Enterprise Software Market Report Scope & Overview:

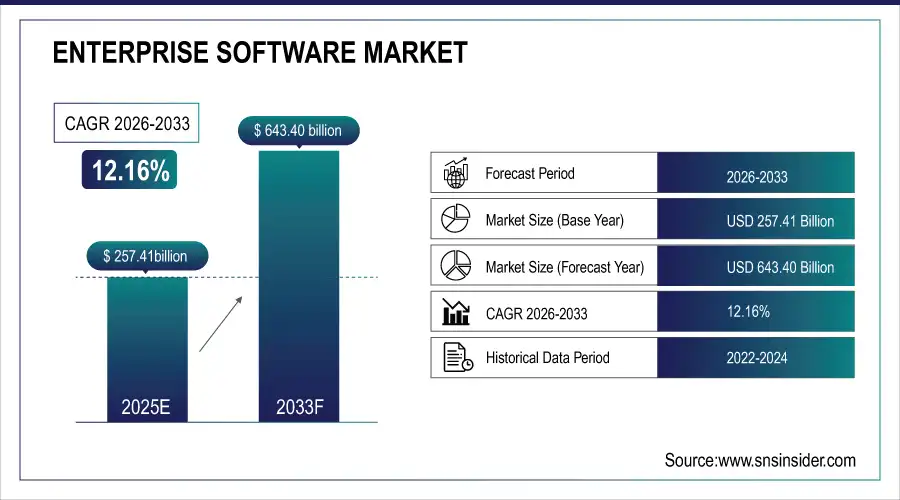

The Enterprise Software Market Size was valued at USD 257.41 Billion in 2025E and is expected to reach USD 643.40 Billion by 2033 and grow at a CAGR of 12.16% over the forecast period 2026-2033.

The Enterprise Software Market analysis growth is propelled by the digitization that is accelerating rapidly in every sector, as organizations are increasingly using integrated solutions to improve productivity, standardize processes, and lower operational costs. The growing use of cloud-based solutions also facilitates the deployment of scalable and affordable software for various organizations, which is even appreciable for SMEs and can foster growth in this market. According to study, over 68% of large enterprises and 32% of SMEs are investing in integrated enterprise software to streamline operations, enhance productivity, and reduce operational costs.

Market Size and Forecast:

-

Market Size in 2025: USD 257.41 Billion

-

Market Size by 2033: USD 643.40 Billion

-

CAGR: 12.16% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Enterprise Software Market - Request Free Sample Report

Enterprise Software Market Trends

-

Rapid digital transformation drives enterprises to adopt integrated software solutions globally.

-

Cloud-based deployment grows fast, enabling scalable and cost-effective SME adoption.

-

AI and automation integration enhances predictive analytics and operational efficiency across industries.

-

Increasing demand for remote collaboration tools accelerates workflow digitization and productivity.

-

Personalized customer engagement rises due to CRM systems leveraging AI insights.

-

Multi-module integration (ERP, CRM, BI, SCM) improves cross-department operational efficiency.

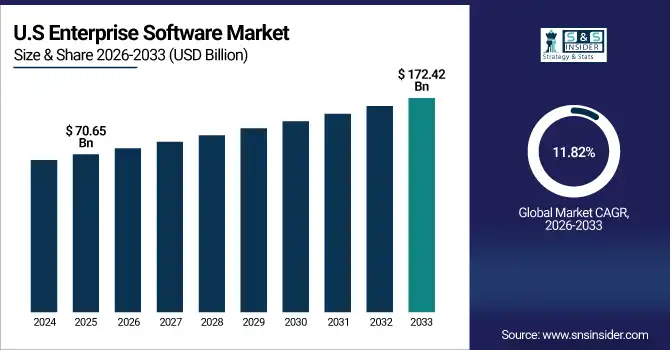

The U.S. Enterprise Software Market size was USD 70.65 Billion in 2025E and is expected to reach USD 172.42 Billion by 2033, growing at a CAGR of 11.82% over the forecast period of 2026-2033, driven by increasing investments in digital infrastructure, demand for scalable enterprise solutions, focus on regulatory compliance, enhanced security, and the need for improved collaboration and seamless business process management across organizations.

Enterprise Software Market Growth Drivers:

-

Digital Transformation Adoption Accelerates Enterprise Software Demand Across Global Industries Rapidly

The Enterprise Software Market is growing worldwide driven by, increase in number of organizations globally adopting digital transformation initiatives remains the main. The cloud-based enterprise software that we know today has allowed SMEs the scalability alongside the subscription-based pricing and low investment needed to compete with larger firms. The rising integration of business processes that require real-time analytics, process automation, and intelligent workflow management in IT & Telecom, BFSI, retail, healthcare, and other sectors are also driving the growth of enterprise software.

