ESIM Market Report Scope & Overview:

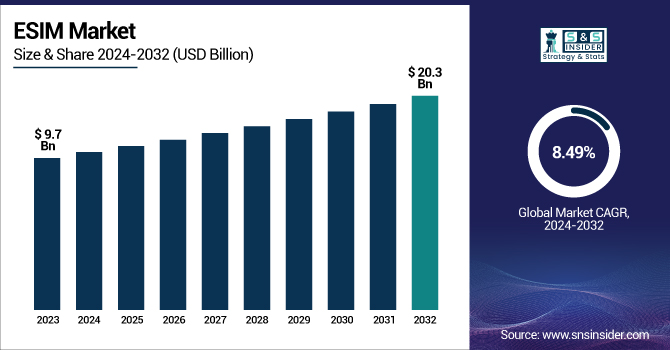

The ESIM Market was valued at USD 9.7 Billion in 2023 and is expected to reach USD 20.3 Billion by 2032, growing at a CAGR of 8.49% from 2024-2032.

To Get more information on ESIM Market - Request Free Sample Report

The eSIM market is expanding rapidly across smartphones, wearables, IoT devices, and laptops, driven by the demand for flexible connectivity. The number of eSIM-enabled devices is steadily increasing, with strong adoption in regions such as North America, Europe, and Asia-Pacific. A consistent rise in eSIM subscription activations reflects growing consumer and enterprise adoption, particularly in telecom and automotive sectors. Market share distribution among eSIM service providers varies by region, with leading players enhancing network compatibility through strategic partnerships. Additionally, the report highlights trends such as remote SIM provisioning, industrial IoT integration, and evolving regulations that are shaping the future of the eSIM ecosystem.

ESIM Market Dynamis

Driver

-

Rising demand for seamless connectivity across devices is fueling the adoption of eSIM technology in smartphones, IoT, and automotive sectors.

eSIM technology represents a step closer to seamless and flexible connectivity for a wide range of devices, including smartphones, wearables, IoT devices, and laptops. While eSIM is mostly used by consumers and enterprises. Moreover, the increasing deployment of eSIMs by telecom operators and device manufacturers is also contributing to the market expansion. Also, adoption is boosted by integration of eSIMs in automotive applications like connected vehicles. While the eSIM will have a large consumer user base, without the traditional SIM card and carrier plan, eSIM will provide convenience for everybody — making the world, indeed, a connected place.

Restraint

-

Limited carrier support and compatibility issues hinder the widespread adoption of eSIM technology in certain regions.

Although eSIM technology is being adopted at a rapid pace, however, the major restraint is due to limited support from telecom operators in some of the regions. Full eSIM deployment is still delayed by several carriers sticking to traditional SIM cards. Network providers and manufacturers are also not fully in sync whether the eSIM-enabled devices they build will translate into seamless connectivity since both come from a different tech and distribution ecosystem altogether. Lastly, reluctance if not apprehension when it comes to security and privacy, especially as it relates to remote SIM provisioning, still lingers for enterprises and consumers. Although developed regions such as North America and Europe are expanding eSIM growth, slower deployment in developing regions is mostly constrained by weaker infrastructure. A continuation of its growth trajectory will ultimately rely on solving these compatibility issues and greater carrier participation.

Opportunity

-

The expansion of eSIM in IoT and automotive sectors presents significant growth potential for global connectivity solutions.

The increasing penetration of eSIM technology in IoT and automotive applications is a huge opportunity for market growth. For example, many smart devices, including regional industrial IoT solutions, and connected vehicles benefit from eSIMs, which fundamentally increase automation and efficiency by enabling devices to connect to their network provider and make configurations over-the-air. Electronic SIMs, or eSIMs, are used by automotive manufacturers to enable features such as navigation, communication, telematics, and other real-time data exchange in electric and autonomous vehicles. IoT eSIMs can connect globally at lower costs and do not need physical multiple SIMs. With the increasing change in industries towards digitization, the need for such solutions based on eSIM is anticipated to grow. Emerging applications will accelerate the adoption of eSIM with the help of technological advancements such as 5G and remote SIM provisioning.

Challenges

-

Security risks and regulatory compliance issues create barriers to the seamless deployment of eSIM technology worldwide.

The Security concerns and regulatory compliance are the biggest challenges to eSIM adoption. Because eSIMs are provisioned remotely, they are exposed to a heightened risk of cyberattacks, data breaches, and unauthorized access. Telecom providers should incorporate strong encryption and authentication tools to secure data. Furthermore, they find the various regulatory frameworks across different regions to be a compliance issue for global eSIM adoption. Cross border deployments are impacted by remote SIM activation policies, which are restrictive in some countries. Industry stakeholders need to collaborate with the regulatory authorities to develop standardized security protocols for seamless compliance with global telecom regulation to facilitate the safe and broad adoption of eSIM technology.

