Hotel And Hospitality Management Software Market Report Scope & Overview:

The Hotel And Hospitality Management Software Market was valued at USD 3.63 billion in 2023 and is expected to reach USD 6.88 billion by 2032, growing at a CAGR of 7.40% from 2024-2032.

To Get more information on Hotel And Hospitality Management Software Market - Request Free Sample Report

This report includes in-depth analysis of key metrics such as cybersecurity and compliance statistics, training and support effectiveness, automation level indicators, customization and localization trends, and mobile/BYOD adoption rates. The market is experiencing robust growth driven by increasing digital transformation across the hospitality sector, rising demand for seamless guest experiences, and the growing need for centralized property management solutions. Enhanced focus on data protection, especially in the wake of stringent compliance mandates, along with the adoption of AI-driven automation and multilingual, mobile-friendly platforms, is reshaping how hotels operate globally. The integration of training modules and support systems further boosts operational efficiency and staff productivity across diverse property types.

U.S. Hotel And Hospitality Management Software Market was valued at USD 0.94 billion in 2023 and is expected to reach USD 1.78 billion by 2032, growing at a CAGR of 7.28% from 2024-2032.

This growth is driven by the rising demand for enhanced guest experience, streamlined operations, and real-time property management solutions. The widespread adoption of cloud-based platforms, integration of AI and automation, and the need for mobile-friendly, BYOD-compatible systems are transforming hotel operations across the country. Additionally, the U.S. hospitality sector’s focus on data security and regulatory compliance is increasing investment in secure software platforms. The surge in domestic and international travel, along with the rapid digitalization of independent and chain hotels, continues to accelerate market expansion.

Hotel And Hospitality Management Software Market Dynamics

Drivers

-

Growing demand for automation in hotel operations is fueling the adoption of hospitality management software across global service chains.

Rising demand for automation in hotel operations is a major factor boosting the hotel and hospitality management software market. As properties seek to streamline operations and minimize human error, automation through software is becoming indispensable. From reservations to check-in/check-out, room assignments, housekeeping coordination, and guest services, automated systems increase operational efficiency and improve service speed. Hotels are also adopting such software for real-time data access, guest history tracking, and predictive analytics, all of which contribute to better resource allocation and customer satisfaction. Cloud-based platforms and mobile integration have further accelerated software adoption, even in small and mid-size hotels. Additionally, the labor shortage across the hospitality sector has intensified the need for automation, helping hoteliers manage services efficiently with reduced workforce dependency.

Restraints

-

Data security concerns and compliance issues are creating significant barriers in the adoption of hospitality management software systems.

Escalating concerns regarding data privacy and cybersecurity are limiting the growth of the hotel and hospitality management software market. These platforms manage sensitive guest data, including personal identification details, payment information, and stay preferences. A single data breach can lead to severe financial loss and reputational damage, especially for brands managing global operations. Compliance with strict data protection regulations such as GDPR, CCPA, and PCI-DSS adds complexity to implementation. Additionally, many hoteliers lack in-house cybersecurity expertise, leaving their systems vulnerable to threats. Fear of unauthorized access, ransomware, and data misuse often delays software adoption. This is particularly true for smaller operators who may not have the resources to invest in robust cybersecurity frameworks and regular audits.

Opportunities

-

Rapid adoption of cloud-based solutions offers a transformative opportunity for scalable and flexible hotel management operations across all service levels.

The growing preference for cloud-based hotel and hospitality management software presents a key opportunity for market expansion. Cloud platforms offer scalability, allowing properties of all sizes—from boutique hotels to large chains—to implement efficient software without heavy infrastructure investments. They also enable real-time data access across multiple devices and locations, fostering centralized management. Cloud deployment reduces upfront costs and facilitates easier updates, which ensures that hotels remain technologically current. Mobile access further enhances flexibility for staff and guests alike. Additionally, cloud solutions support integrations with third-party apps, including payment gateways, CRM, and smart room controls. As hotels increasingly prioritize agility and cost-efficiency, cloud-based platforms are emerging as the ideal choice for streamlined and modern hospitality operations.

Challenges

-

Integration with existing legacy systems remains a major technical challenge for hospitality providers shifting to advanced software platforms.