IT & Telecom, BFSI, retail, and healthcare collectively drive over 60% of new software deployments, reflecting industry-specific digitalization needs.

Enterprise Software Market Restraints:

-

High Implementation Costs and Complexity Challenge Enterprise Software Market Growth

Despite its advantages, the high cost and complexity of enterprise software implementation is one of the major restraints although there is growth. Deploying and maintaining large-scale ERP or SCM solutions has significant capital expenditure, IT infrastructure requirements, as well as skilled resources to govern and manage it. This can prove especially problematic for SMEs, where the initial costs may be prohibitive, while other factors, such as delayed implementation or integration issues with existing systems, lower the ROI. Research shows only of purchased features are in active use, discouraging further investment and slowing the pace of deployment but enterprises often fall far short of exploiting software feature set. This also adds to the implementation complexities around security and compliance concerns limited in regulated sectors such as Healthcare and BFSI.

Enterprise Software Market Opportunities:

-

AI And Automation Integration Unlocks New Growth Potential Globally

The Enterprise Software Market presents a significant opportunity in embedding artificial intelligence (AI), machine learning (ML) and robotic process automation (RPA) into existing platforms. Predictive analytics, process automation, and smart decision-making powered by AI-driven modules strive to achieve operational efficiency across industries. By minimizing manual intervention in recurring activities like invoicing, supply chain management, and HR processes. automation enables enterprises to cut down on the time and cost they spend in early-stage processes while achieving greater accuracy. Moreover, through AI, CRM systems offer unparalleled insights into customers that allow for personalized engagement, thus increasing customer retention.

Enterprises using RPA report 20–30% reduction in manual task execution time across HR, finance, and supply chain functions.

Enterprise Software Market Segmentation Analysis:

-

By Software: In 2025, Enterprise Resource Planning (ERP) Software led the market with a share of 34.60%, while Customer Relationship Management (CRM) Software is the fastest-growing segment with a CAGR of 12.80%.

-

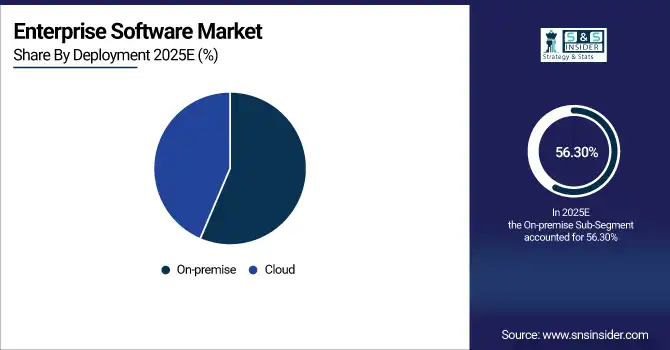

By Deployment: In 2025, On-premise led the market with a share of 56.30%, while Cloud is the fastest-growing segment with a CAGR of 14.20%.

-

By Enterprise Size: In 2025, Large Enterprises led the market with a share of 68.40%, while SMEs are the fastest-growing segment with a CAGR of 13.60%.

-

By End-use: In 2025, IT & Telecom led the market with a share of 32.90%, while Healthcare is the fastest-growing segment with a CAGR of 13.90%.

By Software, Enterprise Resource Planning (ERP) Leads Market and Customer Relationship Management (CRM) Fastest Growth

The Enterprise Resource Planning (ERP) lead in 2025, driven by integrating business processes for finance, supply chain and HR functions and manages resource as an enterprise. Large enterprises continue to adopt ERP for operational efficiency and real-time insights. Meanwhile, Customer Relationship Management software is the fastest-growing segment, fueled by rising needs for personalized customer engagement, AI-based analytics, and omnichannel communication. Small and medium sized enterprises are swiftly adopting cloud-based CRM solutions to enhance customer retention and decision-making process. The combination of the dominance of ERP and the growth of CRM shows a market that balances the needs of the traditional operational programs with the newer customer-centric programs.

