Data Preparation Tools Market Report Scope & Overview:

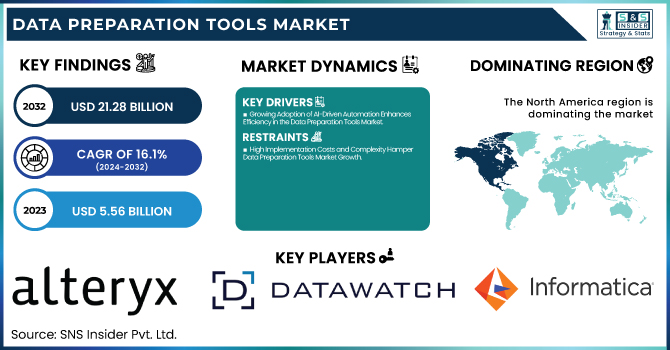

The Data Preparation Tools Market Size was valued at USD 5.56 Billion in 2023 and is expected to reach USD 21.28 Billion by 2032 and grow at a CAGR of 16.1% over the forecast period 2024-2032.

To Get more information on Data Preparation Tools Market - Request Free Sample Report

The Data Preparation Tools Market is expanding rapidly as businesses increasingly rely on data-driven decision-making. Organizations use these tools to clean, integrate, and transform large datasets efficiently. AI and machine learning adoption is enhancing automation, reducing errors, and improving analytics. Cloud-based solutions are gaining popularity for their scalability and flexibility. Key industries like BFSI, IT, healthcare, and retail are driving demand. Additionally, regulatory compliance and the growing focus on data governance are further fueling market growth, making data preparation tools essential for streamlined operations and enhanced business intelligence.

The US Data Preparation Tools Market was USD 1.40 billion in 2023 and is expected to reach USD 4.57 billion by 2032, growing at a CAGR of 14.07% over the forecast period of 2024-2032.

The US Data Preparation Tools Market is witnessing significant growth, driven by the increasing adoption of AI-powered data management solutions across industries such as BFSI, IT, healthcare, and retail. Businesses are leveraging these tools to clean, integrate, and analyze large datasets efficiently. The rising demand for cloud-based data preparation solutions and compliance with data governance regulations are further fueling market expansion.

Data Preparation Tools Market Dynamics

Key Drivers:

-

Growing Adoption of AI-Driven Automation Enhances Efficiency in the Data Preparation Tools Market

The increasing integration of artificial intelligence (AI) and machine learning (ML) in data preparation tools is significantly driving market growth. Businesses are leveraging AI-powered automation to streamline data cleaning, transformation, and integration processes, reducing manual efforts and minimizing errors. AI-driven data preparation tools enhance data accuracy, improve decision-making, and optimize analytics workflows. With organizations handling vast amounts of structured and unstructured data, AI-powered tools enable seamless data management while ensuring compliance with governance standards. The growing need for real-time data processing and predictive analytics further boosts AI adoption in data preparation tools, making them a crucial asset for enterprises seeking efficiency and scalability.

Restrain:

-

High Implementation Costs and Complexity Hamper Data Preparation Tools Market Growth

Despite the advantages, the high cost of implementation and complexity in integrating data preparation tools pose a significant restraint to market expansion. Many organizations, particularly small and medium-sized enterprises (SMEs), struggle with the financial burden of acquiring and deploying advanced data preparation solutions. The need for skilled professionals to manage and operate these tools further adds to the operational challenges.

Additionally, integrating data preparation tools with existing IT infrastructure requires substantial investment in customization, training, and maintenance. The complexity of handling vast amounts of diverse data from multiple sources also leads to compatibility issues, making adoption difficult for businesses with limited resources. These factors hinder the widespread adoption of data preparation tools, slowing down market growth despite the increasing demand for efficient data management solutions.

Opportunities:

-

Rising Demand for Cloud-Based Solutions Creates Lucrative Opportunities in the Data Preparation Tools Market

The shift toward cloud-based data preparation tools is opening new growth opportunities, as businesses seek scalable, cost-effective, and flexible solutions. Cloud-based platforms enable real-time data processing, remote access, and seamless integration with various data sources, making them an attractive option for enterprises of all sizes. The increasing adoption of Software-as-a-Service (SaaS) models further supports this trend, allowing organizations to leverage data preparation tools without high upfront costs.

Additionally, cloud-based data preparation solutions offer enhanced security features, ensuring compliance with evolving data governance and privacy regulations. With businesses prioritizing digital transformation, cloud adoption in data preparation is expected to surge, driving market expansion. The demand for cloud-native solutions is further fueled by the need for efficient data analytics, AI-driven automation, and enhanced collaboration across global teams.

