies and practices, such as real-time monitoring, access control systems, and incident response strategies, to comply with these standards. Failure to meet regulatory requirements can result in hefty fines, legal liabilities, and operational disruptions. Consequently, adhering to these regulations not only ensures compliance but also strengthens overall security posture, safeguarding assets, personnel, and the environment against potential threats.

Integrating AI, IoT, and machine learning into security systems helps oil and gas companies proactively identify and manage potential threats. AI algorithms analyze vast amounts of data to detect patterns and anomalies that might indicate security breaches or operational issues. IoT devices, such as sensors and cameras, provide real-time data on equipment conditions and environmental factors, enhancing situational awareness. Machine learning models learn from historical data to predict future threats and automate responses, improving the efficiency and accuracy of threat detection. Together, these technologies enable companies to anticipate issues before they escalate, respond more effectively to incidents, and continuously adapt to evolving security challenges, ultimately enhancing the protection of critical infrastructure and assets.

Restraints

-

Implementation of new security measures can temporarily disrupt operations.

-

Dependency on external vendors for specialized security solutions and support.

-

Significant investment is required for advanced security technologies and systems.

The oil and gas sector faces substantial costs when investing in advanced security technologies and systems. Implementing advanced solutions such as AI-driven threat detection, sophisticated surveillance systems, and real-time monitoring infrastructure requires significant capital expenditure. These technologies not only involve high initial costs but also necessitate ongoing expenses for maintenance, updates, and training. Additionally, integrating these advanced systems with existing infrastructure can be complex and costly. Companies must allocate resources for both hardware and software, as well as for specialized personnel to manage and operate the systems effectively. The financial burden of these investments can be a major constraint, particularly for smaller companies or those operating in regions with tighter budgets, impacting their ability to enhance security measures comprehensively.

Dependency on external vendors for specialized security solutions and support can be a significant challenge for the oil and gas sector. Many companies rely on third-party providers for advanced security technologies, such as cybersecurity tools, surveillance systems, and threat detection software. This reliance introduces several risks, including potential vulnerabilities if vendors experience security breaches or fail to deliver timely updates and support. Furthermore, overseeing vendor relationships can be intricate and demands strict supervision to guarantee service quality and adherence to industry standards. This dependency can also restrict flexibility and control over security operations, as companies must operate within the constraints and schedules imposed by external partners. Thus, while utilizing external expertise can improve security, it also introduces risks and challenges that require careful management.

Segment Analysis

By Component

With over 78.0% revenue share, the solution segment dominated the market in 2023. The oil and gas sector is a key target for cybercriminals because of its essential infrastructure and valuable information. High-profile cyberattacks in recent years have revealed the need for advanced security solutions to protect against evolving threats. In addition, the industry encounters various threats beyond cyberattacks. Essential physical security measures include advanced surveillance systems with AI capabilities, access control systems featuring biometric authentication, and perimeter security strategies to protect personnel, assets, and facilities from theft, sabotage, and terrorism.

The increase in the threat of terrorism, sabotage, and cybercrime on the oil and gas companies has pointed out risks to the security of this sector. Managing risks and Identifying weaknesses in existing infrastructure is a primary security concern for oil and gas companies. robust security solution implementation is a requirement of the industry. Major security companies offer risk management services that help in evaluating and identifying hazards and risks. Companies need technical proficiency to keep up with the latest cyberattacks, physical security breaches, and other emerging threats.

By Security

With the largest revenue share in 2023, the physical security segment dominated the market. Oil and gas facilities are key targets for terrorist attacks and acts of sabotage. Physical security measures such as access control systems, perimeter security with intrusion detection, and security personnel are essential for preventing and addressing these threats. Given the high value of oil and gas assets, they are particularly susceptible to theft and pilferage.

The network security segment is expected to exhibit the fastest CAGR over the forecast period. The oil and gas industry is quickly adopting digital technologies such as automation and IoT devices. This shift to digitalization introduces multiple vulnerabilities to cyberattacks, which can disrupt operations, compromise sensitive data, or inflict physical damage. Network security solutions like firewalls, intrusion detection systems (IDS), and data encryption become essential to safeguard critical infrastructure.

Network security measures such as firewalls, intrusion detection systems (IDS), and data encryption are crucial for protecting critical infrastructure.

By Service

In 2023, The managed services segment dominated the market with the largest market share. Managed security service providers (MSSPs) offer access to a pool of skilled professionals, empowering companies to bridge this expertise gap. Oil and gas companies might have constrained budgets for IT security. Managed security services provide a cost-efficient solution to access advanced security technologies and expertise without requiring substantial initial investments in infrastructure and staff.

The risk management services segment is expected to demonstrate the quickest CAGR over the forecast period. The oil and gas industry faces a variety of security threats, including physical security breaches, theft, cyberattacks, sabotage, and terrorism. Risk management services assist companies in identifying, evaluating, and prioritizing these threats, enabling them to create effective strategies for mitigation. Governments are Enforcing more stringent regulations on safety and security in the oil and gas industry.