Integrating hotel and hospitality management software with outdated legacy systems continues to pose a significant challenge for many businesses. Many hotels, especially long-established ones, rely on fragmented software or manual systems that are incompatible with newer technologies. Migrating to advanced platforms often requires major overhauls in infrastructure, leading to service disruptions and added costs. Compatibility issues, data migration complexities, and employee retraining slow down the transformation process. Even when new software is implemented, poor synchronization with existing systems can result in data silos, operational inefficiencies, and inaccurate reporting. This challenge is particularly critical for multi-property hotels that need uniform operations across locations. Resolving these integration issues remains crucial for successful digital transformation in the sector.

Hotel And Hospitality Management Software Market Segment Analysis

By Type

The Property Management segment led the Hotel and Hospitality Management Software Market in 2023 with around 25% revenue share due to its critical role in automating core operations. It supports daily functions like front desk services, housekeeping, billing, and occupancy management. Its ability to enhance operational efficiency, reduce manual errors, and improve guest experience makes it indispensable for hotel operators. Increasing adoption among independent hotels and chains for centralized control and seamless operations further reinforced its dominance across the global market.

The Central Reservation segment is anticipated to grow at the fastest CAGR of about 9.81% from 2024 to 2032 due to rising demand for centralized booking and inventory management. With increasing distribution channels including OTAs, direct bookings, and mobile apps, hotels are adopting centralized systems to manage real-time room availability. This integration improves revenue strategies and ensures dynamic pricing, making the system crucial for enhancing visibility and optimizing occupancy across multiple platforms.

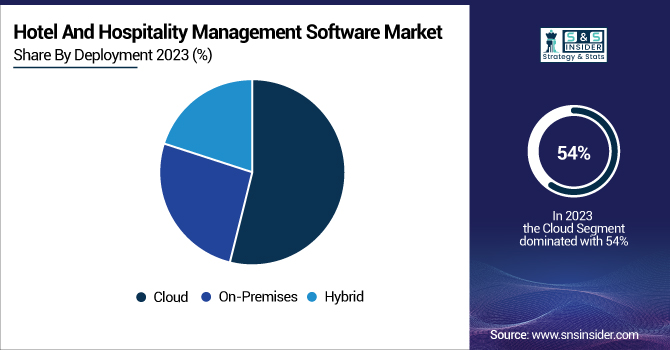

By Deployment

The Cloud segment dominated the Hotel and Hospitality Management Software Market in 2023 with a revenue share of about 54% due to its scalability, flexibility, and cost-effectiveness. Cloud-based solutions allow hotels to manage operations remotely, reduce infrastructure costs, and easily scale up or down based on demand. These platforms offer real-time updates, centralized data access, and seamless integrations with third-party applications, making them an ideal choice for multi-property operations. The growing need for mobile access and continuous software upgrades further solidifies cloud dominance.

The Hybrid segment is expected to grow at the fastest CAGR of about 9.86% from 2024 to 2032 due to its ability to combine the best features of both on-premise and cloud solutions. Hybrid systems provide flexibility in managing sensitive data on-site while leveraging cloud-based capabilities for scalability, collaboration, and cost efficiency. This dual approach allows hotels to meet regulatory requirements and security concerns while benefiting from cloud-based features like mobility, real-time updates, and enhanced analytics.

By End-use

The Hotels segment captured the largest revenue share of nearly 48% in 2023 due to the high volume of software adoption across global hotel chains and independent properties. Hotels require comprehensive software systems to manage reservations, check-ins, housekeeping, billing, and guest services efficiently. As competition intensifies, hotels invest heavily in technology to deliver personalized experiences and operational excellence. The sector’s vast scale, combined with continuous digital transformation, cements its position as the dominant segment in the hospitality software landscape.

The Restaurants and Bars segment is expected to register the fastest CAGR of approximately 9.78% from 2024 to 2032 due to growing digitalization in food and beverage services. Increasing demand for streamlined operations, real-time inventory tracking, POS integration, and customer experience management is driving software adoption in this space. Cloud-based platforms and mobile ordering features are helping restaurants and bars enhance efficiency, reduce wait times, and manage fluctuating demand. These factors are contributing to rapid growth in hospitality-focused software solutions for F&B establishments.

