Broadband Services Market Report Scope & Overview:

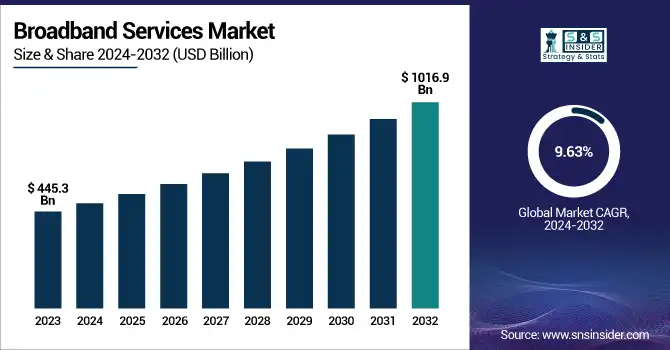

The Broadband Services Market was valued at USD 445.3 Billion in 2023 and is expected to reach USD 1016.9 Billion by 2032, growing at a CAGR of 9.63% from 2024-2032.

To Get more information on Broadband Services Market - Request Free Sample Report

This report consists of a detailed analysis of the Broadband Services Market, highlighting key trends, growth factors, and technological advancements shaping the industry. The adoption rates of high-speed broadband connections are steadily increasing across regions due to rising demand for seamless connectivity, especially in residential and commercial sectors. Network infrastructure expansion, including fiber deployment, is rapidly advancing, particularly in developing economies, improving internet accessibility. Fixed Wireless Access subscriber growth is significant in both urban and rural areas due to flexible and cost-effective broadband alternatives. Additionally, broadband penetration is rising, with average connection speeds increasing in households, driven by the growing need for bandwidth-intensive applications and remote work solutions.

The U.S. The Broadband Services Market was valued at USD 62.6 Billion in 2023 and is expected to reach USD 152.7 Billion by 2032, growing at a CAGR of 10.43% from 2024-2032, driven by several growth factors, including increasing demand for high-speed internet due to the rise in video streaming, online gaming, and remote work. The widespread adoption of fiber-optic technology and 5G-based fixed wireless access solutions is further enhancing connectivity and network reliability. Government initiatives such as rural broadband deployment programs are expanding access in underserved areas, boosting overall market penetration.

Broadband Services Market Dynamics

Drivers:

-

Increasing usage of streaming, remote work, and IoT is driving broadband adoption.

A primary growth driver for the broadband services market is the increasing adoption of digital platforms for streaming, e-learning, remote working, and gaming. The growing reach of fiber optic networks, paired with 5G FWA, delivers ultra-fast and low-latency internet connectivity which is facilitating superior user experience. And growing adoption of smart homes along with Internet of Things devices integrations drive the need for high-quality broadband services. The accelerating adoption of advanced broadband services in rural and underserved regions, in addition to government efforts to close the digital divide, is driving market growth, especially in the developed world.

Restraints:

-

Expensive network installation in rural areas hampers broadband expansion.

Deploying broadband networks, particularly fiber-optic and 5G infrastructure, to remote and rural areas comes with high costs. The large capital expenditure needed for cable installation, the upgrades of existing infrastructure, and the maintenance of the network quality in sparsely populated areas are often off-putting for market participants. Retail costs in these areas may slow the rate at which low-density networks expand. Moreover, affordability constraints among some demographics may restrict the uptake of high-speed broadband services, particularly in fast-scaling economies.

Opportunities:

-

FWA offers cost-effective, scalable connectivity, especially in underserved regions.

Fixed broadband services are being challenged by the boom of 5G-based fixed wireless access technology, which indicates an exciting opportunity in the broadband services market. FWA detalsh provides high-speed 4G and 5G style internet access without requiring many years of cabled upfront capital investment around the community, which makes them perfect for rural and underserved service areas. FWA networks' scalability, lower deployment costs, and flexibility enable telecom operator customer base expansion with greater efficiency. Government demands for rural broadband coverage are also expected to help accelerate FWA adoption, adding to growth prospects for the market.

Challenges:

-

Increasing connected devices and bandwidth usage strain broadband networks, requiring continuous upgrades.

As connected devices, streaming services, and high-bandwidth applications multiply, broadband networks are pressed to deal with congestion and scalability issues. As a result, network providers are required to make constant investments in infrastructure improvements, spectrum allocation, and bandwidth optimization to avoid service quality degradation and ensure continuous connectivity. On top of that, managing cybersecurity risk, especially considering the surge in remote work and IoT device connectivity, continues to be difficult. To maintain growth in this market, these technical and operational barriers must be surmounted.

Broadband Services Market Segmentation Analysis

By Broadband Connection

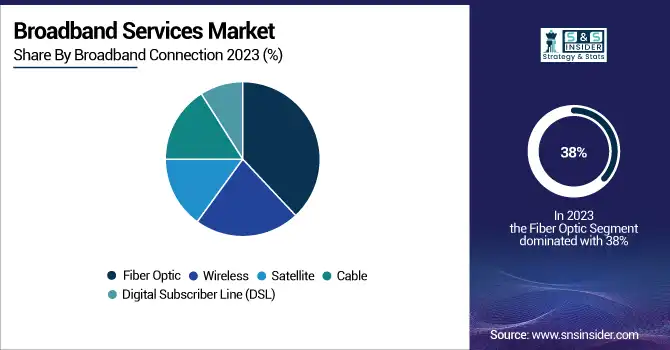

Fiber optics dominated this market and accounted for 38% of revenue share in 2023, This high share is due to fiber optics that could ensure high-quality network signals that go straight from the operator's equipment to an enterprise, business, or household. Fiber networks are known to be futureproof, and these networks embrace new developing technologies for bandwidth enhancement, which grow as per the business needs without the deployment of new networks. But the advent of wireless broadband services presents a powerful threat to the fiber optics broadband market.