Challenges:

-

Data Security and Compliance Challenges Restrict Market Growth in the Data Preparation Tools Industry

Ensuring data security and regulatory compliance remains a critical challenge in the Data Preparation Tools Market. Organizations must adhere to strict data protection regulations such as GDPR, CCPA, and HIPAA, which impose stringent requirements on data handling, storage, and processing. Data breaches, cyber threats, and unauthorized access pose significant risks, leading to potential financial losses and reputational damage.

Additionally, managing compliance across multiple jurisdictions becomes complex, particularly for multinational enterprises handling cross-border data transfers. As data preparation tools aggregate and process large volumes of sensitive information, maintaining privacy and security is paramount. The rising concerns over data governance and ethical AI practices further add to the complexity. To address these challenges, businesses are increasingly investing in robust encryption, access controls, and compliance frameworks, yet the evolving regulatory landscape continues to pose hurdles for seamless data preparation and analytics operations.

Data Preparation Tools Market Segments Analysis

By Functions

The Data Collection segment led the Data Preparation Tools Market in 2023, accounting for 29% of total revenue, driven by the rising need for high-quality, real-time data acquisition across industries. Businesses are increasingly relying on automated data collection tools to gather vast amounts of structured and unstructured data from various sources, including databases, IoT devices, cloud storage, and social media platforms. Leading companies are investing heavily in enhancing data collection capabilities.

In March 2023, Informatica Corporation launched its Informatica Cloud Data Integration-Free, a no-cost data ingestion and integration tool aimed at improving enterprise data collection and management. Similarly, IBM introduced enhancements to its Watson Knowledge Catalog, improving automated data discovery and collection capabilities.

The Data Cataloging segment is projected to witness the fastest growth in the Data Preparation Tools Market, expanding at a CAGR of 17.2% over the forecast period. This growth is attributed to the rising need for efficient data organization, metadata management, and enhanced searchability within enterprises. With businesses dealing with enormous datasets, data cataloging solutions enable better accessibility, governance, and classification of data assets. Several key players have introduced innovations to strengthen this segment.

In July 2023, Alteryx, Inc. launched an upgraded Alteryx Auto Insights, incorporating advanced AI-powered data cataloging functionalities to streamline data discovery and governance.

The increasing regulatory requirements for data governance (GDPR, CCPA, HIPAA), coupled with enterprises’ shift toward cloud-based data management solutions, are propelling the adoption of advanced data cataloging tools. As organizations strive for better data accessibility, governance, and compliance.

By Vertical

The IT and Telecom segment emerged as the dominant vertical in the Data Preparation Tools Market, holding a 37% revenue share in 2023. This dominance is driven by the increasing need for real-time data processing, network optimization, and customer insights in the telecommunications industry. With the rapid expansion of 5G networks, cloud computing, and IoT connectivity, telecom companies are investing in advanced data preparation solutions to streamline data integration, ensure data accuracy, and enhance predictive analytics.

The demand for AI-powered analytics, self-service data preparation tools, and scalable cloud platforms is propelling IT and telecom companies to adopt robust data management solutions. As data volumes continue to surge due to the proliferation of connected devices and streaming services, the reliance on intelligent data preparation tools is becoming critical for improving network performance, fraud detection, and personalized service offerings, reinforcing the segment’s leadership in the market.

The Retail and E-commerce segment is poised for the fastest growth in the Data Preparation Tools Market, projected to expand at a CAGR of 17.6% during the forecast period. The surge in online shopping, omnichannel retail strategies, and customer personalization efforts are driving demand for AI-driven data preparation solutions that enhance data accuracy, automate inventory management, and improve customer analytics. Retailers are increasingly leveraging cloud-based data preparation tools to analyze consumer behavior, optimize supply chain operations, and drive targeted marketing campaigns.

Additionally, Qlik Technologies Inc. launched Qlik AutoML in August 2023, integrating AI-based predictive analytics to improve sales forecasting and demand planning. The growing adoption of big data analytics, AI-driven personalization, and fraud detection algorithms is further accelerating the need for scalable data preparation tools in retail.

By Platform

The Data Integration segment held the largest market share of 59% in 2023 in the Data Preparation Tools Market, driven by the increasing demand for seamless data unification, interoperability, and real-time analytics across industries. Businesses are investing heavily in data integration tools to consolidate structured and unstructured data from multiple sources, enhancing decision-making and operational efficiency. The rapid adoption of cloud-based data lakes, AI-driven analytics, and IoT applications is further accelerating demand.

In July 2023, Informatica Corporation launched its Intelligent Data Management Cloud (IDMC) 2.0, offering enhanced data ingestion, transformation, and governance capabilities. Similarly, in October 2023, Microsoft Corporation upgraded Azure Synapse Analytics, integrating AI-powered automation for large-scale data fusion and analysis.