By Deployment, On-premise Leads Market and Cloud Fastest Growth

The On-premise lead in 2025, Due to it provides strong security, data control, and compliance factors that large enterprises and regulated industries value highly On-premise systems is the ideal choice for complicated business ecosystems as it gives organizations complete control of both the infrastructure and customization choice. Meanwhile, the fastest growing segment is cloud deployment, owing to the growing adoption of scalable, subscription-based solutions, particularly among SMEs. Cloud platforms provide benefits like real-time access and lower initial costs, and they also make it easy to connect with AI and automation. This dichotomy illustrates a shift in the marketplace as legacy enterprises focus on maintaining control, while smaller organizations leverage agility and digital transformation.

By Enterprise Size, Large Enterprises Lead Market and SMEs Fastest Growth

The Large Enterprises leads the market in 2025, owing to large IT budgets with sophisticated business operations and being the early adopters of integrated solutions. These organizations place demand on larger software platforms to manage enterprise scale functions that require compliance and efficiency over multiple departments. Meanwhile, the small and medium enterprises (SME) segment is expected to grow fastest owing to the increasing penetration of cost-effective and scalable cloud-based software solutions. The SME customer base is utilizing subscription-based models and AI-enabled tools that will compete against large players while also promoting streamlining of workflows and improved decision-making a trend that speaks to market dominance while also rapid growth within start-ups and emerging businesses.

By End-use, IT & Telecom Leads Market and Healthcare Fastest Growth

The IT & Telecom leads in 2025, due to its extensive reliance on integrated software solutions for managing networks, data centers, customer services, and digital operations. ERP, CRM, BI and SCM systems are on the priority list of large-scaled IT and telecom companies for maximizing operational efficiency, cutting down costs, and meeting real-time decisions. Meanwhile, the healthcare market has become the fastest-growing segment as it is being driven by the adoption of electronic health records, telemedicine platforms, AI-powered analytics, and regulatory compliance solutions market. The trends for strong digital transformation in these sectors indicate that the healthcare organizations spend on cloud-based, automated, and intelligent software to improve the patient-centric care, administrative workflows and the Operational efficiency.

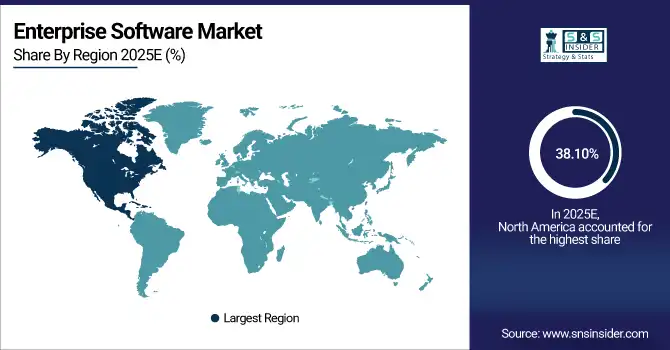

Enterprise Software Market Regional Analysis:

North America Enterprise Software Market Insights:

The North America dominated the Enterprise Software Market in 2025E, with over 38.10% revenue share, driven by the presence of large technology companies, high IT infrastructure maturity and early adoption of advanced software solutions. Customers in the region are investing heavily in ERP, CRM, BI and cloud-based platforms to streamline operations, improve decision making, and support the overall digital transformation strategy. This demand is driven by big enterprises that want a one-stop solution for process automation, data analysis, and customer engagement. Moreover, favourable government policies, strong cloud infrastructure and high security and compliance considerations will lead to a continuous market growth and make North America the largest and most mature enterprise software market in the world.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Enterprise Software Market Insights

The U.S. Enterprise Software Market is driven by digital transformation, cloud adoption, and AI integration, with enterprises prioritizing ERP, CRM, BI, and SCM solutions to enhance efficiency and decision-making.

Asia Pacific Enterprise Software Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 13.05%, owing to organizations scale adoption of cloud-based solutions and expanding digital transformation in the region identified with driving expenditures on IT and its service across enterprises irrespective of size. The growth is augmented by the expanding technology infrastructure, the growing demand for automation, and the growing integration of AI and predictive analytics into enterprise systems. Also, an increasing transition towards cloud and subscription-based models enables systems to adopt enterprise software at a reasonable consumer expense, thereby speeding up adoption rates and reinforcing wider market strength throughout the region.

-

China and India Enterprise Software Market Insights

The China and India Enterprise Software Market is expanding due to rising demand for workflow automation, mobile-enabled enterprise applications, and predictive analytics.