By Operation

With the largest market share in 2023, the midstream segment dominated the market. The expected increase in global energy involves expanding midstream infrastructure, such as pipelines and storage facilities. This expansion leads to an increasing demand for security solutions to safeguard these essential assets. The growing role of natural gas and Liquefied Natural Gas (LNG) in the energy mix requires strong security measures for transportation and storage infrastructure. Additionally, as midstream operations become more digitized, they are exposing new cybersecurity vulnerabilities. Security services are essential for safeguarding pipelines, storage facilities, and control systems against cyberattacks that could interfere with operations or result in physical damage.

The downstream segment is anticipated to demonstrate the fastest CAGR over the forecast period. Downstream operations, including refineries and storage terminals, are becoming increasingly dependent on automation and digital technologies. Additionally, downstream facilities manage large amounts of valuable products, making them vulnerable to theft. Security services offer solutions such as access control, perimeter protection with intrusion detection, and security guards to prevent and address these issues.

By Application

In 2023, the pipeline segment held the largest revenue share and dominated the market. Security solutions are essential for protecting pipelines throughout their entire lifecycles. As pipelines often cover extensive and remote regions, they are susceptible to physical threats such as sabotage, theft, and vandalism. Security services offer measures like pipeline monitoring systems, leak detection technology, and security patrols to prevent and address these risks.

With the fastest CAGR over the forecast period. The exploring and drilling segment is anticipated to exhibit the search for new oil and gas reserves is increasingly pushing exploration activities into remote and often unstable regions. Security services are Essential for ensuring physical security for personnel, equipment, and infrastructure in these challenging environments.

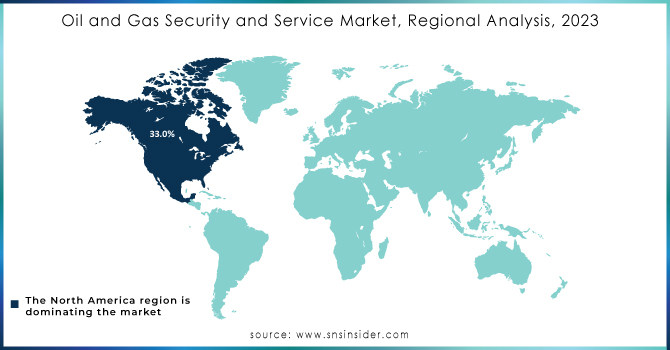

Regional Analysis

With a revenue share of over 33.0% in 2023, North America dominated the oil and gas security and service market. The North American oil and gas sector is a major target for cyberattacks because of its dependence on critical infrastructure and operational technology. This makes it essential to have strong security measures such as penetration testing, vulnerability assessments, and managed security services to detect, prevent, and address cyber threats.

The market in the Asia Pacific region is expected to experience a notable CAGR over the forecast period. Accelerated economic growth in countries like China and India is driving an increase in energy demand. This requires expanding oil and gas infrastructure, leading to a need for security solutions to safeguard these vital assets. Additionally, countries in the APAC region are seeking to diversify their energy sources, resulting in investments in pipelines for transporting natural gas and other products. As a result, security services will be essential for protecting this expanding infrastructure.

Do You Need any Customization Research on Oil and Gas Security and Service Market - Enquire Now

KEY PLAYERS

The major players in the Oil and Gas Security and Service Market are Microsoft, NortonLifeLock Inc., Schneider Electric, Siemens, United Technologies,Cisco Systems, Inc., Honeywell International Inc., Huawei Technologies Co., Ltd., Intel Corporation, Inc, Waterfall Security, and other players.

Recent Developments

-

In April 2024, Siemens introduced Siemens Xcelerator, a tool designed to automatically identify vulnerable production assets. As a result, industrial companies must recognize and address potential security vulnerabilities within their systems.

-

In September 2023, Huawei Technologies Co., Ltd. introduced an intelligent architecture and an intelligent exploration and production (E&P) solution tailored for the oil and gas industry.

| Report Attributes | Details |

| Market Size in 2023 | US$ 26.53 Bn |

| Market Size by 2032 | US$ 43.74 Bn |

| CAGR | CAGR of 5.76% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution and Services) • By Security (Physical Security and Network Security) • By Services (Risk Management Services, System Design, Integration, and Consulting, and Managed Services) • By Operation (Upstream, Midstream, and Downstream) • By Application (Exploring and Drilling, Transportation, Pipelines, Distribution and Retail Services, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Microsoft, NortonLifeLock Inc., Schneider Electric, Siemens, United Technologies, Cisco Systems, Inc., Honeywell International Inc., Huawei Technologies Co., Ltd., Intel Corporation, Inc. |

| Key Drivers | • Increased expenditure on network and physical security • The growing threat of cyber-attacks |

| Market Restraints | • High cost of security solutions |