The Self-service segment is anticipated to grow at the fastest CAGR of 17.9% during the forecast period, fueled by the rising need for user-friendly, no-code/low-code data preparation tools that empower business users without technical expertise. The growing reliance on data democratization, AI-driven analytics, and on-demand data access is driving enterprises to adopt self-service data preparation solutions that enhance agility and reduce dependency on IT teams.

The increasing adoption of self-service BI platforms, cloud-based analytics, and AI-driven automation is revolutionizing data preparation processes, and empowering non-technical professionals to extract insights efficiently. As organizations seek to reduce operational bottlenecks and accelerate decision-making, the demand for self-service data preparation tools is surging, making this segment one of the fastest-growing in the market.

Regional Analysis

In 2023, North America led the Data Preparation Tools Market with an estimated market share of 38%, driven by the strong presence of key technology providers, rapid digital transformation, and the high adoption of AI-powered data analytics solutions. The region’s dominance is supported by significant investments in big data, cloud computing, and business intelligence (BI) tools across various industries, including BFSI, IT & Telecom, and healthcare.

For example, Microsoft Corporation continues to enhance Azure Data Factory, a key data integration and preparation solution, enabling seamless data flow across enterprise applications. Similarly, IBM Corporation launched IBM Cloud Pak for Data, an integrated data and AI platform that simplifies data governance and preparation.

Additionally, the surge in cloud-based SaaS solutions, automation in data pipelines, and self-service analytics is driving North American enterprises to invest in advanced data preparation tools, further solidifying the region’s market leadership.

The Asia Pacific region is projected to register the highest CAGR of 18.4% during the forecast period, fueled by the rising adoption of big data analytics, cloud computing, and AI-driven data preparation tools. The region’s growth is supported by the expansion of e-commerce, digital banking, and smart city initiatives, leading to an exponential increase in data generation. Countries like China, India, and Japan are witnessing rapid digital transformation, with enterprises heavily investing in data management solutions.

Additionally, SAP SE partnered with Indian enterprises to deploy SAP Data Intelligence Cloud, an AI-driven tool for data preparation and integration. As businesses in Asia Pacific strive for data-driven decision-making, automation, and regulatory compliance, the demand for efficient and scalable data preparation tools is surging, making it the fastest-growing regional market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Alteryx, Inc. (Alteryx Designer, Alteryx Server)

-

Datawatch Corporation (Datawatch Monarch, Datawatch Swarm)

-

Informatica Corporation (Informatica PowerCenter, Informatica Data Quality)

-

International Business Machines Corporation (IBM DataStage, IBM InfoSphere QualityStage)

-

Microsoft Corporation (Microsoft Power BI Dataflows, Azure Data Factory)

-

MicroStrategy Incorporated (MicroStrategy HyperIntelligence, MicroStrategy Cloud)

-

Qlik Technologies Inc. (Qlik Sense, Qlik Data Integration)

-

SAP SE (SAP Data Services, SAP Information Steward)

-

SAS Institute Inc. (SAS Data Management, SAS Viya Data Preparation)

-

Tibco Software Inc. (TIBCO Data Virtualization, TIBCO Spotfire)

-

Altair Engineering, Inc. (Altair Monarch, Altair Knowledge Studio)

Recent Trends

-

In March 2024, Alteryx announced the launch of Alteryx AiDIN, an AI-powered automation platform that enhances data preparation and analytics capabilities. The solution integrates machine learning to improve data transformation workflows.

-

In February 2024, Datawatch (now part of Altair) introduced Altair Monarch 2024, featuring enhanced AI-driven data extraction and preparation capabilities for complex datasets. The update aims to streamline analytics processes across industries.

-

In January 2024, Informatica launched CLAIRE GPT, a generative AI-powered data management tool integrated into its Intelligent Data Management Cloud (IDMC) to improve data preparation and governance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.56 Billion |

| Market Size by 2032 | US$ 21.28 Billion |

| CAGR | CAGR of 16.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Self-service, Data Integration) • By Deployment (On-premise, Cloud) • By Functions (Data Collection, Data Cataloging, Data Quality, Data Governance, Data Ingestion, Data Curation) • By Vertical (IT and Telecom, Retail and E-commerce, BFSI, Government, Healthcare, Energy and Utilities, Transportation, Manufacturing, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alteryx, Inc., Datawatch Corporation, Informatica Corporation, International Business Machines Corporation, Microsoft Corporation, MicroStrategy Incorporated, Qlik Technologies Inc., SAP SE, SAS Institute Inc., Tibco Software Inc., Altair Engineering, Inc. |