Europe Enterprise Software Market Insights

Europe Enterprise Software Market is increasing with steady growth owing to fastest growing adoption of digital transformation and advanced IT infrastructure. Firms across every industry are implementing these solutions-ERP, CRM, BI, and SCM-to better manage their operations, improve efficiencies, and make smart decisions based on data. This is driven by the growing emphasis on automation, AI integration, and cloud-based platforms that enhance workflow efficiency and scalability in the market. Moreover, the need for regulatory compliance and data security is pushing organizations towards advanced and stable software systems. In total, Europe is a mature market driven by innovation in which organizations are increasingly focused on operational efficiency, digital workflows, and intelligent enterprise software solutions.

-

Germany and U.K. Enterprise Software Market Insights

The Germany and U.K. Enterprise Software Market is experiencing steady growth, driven by the adoption of integrated business solutions for operational efficiency, regulatory compliance, and process standardization.

Latin America (LATAM) and Middle East & Africa (MEA) Enterprise Software Market Insights

The Latin America and the Middle East & Africa (MEA) is experiencing steady growth, driven by increasing adoption of digital transformation initiatives across industries and rising demand for operational efficiency. Enterprises in these regions are focusing on automation, workflow optimization, and integrated software platforms to enhance productivity and decision-making. Cloud-based and subscription software models are gaining traction, enabling businesses to access scalable and cost-effective solutions. Additionally, growing awareness of data security, compliance, and intelligent process management is encouraging organizations to invest in robust enterprise software systems. These trends highlight the regions’ expanding market potential and gradual shift toward technology-driven business operations.

Enterprise Software Market Competitive Landscape

Microsoft leads the enterprise software market with integrated solutions across productivity, cloud, and AI. Its Office, Dynamics 365, and Azure platforms empower organizations to automate processes, optimize workflows, and implement AI-driven analytics, strengthening operational efficiency and supporting large-scale digital transformation initiatives across industries worldwide.

-

In May 2025, Microsoft introduced a new wave of AI capabilities designed to accelerate agentic AI app development and empower developers to become AI developers.

ServiceNow drives enterprise software adoption through AI-first workflows and cloud-based platforms, streamlining IT service management, HR, and customer experience operations. Its AI Experience interface and strategic partnerships enhance automation, efficiency, and data-driven decision-making, positioning ServiceNow as a key enabler of digital transformation for enterprises globally.

-

In September 2025, ServiceNow unveiled "AI Experience," an AI-powered multimodal user interface designed to unify and anchor enterprise workflows, enhancing user productivity and enabling seamless cross-department collaboration through intelligent automation.

Intuit focuses on delivering AI-powered financial and accounting software for SMEs, enabling automation of tax filing, bookkeeping, and expense management. By leveraging cloud-based solutions, Intuit enhances operational efficiency, scalability, and decision-making for businesses, driving widespread adoption of enterprise software across the small and medium-sized enterprise segment.

-

In September 2025, Intuit introduced AI-driven features in QuickBooks and TurboTax to automate tax filing and financial management for SMEs, enhancing user experience and operational efficiency.

Enterprise Software Market Key Players:

Some of the Enterprise Software Market Companies are:

-

Microsoft Corporation

-

Oracle Corporation

-

SAP SE

-

Salesforce, Inc.

-

IBM Corporation

-

ServiceNow, Inc.

-

Workday, Inc.

-

Adobe Inc.

-

Atlassian Corporation

-

Intuit Inc.

-

Accenture plc

-

Cisco Systems, Inc.

-

Hewlett Packard Enterprise (HPE)

-

Zoho Corporation

-

Infor

-

Epicor Software Corporation

-

Pegasystems Inc.

-

Software AG

-

Freshworks Inc.

-

Sage Group plc

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 257.41 Billion |

| Market Size by 2033 | USD 643.40 Billion |

| CAGR | CAGR of 12.16% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Software (Enterprise Resource Planning (ERP) Software, Business Intelligence Software, Content Management Software, Supply Chain Management Software, Customer Relationship Management Software, Others) • By Deployment (On-premise, Cloud) • By Enterprise Size (SMEs, Large Enterprises) • By End-use (BFSI, Retail, Healthcare, IT & Telecom, Government & Education, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microsoft Corporation, Oracle Corporation, SAP SE, Salesforce Inc., IBM Corporation, ServiceNow Inc., Workday Inc., Adobe Inc., Atlassian Corporation, Intuit Inc., Accenture plc, Cisco Systems Inc., Hewlett Packard Enterprise (HPE), Zoho Corporation, Infor, Epicor Software Corporation, Pegasystems Inc., Software AG, Freshworks Inc., Sage Group plc, and Others. |