IoT MVNO Market Size & Overview:

The IoT MVNO Market was valued at USD 3.09 billion in 2023 and is expected to reach USD 14.26 billion by 2032, growing at a CAGR of 18.59% from 2024-2032.

Get More Information on IoT MVNO Market - Request Sample Report

The IoT MVNO market is growing significantly due to the high adoption of Internet of Things devices in different sectors. With increasing demand for smart solutions, business and consumers alike are looking for reliable and cost-effective connectivity solutions, and therefore, MVNOs are adopting existing mobile networks for IoT applications. The further support has been brought by the implementation of 5G networks, providing the required bandwidth and low latency to satisfy demands for high amounts of data and speeds by IoT devices. The market is set to continue growing since there are 1.76 billion global 5G connections at year-end 2023 with Deutsche Telekom expanding its business-to-business MVNO services in Brazil. MVNOs are becoming ever more central to connecting a broad range of devices and systems-from smart homes to industrial machinery.

With the proliferation of IoT applications, MVNOs are targeting a wide range of industries-from healthcare and transportation to agriculture and logistics-with connectivity solutions that are both cost-effective, scalable, and flexible. As businesses pursue optimization and efficiency, IoT MVNOs become key partners, delivering tailored connectivity plans for specific operational needs, such as low power, high reliability, and security. This has hastened the demand for IoT connectivity solutions in developed as well as emerging markets.

The IoT MVNO market represents presents significant opportunities in innovation with the continuous improvement in 5G and edge computing technologies. As these continue to advance, they will facilitate the provision of faster and more efficient services by the MVNOs, opening their product lines into new areas, such as device management, security, and data analytics. As more and more devices and systems get connected, IoT MVNOs will have an opportunity to expand their market presence by providing complete, end-to-end connectivity solutions that meet the increasing complexity of the IoT ecosystem, paving the way for further growth and transformation.

IoT MVNO Market Dynamics

DRIVERS

-

The Role of Increasing IoT Adoption in Driving IoT MVNO Market Growth

The widespread penetration of IoT devices in diverse sectors like automotive, healthcare, and logistics drives the IoT MVNO market. As industries integrate IoT to make processes more efficient, offer real-time data, and introduce automation, seamless, reliable connectivity is necessary. IoT devices need to maintain constant communication with cloud services, remote monitoring, and data transmission, which can only be maintained by robust connectivity solutions. Since industries with large fleets or systems of interconnected devices stand to benefit in terms of economies of scale through cost-effective, flexible, and scalable plans by MVNOs, they seem well-positioned to meet those demands. High dependence on IoT technology and large volumes of connected devices are resulting in substantial demand for IoT MVNO services, pushing the market further.

-

Technological Advancements Enhancing Connectivity and Driving Growth in the IoT MVNO Market

Innovations such as 5G, NB-IoT, and LPWAN are significantly improving network efficiency and capabilities, which is pivotal for the growth of the IoT MVNO market. These advancements offer high-speed, low-latency, and energy-efficient connectivity, essential for supporting the growing number of IoT devices across industries. 5G, in particular, enables faster data transfer and enhanced connectivity, which is crucial for real-time applications in sectors like healthcare, smart cities, and manufacturing. Similarly, NB-IoT and LPWAN technologies provide long-range connectivity for devices with low power consumption, ideal for use cases like smart agriculture and logistics. These technological breakthroughs enable MVNOs to provide reliable, cost-effective connectivity solutions tailored to the unique needs of IoT applications, making them a central player in supporting IoT growth.

RESTRAINTS

-

Limited Network Coverage Restricting IoT MVNO Market Expansion

The reliance on third-party network infrastructure is a significant reason why IoT MVNOs face limitations in coverage, particularly in rural or remote areas. While MVNOs can offer cost-effective solutions, their lack of control over the underlying networks means that they may not provide reliable connectivity in regions with less developed infrastructure. IoT applications require consistent, real-time data transmission, which becomes challenging in areas where network coverage is sparse or weak. As industries like agriculture, logistics, and smart cities increasingly depend on extensive IoT deployments, limited network reach can prevent MVNOs from meeting the growing demand for wide-area connectivity. This gap in service availability can hinder MVNOs from fully capitalizing on market opportunities, limiting their potential for growth in the IoT space.

-

High Capital Expenditure on Advanced Network Technologies Restricting IoT MVNO Market Growth

Although MVNOs generally avoid the high cost of building infrastructure, the need to invest in advanced network technologies, such as 5G, NB-IoT, and LPWAN, can be capital-intensive. These technologies are crucial for supporting the growing demands of IoT applications, providing faster speeds, lower latency, and better network efficiency. However, the investment required to implement and maintain these technologies can be prohibitive, particularly for smaller MVNOs or new market entrants. The cost of upgrading to the latest network infrastructure can strain financial resources, limiting their ability to compete with larger players or offering more affordable services. This high capital expenditure creates a barrier for smaller players entering the IoT MVNO market, restricting overall market competition and growth opportunities.