ESIM Market Segmentation Analysis

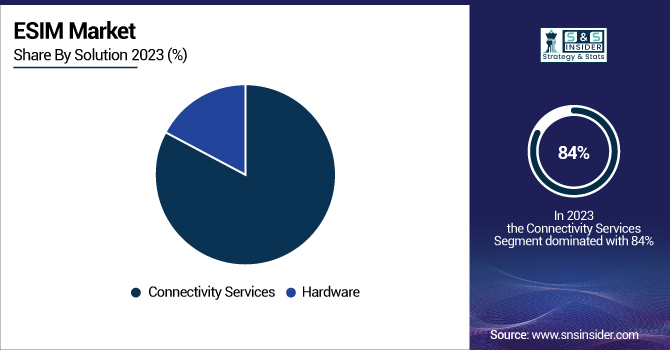

By Solution

In 2023, the connectivity services segment dominated the market and accounted for the largest revenue share. Such rapid growth may be attributed to increasing eSIM usage for M2M connectivity, with generation of revenue for network operators via subscription offerings. Mobile Network Operators give the connectivity services to securely and remotely manage end-user cellular subscriptions. The automotive industry supported the GSMA Embedded SIM Specification to enhance the connectivity between different vehicles, heralding a new era of connected cars.

The hardware segment is anticipated to register the fastest CAGR during the forecast period. due to the rise of consumer electronics manufacturers, driving the demand. This, combined with the increasing trend of manufacturers of smartphones embedding eSIM directly into the device, increases the demand, thereby driving the growth of the segment.

By Application

In 2023, M2M segment dominated the market and accounted for the highest revenue share. As eSIM technology is increasingly utilized in the automobile sector for M2M communication. Connected cars remain the crucial demand of the automotive sector. The use of eSIM in the automobile industry is expected to greatly simplify production and accelerate the growth of the connected car market.

The Consumer electronics segment is projected to register the fastest CAGR during the forecast period. Demand for consumer electronics application is among the larger market forces that shape innovation, growth, and disruption in many technology sectors. eSIM is something that needs less space in a smartphone, which allows the device manufacturers to better utilize that space in the device itself.

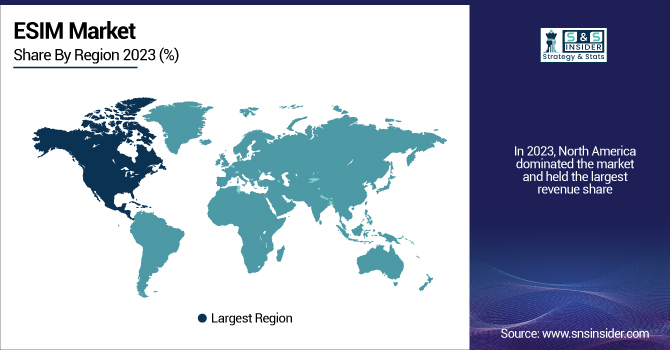

Regional Landscape

In 2023, North America dominated the market and held the largest revenue share. and is projected to grow at the fastest CAGR during the forecast period. This is attributed to the high presence of network providers and the speed of technology in the region.

The Asia Pacific is projected to hold substantial growth during the forecast period. The eSIM momentum in smartphones is being fueled largely by the introduction of eSIM smartphones from major smartphone players, including Huawei and Samsung Electronics, which have signaled the eSIM as the mainstream SIM technology for the next era of connected devices. A few other OEMs from nascent countries like China and India are working on eSIM solutions and building up shared development powers in the ecosystem to design aggressive development campaigns.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Thales Group – Gemalto eSIM

-

Infineon Technologies – OPTIGA Connect eSIM

-

STMicroelectronics – ST4SIM eSIM

-

NXP Semiconductors – NXP eSIM Solutions

-

Giesecke+Devrient (G+D) – AirOn eSIM Management

-

Idemia – Smart Connect eSIM

-

Qualcomm – Snapdragon eSIM

-

Apple Inc. – Apple eSIM

-

Samsung Electronics – Samsung Galaxy eSIM

-

Microsoft – Surface Pro eSIM

-

AT&T Inc. – AT&T eSIM Activation

-

Verizon Communications – Verizon eSIM Service

-

Deutsche Telekom AG – Telekom eSIM

-

China Mobile – CMHK eSIM

-

Singtel – Singtel Ready eSIM

Recent Developments

-

In February 2024, TRASNA Solutions acquired Workz, a company specializing in cloud eSIM technology, to enhance its services in mobile IoT technologies, including SIM, eSIM, and System-on-Chip (SoC) solutions.

-

In March 2024, Airalo, an eSIM marketplace, reached a milestone of over 10 million users, reflecting its growing presence in the global eSIM market.

-

In December 2024, TRASNA Solutions further expanded its IoT services by acquiring IoTerop, a company specializing in device management, aiming to improve its offerings in the IoT ecosystem.

-

In January 2025, major telecommunications companies in Spain, including Movistar and Vodafone, announced the transition from traditional SIM cards to eSIM technology, marking a significant shift towards more secure and efficient mobile connectivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.7 Billion |

| Market Size by 2032 | USD 20.3 Billion |

| CAGR | CAGR of 8.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Hardware, Connectivity services) • By Application (Consumer Electronics, M2M) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thales Group, Infineon Technologies, STMicroelectronics, NXP Semiconductors, Giesecke+Devrient (G+D), Idemia, Qualcomm, Apple Inc., Samsung Electronics, Microsoft, AT&T Inc., Verizon Communications, Deutsche Telekom AG, China Mobile, Singtel |