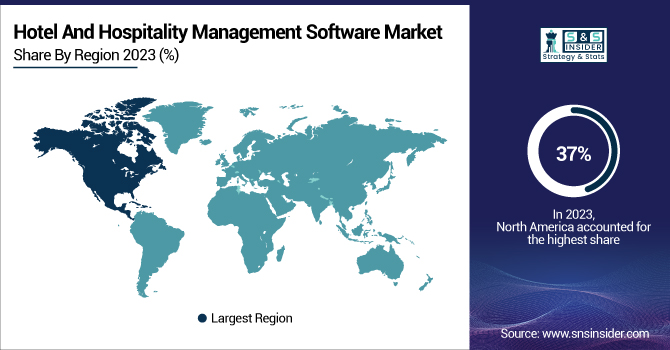

Regional Analysis

North America accounted for the largest revenue share of approximately 37% in the Hotel and Hospitality Management Software Market in 2023 due to widespread technology adoption and a mature hospitality industry. The region hosts numerous international hotel chains that continuously invest in advanced software to enhance operational efficiency and guest experience. High internet penetration, robust IT infrastructure, and a strong presence of leading software providers further support market dominance. Additionally, early cloud migration and digital transformation initiatives have accelerated regional software deployment.

Asia Pacific is expected to grow at the fastest CAGR of about 9.42% from 2024 to 2032, driven by rising tourism, expanding hotel infrastructure, and increasing digital adoption across emerging economies. Countries like China, India, and Southeast Asian nations are witnessing a surge in hospitality investments and smartphone-driven travel behaviors. The growing middle class, rising disposable incomes, and government support for tourism are accelerating the demand for modern hotel software solutions tailored to local operational and language needs.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Agilysys NV LLC (InfoGenesis POS, Agilysys LMS)

-

Cloudbeds (Property Management System, Booking Engine)

-

Hotelogix India Pvt. Ltd (Cloud PMS, Mobile Hotel App)

-

Maestro PMS (Property Management System, Online Booking Engine)

-

Mews Systems (Property Management System, Booking Engine)

-

Microsoft (Dynamics 365 Hospitality Accelerator, Azure for Hospitality)

-

Oracle (OPERA Cloud PMS, Hospitality Integration Platform)

-

RoomRaccoon (Property Management System, Booking Engine)

-

SAP SE (Customer Checkout, S/4HANA for Hospitality)

-

StayNTouch (Cloud PMS, Guest Mobility)

-

Amadeus IT Group (Central Reservation System, Property Management System)

-

Sabre Corporation (SynXis CRS, SynXis Property Manager)

-

InnQuest Software (roomMaster, Web Bookings)

-

Protel hotel-software GmbH. (Protel Air, Protel On-Premise)

-

RMS Cloud (Property Management System, Internet Booking Engine)

-

Cenium AS (Hospitality ERP, Property Management System)

-

eZee Technosys (FrontDesk, Reservation)

-

RoomKeyPMS (Property Management System, Booking Engine)

-

WebRezPro (Cloud PMS, Booking Engine)

-

Schneider Electric (EcoStruxure Building Operation, Guest Room Expert)

-

Siemens AG (Desigo CC, Hotel Solutions)

Recent Developments:

-

In January 2024, Oracle launched OPERA Cloud Central, an all-in-one hospitality platform, integrating distribution, sales, service, and loyalty functions. Scandic Hotels Group became the first to implement it, enhancing operational efficiency and guest experiences across its 280 locations.

-

In October 2024, RMS Cloud introduced new features like automated cancellation fees and improved area allocation, designed to streamline hotel operations, enhance guest experiences, and optimize property management.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.63 Billion |

| Market Size by 2032 | US$ 6.88 Billion |

| CAGR | CAGR of 7.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Property Management, Customer Relationship Management (CRM), Central Reservation, Channel Management, Event Management, Inventory Management, Point-of-Sale, Revenue Management, Others) • By Deployment (On-premises, Cloud, Hybrid) • By End-use (Hotels, Resorts, Hostels, Restaurants and Bars, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Agilysys NV LLC, Cloudbeds, Hotelogix India Pvt. Ltd, Maestro PMS, Mews Systems, Microsoft, Oracle, RoomRaccoon, SAP SE, StayNTouch, Amadeus IT Group, Sabre Corporation, InnQuest Software, Protel hotel-software GmbH., RMS Cloud, Cenium AS, eZee Technosys, RoomKeyPMS, WebRezPro, Schneider Electric, Siemens AG |