IoT MVNO Market Segment Analysis

By Subscribers

The business segment dominated the IoT MVNO market in 2023, accounting for approximately 75% of the revenue share. This dominance is driven by the widespread adoption of IoT solutions in industries such as logistics, healthcare, and manufacturing, where the need for efficient, scalable, and secure connectivity is crucial. Businesses increasingly rely on IoT-enabled devices for automation, asset tracking, and real-time data analysis, which require dependable, high-performance network services provided by MVNOs.

The consumer segment is projected to grow at the fastest CAGR of about 20.67% from 2024 to 2032. This rapid growth is attributed to the rising demand for smart home devices, wearables, and connected vehicles, which are becoming integral to everyday life. As consumers seek more personalized and convenient IoT solutions, MVNOs are well-positioned to meet these needs with flexible, cost-effective plans. The increasing popularity of smart technologies, along with growing consumer awareness, will drive further expansion in this segment.

By Enterprise

The large enterprises segment dominated the IoT MVNO market in 2023, accounting for approximately 71% of the revenue share. This dominance is due to the significant investments large organizations make in IoT solutions for operational efficiency, asset management, and supply chain optimization. With vast operations and global reach, these enterprises require robust, secure, and scalable connectivity, which MVNOs provide, helping businesses manage complex networks across multiple locations seamlessly.

The small and medium enterprises segment is expected to grow at the fastest CAGR of about 20.74% from 2024 to 2032. This growth is driven by the increasing adoption of IoT technologies by SMEs to enhance productivity, reduce costs, and improve customer experiences. As IoT becomes more affordable and accessible, smaller businesses are leveraging MVNO services to implement smart solutions for inventory management, fleet tracking, and data analytics, creating a surge in demand within this segment.

By Operational Model

The Full MVNO segment dominated the IoT MVNO market in 2023, capturing approximately 48% of the revenue share. This leadership is attributed to Full MVNOs’ ability to manage both the infrastructure and service offerings, allowing them to provide tailored, scalable solutions to meet the diverse needs of enterprises. With greater control over network management, Full MVNOs can deliver reliable and customizable connectivity, making them the preferred choice for businesses seeking high-performance IoT services.

The Service Provider MVNO segment is expected to grow at the fastest CAGR of about 19.92% from 2024 to 2032. This rapid growth is driven by the increasing demand for flexible, low-cost IoT connectivity solutions offered by Service Provider MVNOs. By focusing on specific services, such as data management or network optimization, these MVNOs can cater to niche market segments, enabling them to rapidly scale and expand their customer base, thereby fueling their rapid market growth.

REGIONAL ANALYSIS

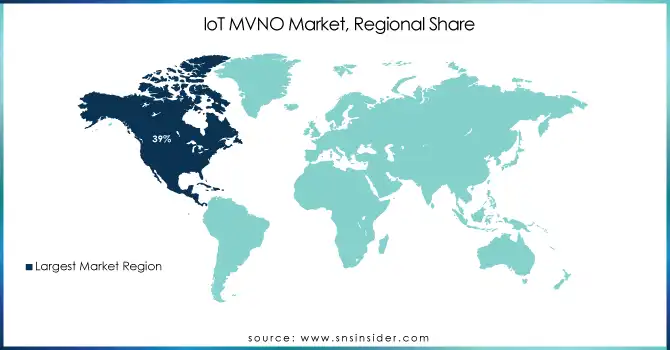

North America dominated the IoT MVNO market in 2023, with 39% of the revenue share. This dominance is primarily due to the region's advanced technological infrastructure and widespread adoption of IoT solutions across various industries such as healthcare, manufacturing, and transportation. The strong presence of major MVNO players and the increasing demand for connected devices and smart technologies in North America have made it a key hub for IoT services, driving substantial market growth.

Asia Pacific is expected to grow at the fastest CAGR of about 21.29% from 2024 to 2032. This rapid growth is fueled by the region's expanding industrial base, increasing urbanization, and government initiatives promoting smart cities and IoT innovation. As businesses and consumers in Asia Pacific increasingly adopt IoT technologies for efficiency and convenience, MVNOs are well-positioned to cater to the rising demand, contributing to the region's significant market expansion.

Do You Need any Customization Research on IoT MVNO Market - Enquire Now

KEY PLAYERS

-

KDDI (IoT Worldwide Architecture, KDDI IoT Connect Air)

-

KORE Wireless (ConnectivityPro, Position Logic)

-

Sierra Wireless (AirVantage IoT Platform, Octave Edge-to-Cloud Solution)

-

Twilio (Twilio IoT SIM, Twilio Wireless Super SIM)

-

Asahi Net (Asahi Net LTE, Asahi Net WiMAX)

-

Telit (Telit OneEdge, Telit deviceWISE IoT Platform)

-

BICS (SIM for Things, Global IoT Connectivity)

-

Lycamobile (Lycamobile IoT SIM, M2M Connectivity Solutions)