Wireless broadband service is expected to register the fastest CAGR during the forecast period among all broadband connections. This rapid growth is attributed to the advancements in technology and the user-friendly nature of the platform. Wireless service connects to the internet via radio waves or Wireless Fidelity, whereas other broadband connections do so via cables. The accelerating speed of mobile wireless services progression from 3G to 4G and now, the emerging 5G technology has only increased the demand for wireless broadband services as can be seen from its multiple applications across society.

By End-Use

The business end-use segment dominated the market and accounted for a significant revenue share in 2023, as there was an increase in dependence on high-speed internet for operations, cloud services, video conferencing, and digital collaboration tools. As a result, businesses are seeking out fiber-optic and high-data broadband solutions to carry out their tasks seamlessly and ensure continuous connectivity. This trend is also likely to persist, particularly as work-from-home and hybrid work models become more widespread.

The household segment is expected to register the fastest CAGR during the forecast period, propelling the demand for broadband connections to facilitate streaming services, online education, gaming, and smart home applications. The movement to work-from-home configurations and online learning has highlighted the demand for high-speed, low-latency bandwidth in the home. Fifth, fixed wireless access and fiber-optic broadband will emerge as strong players, especially in the suburbs and rural areas.

Regional Analysis

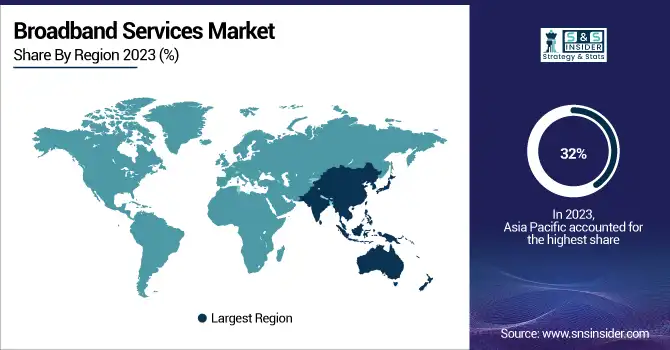

In 2023, the Asia Pacific broadband services dominated the market and accounted for the largest revenue share of 32% globally and is expected to witness significant growth in the coming years owing to the availability to large user base, the emergence of new technologies, and government initiatives. Countries in the Asia Pacific, including China and Japan, will voluntarily adopt that ultra-fast broadband leads the world on usage rates and increases the number of consumers in the coming years. In addition, Internet service providers are still providing add-on services at economic rates to target the middle- and low-income sections of consumers.

North America continues to witness growth in the broadband services market, with various government initiatives designed to reduce the number of people living in unserved or underserved areas. In Canada, demand for remote work and e-learning tools has driven investment in high-speed internet infrastructure, particularly in rural areas. The region's focus on next-gen technologies, including 5G, embedded computing, etc., encourages broadband coverage as well.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

AT&T Inc. – AT&T Fiber

-

Verizon Communications Inc. – Verizon Fios

-

Comcast Corporation – Xfinity Internet

-

Charter Communications Inc. – Spectrum Internet

-

CenturyLink (Lumen Technologies) – CenturyLink Fiber Internet

-

T-Mobile US, Inc. – T-Mobile Home Internet

-

Cox Communications – Cox Gigablast

-

Frontier Communications – Frontier Fiber Internet

-

British Telecommunications (BT Group) – BT Broadband

-

Vodafone Group – Vodafone Broadband

-

Orange S.A. – Orange Livebox Fiber

-

Deutsche Telekom AG – Magenta Home

-

Telefónica S.A. – Movistar Broadband

-

Nippon Telegraph and Telephone Corporation (NTT) – NTT FLET'S Hikari

-

Rakuten Group, Inc. – Rakuten Hikari Internet

Recent Developments

-

September 2024 – Verizon's Acquisition of Frontier Communications: Verizon announced plans to acquire Frontier Communications for approximately $20 billion, aiming to enhance its fiber broadband services and expand its market presence.

-

November 2024 – Charter Communications' Acquisition of Liberty Broadband: Charter Communications agreed to acquire Liberty Broadband in an all-stock transaction, consolidating its position in the broadband market.

-

November 2024 – Liberty Global's Spin-off of Sunrise Communications: Liberty Global completed the spin-off of its Swiss business, Sunrise Communications, into a separate publicly traded company, allowing Sunrise to operate independently in the Swiss telecommunications market.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 445.3 Billion |

|

Market Size by 2032 |

US$ 1016.9 Billion |

|

CAGR |

CAGR of 9.63 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Broadband Connection (Fiber Optic, Wireless, Satellite, Cable, Digital Subscriber Line) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

AT&T Inc., Verizon Communications Inc., Comcast Corporation, Charter Communications Inc., CenturyLink (Lumen Technologies), T-Mobile US, Inc., Cox Communications, Frontier Communications, British Telecommunications (BT Group), Vodafone Group, Orange S.A., Deutsche Telekom AG, Telefónica S.A., Nippon Telegraph and Telephone Corporation (NTT), Rakuten Group, Inc. |