-

Wireless Logic (SIMPro Management Platform, NetPro Connectivity)

-

Truphone (Truphone IoT Connectivity, eSIM for IoT)

-

Aeris Communications (Aeris Fusion IoT Network, Aeris Mobility Suite)

-

Cubic Telecom (Pace Connectivity Management, PLXOR IoT Platform)

-

Hologram (Hologram SIM Card, Hologram Dashboard)

-

1NCE (1NCE IoT Flat Rate, 1NCE Connectivity Management Platform)

-

1OT (1OT SIM Card, 1OT Terminal Management Platform)

-

Soracom (Soracom Air SIM, Soracom Beam)

-

Onomondo (Onomondo IoT SIM, Onomondo Connectivity Platform)

-

China Telecom (China Telecom IoT Open Platform, eSurfing IoT Connectivity)

-

KPN (KPN Things, KPN IoT Connectivity)

-

AT&T (AT&T Control Center, AT&T IoT Data Plans)

-

T-Mobile US (T-Mobile IoT SIM, T-Mobile Control Center)

-

NTT Communications (Enterprise Cloud for IoT, IoT Platform "Things Cloud")

-

Verizon (Verizon ThingSpace, Verizon IoT SIM)

-

Telstra (Telstra IoT Connectivity, Telstra Track and Monitor)

-

Orange S.A. (Orange Live Objects, Orange IoT Connect)

-

Iliad (Free Pro IoT Solutions, Iliad IoT Connectivity)

-

Proximus (Proximus MyThings, Proximus IoT Network)

-

Bouygues Telecom (Bouygues Telecom Objenious, IoT Connect)

-

Deutsche Telekom (Cloud of Things, IoT Solution Builder)

-

Vodafone Group (Vodafone IoT Connectivity, Vodafone IoT Platform)

-

Swisscom (Swisscom IoT Connectivity, Swisscom Low Power Network)

-

DataXoom (DataXoom IoT Data Plans, DataXoom SIM Management)

-

DISH Wireless L.L.C (DISH IoT Network, DISH Smart 5G)

-

TRACFONE (Tracfone IoT SIM, Tracfone Wireless Data Plans)

-

Lebara (Lebara IoT SIM, M2M Connectivity Solutions)

-

FRiENDi (FRiENDi IoT SIM, M2M Data Plans)

-

Tesco Mobile (Tesco Mobile IoT SIM, M2M Connectivity Services)

RECENT DEVELOPMENTS

-

In 2024, Verizon and KDDI partnered to provide advanced connectivity for Sony Honda Mobility’s AFEELA electric vehicle. This collaboration will leverage Verizon’s 5G and 4G LTE networks alongside KDDI’s global communications platform to enhance the vehicle's connectivity and mobility features, supporting its mass production in North America.

-

In December 2024, eSIM Go and Vodafone UK entered a partnership that facilitates the creation of MVNOs for businesses of all sizes. The agreement will provide businesses, from fintech to football clubs, with easy access to Vodafone's network, encouraging quicker connectivity and simpler MVNO entry for diverse sectors.

-

In 2023, BWS IoT and KORE Wireless formed a strategic alliance to enhance asset tracking in South America. This partnership combines BWS's GPS satellite tracking with KORE Wireless's advanced network infrastructure to offer 4G-based tracking solutions across the region.

-

In 2023, KORE Wireless announced the acquisition of Twilio’s IoT business unit, aiming to enhance its position as an "IoT Hyperscaler." This move strengthens KORE's ability to offer advanced, scalable IoT solutions globally, solidifying its leadership in the market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.09 Billion |

| Market Size by 2032 | USD 14.26 Billion |

| CAGR | CAGR of 18.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Operational Model (Full MVNO, Service Provider MVNO, Reseller MVNO) • By Subscribers (Business, Consumer) • By Enterprise (Small and Medium Enterprises, Large Enterprises) • By End Use (Manufacturing, Transportation & Logistics, Healthcare, Retail, Energy & Utilities, Agriculture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | KDDI, KORE Wireless, Sierra Wireless, Twilio, Asahi Net, Telit, BICS, Lycamobile, Wireless Logic, Truphone, Aeris Communications, Cubic Telecom, Hologram, 1NCE, 1OT, Soracom, Onomondo, China Telecom, KPN, AT&T, T-Mobile US, NTT Communications, Verizon, Telstra, Orange S.A., Iliad, Proximus, Bouygues Telecom, Deutsche Telekom, Vodafone Group, Swisscom, DataXoom, DISH Wireless L.L.C, TRACFONE, Lebara, FRiENDi, Tesco Mobile. |

| Key Drivers | • The Role of Increasing IoT Adoption in Driving IoT MVNO Market Growth • Technological Advancements Enhancing Connectivity and Driving Growth in the IoT MVNO Market |

| RESTRAINTS | • Limited Network Coverage Restricting IoT MVNO Market Expansion • High Capital Expenditure on Advanced Network Technologies Restricting IoT MVNO Market Growth |